Modern Materials Handling - November 2012

Modern Materials Handling - November 2012

Modern Materials Handling - November 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

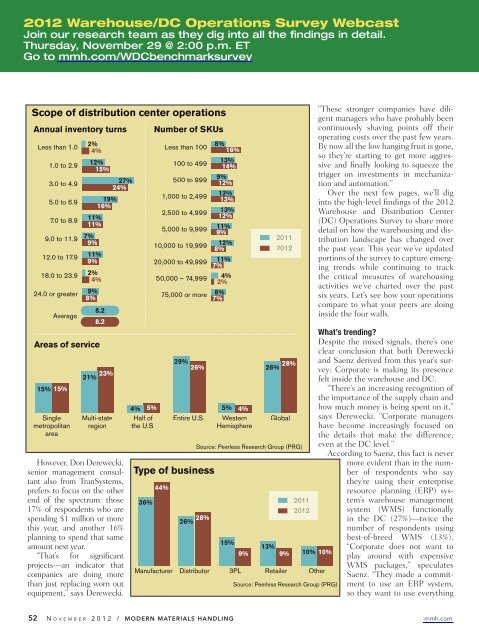

<strong>2012</strong> Warehouse/DC Operations Survey WebcastJoin our research team as they dig into all the findings in detail.Thursday, <strong>November</strong> 29 @ 2:00 p.m. ETGo to mmh.com/WDCbenchmarksurveyScope of distribution center operationsAnnual inventory turns Number of SKUs2%4%Less than 1.01.0 to 2.93.0 to 4.95.0 to 6.97.0 to 8.99.0 to 11.912.0 to 17.918.0 to 23.924.0 or greaterAverageAreas of service15% 15%Singlemetropolitanarea12%15%27%24%19%16%11%11%7%9%11%9%2%4%9%8%8.28.223%21%Multi-stateregionHowever, Don Derewecki,senior management consultantalso from TranSystems,prefers to focus on the otherend of the spectrum: those17% of respondents who arespending $1 million or morethis year, and another 16%planning to spend that sameamount next year.“That’s for significantprojects—an indicator thatcompanies are doing morethan just replacing worn outequipment,” says Derewecki.4% 5%Half ofthe U.S.Less than 1008%16%100 to 49913%14%500 to 9999%12%1,000 to 2,49912%13%2,500 to 4,99913%12%5,000 to 9,99911%9%10,000 to 19,99912%8%20,000 to 49,99911%7%50,000 – 74,99975,000 or more29%26%Entire U.S.Type of business36%44%Manufacturer28%26%Distributor4%2%8%7%5% 4%WesternHemisphere2011<strong>2012</strong>Source: Peerless Research Group (PRG)15%3PL9%“These stronger companies have diligentmanagers who have probably beencontinuously shaving points off theiroperating costs over the past few years.By now all the low hanging fruit is gone,so they’re starting to get more aggressiveand finally looking to squeeze thetrigger on investments in mechanizationand automation.”Over the next few pages, we’ll diginto the high-level findings of the <strong>2012</strong>Warehouse and Distribution Center(DC) Operations Survey to share moredetail on how the warehousing and distributionlandscape has changed overthe past year. This year we’ve updatedportions of the survey to capture emergingtrends while continuing to trackthe critical measures of warehousingactivities we’ve charted over the pastsix years. Let’s see how your operationscompare to what your peers are doinginside the four walls.What’s trending?Despite the mixed signals, there’s oneclear conclusion that both Derewecki28% and Saenz derived from this year’s survey:Corporate is making its presence26%felt inside the warehouse and DC.“There’s an increasing recognition ofthe importance of the supply chain andhow much money is being spent on it,”Global says Derewecki. “Corporate managershave become increasingly focused onthe details that make the difference,even at the DC level.”According to Saenz, this fact is nevermore evident than in the numberof respondents who saythey’re using their enterpriseresource planning (ERP) system’swarehouse management2011<strong>2012</strong> system (WMS) functionallyin the DC (27%)—twice thenumber of respondents usingbest-of-breed WMS (13%).13%“Corporate does not want to9% 10% 10%play around with expensiveWMS packages,” speculatesRetailer OtherSaenz. “They made a commitmentto use an ERP system,so they want to use everythingSource: Peerless Research Group (PRG)52 N o v e m b e r 2 0 1 2 / <strong>Modern</strong> <strong>Materials</strong> <strong>Handling</strong> mmh.com