Modern Materials Handling - November 2012

Modern Materials Handling - November 2012

Modern Materials Handling - November 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

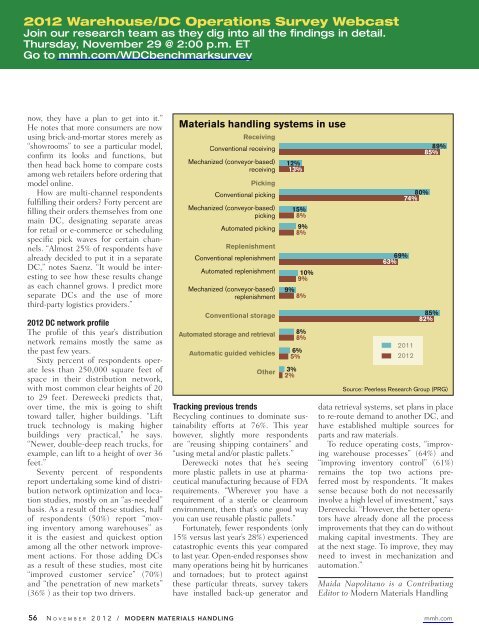

<strong>2012</strong> Warehouse/DC Operations Survey WebcastJoin our research team as they dig into all the findings in detail.Thursday, <strong>November</strong> 29 @ 2:00 p.m. ETGo to mmh.com/WDCbenchmarksurveynow, they have a plan to get into it.”He notes that more consumers are nowusing brick-and-mortar stores merely as“showrooms” to see a particular model,confirm its looks and functions, butthen head back home to compare costsamong web retailers before ordering thatmodel online.How are multi-channel respondentsfulfilling their orders? Forty percent arefilling their orders themselves from onemain DC, designating separate areasfor retail or e-commerce or schedulingspecific pick waves for certain channels.“Almost 25% of respondents havealready decided to put it in a separateDC,” notes Saenz. “It would be interestingto see how these results changeas each channel grows. I predict moreseparate DCs and the use of morethird-party logistics providers.”<strong>2012</strong> DC network profileThe profile of this year’s distributionnetwork remains mostly the same asthe past few years.Sixty percent of respondents operateless than 250,000 square feet ofspace in their distribution network,with most common clear heights of 20to 29 feet. Derewecki predicts that,over time, the mix is going to shifttoward taller, higher buildings. “Lifttruck technology is making higherbuildings very practical,” he says.“Newer, double-deep reach trucks, forexample, can lift to a height of over 36feet.”Seventy percent of respondentsreport undertaking some kind of distributionnetwork optimization and locationstudies, mostly on an “as-needed”basis. As a result of these studies, halfof respondents (50%) report “movinginventory among warehouses” asit is the easiest and quickest optionamong all the other network improvementactions. For those adding DCsas a result of these studies, most cite“improved customer service” (70%)and “the penetration of new markets”(36% ) as their top two drivers.<strong>Materials</strong> handling systems in useReceivingConventional receiving 89%85%Mechanized (conveyor-based)receiving12%13%PickingConventional picking 80%74%Mechanized (conveyor-based)pickingAutomated picking15%8%9%8%ReplenishmentConventional replenishment 69%63%Automated replenishment 10%9%Mechanized (conveyor-based)replenishment9%8%Conventional storageAutomated storage and retrievalAutomatic guided vehiclesOther8%8%6%5%3%2%Tracking previous trendsRecycling continues to dominate sustainabilityefforts at 76%. This yearhowever, slightly more respondentsare “reusing shipping containers” and“using metal and/or plastic pallets.”Derewecki notes that he’s seeingmore plastic pallets in use at pharmaceuticalmanufacturing because of FDArequirements. “Wherever you have arequirement of a sterile or cleanroomenvironment, then that’s one good wayyou can use reusable plastic pallets.”Fortunately, fewer respondents (only15% versus last year’s 28%) experiencedcatastrophic events this year comparedto last year. Open-ended responses showmany operations being hit by hurricanesand tornadoes; but to protect againstthese particular threats, survey takershave installed back-up generator and2011<strong>2012</strong>85%82%Source: Peerless Research Group (PRG)data retrieval systems, set plans in placeto re-route demand to another DC, andhave established multiple sources forparts and raw materials.To reduce operating costs, “improvingwarehouse processes” (64%) and“improving inventory control” (61%)remains the top two actions preferredmost by respondents. “It makessense because both do not necessarilyinvolve a high level of investment,” saysDerewecki. “However, the better operatorshave already done all the processimprovements that they can do withoutmaking capital investments. They areat the next stage. To improve, they mayneed to invest in mechanization andautomation.”Maida Napolitano is a ContributingEditor to <strong>Modern</strong> <strong>Materials</strong> <strong>Handling</strong>56 N o v e m b e r 2 0 1 2 / <strong>Modern</strong> <strong>Materials</strong> <strong>Handling</strong> mmh.com