Download Now - The Burrill Report

Download Now - The Burrill Report

Download Now - The Burrill Report

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

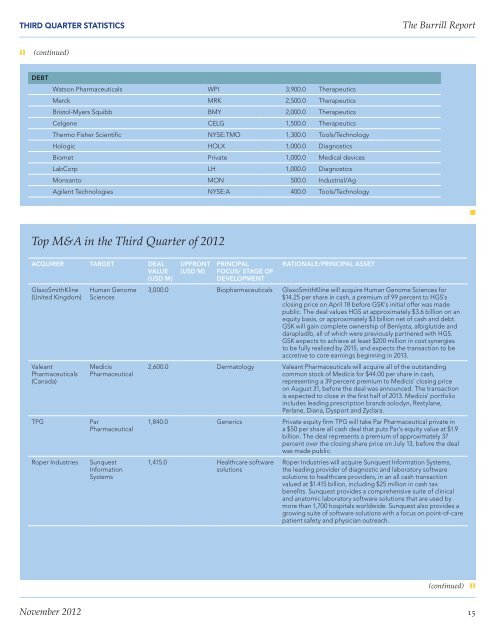

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)DEBTWatson Pharmaceuticals WPI 3,900.0 <strong>The</strong>rapeuticsMerck MRK 2,500.0 <strong>The</strong>rapeuticsBristol-Myers Squibb BMY 2,000.0 <strong>The</strong>rapeuticsCelgene CELG 1,500.0 <strong>The</strong>rapeutics<strong>The</strong>rmo Fisher Scientific NYSE:TMO 1,300.0 Tools/TechnologyHologic HOLX 1,000.0 DiagnosticsBiomet Private 1,000.0 Medical devicesLabCorp LH 1,000.0 DiagnosticsMonsanto MON 500.0 Industrial/AgAgilent Technologies NYSE:A 400.0 Tools/TechnologynTop M&A in the Third Quarter of 2012ACQUIRER TARGET DEALVALUE(USD M)GlaxoSmithKline(United Kingdom)ValeantPharmaceuticals(Canada)TPGRoper IndustriesHuman GenomeSciencesMedicisPharmaceuticalParPharmaceuticalSunquestInformationSystemsUPFRONT(USD M)PRINCIPALFOCUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSET3,000.0 Biopharmaceuticals GlaxoSmithKline will acquire Human Genome Sciences for$14.25 per share in cash, a premium of 99 percent to HGS’sclosing price on April 18 before GSK’s initial offer was madepublic. <strong>The</strong> deal values HGS at approximately $3.6 billion on anequity basis, or approximately $3 billion net of cash and debt.GSK will gain complete ownership of Benlysta, albiglutide anddarapladib, all of which were previously partnered with HGS.GSK expects to achieve at least $200 million in cost synergiesto be fully realized by 2015, and expects the transaction to beaccretive to core earnings beginning in 2013.2,600.0 Dermatology Valeant Pharmaceuticals will acquire all of the outstandingcommon stock of Medicis for $44.00 per share in cash,representing a 39 percent premium to Medicis’ closing priceon August 31, before the deal was announced. <strong>The</strong> transactionis expected to close in the first half of 2013. Medicis’ portfolioincludes leading prescription brands solodyn, Restylane,Perlane, Diana, Dysport and Zyclara.1,840.0 Generics Private equity firm TPG will take Par Pharmaceutical private ina $50 per share all cash deal that puts Par’s equity value at $1.9billion. <strong>The</strong> deal represents a premium of approximately 37percent over the closing share price on July 13, before the dealwas made public.1,415.0 Healthcare softwaresolutionsRoper Industries will acquire Sunquest Information Systems,the leading provider of diagnostic and laboratory softwaresolutions to healthcare providers, in an all cash transactionvalued at $1.415 billion, including $25 million in cash taxbenefits. Sunquest provides a comprehensive suite of clinicaland anatomic laboratory software solutions that are used bymore than 1,700 hospitals worldwide. Sunquest also provides agrowing suite of software solutions with a focus on point-of-carepatient safety and physician outreach.(continued) ❱❱November 2012 15