Is inflation targeting dead? Central Banking After the Crisis - Vox

Is inflation targeting dead? Central Banking After the Crisis - Vox

Is inflation targeting dead? Central Banking After the Crisis - Vox

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

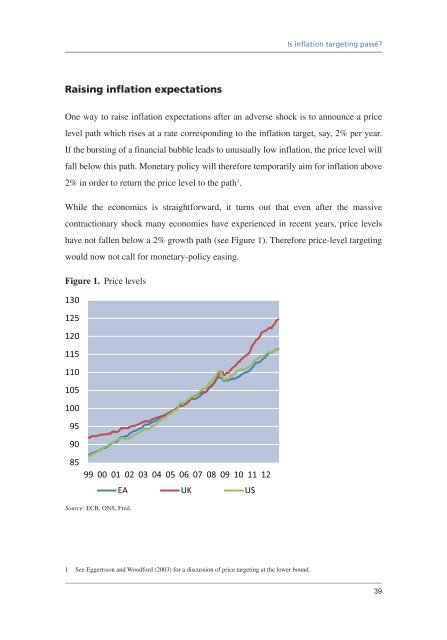

<strong>Is</strong> <strong>inflation</strong> <strong>targeting</strong> passé?Raising <strong>inflation</strong> expectationsOne way to raise <strong>inflation</strong> expectations after an adverse shock is to announce a pricelevel path which rises at a rate corresponding to <strong>the</strong> <strong>inflation</strong> target, say, 2% per year.If <strong>the</strong> bursting of a financial bubble leads to unusually low <strong>inflation</strong>, <strong>the</strong> price level willfall below this path. Monetary policy will <strong>the</strong>refore temporarily aim for <strong>inflation</strong> above2% in order to return <strong>the</strong> price level to <strong>the</strong> path 1 .While <strong>the</strong> economics is straightforward, it turns out that even after <strong>the</strong> massivecontractionary shock many economies have experienced in recent years, price levelshave not fallen below a 2% growth path (see Figure 1). Therefore price-level <strong>targeting</strong>would now not call for monetary-policy easing.Figure 1. Price levels13012512011511010510095908599 00 01 02 03 04 05 06 07 08 09 10 11 12EA UK USSource: ECB, ONS, Fred.1 See Eggertsson and Woodford (2003) for a discussion of price <strong>targeting</strong> at <strong>the</strong> lower bound.39