Income Tax at a Glance - National Board of Revenue

Income Tax at a Glance - National Board of Revenue

Income Tax at a Glance - National Board of Revenue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

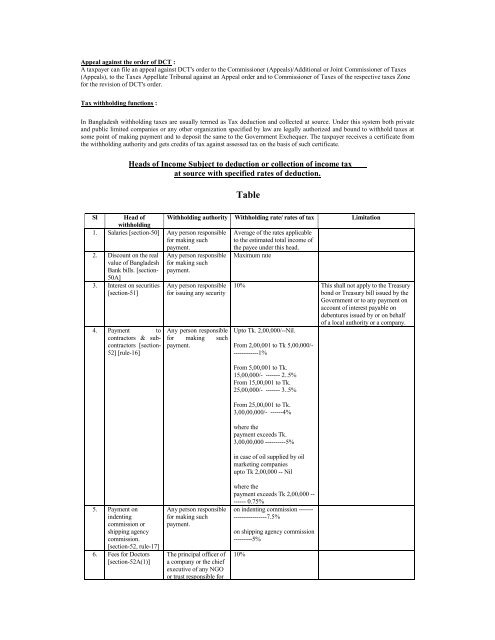

Appeal against the order <strong>of</strong> DCT :A taxpayer can file an appeal against DCT's order to the Commissioner (Appeals)/Additional or Joint Commissioner <strong>of</strong> <strong>Tax</strong>es(Appeals), to the <strong>Tax</strong>es Appell<strong>at</strong>e Tribunal against an Appeal order and to Commissioner <strong>of</strong> <strong>Tax</strong>es <strong>of</strong> the respective taxes Zonefor the revision <strong>of</strong> DCT's order.<strong>Tax</strong> withholding functions :In Bangladesh withholding taxes are usually termed as <strong>Tax</strong> deduction and collected <strong>at</strong> source. Under this system both priv<strong>at</strong>eand public limited companies or any other organiz<strong>at</strong>ion specified by law are legally authorized and bound to withhold taxes <strong>at</strong>some point <strong>of</strong> making payment and to deposit the same to the Government Exchequer. The taxpayer receives a certific<strong>at</strong>e fromthe withholding authority and gets credits <strong>of</strong> tax against assessed tax on the basis <strong>of</strong> such certific<strong>at</strong>e.Heads <strong>of</strong> <strong>Income</strong> Subject to deduction or collection <strong>of</strong> income tax<strong>at</strong> source with specified r<strong>at</strong>es <strong>of</strong> deduction.TableSl Head <strong>of</strong> Withholding authority Withholding r<strong>at</strong>e/ r<strong>at</strong>es <strong>of</strong> tax Limit<strong>at</strong>ionwithholding1. Salaries [section-50] Any person responsiblefor making suchpayment.Average <strong>of</strong> the r<strong>at</strong>es applicableto the estim<strong>at</strong>ed total income <strong>of</strong>the payee under this head.2. Discount on the realvalue <strong>of</strong> BangladeshBank bills. [section-50A]Any person responsiblefor making suchpayment.Maximum r<strong>at</strong>e3. Interest on securities[section-51]4. Payment tocontractors & subcontractors[section-52] [rule-16]Any person responsiblefor issuing any securityAny person responsiblefor making suchpayment.10% This shall not apply to the Treasurybond or Treasury bill issued by theGovernment or to any payment onaccount <strong>of</strong> interest payable ondebentures issued by or on behalf<strong>of</strong> a local authority or a company.Upto Tk. 2,00,000/--Nil.From 2,00,001 to Tk 5,00,000/-------------1%From 5,00,001 to Tk.15,00,000/- ------- 2..5%From 15,00,001 to Tk.25,00,000/- ------- 3..5%From 25,00,001 to Tk.3,00,00,000/- ------4%where thepayment exceeds Tk.3,00,00,000 ----------5%in case <strong>of</strong> oil supplied by oilmarketing companiesupto Tk 2,00,000 -- Nil5. Payment onindentingcommission orshipping agencycommission.[section-52, rule-17]6. Fees for Doctors[section-52A(1)]Any person responsiblefor making suchpayment.The principal <strong>of</strong>ficer <strong>of</strong>a company or the chiefexecutive <strong>of</strong> any NGOor trust responsible forwhere thepayment exceeds Tk 2,00,000 -------- 0.75%on indenting commission -----------------------7.5%on shipping agency commission---------5%10%