Viet Nam - A Guide for Business and Investment - asean-korea centre

Viet Nam - A Guide for Business and Investment - asean-korea centre

Viet Nam - A Guide for Business and Investment - asean-korea centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

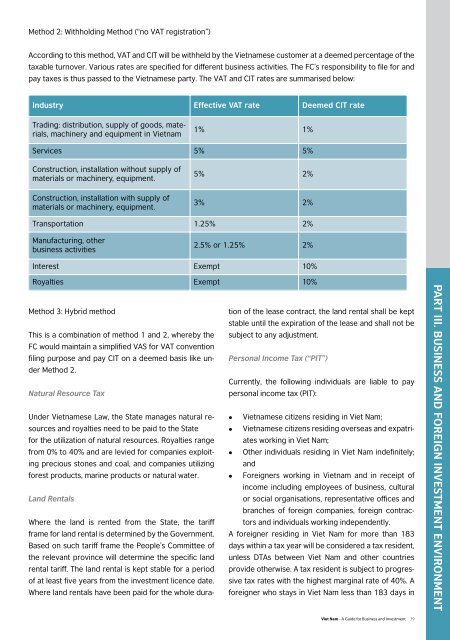

Method 2: Withholding Method (“no VAT registration”)According to this method, VAT <strong>and</strong> CIT will be withheld by the <strong>Viet</strong>namese customer at a deemed percentage of thetaxable turnover. Various rates are specified <strong>for</strong> different business activities. The FC’s responsibility to file <strong>for</strong> <strong>and</strong>pay taxes is thus passed to the <strong>Viet</strong>namese party. The VAT <strong>and</strong> CIT rates are summarised below:Industry Effective VAT rate Deemed CIT rateTrading: distribution, supply of goods, materials,machinery <strong>and</strong> equipment in <strong>Viet</strong>nam1% 1%Services 5% 5%Construction, installation without supply ofmaterials or machinery, equipment.Construction, installation with supply ofmaterials or machinery, equipment.5% 2%3% 2%Transportation 1.25% 2%Manufacturing, otherbusiness activities2.5% or 1.25% 2%Interest Exempt 10%Royalties Exempt 10%Method 3: Hybrid methodtion of the lease contract, the l<strong>and</strong> rental shall be keptstable until the expiration of the lease <strong>and</strong> shall not beThis is a combination of method 1 <strong>and</strong> 2, whereby the subject to any adjustment.FC would maintain a simplified VAS <strong>for</strong> VAT conventionfiling purpose <strong>and</strong> pay CIT on a deemed basis like underPersonal Income Tax (“PIT”)Method 2.Currently, the following individuals are liable to payNatural Resource Taxpersonal income tax (PIT):Under <strong>Viet</strong>namese Law, the State manages natural resources• <strong>Viet</strong>namese citizens residing in <strong>Viet</strong> <strong>Nam</strong>;<strong>and</strong> royalties need to be paid to the State<strong>for</strong> the utilization of natural resources. Royalties range• <strong>Viet</strong>namese citizens residing overseas <strong>and</strong> expatriatesworking in <strong>Viet</strong> <strong>Nam</strong>;from 0% to 40% <strong>and</strong> are levied <strong>for</strong> companies exploitingprecious stones <strong>and</strong> coal, <strong>and</strong> companies utilizing• Other individuals residing in <strong>Viet</strong> <strong>Nam</strong> indefinitely;<strong>and</strong><strong>for</strong>est products, marine products or natural water.L<strong>and</strong> RentalsWhere the l<strong>and</strong> is rented from the State, the tariff• Foreigners working in <strong>Viet</strong>nam <strong>and</strong> in receipt ofincome including employees of business, culturalor social organisations, representative offices <strong>and</strong>branches of <strong>for</strong>eign companies, <strong>for</strong>eign contractors<strong>and</strong> individuals working independently.frame <strong>for</strong> l<strong>and</strong> rental is determined by the Government.Based on such tariff frame the People’s Committee ofthe relevant province will determine the specific l<strong>and</strong>rental tariff. The l<strong>and</strong> rental is kept stable <strong>for</strong> a periodof at least five years from the investment licence date.Where l<strong>and</strong> rentals have been paid <strong>for</strong> the whole dura-A <strong>for</strong>eigner residing in <strong>Viet</strong> <strong>Nam</strong> <strong>for</strong> more than 183days within a tax year will be considered a tax resident,unless DTAs between <strong>Viet</strong> <strong>Nam</strong> <strong>and</strong> other countriesprovide otherwise. A tax resident is subject to progressivetax rates with the highest marginal rate of 40%. A<strong>for</strong>eigner who stays in <strong>Viet</strong> <strong>Nam</strong> less than 183 days inPART III. BUSINESS AND FOREIGN INVESTMENT ENVIRONMENT<strong>Viet</strong> <strong>Nam</strong> - A <strong>Guide</strong> <strong>for</strong> <strong>Business</strong> <strong>and</strong> <strong>Investment</strong> 39