special provisions regarding baggage and goods imported or ...

special provisions regarding baggage and goods imported or ...

special provisions regarding baggage and goods imported or ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

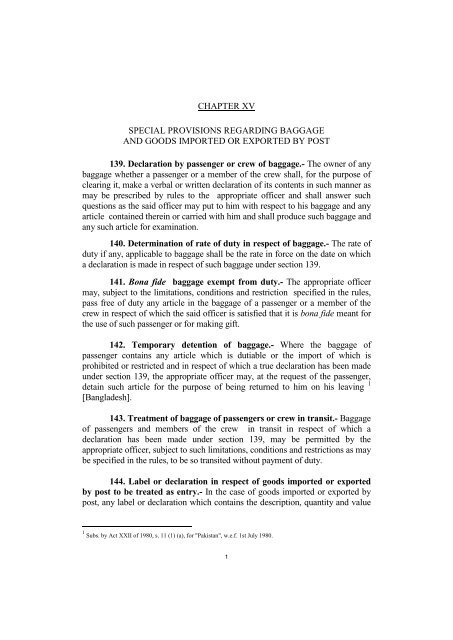

CHAPTER XVSPECIAL PROVISIONS REGARDING BAGGAGEAND GOODS IMPORTED OR EXPORTED BY POST139. Declaration by passenger <strong>or</strong> crew of <strong>baggage</strong>.- The owner of any<strong>baggage</strong> whether a passenger <strong>or</strong> a member of the crew shall, f<strong>or</strong> the purpose ofclearing it, make a verbal <strong>or</strong> written declaration of its contents in such manner asmay be prescribed by rules to the appropriate officer <strong>and</strong> shall answer suchquestions as the said officer may put to him with respect to his <strong>baggage</strong> <strong>and</strong> anyarticle contained therein <strong>or</strong> carried with him <strong>and</strong> shall produce such <strong>baggage</strong> <strong>and</strong>any such article f<strong>or</strong> examination.140. Determination of rate of duty in respect of <strong>baggage</strong>.- The rate ofduty if any, applicable to <strong>baggage</strong> shall be the rate in f<strong>or</strong>ce on the date on whicha declaration is made in respect of such <strong>baggage</strong> under section 139.141. Bona fide <strong>baggage</strong> exempt from duty.- The appropriate officermay, subject to the limitations, conditions <strong>and</strong> restriction specified in the rules,pass free of duty any article in the <strong>baggage</strong> of a passenger <strong>or</strong> a member of thecrew in respect of which the said officer is satisfied that it is bona fide meant f<strong>or</strong>the use of such passenger <strong>or</strong> f<strong>or</strong> making gift.142. Temp<strong>or</strong>ary detention of <strong>baggage</strong>.- Where the <strong>baggage</strong> ofpassenger contains any article which is dutiable <strong>or</strong> the imp<strong>or</strong>t of which isprohibited <strong>or</strong> restricted <strong>and</strong> in respect of which a true declaration has been madeunder section 139, the appropriate officer may, at the request of the passenger,detain such article f<strong>or</strong> the purpose of being returned to him on his leaving 1[Bangladesh].143. Treatment of <strong>baggage</strong> of passengers <strong>or</strong> crew in transit.- Baggageof passengers <strong>and</strong> members of the crew in transit in respect of which adeclaration has been made under section 139, may be permitted by theappropriate officer, subject to such limitations, conditions <strong>and</strong> restrictions as maybe specified in the rules, to be so transited without payment of duty.144. Label <strong>or</strong> declaration in respect of <strong>goods</strong> <strong>imp<strong>or</strong>ted</strong> <strong>or</strong> exp<strong>or</strong>tedby post to be treated as entry.- In the case of <strong>goods</strong> <strong>imp<strong>or</strong>ted</strong> <strong>or</strong> exp<strong>or</strong>ted bypost, any label <strong>or</strong> declaration which contains the description, quantity <strong>and</strong> value1 Subs. by Act XXII of 1980, s. 11 (1) (a), f<strong>or</strong> "Pakistan", w.e.f. 1st July 1980.1

thereof shall be deemed to be an entry f<strong>or</strong> imp<strong>or</strong>t <strong>or</strong> exp<strong>or</strong>t, as the case may be,f<strong>or</strong> the purposes of this Act.145. Rate of duty in respect of <strong>goods</strong> <strong>imp<strong>or</strong>ted</strong> <strong>or</strong> exp<strong>or</strong>ted by post.-(1) The rate of duty, if any, applicable to any <strong>goods</strong> <strong>imp<strong>or</strong>ted</strong> by post shall bethe rate in f<strong>or</strong>ce on the date on which the postal auth<strong>or</strong>ities present to theappropriate officer the declaration <strong>or</strong> label referred to in section 144 f<strong>or</strong> thepurpose of assessing the duty thereon.(2) The rate of duty, if any, applicable to any <strong>goods</strong> exp<strong>or</strong>ted by the postshall be the rate in f<strong>or</strong>ce on the date on which the exp<strong>or</strong>ter delivers such <strong>goods</strong> tothe postal auth<strong>or</strong>ities f<strong>or</strong> exp<strong>or</strong>tation.2