Amendment of Customs Act, 1969

Amendment of Customs Act, 1969

Amendment of Customs Act, 1969

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

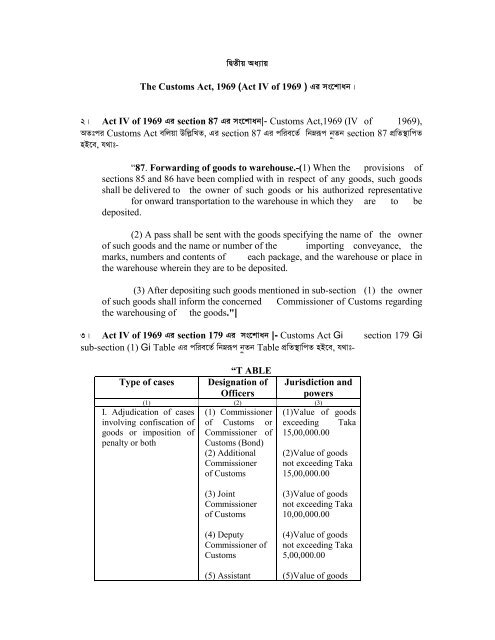

wØZxq Aa¨vqThe <strong>Customs</strong> <strong>Act</strong>, <strong>1969</strong> (<strong>Act</strong> IV <strong>of</strong> <strong>1969</strong> ) Gi ms‡kvab|2| <strong>Act</strong> IV <strong>of</strong> <strong>1969</strong> Gi section 87 Gi ms‡kvab|- <strong>Customs</strong> <strong>Act</strong>,<strong>1969</strong> (IV <strong>of</strong> <strong>1969</strong>),AZtci <strong>Customs</strong> <strong>Act</strong> ewjqv Dwj−wLZ, Gi section 87 Gi cwie‡Z© wbæiƒc b~Zb section 87 cÖwZ¯’vwcZnB‡e, h_vt-“87. Forwarding <strong>of</strong> goods to warehouse.-(1) When the provisions <strong>of</strong>sections 85 and 86 have been complied with in respect <strong>of</strong> any goods, such goodsshall be delivered to the owner <strong>of</strong> such goods or his authorized representativefor onward transportation to the warehouse in which they are to bedeposited.(2) A pass shall be sent with the goods specifying the name <strong>of</strong> the owner<strong>of</strong> such goods and the name or number <strong>of</strong> the importing conveyance, themarks, numbers and contents <strong>of</strong> each package, and the warehouse or place inthe warehouse wherein they are to be deposited.(3) After depositing such goods mentioned in sub-section (1) the owner<strong>of</strong> such goods shall inform the concerned Commissioner <strong>of</strong> <strong>Customs</strong> regardingthe warehousing <strong>of</strong> the goods."|3| <strong>Act</strong> IV <strong>of</strong> <strong>1969</strong> Gi section 179 Gi ms‡kvab |- <strong>Customs</strong> <strong>Act</strong> Gi section 179 Gisub-section (1) Gi Table Gi cwie‡Z© wbæiƒc b~Zb Table cÖwZ¯’vwcZ nB‡e, h_vt-Type <strong>of</strong> cases“T ABLEDesignation <strong>of</strong>OfficersJurisdiction andpowers(1) (2) (3)I. Adjudication <strong>of</strong> casesinvolving confiscation <strong>of</strong>goods or imposition <strong>of</strong>penalty or both(1) Commissioner<strong>of</strong> <strong>Customs</strong> orCommissioner <strong>of</strong><strong>Customs</strong> (Bond)(2) AdditionalCommissioner<strong>of</strong> <strong>Customs</strong>(1)Value <strong>of</strong> goodsexceeding Taka15,00,000.00(2)Value <strong>of</strong> goodsnot exceeding Taka15,00,000.00(3) JointCommissioner<strong>of</strong> <strong>Customs</strong>(4) DeputyCommissioner <strong>of</strong><strong>Customs</strong>(5) Assistant(3)Value <strong>of</strong> goodsnot exceeding Taka10,00,000.00(4)Value <strong>of</strong> goodsnot exceeding Taka5,00,000.00(5)Value <strong>of</strong> goods

Commissioner<strong>of</strong> <strong>Customs</strong>(6) Superintendent<strong>of</strong> <strong>Customs</strong> orPrincipalAppraisernot exceeding Taka3,00,000.00(6)Value <strong>of</strong> goodsnot exceeding Taka1,00,000.00II. Adjudication <strong>of</strong> casesrelating to Manifestclearance in customhousesand customsstationsinvolving onlyimposition <strong>of</strong> penaltyunder item 24 <strong>of</strong> the Tableunder sub-section (1) <strong>of</strong>section 156.II.DeputyCommissioner <strong>of</strong><strong>Customs</strong> orAssistantCommissioner <strong>of</strong><strong>Customs</strong> in charge<strong>of</strong> Manifestclearance incustom-houses orcustoms-stations,as the case may be.Value <strong>of</strong> the goodswithout limit :Ó|4| <strong>Act</strong> IV <strong>of</strong> <strong>1969</strong> Gi section 196B Gi ms‡kvab|- <strong>Customs</strong> <strong>Act</strong> Gi section 196BGi "appealed against" kã¸wji ci "or may refer the case back to the authority whichpassed such decision or order with such directions as the Appellate Tribunal may thinkfit, for a fresh adjudication or decision, as the case may be, after taking additionalevidence, if necessary" kã¸wj I Kgv¸wj ms‡hvwRZ nB‡e|5| <strong>Act</strong> IV <strong>of</strong> <strong>1969</strong> Gi section 204 Gi ms‡kvab|- <strong>Customs</strong> <strong>Act</strong> Gi section 204 GDwj−wLZ "on payment <strong>of</strong> a fee not exceeding twenty Taka" kã¸wji cwie‡Z© "on payment <strong>of</strong>such fee as the Board may determine for this purpose" kã¸wj cÖwZ¯’vwcZ nB‡e|6| <strong>Act</strong> IV <strong>of</strong> <strong>1969</strong> Gi section 205 Gi ms‡kvab|- <strong>Customs</strong> <strong>Act</strong> Gi section 205 Gicwie‡Z© wbæiƒc section 205 cÖwZ¯’vwcZ nB‡e, h_vt-"205. <strong>Amendment</strong> <strong>of</strong> documents.- Except in the case provided for by sections29,45,53 and 88, an <strong>of</strong>ficer <strong>of</strong> customs not below the rank <strong>of</strong> an AssistantCommissioner <strong>of</strong> <strong>Customs</strong> may, in his discretion, on payment <strong>of</strong> such fee as theBoard may determine for this purpose, authorize any document, after it has beenpresented at the customshouse, to be amended." |7| <strong>Act</strong> IV <strong>of</strong> <strong>1969</strong> Gi FIRST SCHEDULE Gi ms‡kvab |- <strong>Customs</strong> <strong>Act</strong> GiÒFIRST SCHEDULEÓ Gi cwie‡Z© GB AvB‡bi Zdwmj-1 G Dwj−wLZ ÒFIRST SCHEDULEÓcÖwZ¯’vwcZ nB‡e ( Avjv`vfv‡e gyw`ªZ)|