Modern Materials Handling - November 2012

Modern Materials Handling - November 2012

Modern Materials Handling - November 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

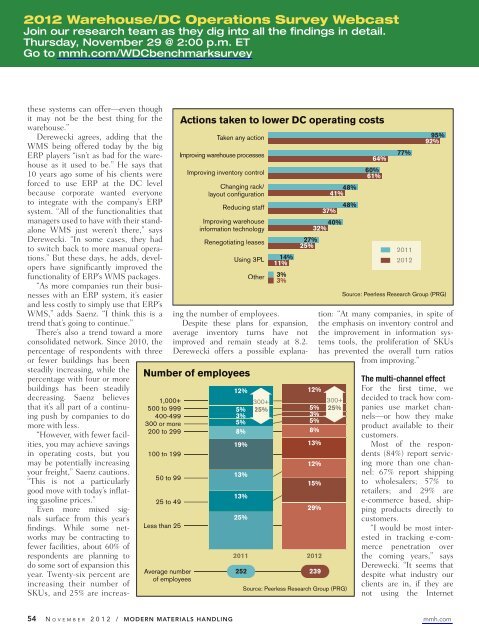

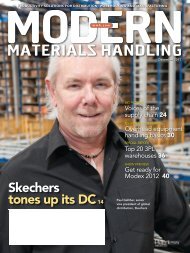

<strong>2012</strong> Warehouse/DC Operations Survey WebcastJoin our research team as they dig into all the findings in detail.Thursday, <strong>November</strong> 29 @ 2:00 p.m. ETGo to mmh.com/WDCbenchmarksurveythese systems can offer—even thoughit may not be the best thing for thewarehouse.”Derewecki agrees, adding that theWMS being offered today by the bigERP players “isn’t as bad for the warehouseas it used to be.” He says that10 years ago some of his clients wereforced to use ERP at the DC levelbecause corporate wanted everyoneto integrate with the company’s ERPsystem. “All of the functionalities thatmanagers used to have with their standaloneWMS just weren’t there,” saysDerewecki. “In some cases, they hadto switch back to more manual operations.”But these days, he adds, developershave significantly improved thefunctionality of ERP’s WMS packages.“As more companies run their businesseswith an ERP system, it’s easierand less costly to simply use that ERP’sWMS,” adds Saenz. “I think this is atrend that’s going to continue.”There’s also a trend toward a moreconsolidated network. Since 2010, thepercentage of respondents with threeor fewer buildings has beenActions taken to lower DC operating costsTaken any action 95%92%Improving warehouse processes64%77%Improving inventory control 60%61%Changing rack/layout configuration48%41%Reducing staff 48%37%Improving warehouseinformation technologyNumber of employees1,000+500 to 999400-499300 or more200 to 299100 to 19950 to 9925 to 49Less than 25Average numberof employees40%32%Renegotiating leases 27%25%Other 3%3%Using 3PL 14%11%2011<strong>2012</strong>12%5%3%5%8%19%13%13%25%300+25%12%5%3%5%8%13%12%15%29%2011 <strong>2012</strong>252 239Source: Peerless Research Group (PRG)Source: Peerless Research Group (PRG)steadily increasing, while thepercentage with four or morebuildings has been steadilydecreasing. Saenz believesthat it’s all part of a continuingpush by companies to domore with less.“However, with fewer facilities,you may achieve savingsin operating costs, but youmay be potentially increasingyour freight,” Saenz cautions.“This is not a particularlygood move with today’s inflatinggasoline prices.”Even more mixed signalssurface from this year’sfindings. While some networksmay be contracting tofewer facilities, about 60% ofrespondents are planning todo some sort of expansion thisyear. Twenty-six percent areincreasing their number ofSKUs, and 25% are increasingthe number of employees.Despite these plans for expansion,average inventory turns have notimproved and remain steady at 8.2.Derewecki offers a possible explanation:“At many companies, in spite ofthe emphasis on inventory control andthe improvement in information systemstools, the proliferation of SKUshas prevented the overall turn ratiosfrom improving.”300+25%The multi-channel effectFor the first time, wedecided to track how companiesuse market channels—orhow they makeproduct available to theircustomers.Most of the respondents(84%) report servicingmore than one channel:67% report shippingto wholesalers; 57% toretailers; and 29% aree-commerce based, shippingproducts directly tocustomers.“I would be most interestedin tracking e-commercepenetration overthe coming years,” saysDerewecki. “It seems thatdespite what industry ourclients are in, if they arenot using the Internet54 N o v e m b e r 2 0 1 2 / <strong>Modern</strong> <strong>Materials</strong> <strong>Handling</strong> mmh.com