Download Now - The Burrill Report

Download Now - The Burrill Report

Download Now - The Burrill Report

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

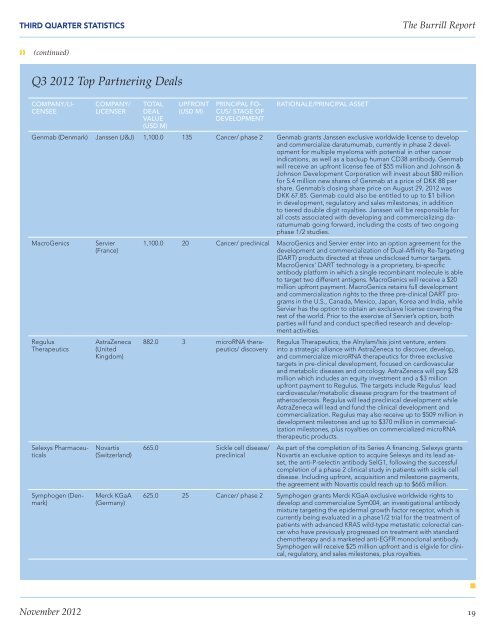

THIRD QUARTER STATISTICS<strong>The</strong> <strong>Burrill</strong> <strong>Report</strong>❱❱ (continued)Q3 2012 Top Partnering DealsCOMPANY/LI-CENSEECOMPANY/LICENSERTOTALDEALVALUE(USD M)UPFRONT(USD M)PRINCIPAL FO-CUS/ STAGE OFDEVELOPMENTRATIONALE/PRINCIPAL ASSETGenmab (Denmark) Janssen (J&J) 1,100.0 135 Cancer/ phase 2 Genmab grants Janssen exclusive worldwide license to developand commercialize daratumumab, currently in phase 2 developmentfor multiple myeloma with potential in other cancerindications, as well as a backup human CD38 antibody. Genmabwill receive an upfront license fee of $55 million and Johnson &Johnson Development Corporation will invest about $80 millionfor 5.4 million new shares of Genmab at a price of DKK 88 pershare. Genmab’s closing share price on August 29, 2012 wasDKK 67.85. Genmab could also be entitled to up to $1 billionin development, regulatory and sales milestones, in additionto tiered double digit royalties. Janssen will be responsible forall costs associated with developing and commercializing daratumumabgoing forward, including the costs of two ongoingphase 1/2 studies.MacroGenicsRegulus<strong>The</strong>rapeuticsSelexys PharmaceuticalsSymphogen (Denmark)Servier(France)AstraZeneca(UnitedKingdom)Novartis(Switzerland)Merck KGaA(Germany)1,100.0 20 Cancer/ preclinical MacroGenics and Servier enter into an option agreement for thedevelopment and commercialization of Dual-Affinity Re-Targeting(DART) products directed at three undisclosed tumor targets.MacroGenics’ DART technology is a proprietary, bi-specificantibody platform in which a single recombinant molecule is ableto target two different antigens. MacroGenics will receive a $20million upfront payment. MacroGenics retains full developmentand commercialization rights to the three pre-clinical DART programsin the U.S., Canada, Mexico, Japan, Korea and India, whileServier has the option to obtain an exclusive license covering therest of the world. Prior to the exercise of Servier’s option, bothparties will fund and conduct specified research and developmentactivities.882.0 3 microRNA therapeutics/discovery665.0 Sickle cell disease/preclinicalRegulus <strong>The</strong>rapeutics, the Alnylam/Isis joint venture, entersinto a strategic alliance with AstraZeneca to discover, develop,and commercialize microRNA therapeutics for three exclusivetargets in pre-clinical development, focused on cardiovascularand metabolic diseases and oncology. AstraZeneca will pay $28million which includes an equity investment and a $3 millionupfront payment to Regulus. <strong>The</strong> targets include Regulus’ leadcardiovascular/metabolic disease program for the treatment ofatherosclerosis. Regulus will lead preclinical development whileAstraZeneca will lead and fund the clinical development andcommercialization. Regulus may also receive up to $509 million indevelopment milestones and up to $370 million in commercializationmilestones, plus royalties on commercialized microRNAtherapeutic products.As part of the completion of its Series A financing, Selexys grantsNovartis an exclusive option to acquire Selexys and its lead asset,the anti-P-selectin antibody SelG1, following the successfulcompletion of a phase 2 clinical study in patients with sickle celldisease. Including upfront, acquisition and milestone payments,the agreement with Novartis could reach up to $665 million.625.0 25 Cancer/ phase 2 Symphogen grants Merck KGaA exclusive worldwide rights todevelop and commercialize Sym004, an investigational antibodymixture targeting the epidermal growth factor receptor, which iscurrently being evaluated in a phase1/2 trial for the treatment ofpatients with advanced KRAS wild-type metastatic colorectal cancerwho have previously progressed on treatment with standardchemotherapy and a marketed anti-EGFR monoclonal antibody.Symphogen will receive $25 million upfront and is elgivle for clinical,regulatory, and sales milestones, plus royalties.nNovember 2012 19