Modern Materials Handling - November 2012

Modern Materials Handling - November 2012

Modern Materials Handling - November 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

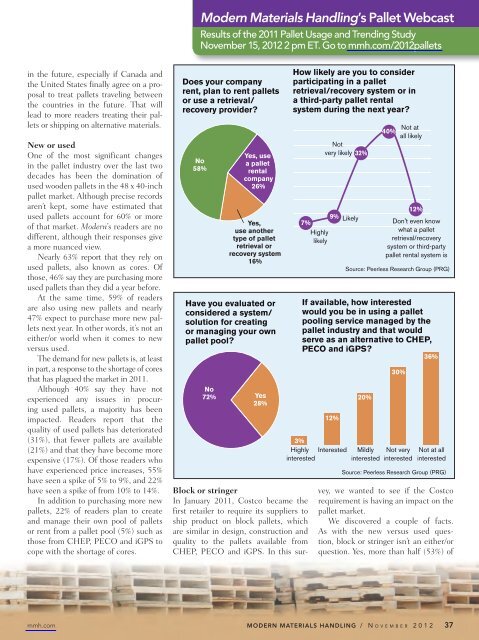

<strong>Modern</strong> <strong>Materials</strong> <strong>Handling</strong>’s Pallet WebcastResults of the 2011 Pallet Usage and Trending Study<strong>November</strong> 15, <strong>2012</strong> 2 pm ET. Go to mmh.com/<strong>2012</strong>palletsin the future, especially if Canada andthe United States finally agree on a proposalto treat pallets traveling betweenthe countries in the future. That willlead to more readers treating their palletsor shipping on alternative materials.New or usedOne of the most significant changesin the pallet industry over the last twodecades has been the domination ofused wooden pallets in the 48 x 40-inchpallet market. Although precise recordsaren’t kept, some have estimated thatused pallets account for 60% or moreof that market. <strong>Modern</strong>’s readers are nodifferent, although their responses givea more nuanced view.Nearly 63% report that they rely onused pallets, also known as cores. Ofthose, 46% say they are purchasing moreused pallets than they did a year before.At the same time, 59% of readersare also using new pallets and nearly47% expect to purchase more new palletsnext year. In other words, it’s not aneither/or world when it comes to newversus used.The demand for new pallets is, at leastin part, a response to the shortage of coresthat has plagued the market in 2011.Although 40% say they have notexperienced any issues in procuringused pallets, a majority has beenimpacted. Readers report that thequality of used pallets has deteriorated(31%), that fewer pallets are available(21%) and that they have become moreexpensive (17%). Of those readers whohave experienced price increases, 55%have seen a spike of 5% to 9%, and 22%have seen a spike of from 10% to 14%.In addition to purchasing more newpallets, 22% of readers plan to createand manage their own pool of palletsor rent from a pallet pool (5%) such asthose from CHEP, PECO and iGPS tocope with the shortage of cores.Does your companyrent, plan to rent palletsor use a retrieval/recovery provider?No58%Yes, usea palletrentalcompany26%Yes,use anothertype of palletretrieval orrecovery system16%Have you evaluated orconsidered a system/solution for creatingor managing your ownpallet pool?No72% Yes28%How likely are you to considerparticipating in a palletretrieval/recovery system or ina third-party pallet rentalsystem during the next year?Notvery likely9%7%HighlylikelyIf available, how interestedwould you be in using a palletpooling service managed by thepallet industry and that wouldserve as an alternative to CHEP,PECO and iGPS?36%12%3%Highly InterestedinterestedLikely32%20%Mildlyinterested40%Not atall likelyDon't even knowwhat a palletretrieval/recoverysystem or third-partypallet rental system is30%Not veryinterested12%Source: Peerless Research Group (PRG)Not at allinterestedSource: Peerless Research Group (PRG)Block or stringerIn January 2011, Costco became thefirst retailer to require its suppliers toship product on block pallets, whichare similar in design, construction andquality to the pallets available fromCHEP, PECO and iGPS. In this survey,we wanted to see if the Costcorequirement is having an impact on thepallet market.We discovered a couple of facts.As with the new versus used question,block or stringer isn’t an either/orquestion. Yes, more than half (53%) ofmmh.com MODERN MATERIALS HANDLING / N O V E M B E R 2 0 1 2 37