Income Tax at a Glance - National Board of Revenue

Income Tax at a Glance - National Board of Revenue

Income Tax at a Glance - National Board of Revenue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

For retarded taxpayers, tax payable for theFirst 2,50,000/- NilNext 3,00,000/- 10%Next 4,00,000/- 15%Next 3,00,000/- 20%Rest Amount 25%Minimum tax for any individual assessee is Tk. 2,000Non-resident Individual 25%(other than non-resident Bangladeshi)On Dividend income 20%For CompaniesPublicly Traded Company 27.5%Non-publicly Traded Company 37.5%Bank, Insurance & Financial Company 42.5%Cigarette manufacturing company (not listed with stock exchange) 42.5%Cigarette manufacturing company (listed with stock exchange) 35%Mobile Phone Oper<strong>at</strong>or Company 45%Publicly Traded Mobile Oper<strong>at</strong>or Company 35%If any publicly traded company (excluding Mobile Oper<strong>at</strong>or Company) declares more than 20% dividend, 10% reb<strong>at</strong>e on totaltax allowed.<strong>Tax</strong> Reb<strong>at</strong>e for investment :R<strong>at</strong>e <strong>of</strong> Reb<strong>at</strong>e:Amount <strong>of</strong> allowable investment is either actual investment in a year or up to 20% <strong>of</strong> total income or Tk. 100,00,000/-whichever is less. <strong>Tax</strong> reb<strong>at</strong>e amounts to 10% <strong>of</strong> allowable investment.Types <strong>of</strong> investment qualified for the tax reb<strong>at</strong>e are :- Life insurance premium , Contribution to deferred annuity , Contribution to Provident Fund to which Provident Fund Act, 1925 applies , Self contribution and employer's contribution to Recognized Provident Fund , Contribution to Super Annu<strong>at</strong>ion Fund , Investment in debenture or debenture stock, Stocks or Shares, acquired through Initial Public Offering (IPO), Contribution upto Tk 60,000 to deposit pension scheme sponsored by any scheduled bank, Contribution to Benevolent Fund and Group Insurance premium , Contribution to Zak<strong>at</strong> Fund , Don<strong>at</strong>ion to charitable hospital approved by N<strong>at</strong>ional <strong>Board</strong> <strong>of</strong> <strong>Revenue</strong> , Don<strong>at</strong>ion to philanthropic or educ<strong>at</strong>ional institution approved by the Government , Don<strong>at</strong>ion to socio-economic or cultural development institution established in Bangladesh by Aga KhanDevelopment Network ,

Le temps des puissancesEspoir d’Europel’ouverture est là, déjà effective. La vraie questionest : que fait-on pour que ce nouvel espace soitutile à nos entreprises, à nos entrepreneurs et àla société française ? Nous avons pris cette initi<strong>at</strong>ivecentrée sur l’inform<strong>at</strong>ion et la sensibilis<strong>at</strong>ionen liaison d’ailleurs avec les membres du Gouvernementqui sont concernés, et nous avonsentrepris une politique de contacts avec les paysprochainement entrants dans l’Europe. Avecquelques-uns de mes collègues et en liaisonavec nos ambassadeurs, nous avons déterminé,avec François Loos, les pays cibles par lesquelson devait commencer. Nous allons nous rendreen Pologne, en Tchéquie, en Slovénie, accompagnésde quelques présidents de Chambres etd’entrepreneurs pour nouer des liens et ouvrirles portes, pour éviter que la France ne soiten retard. C’est une première démarche pragm<strong>at</strong>iquequi consiste à dire : la concurrence vas’accentuer, nous rencontrerons des problèmesavec les fonds structurels,mais de toutefaçon cela va se faire.Alors comment faitonpour que ce soitle plus pr<strong>of</strong>itablepossible ?Renforcer les liensavec les paysqui partagentla même visionde l’EuropeJ’<strong>at</strong>tire néanmoinsl’<strong>at</strong>tention, y comprisde notre Ministreet des parlementaires,sur le fait qu’ily a un risque dansl’harmonis<strong>at</strong>ion descharges et des servitudesadministr<strong>at</strong>ives. J’ai entendu un responsableéconomique dire qu’il faut que nos entreprisesen pr<strong>of</strong>itent pour aller s’implanter là-bas ; ce quiest certes un projet louable, mais je ne suis passi sûr que les salariés de nos entreprises apprécieront.Voyons plutôt comment on peut à la foisnouer des liens et produire sur place, touten veillant à minimiser les effets destructeurspour l’emploi en France.Il est essentiel de renforcer les liens avec les paysavec lesquels nous partageons à l’évidencela même vision de l’Europe, notamment avecles Allemands. Nous avons pris l’initi<strong>at</strong>ive pournous rapprocher des Italiens, des Espagnols etdes Allemands, pour voir entre chefs d’entrepriseet entre Chambres de Commerce ce que nouspourrons faire ensemble. Le dernier point quim’a frappé, et auquel je suis particulièrement<strong>at</strong>tentif, c’est tout ce qui concerne le bassinméditerranéen et ce qu’on peut appeler le Sud,et en tout cas la France. Quand vous comparezla planisphère avec la dimension des pays enfonction de leur PIB, et la même planisphèreavec la dimensiondes pays en fonctionde leur démographie,tout lemonde comprendque nous sommesface à un véritableproblème, conséquencedu choc dedeux dépressions :dépression démographiqueau Nord,dépression économiqueau Sud. Iln’y aura pas d’issues<strong>at</strong>isfaisante pour l’Europe en général, et pourla France en particulier, si nous n’engageons pasun énorme effort d’appui au développement économiquede l’Afrique et notamment du Maghreb.111

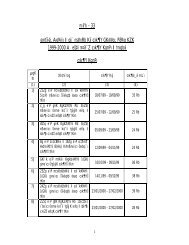

Appeal against the order <strong>of</strong> DCT :A taxpayer can file an appeal against DCT's order to the Commissioner (Appeals)/Additional or Joint Commissioner <strong>of</strong> <strong>Tax</strong>es(Appeals), to the <strong>Tax</strong>es Appell<strong>at</strong>e Tribunal against an Appeal order and to Commissioner <strong>of</strong> <strong>Tax</strong>es <strong>of</strong> the respective taxes Zonefor the revision <strong>of</strong> DCT's order.<strong>Tax</strong> withholding functions :In Bangladesh withholding taxes are usually termed as <strong>Tax</strong> deduction and collected <strong>at</strong> source. Under this system both priv<strong>at</strong>eand public limited companies or any other organiz<strong>at</strong>ion specified by law are legally authorized and bound to withhold taxes <strong>at</strong>some point <strong>of</strong> making payment and to deposit the same to the Government Exchequer. The taxpayer receives a certific<strong>at</strong>e fromthe withholding authority and gets credits <strong>of</strong> tax against assessed tax on the basis <strong>of</strong> such certific<strong>at</strong>e.Heads <strong>of</strong> <strong>Income</strong> Subject to deduction or collection <strong>of</strong> income tax<strong>at</strong> source with specified r<strong>at</strong>es <strong>of</strong> deduction.TableSl Head <strong>of</strong> Withholding authority Withholding r<strong>at</strong>e/ r<strong>at</strong>es <strong>of</strong> tax Limit<strong>at</strong>ionwithholding1. Salaries [section-50] Any person responsiblefor making suchpayment.Average <strong>of</strong> the r<strong>at</strong>es applicableto the estim<strong>at</strong>ed total income <strong>of</strong>the payee under this head.2. Discount on the realvalue <strong>of</strong> BangladeshBank bills. [section-50A]Any person responsiblefor making suchpayment.Maximum r<strong>at</strong>e3. Interest on securities[section-51]4. Payment tocontractors & subcontractors[section-52] [rule-16]Any person responsiblefor issuing any securityAny person responsiblefor making suchpayment.10% This shall not apply to the Treasurybond or Treasury bill issued by theGovernment or to any payment onaccount <strong>of</strong> interest payable ondebentures issued by or on behalf<strong>of</strong> a local authority or a company.Upto Tk. 2,00,000/--Nil.From 2,00,001 to Tk 5,00,000/-------------1%From 5,00,001 to Tk.15,00,000/- ------- 2..5%From 15,00,001 to Tk.25,00,000/- ------- 3..5%From 25,00,001 to Tk.3,00,00,000/- ------4%where thepayment exceeds Tk.3,00,00,000 ----------5%in case <strong>of</strong> oil supplied by oilmarketing companiesupto Tk 2,00,000 -- Nil5. Payment onindentingcommission orshipping agencycommission.[section-52, rule-17]6. Fees for Doctors[section-52A(1)]Any person responsiblefor making suchpayment.The principal <strong>of</strong>ficer <strong>of</strong>a company or the chiefexecutive <strong>of</strong> any NGOor trust responsible forwhere thepayment exceeds Tk 2,00,000 -------- 0.75%on indenting commission -----------------------7.5%on shipping agency commission---------5%10%

7. Royalty or technicalknow-how fee[section-52A(2)]8. Fees for pr<strong>of</strong>essionalor technical servicesor any serviceapplying forpr<strong>of</strong>essionalknowledge [section-52A(3)]9. Payment <strong>of</strong> certainservices likestevedoring agency,priv<strong>at</strong>e securityservice or anyservice other thanthe servicesmentioned inChapter VII <strong>of</strong> ITO[section-52AA]10. Clearing andforwarding agents[section 52AAA]11. Cigarettesmanufacturing[section 52B]12. Compens<strong>at</strong>ionagainst acquisition<strong>of</strong> property [section52C]13. Interest on savinginstruments [section52D]14. BrickManufacturer[section 52F]making such payment.The government or any 10%other authority,corpor<strong>at</strong>ion or body orany company or anybanking company orany insurance companyor any co-oper<strong>at</strong>ivebank or any NGOresponsible for makingsuch payment.Do 10% Person certified by NBR havingnon assessable income or personhaving income exempted from taxThe government or any 10%other authority,corpor<strong>at</strong>ion or body orany company or anybanking company or anyinsurance company orany co-oper<strong>at</strong>ive bank orany NGO responsiblefor paying anycommission to astevedoring agency ormaking any payment toa priv<strong>at</strong>e securityservice.Commissioner <strong>of</strong> 10%Customs.Any person responsiblefor selling banderols toany manufacturer <strong>of</strong>cigarettes.Any person responsiblefor payment <strong>of</strong> suchcompens<strong>at</strong>ionAny person responsiblefor making suchpaymentAny person responsiblefor issuing anypermission or renewal<strong>of</strong> permission formanufacture <strong>of</strong> bricks.6% <strong>of</strong> the value <strong>of</strong> the banderols(a). 2% <strong>of</strong> the amount <strong>of</strong> suchcompens<strong>at</strong>ion against theimmovable property situ<strong>at</strong>edwithin City Corpor<strong>at</strong>ion,Paurashava or Cantonment<strong>Board</strong>(b). 1% <strong>of</strong> the amount <strong>of</strong> suchcompens<strong>at</strong>ion against theimmovable property situ<strong>at</strong>edoutside the jurisdiction <strong>of</strong>City Corpor<strong>at</strong>ion,Paurashava or Cantonment<strong>Board</strong>5% No deduction to be made if thesaving instrument is purchased byany approved superannu<strong>at</strong>ion fundor pension fund <strong>of</strong> gr<strong>at</strong>uity fund orany recognized provident fund orany workers' pr<strong>of</strong>it particip<strong>at</strong>ionTk.30,000/- for one sectionbrick field.Tk. 45,000/- for two sectionbrick field.fund.15. Commission <strong>of</strong> letter<strong>of</strong> credit [sectionAny person responsiblefor opening letter <strong>of</strong>Tk. 60,000/- for three sectionbrick field.5%

52I] credit.16. Renewal <strong>of</strong> tradelicense by CityCorpor<strong>at</strong>ion orPaurashava [section52K]17. Freight forwardagency commission[section 52M]18. Rental PowerCompany[section 52N]19. Foreign technicianserving in diamondcutting industries[section 52O]20. Convention hall,convention centreetc. [section 52P]21. Service charges,remuner<strong>at</strong>ions,consulting fees,commissionsremitted fromabroad for servicesworks done bypersons living in thecountry[section 52Q]22. Importer [section53]23. House property[section 53A] [rule17B]24. Shipping business <strong>of</strong>a resident [section53AA]25. Export <strong>of</strong> manpower[section 53B, rule-17C]City Corpor<strong>at</strong>ion orPaurashava.Any person responsiblefor making suchpayment.Bangladesh PowerDevelopment <strong>Board</strong>during payment to anypower gener<strong>at</strong>ioncompany against powerTk. 500/- for each trade license.15%4%purchase.Employer. 5% This r<strong>at</strong>e is for 3 years from theappointment <strong>of</strong> such foreigntechnician and appointment to becompleted by 30 June 2010.The Government or anyauthority, corpor<strong>at</strong>ionor body or anycompany or anybanking company orany co-oper<strong>at</strong>ive bankor any NGO run orsupported by anyforeign don<strong>at</strong>ion or anyuniversity or medicalcollege or dentalcollege or engineeringcollege as user.Commercial banks orfinancial institutions.The Commissioner <strong>of</strong>Customs.The Government or anyauthority, corpor<strong>at</strong>ionor body or anycompany or anybanking company orany co-oper<strong>at</strong>ive bankor any NGO run orsupported by anyforeign don<strong>at</strong>ion or anyuniversity or medicalcollege or dentalcollege or engineeringcollege as tenant.Commissioner <strong>of</strong>Customs or any otherauthority dulyauthorised.The Director General,Bureau <strong>of</strong> Manpower,Employment andTraining.5%10% No deduction to be made againstremittance sent by wage earners'.5% <strong>Tax</strong> <strong>at</strong> source will not be withheldfor items prescribed in rule 17A.Up to Tk. 20,000/-per month [p. m] ---- NilFrom Tk 20,001/- to Tk.40,000/- p.m. -------3%More than Tk 40,000/- p.m.---5%5% <strong>of</strong> total freight received orreceivable in or out <strong>of</strong>Bangladesh.3% <strong>of</strong> total freight received orreceivable from servicesrendered between two or moreforeign countries.10%This does not apply if the owner <strong>of</strong>house property is given a certific<strong>at</strong>eby the DCT regarding not havingany assessable income during theyear or is having income otherwiseexempted from payment <strong>of</strong> incometax.

26. Export <strong>of</strong> Knit-wearand wovengarments, terrytowel, jute goods,frozen food,vegetables, le<strong>at</strong>hergoods, packed food[section 53BB]27. Member <strong>of</strong> StockExchanges [section53BBB]28. Export or any goodsexcept knit-wearand wovengarments, terrytowel, jute goods ,frozen food,vegetables, le<strong>at</strong>hergoods, packed food[section 53BBBB]29. Goods or propertysold by publicauction [section53C][rule 17D]30. Courier business <strong>of</strong> anon-resident [section53CC]31. Payment to actors,actresses, producersetc [section 53D][rule 17E]32. Commission,discount or fees[section 53E]33. Commission orremuner<strong>at</strong>ion paid toagent <strong>of</strong> foreignbuyer[section 53EE]34. Interest on savingdeposits and fixeddeposits[section 53F]35. Real est<strong>at</strong>e or landdevelopmentbusiness[section 53FF]Bank.The Chief ExecutiveOfficer <strong>of</strong> stockexchange.Bank.Any person makingsale.Any person being acompany working aslocal agent <strong>of</strong> a nonresidentcouriercompany.1. The personproducing the film,drama, advertisement,TV/radio programmeor purchasing suchprogrammes.Any person being acorpor<strong>at</strong>ion, bodyincluding a companymaking such payment.0.60% <strong>of</strong> the total exportproceeds.0.10% --0.70% <strong>of</strong> the total exportproceeds.5% <strong>of</strong> sale price. --15% on the amount <strong>of</strong> servicecharge accrued.10% --10%Bank. 7.5%Any person responsiblefor making suchpayment.Any person responsiblefor registering anydocument for transfer<strong>of</strong> any land or buildingor apartment.No deduction or deduction <strong>at</strong> areduced r<strong>at</strong>e to be made if anexporter produces certific<strong>at</strong>e fromNBR regarding having fully orpartly exempted income.No deduction or deduction <strong>at</strong> areduced r<strong>at</strong>e to be made if anexporter produces certific<strong>at</strong>e fromNBR regarding having fully orpartly exempted income.--10% This shall not apply on the amount<strong>of</strong> interest or share <strong>of</strong> pr<strong>of</strong>it arisingout <strong>of</strong> any deposit pension schemesponsored by the government or bya schedule bank with prior approval<strong>of</strong> the Government.In case <strong>of</strong> Building/Apartmentconstructed for residentialpurchases:(i) Tk. 2,000 per square meter forbuilding or apartmentsitu<strong>at</strong>ed <strong>at</strong> Gulshan ModelTown,Banani,Baridhara,Motijheel andDilkusha. Tk 8,000/- forthose other than residentialpurposes;(ii) Tk. 1,800 per square meterfor building or apartmentsitu<strong>at</strong>ed <strong>at</strong> Dhanmandi,Defense Officers HousingSociety (DOHS),Mahakhali, Lalm<strong>at</strong>iaHousing Society, UttaraModel Town, Bashundhara

Residential Area, DhakaCantonment Area, KarwanBazar Commercial Area <strong>of</strong>Dhaka and, Panchlaish,Khulshi Residential Area,Agrabad and Nasirabad <strong>of</strong>Chittagong. Tk 6,000/- forthose other than residentialpurposes;36. Insurancecommission[section 53G]37. Fees <strong>of</strong> surveyors <strong>of</strong>general insurancecompany[section 53GG]38. Transfer <strong>of</strong> property[section 53H]39. Interest on deposit <strong>of</strong>post <strong>of</strong>fice & savingbank account[section 53I]40. Rental value <strong>of</strong>vacant land or plantor machinery[section 53J] [rule17BB]41. Advertisement <strong>of</strong>newspaper ormagazine or priv<strong>at</strong>etelevision channel[section 53K]Any person responsiblefor paying suchcommission to aresident.Any person responsiblefor paying such fees toresidentAny person responsiblefor registering anydocument <strong>of</strong> a person.Any person responsiblefor making suchpayment.The Government or anyauthority, corpor<strong>at</strong>ionor body including itsunits, the activities orany NGO, anyuniversity or medicalcollege, dental college,engineering collegeresponsible for makingsuch payment.The Government or anyother authority,corpor<strong>at</strong>ion or body orany company or anybanking company orany insurance company(iii) Tk. 800 per square meterwhere the building orapartment is situ<strong>at</strong>ed inareas other than areasmentioned in sub-clause (i)& (ii). Tk 2,000/- for thoseother than residentialpurposes.In case <strong>of</strong> Land:2% <strong>of</strong> deed value in case <strong>of</strong>property situ<strong>at</strong>ed in any citycorpor<strong>at</strong>ion, paurashava orcantonment board.1% <strong>of</strong> deed value in case <strong>of</strong>property situ<strong>at</strong>ed in places otherthan any city corpor<strong>at</strong>ion,paurashava or cantonment board.5%15%2% <strong>of</strong> deed value in case <strong>of</strong>property situ<strong>at</strong>ed in Dhaka,Narayanganj, Gazipur, CDA,KDA, RDA, any citycorpor<strong>at</strong>ion, paurashava orcantonment board.1% <strong>of</strong> deed value in case <strong>of</strong>property situ<strong>at</strong>ed in areas otherthan those mentioned above.This shall not apply to sale by abank or a financial institution as amortgagee empowered to sell;mortgagee <strong>of</strong> any property to theBHBFC; mortgagee to any bank <strong>of</strong>any property; transfer <strong>of</strong> anyagricultural land in Bangladeshexcept land situ<strong>at</strong>ed in any areamentioned in paragraph [i] or [ii],<strong>of</strong> sub-clause [c] or clause [15] <strong>of</strong>section 2;10% This shall not apply if the totalamount <strong>of</strong> interest is paid to suchpayee or class <strong>of</strong> payees asspecified by the <strong>Board</strong>.Up to Tk. 15,000/- per month ---------------Nil.From Tk 15,001/- to Tk30,000/- per month –3%More than Tk. 30,000/- permonth ----------5%3%.

42. Collection <strong>of</strong> taxfrom sale <strong>of</strong> share <strong>at</strong>a premium over facevalue [section 53L]43. Collection <strong>of</strong> taxfrom transfer <strong>of</strong>shares by thesponsor shareholdersor placement holders<strong>of</strong> a company listedon stock exchange[section 53M]44. Dividends[section 54]or any cooper<strong>at</strong>ive bankor any NGO or anyuniversity or medicalcollege or dentalcollege or engineeringcollege responsible formaking such payment.Securities & ExchangeCommissionSecurities & ExchangeCommission/StockExchangeThe principal <strong>of</strong>ficer <strong>of</strong>a company.3%5%Resident/ non-residentBangladeshi company ----- 20%Resident/ non-residentBangladeshi person other thancompany -----10%If the DCT certifies, deduction inthis regard may not be made ormade <strong>at</strong> a r<strong>at</strong>e less than themaximum r<strong>at</strong>e.45. <strong>Income</strong> from lottery[section 55]46. <strong>Income</strong> <strong>of</strong> nonresidents[section 56]Any person responsiblefor making suchpayment.Any person responsiblefor making suchpayment.Non-resident (other thanBangladeshi non-resident)person other than a company---25%.20%Non resident company <strong>at</strong> ther<strong>at</strong>e applicable to a company.Non-resident non-Bangladeshiperson other than a company ---25%Non-resident Bangladeshiperson <strong>at</strong> the r<strong>at</strong>e applicable to aresident.Major areas for final settlement <strong>of</strong> tax liability :<strong>Tax</strong> deducted <strong>at</strong> source for the following cases is tre<strong>at</strong>ed as final discharge <strong>of</strong> tax liabilities. No additional tax is charged orrefund is allowed in the following cases:-Supply or contract workBand rolls <strong>of</strong> hand made cigarettesImport <strong>of</strong> goodsTransfer <strong>of</strong> propertiesExport <strong>of</strong> manpowerReal Est<strong>at</strong>e BusinessExport value <strong>of</strong> certain items including knit and woven garments.Local shipping businessRoyalty, technical know-how feeInsurance agent commissionAuction purchasePayment on account <strong>of</strong> survey by surveyor <strong>of</strong> a general insurance companyClearing & forwarding agency commissionTransaction by a member <strong>of</strong> a Stock ExchangeCourier businessCompens<strong>at</strong>ion against acquisition <strong>of</strong> property

Premium value over face value <strong>of</strong> a share<strong>Income</strong> from transfer <strong>of</strong> securities <strong>of</strong> a sponsor shareholder.Winning from lotteries.<strong>Tax</strong> Recovery System :In case <strong>of</strong> non-payment <strong>of</strong> income tax demand the following measures can be taken against a taxpayer for realiz<strong>at</strong>ion <strong>of</strong> tax:-Imposition <strong>of</strong> penalty,Attachment <strong>of</strong> bank accounts, salary or any other payment,Filing <strong>of</strong> Certific<strong>at</strong>e case to the Special Magistr<strong>at</strong>e.Advance Payment <strong>of</strong> <strong>Tax</strong> :Every taxpayer is required to pay advance tax in four equal installments falling on 15th September; 15th December; 15th Marchand 15th June <strong>of</strong> each year if the l<strong>at</strong>est assessed income exceeds Taka four lakh. Penalty and interest are imposed for default inpayment <strong>of</strong> any installment <strong>of</strong> advance tax.Fiscal incentives :Following are fiscal incentives available to a taxpayer:-a) <strong>Tax</strong> holiday : <strong>Tax</strong> holiday is allowed for industrial undertaking and physical infrastructure facility established between1st July 2011 to 30th June 2013 in fulfillment <strong>of</strong> certain conditions.Industrial Undertaking Eligible for <strong>Tax</strong> holiday :(i) (a) active pharmaceuticals ingredient industry and radio pharmaceuticals industry;(b) barrier contraceptive and rubber l<strong>at</strong>ex;(c) basic chemicals or dyes and chemicals;(d) basic ingredients <strong>of</strong> electronic industry (e.g resistance, capacitor, transistor, integr<strong>at</strong>or circuit);(e) bio-fertilizer;(f) biotechnology;(g) boilers;(h) compressors;(i) computer hardware;(j) energy efficient appliances;(k) insecticide or pesticide;(l) petro-chemicals;(m) pharmaceuticals;(n) processing <strong>of</strong> locally produced fruits and vegetables;(o) radio-active (diffusion) applic<strong>at</strong>ion industry (e.g. developing quality or decaying polymer or preserv<strong>at</strong>ion <strong>of</strong>food or disinfecting medicinal equipment);(p) textile machinery;(q)(q)tissue grafting; orany other c<strong>at</strong>egory <strong>of</strong> industrial undertaking as the Government may, by notific<strong>at</strong>ion in the <strong>of</strong>ficial Gazette,specify.Physical Infrastructure Eligible for <strong>Tax</strong> holiday:(a) deep sea port;(b) elev<strong>at</strong>ed expressway;(c) export processing zone;(d) flyover;(e) gas pipe line,(f) Hi-tech park;(g) Inform<strong>at</strong>ion and Communic<strong>at</strong>ion Technology (ICT) village or s<strong>of</strong>tware technology zone;(h) Inform<strong>at</strong>ion Technology (IT) park;(i) large w<strong>at</strong>er tre<strong>at</strong>ment plant and supply through pipe line;(j) Liquefied N<strong>at</strong>ural Gas (LNG) terminal and transmission line;(k) mono-rail;(l) rapid transit;(m) renewable energy (e.g energy saving bulb, solar energy plant, windmill);(n) sea or river port;(o) toll road;(p) underground rail;(q) waste tre<strong>at</strong>ment plant; or(r) any other c<strong>at</strong>egory <strong>of</strong> physical infrastructure facility as the Government may, by notific<strong>at</strong>ion in the <strong>of</strong>ficialGazette, specify.b) Acceler<strong>at</strong>ed depreci<strong>at</strong>ion: Acceler<strong>at</strong>ed depreci<strong>at</strong>ion on cost <strong>of</strong> machinery is admissible for new industrial

undertaking in the first year <strong>of</strong> commercial production 50%, in the second year 30% and in the third year 20%.c) <strong>Income</strong> derived from any Small and Medium Enterprise (SME) engaged in production <strong>of</strong> any goods andhaving an annual turnover <strong>of</strong> not more than taka twenty four lakh is exempt from tax.d) Industry set up in EPZ and commencing commercial production or oper<strong>at</strong>ion before December 31, 2011 isexempt from tax for a period <strong>of</strong> 10 years from the d<strong>at</strong>e <strong>of</strong> commencement <strong>of</strong> commercial production. Industryto be set up after January 1, 2012 will enjoy tax holiday for five years.e) <strong>Income</strong> from poultry is exempt from tax up to 30th June, 2013, subject to investing <strong>at</strong> least 10% <strong>of</strong> theexempted income th<strong>at</strong> exceeds one lakh and fifty thousand Taka, in government securities or bonds.f) <strong>Income</strong> derived from export <strong>of</strong> handicrafts is exempted from tax up to 30th June, 2013.g) An amount equal to 50% <strong>of</strong> the income derived from export business is exempted from tax.h) Listed companies are entitled to 10% tax reb<strong>at</strong>e if they declare dividend <strong>of</strong> 20% or more.i) <strong>Income</strong> from Inform<strong>at</strong>ion Technology Enabled Services (ITES) business is exempted up to 30th June, 2013.(j) <strong>Income</strong> <strong>of</strong> a priv<strong>at</strong>e power gener<strong>at</strong>ion company subject to certain conditions included in priv<strong>at</strong>e sectorpower gener<strong>at</strong>ion policy <strong>of</strong> Bangladesh is exempted from tax for 15 years form the day <strong>of</strong> commencement<strong>of</strong> commercial production before June 30, 2013. <strong>Income</strong> <strong>of</strong> a priv<strong>at</strong>e power gener<strong>at</strong>ion companycommencing commercial production from July, 2013 will enjoy tax holiday for 10 years subject to certainlimits and conditions.Avoidance <strong>of</strong> Double <strong>Tax</strong><strong>at</strong>ion Agreement :There are agreements on avoidance <strong>of</strong> double tax<strong>at</strong>ion between Bangladesh and 28 countries which are:-(1) United Kingdom <strong>of</strong> Gre<strong>at</strong> Britain and Northern Ireland, (2) Singapore (3) Sweden (4) Republic <strong>of</strong> Korea (5) Canada (6)Pakistan (7) Romania (8) Sri Lanka (9) France (10) Malaysia (11) Japan (12) India (13) Germany (14) The Netherlands (15)Italy (16) Denmark (17) China (18) Belgium (19) Thailand (20) Poland (21) Philippines (22) Vietnam (23) Turkey (24)Norway (25) USA (26) Indonesia (27) Switzerland.

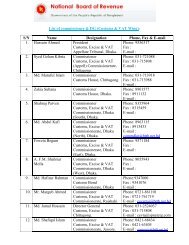

List <strong>of</strong> the Commissioner's/DG's (<strong>Income</strong> <strong>Tax</strong> Wing)Sl. Name <strong>of</strong> theName <strong>of</strong> the Phone No. Fax No. E-mailNo.OfficeOfficer(1) (2) (3) (4) (5) (6)1. Commissioner<strong>Tax</strong>es Zone-1, DhakaMr. Dr. MahbuburRahman83629448333855(PA)2. CommissionerMs. Rahela831 2416<strong>Tax</strong>es Zone-2, Dhaka Chowdhury3. CommissionerMr. Md Sirajul Islam 831 2402<strong>Tax</strong>es Zone-3, Dhaka4. CommissionerMr. Dr. Md. Mahbabur 933 6788<strong>Tax</strong>es Zone-4, Dhaka Rahman5. CommissionerMr. Md. Abdur Razzak 934 6364<strong>Tax</strong>es Zone-5, Dhaka6. CommissionerMr. Pervez Iabal 831 6049<strong>Tax</strong>es Zone-6, Dhaka7. CommissionerMr. Syed Md. 835 0603<strong>Tax</strong>es Zone-7, Dhaka Mahbubur Rahman8. CommissionerMr. Kalipada Halder 934 0075<strong>Tax</strong>es Zone-8, Dhaka9. Commissioner (incharge)Large <strong>Tax</strong>payer's Unit(LTU)10. CommissionerCentral Survey Zone,Dhaka11. Commissioner<strong>Tax</strong>es Zone-1,Chittagong12. Commissioner<strong>Tax</strong>es Zone-2,Chittagong13. Commissioner<strong>Tax</strong>es Zone-3,Chittagong14. Commissioner<strong>Tax</strong>es Zone-Rajshahi15. Commissioner<strong>Tax</strong>es Zone-Khulna16. Commissioner<strong>Tax</strong>es Appeal Zone-1,Dhaka17. Commissioner<strong>Tax</strong>es Appeal Zone-2,Dhaka18. Commissioner<strong>Tax</strong>es Appeal Zone-3,Dhaka19. Commissioner<strong>Tax</strong>es Appeal Zone-ChittagongMr. Md. Abdul B<strong>at</strong>enAdd. CommissionerMr. Sanjit KumarBiswasMr. RamendraChandra BasakMr. Md. HabiburRahman Akhand831 2472717 4224031-715190031-710840Mr. Sultan Mahmud 031-725897Mrs. Rokeya Kh<strong>at</strong>un 0721-812320Mr. Md. Dabir Uddin 041-760669Mr. Mir Mushtaq Ali 933 7533Mrs. Rowshan AraAkhter833-3116Mr. Liak<strong>at</strong> Ali Khan 833 3116Mr. Haidar Khan 031-714217

20. Commissioner<strong>Tax</strong>es Appeal Zone-Khulna21. Director GeneralCentral Intelligence Cell22. Director General<strong>Tax</strong> Inspection, Dhaka23. Director General<strong>Tax</strong> Training Academy24. Commissioner<strong>Tax</strong>es Zone-Rangpur25. Commissioner<strong>Tax</strong>es Zone-Barisal26. Commissioner<strong>Tax</strong>es Zone-SylhetMr. Chinmoy ProshunBiswas041-760349Mr. Md. Alauddin 833 1011Mr. Kanon Kumar Roy 835 9444Mr. Md. Meftahuddin 933 3520KhanMr. Balal Uddin 0521-61772Mr. Radhesam Roy 0431-72202Mr. M.A Jabbar 0821-716403