of 20 percent - Atoss AG

of 20 percent - Atoss AG

of 20 percent - Atoss AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

aNNUal REpORT <strong>20</strong>08

2 GESCHÄFTSBERICHT <strong>20</strong>08<br />

UNTERNEHMEN UND MISSION 3<br />

aTOSS IN FIGURES<br />

CORpORaTE OvERvIEw aCCORDING TO IFRS: 12-MONTH COMpaRISON IN T EUR pER DECEMBER 31<br />

01.01.<strong>20</strong>08<br />

- 31.12.<strong>20</strong>08<br />

Shares <strong>of</strong><br />

Total Sales<br />

01.01.<strong>20</strong>07<br />

- 31.12.<strong>20</strong>07<br />

Shares <strong>of</strong><br />

Total Sales<br />

Rate <strong>of</strong> Change<br />

<strong>20</strong>08 to <strong>20</strong>07<br />

S<strong>of</strong>tware 16,017 59% 14,649 60% 9%<br />

S<strong>of</strong>tware licences 6,064 23% 5,409 22% 12%<br />

S<strong>of</strong>tware maintenance 9,953 37% 9,240 38% 8%<br />

Consulting 7,363 27% 6,<strong>20</strong>7 25% 19%<br />

Hardware 2,769 10% 2,683 11% 3%<br />

Other 794 3% 883 4% -10%<br />

Total Sales 26,943 100% 24,422 100% 10%<br />

EBITDa 5,429 <strong>20</strong>% 4,<strong>20</strong>6 17% 29%<br />

EBIT 5,046 19% 3,730 15% 35%<br />

EBT 5,115 19% 4,172 17% 23%<br />

Net Income 3,510 13% 2,501 10% 40%<br />

Cash Flow 2,501 9% 4,152 17% -40%<br />

liquidity (1/2) 14,000 13,468 4%<br />

EpS (in Euro) 0.88 0.63 40%<br />

Employees (3) 226 195 16%<br />

CORpORaTE OvERvIEw aCCORDING TO IFRS: QUaRTERly COMpaRISON IN T EUR<br />

Q4/08 Q3/08 Q2/08 Q1/08 Q4/07<br />

S<strong>of</strong>tware 4,178 4,126 3,996 3,717 3,900<br />

S<strong>of</strong>tware licences 1,642 1,603 1,513 1,307 1,419<br />

S<strong>of</strong>tware maintenance 2,536 2,523 2,484 2,410 2,481<br />

Consulting 1,839 1,860 1,894 1,770 1,740<br />

Hardware 689 540 814 725 678<br />

Other 170 222 216 186 352<br />

Total Sales 6,876 6,748 6,921 6,399 6,670<br />

EBITDa 1,<strong>20</strong>3 1,310 1,521 1,395 1,050<br />

EBIT 1,097 1,214 1,429 1,306 941<br />

EBIT-margin in % 16% 18% 21% <strong>20</strong>% 14%<br />

EBT 1,166 1,394 1,549 1,006 1,075<br />

Net Income 831 948 1,046 685 693<br />

Cash Flow -1,055 3,034 -2,513 3,035 -1,325<br />

liquidity (1/2) 14,000 15,425 12,472 16,375 13,468<br />

EpS (in Euro) 0.21 0.24 0.26 0.17 0.17<br />

Employees (3) 226 213 <strong>20</strong>7 198 195<br />

(1) Cash and marketable securities<br />

(2) Dividend amounted to EUR 0.31 per share on April 30, <strong>20</strong>08 (previous year on April 27, <strong>20</strong>07: EUR 0.24)<br />

(3) End <strong>of</strong> quarter<br />

GROwTH aCROSS 3 RECORD yEaRS *<br />

TOTal SalES<br />

+ 32%<br />

CONSUlTING SalES<br />

+ 48%<br />

EBIT<br />

+ 796%<br />

* <strong>20</strong>06 - <strong>20</strong>08<br />

SOFTwaRE lICENCES<br />

SalES<br />

+ 52%<br />

CapITal INvESTMENT<br />

ON R&D<br />

+ 26%<br />

EaRNINGS pER SHaRE<br />

+ 633%

4 GESCHÄFTSBERICHT aNNUal REpORT <strong>20</strong>08 <strong>20</strong>08<br />

UNTERNEHMEN UND MISSION 5<br />

CONTENTS<br />

6 INTERVIEW WITh ANDREAS F.J. OBEREDER<br />

8 ATOSS – ThE COmpANy<br />

<strong>20</strong> ATOSS mARkETS<br />

59 TESTImONIALS<br />

60 LETTER TO ShAREhOLDERS<br />

62 INVESTOR RELATIONS<br />

68 CORpORATE GOVERNANCE REpORT<br />

76 SUpERVISORy BOARD REpORT<br />

80 GROUp mAN<strong>AG</strong>EmENT REpORT<br />

92 BALANCE ShEET<br />

93 INCOmE ShEET<br />

94 CASh FLOW STATEmENT<br />

95 STATEmENT OF ChANGES IN EQUITy<br />

96 NOTES TO ThE CONSOLIDATED FINANCIAL STATEmENT<br />

140 AUDIT OpINION<br />

141 DECLARATION By ThE LEGAL REpRESENTATIVES<br />

143 CORpORATE CALENDAR<br />

14 5 ImpRINT

6 GESCHÄFTSBERICHT aNNUal REpORT <strong>20</strong>08 <strong>20</strong>08<br />

INTERvIEw<br />

7<br />

«Modern workforce management<br />

presents excellent opportunities<br />

in challenging times.»<br />

andreas F.J. Obereder<br />

Founder and CEO<br />

aTOSS S<strong>of</strong>tware aG<br />

Mr. Obereder, the financial crisis has a firm grip on the economy.<br />

and aTOSS is announcing the year <strong>20</strong>08 as the best in<br />

the history <strong>of</strong> the company. How do you explain this?<br />

Indeed, we have also succeeded in achieving continued<br />

growth in the fourth quarter, and have once again posted excellent<br />

results in <strong>20</strong>08, refl ected by double digit gains in sales<br />

and pr<strong>of</strong>i t. With new customers such as PUMA on our roster,<br />

we concluded the year with some outstanding successes. We<br />

are optimistic that we are very well prepared for <strong>20</strong>09.<br />

are you taking a positive look on the future in spite <strong>of</strong> the<br />

crisis?<br />

Yes, because we have experienced that our key issues <strong>of</strong><br />

workforce management and demand driven workforce<br />

scheduling are in strong demand – and most especially at<br />

this point in time. Companies are increasingly searching for<br />

ways and means to signifi cantly optimize their costs, and<br />

realize a rapid return on investment at the same time. And<br />

this is precisely where ATOSS is ideally positioned. In our<br />

projects we generate double digit savings for our customers<br />

in the personnel area. In the retailing sector, for example,<br />

higher service levels <strong>of</strong> more than <strong>20</strong> <strong>percent</strong> are not<br />

uncommon.<br />

So workforce management is not just a new catchword from<br />

the marketing pundits?<br />

No – quite the opposite. Which reminds me <strong>of</strong> the wonderful<br />

quote by Victor Hugo, who once said that there is «nothing as<br />

strong as an idea whose time has come.» And this truly applies<br />

to our workforce management topics. Across Europe<br />

we rank as one <strong>of</strong> the pioneers in this segment and we are<br />

currently experiencing just how expedient our portfolio <strong>of</strong> <strong>of</strong>ferings<br />

revolving around fl exible workforce management has<br />

been and remains.<br />

Cutting costs is a major trend these days ...<br />

Certainly, but we need a more differentiated view <strong>of</strong> the situation.<br />

It has long been clear that the rationalization potentials<br />

in manufacturing or in procurement have been largely<br />

exhausted. The personnel area is an entirely different<br />

matter, however, and still holds tremendous potential. Our<br />

experience gained in many different projects confi rms this<br />

time and time again. Thanks to more fl exible workforce<br />

management one <strong>of</strong> our customers in the service sector was<br />

able to reduce the personnel cost share from a current 25<br />

<strong>percent</strong> to 19 <strong>percent</strong>. And all this without compromising on<br />

service and customer care quality.<br />

and what role does aTOSS play in the process?<br />

Put simply, we ensure that the utilization <strong>of</strong> human resources<br />

and working hours can be better distributed, and adjusted to<br />

actual requirements in a cost optimized manner. In many<br />

companies working time is wasted and unproductive – as in<br />

idling time in logistics, for example. Or think <strong>of</strong> the quiet days<br />

or hours in retailing with low customer frequency. On the<br />

other hand, companies pay for expensive overtime due to<br />

demanding short term order situations or a lack <strong>of</strong> adequately<br />

qualifi ed employees. Our customers are able to balance these<br />

factors and achieve considerable cost savings at the same<br />

time.<br />

But reducing costs is just one side <strong>of</strong> the coin ...<br />

That is correct. It is far more important to see what our<br />

technologies are capable <strong>of</strong> activating in the areas <strong>of</strong> service<br />

and customer orientation, for example. Take a small, very<br />

conservative model calculation from the retail area, involving<br />

a chain with 100 stores: assuming that enhanced workforce<br />

management oriented to customer frequency results in one<br />

or two pairs <strong>of</strong> shoes more sold per week and per employee<br />

at each branch this ...<br />

Soon adds up to seven-digit sales gains ...<br />

Exactly, and all this in addition to identical or even lower<br />

costs. For many <strong>of</strong> our customers this is a genuine opportunity<br />

to strengthen their position. In challenging times, this can be<br />

absolutely essential for survival.<br />

But isn’t flexible workforce management more a topic for<br />

expanding markets?<br />

Quite the opposite. Some day, when the history <strong>of</strong> this world<br />

economic crisis is written, there will be a chapter on employees<br />

and the labor markets. And workforce management<br />

will play a major role. Today, it is already clearly evident how<br />

instruments enabling more fl exible working hours are<br />

functioning effi ciently in Germany. Companies that have<br />

introduced extended working hour accounts can fi rst reduce<br />

the time credit balance that their employees have built up in<br />

periods <strong>of</strong> market growth before having to think about shorter<br />

working hours or cutting back on staff. In the past, this approach<br />

has strengthened competitive capabilities, as overtime<br />

costs have been reduced, while the immediate availability<br />

<strong>of</strong> valuable personnel after the crisis boosts competitive<br />

strengths. In both good and in bad times alike it is essential<br />

to understand employees as a vital success factor and not<br />

just regard human resources as a cost aspect.<br />

But this is not exactly the prevailing view ...<br />

That is true – unfortunately. But this is also where opportunities<br />

lie: by comparison with Germany, other countries have<br />

quite a lot <strong>of</strong> ground to catch up in terms <strong>of</strong> demand driven<br />

workforce management and scheduling. In view <strong>of</strong> this fact<br />

we are optimistic that we will grow more strongly on foreign<br />

markets in future than we have to date.<br />

Thank you for this interview.

8 aNNUal REpORT <strong>20</strong>08<br />

aTOSS<br />

« wORKFORCE MaNaGEMENT<br />

IS OUR<br />

paSSION »<br />

ATOSS<br />

The activities <strong>of</strong> around 2.5 million<br />

employees are managed with the help <strong>of</strong><br />

ATOSS solutions.<br />

9

10 aNNUal REpORT <strong>20</strong>08<br />

For more than <strong>20</strong> years, ATOSS has been committed to shaping and designing working worlds to the advantage <strong>of</strong> companies,<br />

employees In kaum einer and anderen society – Branche based on spielen pragmatic minutiöse consulting Planung and innovative und höchste s<strong>of</strong>tware. Flexibilität Today, eine our so s<strong>of</strong>tware wichtige is Rolle at work für den in <strong>20</strong> Unterneh- countries<br />

and menserfolg. eight languages Intelligenter across Personaleinsatz the globe. According und schlanke to a current Prozesse IDC survey, sind geschäftskritisch, ATOSS ranks among um die the Herausforderungen top 5 players in Europe dieses in<br />

the globalen future Wachstumsmarktes market <strong>of</strong> workforce zu management. meistern. ATOSS More hilft, than den <strong>20</strong>0 Personaleinsatz creative and committed zu optimieren, members Kosten <strong>of</strong> einzusparen staff are responsible und die Ser- for<br />

this vicequalität success. und Their Motivation personality der and Mitarbeiter competence zu steigern. translate our mission into reality, day by day.<br />

<strong>Atoss</strong>-Kunde Deutsche Bahn<br />

aTOSS<br />

Company & Team<br />

11

12<br />

aNNUal REpORT <strong>20</strong>08<br />

workforce management comprises the analysis, planning, steering and optimization <strong>of</strong> personnel deployment, with the<br />

In aim kaum <strong>of</strong> reducing einer anderen costs and Branche enhancing spielen efficiency, minutiöse productivity, Planung und and höchste customer Flexibilität orientation eine so as wichtige well as Rolle employee für den satisfaction. Unternehmenserfolg.<br />

In brief: the Intelligenter right number Personaleinsatz <strong>of</strong> employees with und schlanke the right Prozesse qualifications sind geschäftskritisch, at the right time and um the die Herausforderungen right place – at optimized dieses<br />

globalen costs. Especially Wachstumsmarktes in challenging zu meistern. times consistent ATOSS hilft, workforce den Personaleinsatz management is zu a optimieren, strategic competitive Kosten einzusparen advantage und given die Ser- that<br />

vicequalität many companies und Motivation are focusing der Mitarbeiter on ensuring zu efficient steigern. operations with increasingly tighter personnel resources. Thanks to<br />

workforce <strong>Atoss</strong>-Kunde Management<br />

Deutsche Bahn<br />

expedient workforce management, maximum results can be attained in connection with lower personnel budgets.<br />

aTOSS<br />

13

14<br />

aNNUal REpORT <strong>20</strong>08<br />

aTOSS has the right workforce Management s<strong>of</strong>tware for all requirements and every company size. Competent and prag-<br />

In matic kaum consulting einer anderen rounds Branche <strong>of</strong>f the portfolio. spielen minutiöse Our roster Planung <strong>of</strong> about und 4,000 höchste clients Flexibilität appreciates eine the so extensive wichtige Rolle functionality, für den Unterneh- the intuimenserfolg.tive<br />

operability Intelligenter and state <strong>of</strong> Personaleinsatz the art technology und schlanke based on Prozesse Java EE. Our sind agile geschäftskritisch, development methods um die Herausforderungen guarantee the most dieses rapid<br />

globalen possible response Wachstumsmarktes to market and zu meistern. customer ATOSS requirements. hilft, den This Personaleinsatz success draws zu on optimieren, a solid footing: Kosten every einzusparen year, we invest und die approxServicequalitätimately <strong>20</strong> <strong>percent</strong> und Motivation <strong>of</strong> our revenues der Mitarbeiter in the further zu steigern. development <strong>of</strong> our products.<br />

<strong>Atoss</strong>-Kunde Deutsche Bahn<br />

aTOSS<br />

S<strong>of</strong>tware & Services<br />

15

16<br />

aNNUal REpORT <strong>20</strong>08<br />

Team spirit has made major contributions to the success <strong>of</strong> ATOSS over the years – a strong community from which all stand<br />

In to kaum benefit. einer Our anderen partners Branche appreciate spielen our attractive minutiöse partner Planung concept und höchste and the Flexibilität tailored eine cooperation so wichtige <strong>of</strong>ferings. Rolle für Together, den Unterneh- we are<br />

treading menserfolg. new Intelligenter paths, and continuously Personaleinsatz expanding und schlanke our market Prozesse position. sind geschäftskritisch, Our cooperation activities um die Herausforderungen create win-win situations dieses<br />

and globalen emphasize Wachstumsmarktes fair and long term zu meistern. business ATOSS relationships. hilft, den In Personaleinsatz future too, our aim zu optimieren, is to grow with Kosten our partners, einzusparen which und is die why Ser- we<br />

are vicequalität consistently und Motivation expanding our der network Mitarbeiter – on zu regional, steigern. national and international levels.<br />

<strong>Atoss</strong>-Kunde Deutsche Bahn<br />

aTOSS<br />

partners & alliances<br />

17

18<br />

aNNUal REpORT <strong>20</strong>08<br />

Especially in challenging times the strategic significance <strong>of</strong> workforce management increases. Costs and processes are<br />

In put kaum to the einer test anderen and optimization Branche spielen potentials minutiöse are explored Planung in und all areas. höchste Personnel Flexibilität processes eine so wichtige in particular Rolle für hold den tremendous Unternehmenserfolg.<br />

potential, as Intelligenter almost 40 <strong>percent</strong> Personaleinsatz <strong>of</strong> working und hours schlanke in Germany Prozesse sind are unproductive geschäftskritisch, (Source: um die Proudfoot Herausforderungen Consulting dieses <strong>20</strong>08).<br />

globalen Demand driven Wachstumsmarktes workforce management zu meistern. makes ATOSS a hilft, measurable den Personaleinsatz contribution to zu greater optimieren, economic Kosten efficiency einzusparen and und competitive die Servicequalität<br />

strength. According und Motivation to Datamonitor, der Mitarbeiter the workforce zu steigern. management market is growing at an annual pace <strong>of</strong> 10.1 <strong>percent</strong>, and<br />

<strong>Atoss</strong>-Kunde Deutsche Markets Bahn<br />

our growth is advancing accordingly.<br />

aTOSS<br />

19

<strong>20</strong> aNNUal REpORT <strong>20</strong>08<br />

« wORKFORCE MaNaGEMENT<br />

DRIvES<br />

RETaIl SalES »<br />

RETaIl<br />

RETAIL<br />

More than 400 retailers – large and small –<br />

rely on ATOSS solutions today.<br />

21

22<br />

aNNUal REpORT <strong>20</strong>08<br />

FOOD RETaIlING<br />

Especially in grocery retailing competition is fierce. Customers expect product diversity and extensive <strong>of</strong>ferings, fresh<br />

In produce kaum einer and good anderen service Branche – as well spielen as favorable minutiöse prices. Planung While und margins höchste are Flexibilität declining, eine retailers so wichtige must keep Rolle their für den cost Unterneh- efficiency<br />

under menserfolg. stringent Intelligenter control. Thanks Personaleinsatz to the ATOSS und Retail schlanke Solution, Prozesse grocery sind retailers geschäftskritisch, succeed in um mastering die Herausforderungen the balancing act dieses between<br />

globalen cost Wachstumsmarktes pressure and customer zu meistern. orientation. ATOSS In the hilft, process den Personaleinsatz optimization category, zu optimieren, the renowned Kosten einzusparen trade magazine und handels- die Serjournalvicequalität<br />

bestowed und Motivation a gold award der Mitarbeiter on the ATOSS zu solution steigern. as «Top Product Retail <strong>20</strong>09». aTOSS <strong>Atoss</strong>-Kunde customer Deutsche EDEKa Bahn<br />

23

24<br />

aNNUal REpORT <strong>20</strong>08<br />

NONFOOD RETaIlING<br />

High demands on service quality and rising competitive pressure confront retailers with major challenges. Apart from<br />

In goods, kaumpersonnel einer anderen represents Branche the spielen major cost minutiöse driver, Planung necessitating und höchste demand Flexibilität driven as well eine as so cost wichtige optimized Rolle workforce für den Unternehdeployment.menserfolg. In workforce Intelligenter scheduling, Personaleinsatz ATOSS Retail und Solution schlanke factors Prozesse in sales, sind events, geschäftskritisch, customer frequency um die and Herausforderungen even weather conditions. dieses<br />

Thanks globalen to Wachstumsmarktes this solution, our customers zu meistern. have ATOSS succeeded hilft, den in Personaleinsatz pushing down overtime zu optimieren, by up to Kosten 75 <strong>percent</strong> einzusparen within the und shortest die Ser-<br />

period vicequalität <strong>of</strong> time. und At Motivation present, the der activities Mitarbeiter <strong>of</strong> more zu steigern. than 300,000 employees in the retail sector are planned and managed with<br />

<strong>Atoss</strong>-Kunde aTOSS customer Deutsche Bahn O2 the help <strong>of</strong> ATOSS solutions.<br />

25

26 aNNUal REpORT <strong>20</strong>08<br />

TRaNSpORT & lOGISTICS<br />

27<br />

« wORKFORCE MaNaGEMENT<br />

SETS EvERYTHING<br />

in MOTION »<br />

TRANSPORT & LOGISTICS<br />

<strong>20</strong> <strong>percent</strong> higher productivity within<br />

the first year – not uncommon<br />

among ATOSS logistics customers.

28<br />

aNNUal REpORT <strong>20</strong>08<br />

TRaNSpORT & lOGISTICS<br />

whether rail, road, water or airborne transport: lean processes and the intelligent deployment and management <strong>of</strong> thousands<br />

In <strong>of</strong> kaum qualified einer employees anderen guarantee Branche spielen the smooth minutiöse flow Planung <strong>of</strong> local and und long höchste distance Flexibilität traffic, eine enabling so wichtige the on-time Rolle für arrival den Unterneh- <strong>of</strong> people<br />

menserfolg. and delivery <strong>of</strong> Intelligenter goods. ATOSS Personaleinsatz helps deploy existing und schlanke personnel Prozesse to utmost sind geschäftskritisch, efficiency levels, while um die reducing Herausforderungen costs and enhancing dieses<br />

globalen service quality Wachstumsmarktes at the same time. zu meistern. Superb performance ATOSS hilft, den that Personaleinsatz pays <strong>of</strong>f handsomely: zu optimieren, the majority Kosten <strong>of</strong> our einzusparen projects achieve und die their Servicequalität<br />

return on investment und Motivation within der the Mitarbeiter first 12 months zu steigern. after implementation.<br />

<strong>Atoss</strong>-Kunde Deutsche Bahn<br />

aTOSS customer Deutsche Bahn<br />

29

30<br />

aNNUal REpORT <strong>20</strong>08<br />

TRaNSpORT & lOGISTICS<br />

There is hardly another branch in which down to the minute, detailed planning, lean processes and utmost flexibility play<br />

such In kaum an einer important anderen role Branche as in the spielen global minutiöse growth market Planung <strong>of</strong> und logistics. höchste Especially Flexibilität here, eine so efficient wichtige workforce Rolle für den management, Unterneh-<br />

employee menserfolg. performance Intelligenter capabilities Personaleinsatz and rapid und schlanke action are Prozesse critical success sind geschäftskritisch, factors. In many um instances die Herausforderungen it is even required dieses to<br />

integrate globalen Wachstumsmarktes external staff pools zu into meistern. the planning ATOSS at hilft, short den notice. Personaleinsatz ATOSS solutions zu optimieren, ensure that Kosten logistics einzusparen companies und have die Ser- the<br />

necessary vicequalität flexibility und Motivation to rapidly der respond Mitarbeiter to orders zu steigern. and up to the minute requirements, while keeping a lid on personnel costs.<br />

aTOSS customer BlG <strong>Atoss</strong>-Kunde lOGISTICS Deutsche GROUp Bahn<br />

These benefits help secure competitive capabilities in high wage countries.<br />

31

32 aNNUal REpORT <strong>20</strong>08<br />

HEalTH CaRE<br />

« wORKFORCE MaNaGEMENT<br />

MAKES CARE<br />

more personal »<br />

HEALTH CARE<br />

Double-digit million<br />

savings achievable.<br />

33

34<br />

aNNUal REpORT <strong>20</strong>08<br />

HEalTH CaRE<br />

Due to the implementation <strong>of</strong> new working time legislation and complex collectively bargained regulations 95 <strong>percent</strong> <strong>of</strong> today’s<br />

hospitals In kaum einer are confronted anderen Branche with higher spielen costs. minutiöse The main Planung reason und is the höchste conversion Flexibilität to duty eine plans so conforming wichtige Rolle to new für den legislation Unterneh- and<br />

collectively menserfolg. bargained Intelligenter regulations. Personaleinsatz Hospitals und must schlanke factor Prozesse in new legislation, sind geschäftskritisch, while keeping a um keen die eye Herausforderungen on economic efficiency. dieses<br />

Whether globalen complex Wachstumsmarktes regulations, zu clinic meistern. specific ATOSS agreements, hilft, den rapid Personaleinsatz changes in wards, zu optimieren, or duty plans Kosten geared einzusparen to employee und wishes die Ser-<br />

ATOSS vicequalität Medical und Solution Motivation solves der Mitarbeiter the problems. zu Our steigern. customers have reduced annual administration costs by up to 50 <strong>percent</strong>,<br />

aTOSS customer Kongregation der Barmherzigen <strong>Atoss</strong>-Kunde Schwestern<br />

Deutsche Bahn<br />

without compromising on the wellbeing <strong>of</strong> patients and staff. Around 100 health care facilities currently rely on ATOSS solutions.<br />

35

36 aNNUal REpORT <strong>20</strong>08<br />

CIvIl SERvICE<br />

« wORKFORCE MaNaGEMENT<br />

ENHANCES<br />

SERvICE QUALITY »<br />

CIvIL SERvICE<br />

70 <strong>percent</strong> less planning input<br />

possible in administration.<br />

37

38 aNNUal REpORT <strong>20</strong>08<br />

CIvIl SERvICE<br />

39<br />

whether on government, federal or community levels – citizens expect good service, commitment and information on<br />

demand. Service and opening hours must be extended in a socially compatible manner, and process structures consistently<br />

optimized. Over the long term, flexible employee management secures personnel budgets, benefitting both citizens and<br />

employees alike. ATOSS supports civil service institutions in making and implementing the necessary changes – while<br />

ensuring the best possible utilization <strong>of</strong> existing working hours and legislative and collectively bargained latitudes.<br />

aTOSS customer Municipality <strong>of</strong> Regensburg<br />

<strong>Atoss</strong>-Kunde Deutsche Bahn

40 aNNUal REpORT <strong>20</strong>08<br />

CIvIl SERvICE<br />

41<br />

In the public sector today stronger customer orientation also calls for more flexible and demand driven personnel deployment<br />

and management. In this context, cost neutrality and employee acceptance take top priority. Thanks to Workforce Management<br />

s<strong>of</strong>tware by ATOSS operations can be extended and peak workloads compensated for, while factoring in staff interests<br />

at the same time. Thanks to our solutions, overtime, for example, can be trimmed by up to <strong>20</strong> <strong>percent</strong>. Applying the ATOSS<br />

ROI analysis method, our specialists identify such quantitative potentials and show up concrete, practical implementation<br />

scenarios.<br />

aTOSS customer Kassenärztliche vereinigung <strong>Atoss</strong>-Kunde Deutsche Nordrhein Bahn

42 aNNUal REpORT <strong>20</strong>08<br />

SERvICES<br />

« wORKFORCE MaNaGEMENT<br />

ENSURES<br />

customer SaTISFaCTION »<br />

SERvICES<br />

Efficiency gains <strong>of</strong> <strong>20</strong> <strong>percent</strong><br />

achievable.<br />

43

44<br />

aNNUal REpORT <strong>20</strong>08<br />

SERvICES<br />

Motivated and committed employees serving customers to high levels <strong>of</strong> flexibility define the success <strong>of</strong> service providers.<br />

In Advanced kaum einer ATOSS anderen Workforce Branche Management spielen minutiöse delivers Planung the extra und service höchste quality Flexibilität that makes eine so the wichtige decisive Rolle difference. für den The Unterneh- ATOSS<br />

Employee menserfolg. & Intelligenter Manager Self Personaleinsatz Service portal und promotes schlanke transparency Prozesse sind and geschäftskritisch, personal responsibility: um die Herausforderungen staff deployment and dieses duty<br />

plans globalen can Wachstumsmarktes be called up at all times, zu meistern. while holiday ATOSS leave hilft, can den be Personaleinsatz approved in an unbureaucratic zu optimieren, Kosten manner einzusparen without the und submission die Ser-<br />

<strong>of</strong> vicequalität application und forms. Motivation In addition der Mitarbeiter to customer zu oriented steigern. personnel organization, this creates a productive working environment<br />

aTOSS <strong>Atoss</strong>-Kunde customer DeutscheSIXT Bahn<br />

and strong employee satisfaction.<br />

45

46<br />

aNNUal REpORT <strong>20</strong>08<br />

SERvICES<br />

Today’s customers expect excellent service, strong commitment and permanent availability – frequently on extremely short<br />

notice. In kaumIn einer spite anderen <strong>of</strong> rising cost Branche pressure spielen and minutiöse tight resources, Planung service und höchste providers Flexibilität master eine these so challenges wichtige Rolle with für the den help Unterneh- <strong>of</strong> ATOSS<br />

s<strong>of</strong>tware. menserfolg. Optimized Intelligenter working Personaleinsatz hours secure und 24/7 schlanke services Prozesse – <strong>of</strong>ten on sind 365 geschäftskritisch, days a year. Human um resources die Herausforderungen departments benefit dieses<br />

from globalen timesavings Wachstumsmarktes in planning and zu meistern. administration, ATOSS while hilft, den productivity Personaleinsatz becomes zu measurable optimieren, and Kosten can einzusparen be awarded und accordingly. die Ser-<br />

The vicequalität ATOSS Decision und Motivation Support der analysis Mitarbeiter tool delivers zu steigern. sound key performance indicators and creates the necessary transparency<br />

aTOSS <strong>Atoss</strong>-Kunde customer Deutsche Carglass Bahn<br />

for management decisions. This helps service providers set themselves <strong>of</strong>f from competitors.<br />

47

48<br />

aNNUal REpORT <strong>20</strong>08<br />

SERvICES<br />

Exclusive service and discrete attention are central requirements in the upmarket hotel and catering branch. In this context, staff<br />

In concerns kaum einer play a anderen decisive Branche role. Changing spielen shifts, minutiöse weekend Planung work und and höchste overtime Flexibilität are the order eine <strong>of</strong> so the wichtige day. The Rolle objective für den <strong>of</strong> Unterneh- workforce<br />

menserfolg. management Intelligenter is to ensure Personaleinsatz that service quality und adheres schlanke to the Prozesse aspired sind high geschäftskritisch, standards, while maintaining um die Herausforderungen cost efficient personnel dieses<br />

globalen deployment Wachstumsmarktes at the same time. Personnel zu meistern. organization ATOSS hilft, that den is consistently Personaleinsatz oriented zu to optimieren, customer needs Kosten forms einzusparen the foundation und die for Ser- this,<br />

vicequalität as well as working und Motivation time management der Mitarbeiter that automatically zu steigern. factors in legal regulations and employee wishes into the planning. After<br />

aTOSS customer <strong>Atoss</strong>-Kunde Hotel lesDeutsche Trois Rois Bahn<br />

all, motivated and satisfied employees make all the difference.<br />

49

50 aNNUal REpORT <strong>20</strong>08<br />

MaNUFaCTURING<br />

« wORKFORCE MaNaGEMENT<br />

PRODUCES<br />

SUCCESS »<br />

MANUFACTURING<br />

50 <strong>percent</strong> less idling time.<br />

51

52 aNNUal REpORT <strong>20</strong>08<br />

F O O D a N D l U X U R y F O O D<br />

53<br />

producers in the food and luxury food industries are frequently subject to seasonal demand fluctuations. Competitive pressure<br />

In forces kaumthem einer to anderen efficiently Branche utilize the spielen capacity minutiöse <strong>of</strong> their Planung locations und and höchste rapidly Flexibilität respond to eine changing so wichtige order Rolle situations. für den Drawing Unterneh- on<br />

menserfolg. Workforce Management Intelligenter s<strong>of</strong>tware Personaleinsatz by ATOSS und our schlanke customers Prozesse <strong>of</strong>ten administrate sind geschäftskritisch, hundreds <strong>of</strong> um complex die Herausforderungen working time models dieses and<br />

globalen calculate Wachstumsmarktes deployment scenarios zu with meistern. concrete ATOSS labor hilft, costs den and Personaleinsatz thereby succeed zu in optimieren, achieving better Kosten planning einzusparen <strong>of</strong> their und production. die Servicequalität<br />

This increases und response Motivation and der service Mitarbeiter capabilities, zu steigern. and reduces personnel costs as well as production costs.<br />

<strong>Atoss</strong>-Kunde Deutsche Bahn<br />

aTOSS customer Haribo

54<br />

aNNUal REpORT <strong>20</strong>08<br />

CHEMICalS<br />

Increasing global competition, demand fluctuations and exploding raw materials costs determine the environment in which<br />

In the kaum chemical einerindustry anderenoperates. Branche In spielen order minutiöse to ensure optimal Planung production und höchste capacity Flexibilität utilization eine so in wichtige spite <strong>of</strong> these Rolle factors, für den processes Unternehmenserfolg.<br />

must be consistently Intelligenter optimized Personaleinsatz and personnel und schlanke requirements Prozesse precisely sind geschäftskritisch, adapted to current um demand. die Herausforderungen With the help <strong>of</strong> ATOSS dieses<br />

globalen solutions, Wachstumsmarktes working time models zu are meistern. flexibly ATOSS implemented, hilft, den and Personaleinsatz workforce deployment zu optimieren, and order Kosten volumes einzusparen synchronized und die Ser- in a<br />

vicequalität cost optimized und manner, Motivation reducing der Mitarbeiter expensive zu overtime steigern. and idle time. In times <strong>of</strong> weak demand, working time accounts have a<br />

aTOSS <strong>Atoss</strong>-Kunde customer Deutsche BaSF Bahn<br />

regulatory function, providing the flexibility to balance order volume fluctuations over the short and medium term.<br />

55

56 aNNUal REpORT <strong>20</strong>08<br />

CONTRaCT aND INDIvIDUal pRODUCTION<br />

57<br />

In contract and individual production the complexity <strong>of</strong> projects demands the utmost in terms <strong>of</strong> planning, flexibility, schedule<br />

adherence and optimal resource management – across company borders in many cases. Subcontractors, third party employees<br />

and suppliers must all be integrated into the planning process. Order linked workforce management and scheduling by ATOSS<br />

enables a comprehensive view <strong>of</strong> processes, and, by integration with an ERP system, the effective and just in time planning <strong>of</strong><br />

working hours and materials in individual orders. In this way, workforce management becomes an efficient instrument for budgetoriented<br />

manufacturing. In large-scale projects, savings in the order <strong>of</strong> millions <strong>of</strong> euros are not uncommon.<br />

aTOSS customer <strong>Atoss</strong>-Kunde MEyER Deutsche wERFT Bahn

58 E X C E R p T O F O U R C U S T O M E R R O S T E R I T E S T I M O N I a l S<br />

59<br />

ADELhOLZENER ALpENQUELLE • ADO-GARDINENWERkE • AEG ELECTRIC TOOLS • ALDI SÜD<br />

ALLGAIER WERkE • ALU kÖNIG STAhL • AmWAy • ApETITO • AppELRATh-CÜppER • ARA ShOES<br />

ARBEITSkAmmER DES SAARLANDES • ARBÖ • AUGUSTINER BRÄU • AUSTRIAN AIRLINES<br />

AVERy • AVIS • AWO BEZIRkSVERBAND mITTELRhEIN • BANkhAUS LUDWIG SpERRER • BASF<br />

BAyER • BAyERISChER LANDES-SpORTVERBAND • BEIT SySTEmhAUS • BENE • BERGLANDmILCh<br />

BEZIRk UNTERFRANkEN • BGm BERUFSGENOSSENSChAFT mETALL NORD SÜD<br />

BILFINGER BERGER INDUSTRIAL SERVICES • BISChÖFLIChES GENERALVIkARIAT mÜNSTER<br />

BLG LOGISTICS GROUp • BOFROST • BRISTOL-myERS SQUIBB • BROSE FAhRZEUGTEILE<br />

BUNDESANSTALT FÜR pOST & TELEkOmmUNIkATION • BUNDESEISENBAhNVERmÖGEN<br />

CARGLASS • CARITASVERBAND ERZDIÖZESE mÜNChEN UND FREISING • CATERpILLAR mOTOREN<br />

COCA COLA • COmDIRECT BANk • CONRAD ELECTRONICS • CORDES & GRAEFE • CREDIT SUISSE<br />

DAB BANk • DANFOSS • DBV WINTERThUR • DEhNER • DEUTSChE BAhN • DEUTSChE Bkk<br />

DEUTSChE RENTENVERSIChERUNG NORDBAyERN • DEUTSChE SEE • DIAkONIEZENTRUm SALZBURG<br />

DODENhOF • DOUGLAS • EDEkA • EJOT • ERDINGER WEISSBRÄU • ERNTEBROT • ESSILOR<br />

EVANGELISChE STIFTUNG ALSTERDORF • FAChhOChSChLE NÜRNBERG • FEhR UmWELT<br />

FELDSChLÖSSChEN GETRÄNkE • FENEBERG LEBENSmITTEL • FLENSBURGER BRAUEREI<br />

FRANkENBERG NAhRUNG UND GENUSSmITTEL • FRÄNkISChE ROhRWERkE • FRIWO<br />

FÜRSTLIChE BRAUEREI ThURN UND TAXIS • F.X. NAChTmANN BLEIkRISTALLWERkE<br />

GEFINEX • GEOBRA BRANDSTÄTTER SpIELWARENFABRIk • GkN DRIVELINE • GORENJE<br />

hACkER-pSChORR-BRÄU • hAkLE-kImBERLy • hARIBO LAkRITZEN • hARZ ENERGIE<br />

hERmES ARZNEImITTEL • hERmES SChLEIFmITTEL • hOFpFISTEREI • hOLSTEN-BRAUEREI<br />

hOST EUROpE • hOTEL LES TROIS ROIS • hSh NORDBANk • hSk DR.-hORST-SChmIDT-kLINIkEN<br />

hUGENDUBEL • hUhTAmAkI • hUk-COBURG • IGEpA • INGRAm mICRO • JOhN DEERE<br />

JOhNSON & JOhNSON mEDICAL pRODUCTS • JUVENA • J. BAUER mILChVERARBEITUNG<br />

kASSENÄRZTLIChE BUNDESVEREINIGUNG • kASSENÄRZTLIChE VEREINIGUNG NORDRhEIN<br />

kERmI • kEUCO • kEy SAFETy SySTEmS • kLINIkUm INGOLSTADT • kLINIkUm ROSENhEIm<br />

kLINIkUm SAARBRÜCkEN • k&L RUppERT • kODAk GRAphIC COmmUNICATIONS<br />

kONGREGATION DER BARmhERZIGEN SChWESTERN • kRAFTWERkE mAINZ-WIESBADEN<br />

kREISVERWALTUNG kAISERSLAUTERN • kÜhNE + N<strong>AG</strong>EL • kÜppERSBUSCh hAUSGERÄTE<br />

kURBETRIEBE LANDEShAUpTSTADT WIESBADEN • kVNO • LANDESÄRZTEk AmmER hESSEN<br />

LANDWIRTSChAFTSkAmmER NORDRhEIN-WESTFALEN • LANDWIRTSChAFTLIChE RENTENBANk<br />

LEBkUChEN-SChmIDT • LECh- STAhLWERkE • LUFThANSA • m<strong>AG</strong>NA STEyR FAhRZEUGTEChNIk<br />

mAIN-kINZIG-kLINIkEN • mAN NUTZFAhRZEUGE • mAX BAhR • mEFFERT FARBWERkE<br />

mESSE FRIEDRIChShAFEN • mEyER WERFT • mISTER*LADy JEANS • mOLkEREI mEGGLE<br />

mONDI pACk<strong>AG</strong>ING • mÖBEL mARTIN • mpREIS • mUSTANG BEkLEIDUNGSWERkE<br />

NOLTE kÜChEN • NEW BEN • NORDmILCh • NORTh SEA TERmINAL BREmERhAVEN<br />

NOVOFERm • O 2 • OBERhAVEL kLINIkEN • OFFSETDRUCk NÜRNBERG • OLympUS<br />

pEpSI COLA • pANASONIC • pAULANER BRAUEREI • phOENIX phARmAhANDEL • pUmA<br />

pROCTER & GAmBLE phARmACEUTICALS • RADIO BREmEN • RECARO AIRCRAFT SEATING<br />

REmONDIS • RENOLIT • RhEINFELSQUELLEN • RITTER SpORT • ROTkREUZkLINIkUm mÜNChEN<br />

RÜGENWALDER WURSTFABRIk • SAN FR ANCISCO COFFEE COmpANy • SATURN • S-BAhN BERLIN<br />

SChÄFER‘S BROT- UND kUChENSpEZIALITÄTEN • SChERER & TRIER • SChLÜTERSChE DRUCk<br />

SChmITZ CARGOBULL • SChÖFFEL SpORTBEkLEIDUNG • SChÜCO • SEDDA pOLSTERmÖBEL<br />

ShG kLINIkEN • SIEmES • SIXT • SONy BmG mUSIC ENTERTAINmENT • SOZIALSTIFTUNG BAmBERG<br />

SpARkASSE JENA SAALE • SpORTSChECk • STADT ESSLINGEN • STADT REGENSBURG<br />

STADT kAISERSLAUTERN • STADT WÜRZBURG • STADTWERkE ROSTOCk • STApLES<br />

STIFTUNG pFENNIGpARADE • STRAUSS INNOVATION • STRENESSE • SULZER pUmpEN • SWISS<br />

TELEkOm ShOp VERTRIEBSGESELLSChAFT • TEREX • TERRE DES hOmmES DEUTSChLAND<br />

ThALIA BÜChER • ThySSENkRUpp STAINLESS • TOShIBA • TROST • TRW AUTOmOTIVE<br />

TWL TEChNISChE WERkE LUDWIGShAFEN • UNIVERSITÄTSkLINIkUm GIESSEN UND mARBURG<br />

V. D. LINDE-ARZNEImITTEL • VALEO • VBG VERWALTUNGS-BERUFSGENOSSENSChAFT<br />

VERL<strong>AG</strong>SGRUppE RANDOm hOUSE • VINZENZ mURR • VOGLAUER mÖBELWERk • VOSSLOh<br />

WELTBILD VERL<strong>AG</strong> • WEpA pApIERFABRIk • WEST ENERGIE UND VERkEhR • W.L. GORE ASSOCIATES<br />

WOLFORD • WORLD VISION DEUTSChLAND • ZENTRUm FÜR SOZIALE pSyChIATRIE<br />

ZILLERTALER VERkEhRSBETRIEBE • ZWECkVERBAND ABFALLWIRTSChAFT REGION hANNOVER<br />

«By eliminating a host <strong>of</strong> administrative routine tasks<br />

we have been able to save up to five working hours a<br />

day, which can be used for other tasks instead.»<br />

armin loch, Head <strong>of</strong> Wage and Salary Accounting,<br />

ALLGAIER Werke<br />

«With the help <strong>of</strong> flexible working hours and efficient<br />

workforce management and scheduling we have<br />

been able to keep our personnel costs so low that<br />

our prices remain competitive. In this way we are<br />

securing our corporate success over the long term,<br />

and consequently safeguarding the current levels <strong>of</strong><br />

employment.»<br />

Heino Spaude, Head <strong>of</strong> Personnel Systems,<br />

BLG LOGISTICS GROUP<br />

«In retailing, flexible and demand driven workforce<br />

management is becoming increasingly important.<br />

This is the only way to ensure optimal customer care<br />

over the long term. In concrete terms this means<br />

well-stocked shelves, ample staffed cash desks and<br />

minimum waiting periods for our customers. The<br />

fact that we are addressing working time management<br />

across our corporation in such a consistent manner<br />

documents clearly once again where we are placing<br />

our key emphasis.»<br />

volker Bredemeier, Department Manager Human<br />

Resources/IT Coordination, EDEKA Minden-Hannover<br />

«The ATOSS Employee and manager Self Service<br />

solution promotes the personal responsibility <strong>of</strong> our<br />

associates and trust based cooperation. This supports<br />

our company culture.»<br />

Brigitte Miculcy, Human Resources,<br />

W.L. Gore & Associates<br />

«It is really fun to work with ATOSS because it is<br />

readily apparent that all their people are highly<br />

committed and totally identify with their company.»<br />

wolfgang Friedl, Competence Center Applications,<br />

BEIT Systemhaus<br />

«Our project could have been named ‹From lowest<br />

to top priority›. All participants – from sales staff to<br />

the hR department and all the way up to top management<br />

– realized that personnel management would<br />

have to be part <strong>of</strong> the value creation chain in future.<br />

personnel data must be recorded and made available<br />

in such a way that they make value contributions on<br />

operational and strategic levels. Our ATOSS Solution<br />

ensures this day by day.»<br />

Reinhard Zuber, Corporate Development,<br />

Thalia Bücher <strong>AG</strong> Switzerland, a company <strong>of</strong> the<br />

Douglas Holding<br />

«In terms <strong>of</strong> the working hours <strong>of</strong> physicians and care<br />

staff, a great deal has changed over the past years,<br />

and in future we will certainly be adopting new collectively<br />

bargained and individual facility regulations.<br />

On the one hand, with the help <strong>of</strong> our system we are<br />

able to easily map changes imposed from the outside.<br />

On the other hand, we have an instrument at our disposal<br />

with which we can allocate the available working<br />

hours in an efficient manner, without compromising<br />

on care quality.»<br />

Franz Dußmann, Head <strong>of</strong> Care Services,<br />

Klinikum Rosenheim<br />

«We look back on many years <strong>of</strong> reliable and successful<br />

cooperation with ATOSS. The smooth conversion<br />

to the new JAVA based platform that <strong>of</strong>fers us considerably<br />

extended flexibility and functionalities proves<br />

once again that the decision we made at the beginning<br />

<strong>of</strong> the nineties was the right one. Thanks to our new,<br />

advanced solution, we are extremely well equipped to<br />

meet all demands and requirements.»<br />

Helmut Täger, Head <strong>of</strong> Personnel Service Center,<br />

Deutsche Bahn <strong>AG</strong><br />

«Very impressed person – that is what I have been<br />

for quite some time! ATOSS is truly an exemplary<br />

company.»<br />

Jürgen Kast, General Administrative and Personnel<br />

Office, Municipality <strong>of</strong> Esslingen am Neckar

60 AnnuAl RepoRt <strong>20</strong>08 letteR to shAReholdeRs<br />

61<br />

letteR to shAReholdeRs<br />

dear shareholders,<br />

ladies and Gentlemen,<br />

Marked by innovation, excellent financial results and significant<br />

growth in market share the year <strong>20</strong>08 was by far the<br />

most successful financial year in our company’s history.<br />

Our success is also pro<strong>of</strong> <strong>of</strong> the huge increase in importance<br />

accorded to our focus area <strong>of</strong> Workforce Management – all<br />

the more so in the current economic environment. The<br />

increasing competitive pressures on businesses demand<br />

excellence in every process surrounding the deployment <strong>of</strong><br />

personnel. Customer orientation, enhanced service quality<br />

as well as the transparency and optimization <strong>of</strong> costs are as<br />

much a priority as is employee satisfaction. At these levels,<br />

Workforce Management can deliver significant improvements<br />

and massively enhance value added, with an impact<br />

on sales and results running into double-digit millions <strong>of</strong><br />

euro, exceeding many times over the actual investment cost.<br />

The benefit <strong>of</strong> our Workforce Management solutions is huge,<br />

and under the current economic conditions its importance is<br />

growing markedly. In modern organizations today, Workforce<br />

Management is the driving force behind a sustained<br />

increase in the ability to compete.<br />

<strong>20</strong>08 – the third record year in succession<br />

The financial year <strong>20</strong>08 saw a continuation <strong>of</strong> the success<br />

achieved in previous years. While the economy in general,<br />

even from the third quarter onwards, began to suffer under<br />

the effects <strong>of</strong> the financial crisis, ATOSS developed powerfully<br />

in both Q3 and Q4, and with record orders on hand laid<br />

the foundation for further positive development.<br />

In the course <strong>of</strong> the reporting period sales rose 10 <strong>percent</strong> to<br />

EUR 26.9 million, while the improvement in results once again<br />

represented a multiple <strong>of</strong> this growth. Operating pr<strong>of</strong>its (EBIT)<br />

were up by 35 <strong>percent</strong> at over EUR 5 million, while earnings<br />

per share rose 40 <strong>percent</strong> to EUR 0.88. The highly positive<br />

development in our core business <strong>of</strong> s<strong>of</strong>tware licenses was<br />

particularly gratifying. Over the years as a whole, sales in this<br />

area climbed 12 <strong>percent</strong> to EUR 6.1 million. Orders received<br />

were up by 8 <strong>percent</strong> at EUR 6.6 million, and orders on hand<br />

rose by 32 <strong>percent</strong> to stand at EUR 2.5 million. Development<br />

in the fourth quarter was particularly dynamic.<br />

Our approach remains unchanged: we are focused on<br />

consistently implementing our corporate strategy with the<br />

goal <strong>of</strong> combining stability, innovation and pr<strong>of</strong>itable growth.<br />

Once again our record performance on sales and results<br />

continues to safeguard our substantially positive cash flow<br />

and underpin further improvements in liquidity and the<br />

equity ratio. The strategy adopted by ATOSS S<strong>of</strong>tware <strong>AG</strong> and<br />

our first-class positioning have also enabled us in recent<br />

years, and in financial year <strong>20</strong>08 in particular, to increase our<br />

share <strong>of</strong> the growing market for Workforce Management.<br />

share price stable, dividend yield high<br />

In the past financial year <strong>20</strong>08 the success <strong>of</strong> our business<br />

was not rewarded by a rising share price. Nevertheless, we<br />

believe that the substantial stability <strong>of</strong> our share price in a<br />

disastrous stock market environment is founded on the<br />

considerable trust that investors place in ATOSS S<strong>of</strong>tware<br />

<strong>AG</strong>. At the annual general meeting on April 30, <strong>20</strong>09 we shall<br />

propose to our shareholders that we pay a dividend <strong>of</strong><br />

EUR 0.44 per share, representing a dividend yield in excess<br />

<strong>of</strong> 6 <strong>percent</strong>. In doing so we are adhering consistently to our<br />

dividend policy first declared at the beginning <strong>of</strong> <strong>20</strong>03. Overall<br />

since <strong>20</strong>03, ATOSS has distributed more than EUR 9 per<br />

share to its shareholders.<br />

opportunities for <strong>Atoss</strong> in a difficult environment<br />

Since September <strong>20</strong>08 there has been a worldwide collapse<br />

in demand that extends to all sectors. The willingness <strong>of</strong><br />

companies to invest has been substantially eroded as the<br />

extent <strong>of</strong> the recession remains largely uncertain. What is<br />

certain is that <strong>20</strong>09 will be a challenging year for us all. What<br />

is also certain is the fact that ATOSS is excellently placed to<br />

prevail in this environment, take advantage <strong>of</strong> the opportunities<br />

that present themselves and adequately counter the<br />

risks that arise.<br />

The optimization <strong>of</strong> business processes extends not just to<br />

areas such as automation and production processes that<br />

have been addressed with much success by many companies<br />

in recent years. It is rather the case that more and more<br />

businesses perceive the need to focus on how to deal with<br />

the valuable resources their workforce constitutes. It is<br />

essential for them to address the continuing optimization <strong>of</strong><br />

the productivity and service quality their employees deliver<br />

in order to ensure their own competitiveness.<br />

In a competitive environment in which products, presentations<br />

and prices are frequently very similar and margins are<br />

tight, it is service and the ability to react cost-efficiently to<br />

fluctuations in demand that allow one competitor to stand<br />

out from the rest. It is for this reason that ATOSS solutions<br />

are in such strong demand among service, retail and many<br />

other organizations that aspire to increase the flexibility <strong>of</strong><br />

their work processes. We <strong>of</strong>fer tools that support the proactive<br />

control <strong>of</strong> constantly changing processes across the<br />

board on the basis <strong>of</strong> high-grade transparency. This in turn<br />

creates productivity gains and a clear improvement in service<br />

quality coupled with increased employee satisfaction. As a<br />

result, our clients enjoy clear and sustained advances and<br />

benefits in their competitive capabilities.<br />

<strong>Atoss</strong> remains on course for record performance<br />

Through our products and our technology, we create substantial<br />

efficiency gains for our clients in a comparatively short<br />

period <strong>of</strong> time. On the financial side, we can point to a degree<br />

<strong>of</strong> solidity and therefore also security in all relevant aspects<br />

that is outstanding for a company <strong>of</strong> our size. The high level<br />

<strong>of</strong> orders we have on hand constitutes another quite decisive<br />

factor. We therefore anticipate that sales and results in the<br />

new financial year <strong>20</strong>09 will remain at the record level<br />

achieved in <strong>20</strong>08.<br />

This statement may appear courageous in the midst <strong>of</strong> a<br />

global crisis in which few dare to venture a specific forecast.<br />

Yet our business model is highly robust, we have a record<br />

order book and our people are highly motivated. And we have<br />

Andreas F.J. Obereder<br />

the right message for our customers – now more than ever<br />

before!<br />

We are very proud <strong>of</strong> the outstanding performance <strong>of</strong> our<br />

staff. They have laid the foundation for strong development<br />

and helped to establish our excellent positioning. We would<br />

therefore like to thank them for their determination and their<br />

enthusiastic commitment without which the success <strong>of</strong> our<br />

company would not have been possible. Our thanks are due<br />

also to our customers and shareholders for their interest in<br />

ATOSS and their strong loyalty.<br />

Yours truly,<br />

Andreas F.J. Obereder Christ<strong>of</strong> Leiber<br />

(Chief Executive Officer) (Member <strong>of</strong> the Board<br />

<strong>of</strong> Management)<br />

Christ<strong>of</strong> Leiber

62<br />

AnnuAl RepoRt <strong>20</strong>08<br />

unteRnehMen InVestoR und RelAtIons<br />

MIssIon 63<br />

InVestoR<br />

RelAtIons<br />

«Two <strong>of</strong> the key elements <strong>of</strong> the corporate strategy pursued<br />

by ATOSS have been to remain absolutely independent <strong>of</strong> external<br />

funding and to ensure that the available liquidity is invested<br />

with the maximum possible security.»<br />

<strong>Atoss</strong> stoCK<br />

ISIN/WKN DE0005104400 / 510440<br />

Class No par value bearer shares<br />

shAReholdeRs <strong>Atoss</strong> s<strong>of</strong>tWARe <strong>AG</strong><br />

Founding family<br />

55,70%<br />

Free fl oat<br />

42,59%<br />

0% <strong>20</strong> 40 60 80 100<br />

Reporting period <strong>20</strong>08 Previous year <strong>20</strong>07<br />

Capital stock in EUR 4,025,667 4,025,667<br />

Number <strong>of</strong> shares 4,025,667 4,025,667<br />

Free fl oat 42.59% 43.50%<br />

Treasury stock 1.71% 0.80%<br />

Founding family 55.70% 55.70%<br />

Listings Prime Standard (Regulated Market, F)<br />

XETRA and OTC B-B, D, HH, M, S<br />

Indices Prime All Share, Prime S<strong>of</strong>tware, Technology All Share<br />

Designated sponsor VEM Aktienbank <strong>AG</strong><br />

Financial year January 1 to December 31<br />

First listing March 21, <strong>20</strong>00<br />

Stock exchange symbol AOF<br />

Dividend paid in EUR In this period for the preceding year 0.31 0.24<br />

Dividend proposed For approval at the <strong>AG</strong>M in EUR 0.44 0.31<br />

Earnings per share in EUR 0.88 0.63<br />

Annual high in EUR 8.90 11.21<br />

Annual low in EUR 5.<strong>20</strong> 7.60<br />

Average share price in EUR 7.81 8.68<br />

P/E ratio high 10 18<br />

P/E low 6 12<br />

P/E average 9 14<br />

Opening price in EUR 8.10 9.71<br />

Closing price in EUR 7.23 8.29<br />

Market capitalization in million On December 30, <strong>20</strong>08 / December 28, <strong>20</strong>07 29.11 33.37<br />

Treasury stock<br />

1,71%

64 AnnuAl RepoRt <strong>20</strong>08<br />

unteRnehMen InVestoR und RelAtIons<br />

MIssIon 65<br />

ATOSS<br />

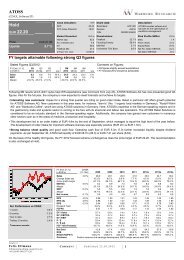

Prime IG S<strong>of</strong>tware performance<br />

Q1/<strong>20</strong>08 Q2/<strong>20</strong>08 Q3/<strong>20</strong>08 Q4/<strong>20</strong>08<br />

Key fIGuRes peR shARe<br />

EUR <strong>20</strong>08 <strong>20</strong>07<br />

Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1<br />

High 7.60 8.90 8.40 8.40 9.35 9.63 9.70 11.21<br />

Low 5.<strong>20</strong> 7.10 7.61 7.<strong>20</strong> 7.60 8.02 7.95 8.00<br />

Share price at end <strong>of</strong> quarter 7.23 7.10 7.95 7.80 8.29 8.50 8.19 8.58<br />

Treasury stock 68,894 24,500 29,500 29,500 31,881 65,881 65,881 65,881<br />

Dividend paid per share 0.00 0.00 0.31 0.00 0.00 0.00 0.24 0.00<br />

Cash flow per share -0.34 0.76 -0.63 0.76 -0.33 0.82 -0.19 0.76<br />

Liquidity per share 3.48 3.83 3.09 4.07 3.35 3.75 2.97 3.44<br />

EPS 0.21 0.24 0.26 0.17 0.17 0.14 0.17 0.15<br />

EPS (diluted) 0.<strong>20</strong> 0.24 0.26 0.17 0.17 0.14 0.16 0.14<br />

110 %<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

<strong>20</strong>08 – stock markets suffer massively under the financial crisis<br />

The subprime mortgage crisis that began in the USA and unfolded in the second<br />

half <strong>of</strong> <strong>20</strong>07 rolled on in <strong>20</strong>08 with a rapidity that led to meltdown on the capital<br />

markets. The ceaseless fall in prices on the US real estate market prompted an<br />

increasing number <strong>of</strong> mortgage defaults and undermined the purchasing power <strong>of</strong><br />

US citizens. The market for financial products that were to a large extent artificially<br />

manufactured as a means <strong>of</strong> passing on bundles <strong>of</strong> high-risk mortgages<br />

collapsed. No one knew any longer who was ultimately responsible for the risk<br />

these products carried. The parties involved had lost all track.<br />

Financial businesses in particular suffered losses, both in value and in terms <strong>of</strong><br />

trust, while inter-bank lending ground almost to a complete halt. Measures by<br />

central banks to stabilize the situation and emergency packages put together by<br />

governments on a vast scale were implemented the world over. Their initial purpose<br />

was to prevent total systemic collapse, while later action was directed towards<br />

stimulating economic activity. What began as a subprime crisis had long since developed<br />

into a financial market crisis, which in turn impacted on the real economy.<br />

heavy losses extend to almost all asset classes worldwide<br />

The financial crisis triggered a global collapse in share prices, the like <strong>of</strong> which<br />

had not been seen since the worldwide economic crisis <strong>of</strong> 1974. Raw material<br />

prices that had risen on a wave <strong>of</strong> speculation also slumped. The price <strong>of</strong> oil for<br />

example fell to a third <strong>of</strong> its former level in the space <strong>of</strong> just four months in the<br />

second half <strong>of</strong> the year. Among the benchmark indices on the major stock markets,<br />

the Japanese Nikkei lost 42 <strong>percent</strong> in value, Britain’s FTSE fell 31 <strong>percent</strong> and the<br />

French CAC dropped by almost 43 <strong>percent</strong>. In Germany the DAX recorded the<br />

second-worst year in its history with a loss <strong>of</strong> 40 <strong>percent</strong>, while the TecDAX lost as<br />

much as 48 <strong>percent</strong>.<br />

<strong>Atoss</strong> stock stands up well<br />

The DAX S<strong>of</strong>tware Performance Index as the principal index <strong>of</strong>fering a basis for<br />

comparison with the performance <strong>of</strong> ATOSS stock fell by 32 <strong>percent</strong> during the<br />

reporting period. In this fearful environment, however, the ATOSS share price<br />

remained highly stable, slipping by only 12 <strong>percent</strong> in the course <strong>of</strong> the year. Taking<br />

into account the dividend, the fall was just 10 <strong>percent</strong>. The stock price did however<br />

exhibit some considerable volatility, especially in the fourth quarter. Nevertheless<br />

the stable development in business appears to have reinforced investors’ confidence<br />

in ATOSS.<br />

low share price provides an opportunity to buy back shares<br />

The low level to which the share price fell as turbulence swept the stock market in<br />

the fourth quarter prompted the Board <strong>of</strong> Management to use some <strong>of</strong> the<br />

company’s available liquidity to buy treasury stock. The price <strong>of</strong> ATOSS stock had<br />

previously remained comparatively stable, but in October in a nervous and generally<br />

weak market, the share price was particularly attractive. The ratio <strong>of</strong> enterprise<br />

value (market capitalization less liquidity) to expected operating pr<strong>of</strong>its was<br />

between two and three.

66 AnnuAl RepoRt <strong>20</strong>08 unteRnehMen InVestoR und RelAtIons<br />

MIssIon 67<br />

Under the terms <strong>of</strong> the authority granted by the General Meeting on April 29, <strong>20</strong>08<br />

to buy back shares and on the basis <strong>of</strong> several resolutions adopted by the Board <strong>of</strong><br />

Management, a total <strong>of</strong> 44,894 shares were purchased on the stock market at an<br />

average price <strong>of</strong> EUR 6.51 per share. In accordance with the Board <strong>of</strong> Management<br />

resolution, further stock may be purchased up to April 30, <strong>20</strong>09, up to an overall<br />

total <strong>of</strong> 341,588 shares.<br />

Analysts and journalists pronounce a highly positive verdict on <strong>Atoss</strong><br />

Analysts at SES Research GmbH, a Warburg Group company, have monitored<br />

ATOSS S<strong>of</strong>tware <strong>AG</strong> continuously over the course <strong>of</strong> the year and carried out valuations<br />

on the basis <strong>of</strong> the development in our undertaking as well as against the<br />

background <strong>of</strong> the changes that have taken place during the year on the capital<br />

markets. In January SES once again affirmed its “buy” rating with an upside target<br />

<strong>of</strong> EUR 14. ATOSS, said the analysts, was able to deliver despite the crisis, the forecasts<br />

had once again been exceeded, and for an IT company ATOSS exhibited an<br />

exceptionally good risk pr<strong>of</strong>ile and highly stable earnings. The media, too, seized<br />

on the strong operating performance that ATOSS had achieved, with a gratifying<br />

variety <strong>of</strong> reports carried by newspapers, journals, stock market news services<br />

and radio and television channels aimed at a business audience.<br />

Investment policy remains strictly conservative, focused on preserving value<br />

Two <strong>of</strong> the key elements <strong>of</strong> the corporate strategy pursued by ATOSS have always<br />

been to remain absolutely independent <strong>of</strong> external funding and to ensure that the<br />

available liquidity is invested with the maximum possible security. At the end <strong>of</strong><br />

<strong>20</strong>08 ATOSS had some EUR 14.0 million invested in interest-bearing current<br />

accounts, fixed-term deposits and short-dated Federal treasury notes.<br />

stock underpinned by strong cash position, good dividend yield and low valuation<br />

Thanks to its strictly conservative investment policy and its positive cash flow,<br />

despite the dividend payment ATOSS succeeded in further increasing its liquidity<br />

during the reporting period. In fact, liquidity rose by EUR 0.5 million relative to the<br />

year before to stand at EUR 14.0 million. On that basis after deduction <strong>of</strong> liquid<br />

funds, on the balance sheet closing date the entire enterprise was valued at just 3<br />

times the operating pr<strong>of</strong>it. Given the company’s substantial liquidity and the<br />

successful development in business, this low valuation <strong>of</strong>fers a sound assurance<br />

<strong>of</strong> share price stability. This view has been confirmed in many discussions that the<br />

ATOSS Board <strong>of</strong> Management has held with investors and analysts.<br />

long-term dividend policy<br />

There is also the fact that ATOSS consistently continues to pursue the dividend<br />

policy first announced by the company at the beginning <strong>of</strong> <strong>20</strong>03. A proposal will<br />

accordingly be put to the General Meeting to pay a dividend for <strong>20</strong>08 in the amount<br />

<strong>of</strong> EUR 0.44 (previous year: EUR 0.31) per share, representing an increase <strong>of</strong><br />

42 <strong>percent</strong> over <strong>20</strong>07. This puts the dividend yield on ATOSS stock at 6.3 <strong>percent</strong>.<br />

Including the planned dividend for <strong>20</strong>08, since <strong>20</strong>03 ATOSS will have paid out a<br />

total <strong>of</strong> EUR 9.59 per share to its shareholders. Considering the share price performance<br />

against this background – at the start <strong>of</strong> <strong>20</strong>05 the price stood at EUR 7.66<br />

– despite many difficult years on the stock market ATOSS has succeeded in<br />

substantially enhancing the prosperity <strong>of</strong> its shareholders.<br />

deVelopMent In Results, dIVIdends And dIstRIbutIons peR shARe In euR<br />

Year <strong>20</strong>03 <strong>20</strong>04 <strong>20</strong>05 <strong>20</strong>06 <strong>20</strong>07 <strong>20</strong>08<br />

Earnings per share 0.47 0.23 0.12 0.48 0.63 0.88<br />

Dividend per share* - 0.11 - 0.24 0.31 0.44<br />

Special distribution per share 1.50 1.50 - 5.50 - -<br />

* pertaining to respective fiscal year (payment after <strong>AG</strong>M <strong>of</strong> the following year)<br />

Reliability and stability remain our watchwords<br />

What’s more, over the last two years which have been particularly negative for the<br />

stock markets, ATOSS shares have stood up comparatively well. The by now established<br />

stability <strong>of</strong> our business model and the trust we have earned on the part <strong>of</strong><br />

our investors are paying <strong>of</strong>f. Both the Board <strong>of</strong> Management and the company’s<br />

employees will therefore continue to abide by our corporate strategy. That means<br />

that our shareholders can look forward to a continuing, substantially predictable<br />

development in business underpinned by transparent, prompt and open communication.<br />

Moreover on the basis <strong>of</strong> our dividend policy and our securely invested<br />

liquidity, it should also prove possible in future to stabilize the share price.

68<br />

AnnuAl RepoRt <strong>20</strong>08<br />

unteRnehMen CoRpoRAte GoVeRnAnCe und MIssIon RepoRt<br />

69<br />

1. Einführung<br />

CoRpoRAte<br />

Gute Corporate Governance stellte für die ATOSS S<strong>of</strong>tware <strong>AG</strong> schon immer eine Selbstverständlichkeit<br />

in ihrer Unternehmenskultur dar, lange bevor verantwortungsbewusste und nachhaltige Unternehmensführung<br />

unter dem Begriff Corporate Governance Einzug hielt. Die Grundlagen hierzu bilden<br />

GoVeRnAnCe<br />

vor allem das deutsche Aktiengesetz und der Deutsche Corporate Governance Kodex. Insbesondere die<br />

Einhaltung von Leitlinien und Standards zur Corporate Governance leisten nach Überzeugung der<br />

Gesellschaft einen wichtigen Beitrag zur dauerhaften Festigung des Vertrauens von Kunden, Mitarbeitern<br />

und Aktionären in die Unternehmensführung. Sie unterstützen damit den nachhaltigen Erfolg der<br />

RepoRt<br />

ATOSS S<strong>of</strong>tware <strong>AG</strong>.<br />

Hierbei stehen eine effiziente Zusammenarbeit zwischen Vorstand und Aufsichtsrat, eine zuverlässige<br />

und transparente Unternehmenskommunikation sowie die Wahrung der Interessen aller am Unternehmenserfolg<br />

beteiligten Gruppen im Vordergrund.<br />

«Good corporate governance is a matter<br />

<strong>of</strong> course for ATOSS S<strong>of</strong>tware <strong>AG</strong>.»<br />

Deshalb informiert die ATOSS S<strong>of</strong>tware <strong>AG</strong> bereits seit dem Jahr <strong>20</strong>01 regelmäßig über ihre Corparate<br />

Governance Grundsätze, veröffentlicht die jährlichen Entsprechenserklärungen, Directors Dealings<br />

und sonstige wesentliche Informationen zur Corporate Governance der Gesellschaft. Diese Informationen<br />

stehen Kunden, Mitarbeitern und Aktionären gleichermaßen transparent und aktuell zur Verfügung<br />

wie Informationen zur Geschäftsentwicklung und Rechnungslegung in Quartals-, Halbjahres und<br />

Geschäftsberichten und sonstige relevante Informationen in Ad-hoc- Veröffentlichungen, Corporate<br />

News und Pressemitteilungen. Alle diese Informationen sind kontinuierlich auf der Homepage der<br />

Gesellschaft (www.atoss.com) im Bereich Investor Relations einzusehen.<br />

1. INTRODUCTION<br />

2. DECLARATION OF CONFORMITY <strong>20</strong>08<br />

3. BOARD OF MAN<strong>AG</strong>EMENT REMUNERATION REPORT<br />

4. SUPERVISORY BOARD REMUNERATION REPORT<br />

5. OWNERSHIP OF AND DEALINGS IN SHARES AND FINANCIAL INSTRUMENTS<br />

1. Introduction<br />

Good corporate governance has always been a matter <strong>of</strong> course for ATOSS S<strong>of</strong>tware<br />

<strong>AG</strong>, even long before the term was first coined to describe responsible and<br />

sustainable corporate management. The primary foundations are provided by the<br />

German Stock Corporation Act and the German Corporate Governance Code. The<br />

company believes firmly that compliance with corporate governance standards<br />

and guidelines is an important factor in securing the enduring confidence <strong>of</strong> customers,<br />

employees and shareholders in the management <strong>of</strong> our enterprise. Good<br />

governance thus supports the sustained success <strong>of</strong> ATOSS S<strong>of</strong>tware <strong>AG</strong>.<br />

Efficient cooperation between the Board <strong>of</strong> Management and the Supervisory<br />

Board, reliability and transparency in corporate communication and due protection<br />

for the interests <strong>of</strong> all those with a stake in the success <strong>of</strong> the enterprise are<br />

the primary concerns.<br />

Therefore since <strong>20</strong>01 the company has regularly reported on its Principles <strong>of</strong><br />

Corporate Governance and published its annual declarations <strong>of</strong> conformity, directors’<br />

dealings and other essential information regarding the corporate governance<br />

<strong>of</strong> the company. This information in transparent and up to date form is available in<br />

equal measure to customers, employees and shareholders. Details <strong>of</strong> the development<br />

in business and accounting information are disclosed in quarterly, halfyearly<br />

and annual reports and other relevant information is published in ad hoc<br />

announcements, corporate news and press releases. All this information is continuously<br />

available for inspection on the company’s web site (www.atoss.com) in the<br />

Investor Relations section.<br />

2. declaration <strong>of</strong> conformity <strong>20</strong>08<br />

IntroductIon I declaratIon <strong>of</strong> conformIty<br />

ATOSS S<strong>of</strong>tware <strong>AG</strong> welcomes the German Corporate Governance Code put<br />

forward by the Government Commission and most recently amended on June 6,<br />

<strong>20</strong>08. During the period under review the Supervisory Board and the Board <strong>of</strong><br />

Management have therefore concerned themselves intensively with the new requirements<br />

and compared the Code with the company’s own principles. Certain deviations<br />

from the recommendations were identified and discussed.<br />

On this basis at the Supervisory Board meeting on December 3, <strong>20</strong>08 the Supervisory<br />

Board and the Board <strong>of</strong> Management and adopted a new declaration <strong>of</strong><br />

conformity pursuant to § 161 <strong>of</strong> the German Stock Corporation Act. In this declaration<br />

published on the company’s web site it is confirmed that company complies<br />

with the recommendations <strong>of</strong> the Commission on Corporate Governance appointed<br />

by the Federal government are complied with, with the exception <strong>of</strong> those points<br />

stated in the declaration. It is consequently evident that the company fundamentally<br />

conforms with the recommendations and deviates in some few aspects only.

70 AnnuAl RepoRt <strong>20</strong>08<br />

unteRnehMen CoRpoRAte GoVeRnAnCe und MIssIon RepoRt<br />

71<br />

Deviations apply in respect <strong>of</strong> the following points:<br />

• The German Corporate Governance Code recommends that the liability insurance arranged by a<br />

company for its management and supervisory board members (so-called directors and <strong>of</strong>ficers<br />

liability insurance – D&O) should include a self-insured deductible. ATOSS S<strong>of</strong>tware <strong>AG</strong> is fundamentally<br />

not <strong>of</strong> the opinion that the commitment and responsibility with which the members <strong>of</strong> the<br />

Board <strong>of</strong> Management and Supervisory Board fulfill their duties would be enhanced by such a<br />

measure. The D&O insurances for members <strong>of</strong> the Board <strong>of</strong> Management and Supervisory Board do<br />

not therefore include such a provision.<br />

• The German Corporate Governance Code recommends the formation <strong>of</strong> supervisory board committees.<br />

In view <strong>of</strong> the size <strong>of</strong> the company, however, ATOSS S<strong>of</strong>tware <strong>AG</strong> refrains from forming separate<br />

supervisory board committees. Moreover ATOSS S<strong>of</strong>tware <strong>AG</strong> is <strong>of</strong> the opinion that with a Supervisory<br />

Board comprised <strong>of</strong> three members, the efficiency <strong>of</strong> the Board would in no way be increased<br />

by the formation <strong>of</strong> committees.<br />

• The German Corporate Governance Code recommends that fixed and performance-related remuneration<br />

elements be agreed with members <strong>of</strong> the supervisory board. Nevertheless the existing<br />

arrangement providing for a fixed remuneration together with a variable payment dependent on the<br />

number <strong>of</strong> meetings has proven its worth.<br />

• With regard to remuneration paid to members <strong>of</strong> the management board, the German Corporate<br />

Governance Code recommends that fixed and variable components should be agreed. The variable<br />

parts should include components linked to the success <strong>of</strong> the business as well as components with<br />

a long-term incentive effect and an element <strong>of</strong> risk. The remuneration model employed for members<br />

<strong>of</strong> the Board <strong>of</strong> Management includes fixed and variable components which relate to the development<br />

in sales and pr<strong>of</strong>its. Given the existence <strong>of</strong> a uniform remuneration system for members <strong>of</strong> the<br />

Board <strong>of</strong> Management, coupled with the fact that the CEO is also the majority shareholder, any<br />

further long-term incentive systems may be dispensed with.<br />

• The German Corporate Governance Code recommends that the annual general meeting be convened<br />