Cross-Asset Speculation in Stock Markets∗ - Econometrics at Illinois ...

Cross-Asset Speculation in Stock Markets∗ - Econometrics at Illinois ...

Cross-Asset Speculation in Stock Markets∗ - Econometrics at Illinois ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

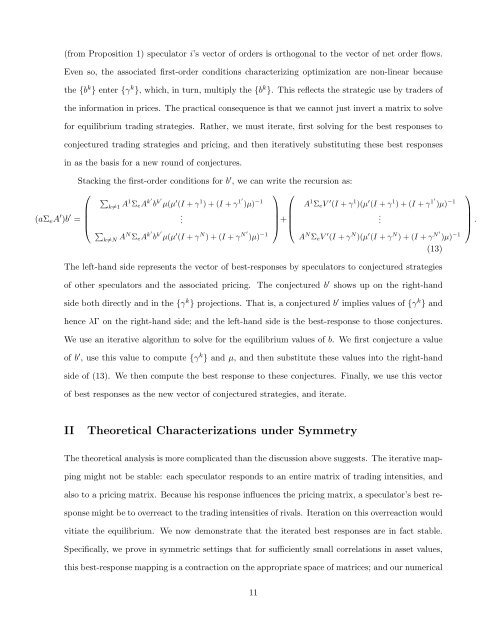

(from Proposition 1) specul<strong>at</strong>or i’s vector of orders is orthogonal to the vector of net order flows.Even so, the associ<strong>at</strong>ed first-order conditions characteriz<strong>in</strong>g optimiz<strong>at</strong>ion are non-l<strong>in</strong>ear becausethe {b k } enter {γ k }, which, <strong>in</strong> turn, multiply the {b k }. This reflects the str<strong>at</strong>egic use by traders ofthe <strong>in</strong>form<strong>at</strong>ion <strong>in</strong> prices. The practical consequence is th<strong>at</strong> we cannot just <strong>in</strong>vert a m<strong>at</strong>rix to solvefor equilibrium trad<strong>in</strong>g str<strong>at</strong>egies. R<strong>at</strong>her, we must iter<strong>at</strong>e, first solv<strong>in</strong>g for the best responses toconjectured trad<strong>in</strong>g str<strong>at</strong>egies and pric<strong>in</strong>g, and then iter<strong>at</strong>ively substitut<strong>in</strong>g these best responses<strong>in</strong> as the basis for a new round of conjectures.Stack<strong>in</strong>g the first-order conditions for b ′ , we can write the recursion as:⎛⎞ ⎛⎞∑k≠1 A1 Σ e A k′ b k′ µ(µ ′ (I + γ 1 ) + (I + γ 1′ )µ) −1 A 1 Σ e V ′ (I + γ 1 )(µ ′ (I + γ 1 ) + (I + γ 1′ )µ) −1(aΣ e A ′ )b ′ = ⎜.⎟⎝⎠ + ⎜.⎟⎝⎠ .∑k≠N AN Σ e A k′ b k′ µ(µ ′ (I + γ N ) + (I + γ N ′ )µ) −1 A N Σ e V ′ (I + γ N )(µ ′ (I + γ N ) + (I + γ N ′ )µ) −1(13)The left-hand side represents the vector of best-responses by specul<strong>at</strong>ors to conjectured str<strong>at</strong>egiesof other specul<strong>at</strong>ors and the associ<strong>at</strong>ed pric<strong>in</strong>g. The conjectured b ′ shows up on the right-handside both directly and <strong>in</strong> the {γ k } projections. Th<strong>at</strong> is, a conjectured b ′ implies values of {γ k } andhence λΓ on the right-hand side; and the left-hand side is the best-response to those conjectures.We use an iter<strong>at</strong>ive algorithm to solve for the equilibrium values of b. We first conjecture a valueof b ′ , use this value to compute {γ k } and µ, and then substitute these values <strong>in</strong>to the right-handside of (13). We then compute the best response to these conjectures. F<strong>in</strong>ally, we use this vectorof best responses as the new vector of conjectured str<strong>at</strong>egies, and iter<strong>at</strong>e.II Theoretical Characteriz<strong>at</strong>ions under SymmetryThe theoretical analysis is more complic<strong>at</strong>ed than the discussion above suggests. The iter<strong>at</strong>ive mapp<strong>in</strong>gmight not be stable: each specul<strong>at</strong>or responds to an entire m<strong>at</strong>rix of trad<strong>in</strong>g <strong>in</strong>tensities, andalso to a pric<strong>in</strong>g m<strong>at</strong>rix. Because his response <strong>in</strong>fluences the pric<strong>in</strong>g m<strong>at</strong>rix, a specul<strong>at</strong>or’s best responsemight be to overreact to the trad<strong>in</strong>g <strong>in</strong>tensities of rivals. Iter<strong>at</strong>ion on this overreaction wouldviti<strong>at</strong>e the equilibrium. We now demonstr<strong>at</strong>e th<strong>at</strong> the iter<strong>at</strong>ed best responses are <strong>in</strong> fact stable.Specifically, we prove <strong>in</strong> symmetric sett<strong>in</strong>gs th<strong>at</strong> for sufficiently small correl<strong>at</strong>ions <strong>in</strong> asset values,this best-response mapp<strong>in</strong>g is a contraction on the appropri<strong>at</strong>e space of m<strong>at</strong>rices; and our numerical11