Cross-Asset Speculation in Stock Markets∗ - Econometrics at Illinois ...

Cross-Asset Speculation in Stock Markets∗ - Econometrics at Illinois ...

Cross-Asset Speculation in Stock Markets∗ - Econometrics at Illinois ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

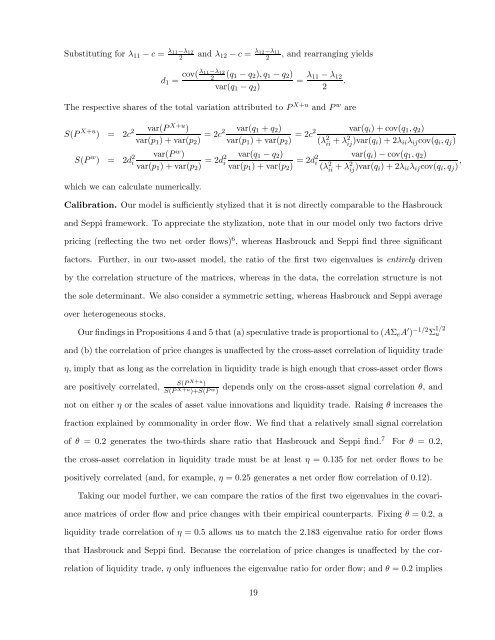

Substitut<strong>in</strong>g for λ 11 − c = λ 11−λ 122and λ 12 − c = λ 12−λ 112, and rearrang<strong>in</strong>g yieldsd 1 = cov(λ 11−λ 122(q 1 − q 2 ),q 1 − q 2 )var(q 1 − q 2 )= λ 11 − λ 12.2The respective shares of the total vari<strong>at</strong>ion <strong>at</strong>tributed to P X+u and P w areS(P X+u ) = 2c 2 var(P X+u )var(p 1 ) + var(p 2 ) = 2c2 var(q 1 + q 2 )var(p 1 ) + var(p 2 ) = 2c2 var(q i ) + cov(q 1 ,q 2 )(λ 2 ii + λ2 ij )var(q i) + 2λ ii λ ij cov(q i ,q j )S(P w ) = 2d 2 ivar(P w )var(p 1 ) + var(p 2 ) = 2d2 iwhich we can calcul<strong>at</strong>e numerically.var(q 1 − q 2 )var(p 1 ) + var(p 2 ) = 2d2 ivar(q i ) − cov(q 1 ,q 2 )(λ 2 ii + λ2 ij )var(q i) + 2λ ii λ ij cov(q i ,q j ) ,Calibr<strong>at</strong>ion. Our model is sufficiently stylized th<strong>at</strong> it is not directly comparable to the Hasbrouckand Seppi framework. To appreci<strong>at</strong>e the styliz<strong>at</strong>ion, note th<strong>at</strong> <strong>in</strong> our model only two factors drivepric<strong>in</strong>g (reflect<strong>in</strong>g the two net order flows) 6 , whereas Hasbrouck and Seppi f<strong>in</strong>d three significantfactors. Further, <strong>in</strong> our two-asset model, the r<strong>at</strong>io of the first two eigenvalues is entirely drivenby the correl<strong>at</strong>ion structure of the m<strong>at</strong>rices, whereas <strong>in</strong> the d<strong>at</strong>a, the correl<strong>at</strong>ion structure is notthe sole determ<strong>in</strong>ant. We also consider a symmetric sett<strong>in</strong>g, whereas Hasbrouck and Seppi averageover heterogeneous stocks.Our f<strong>in</strong>d<strong>in</strong>gs <strong>in</strong> Propositions 4 and 5 th<strong>at</strong> (a) specul<strong>at</strong>ive trade is proportional to (AΣ e A ′ ) −1/2 Σ 1/2uand (b) the correl<strong>at</strong>ion of price changes is unaffected by the cross-asset correl<strong>at</strong>ion of liquidity tradeη, imply th<strong>at</strong> as long as the correl<strong>at</strong>ion <strong>in</strong> liquidity trade is high enough th<strong>at</strong> cross-asset order flowsare positively correl<strong>at</strong>ed,S(P X+u )S(P X+u )+S(P w )depends only on the cross-asset signal correl<strong>at</strong>ion θ, andnot on either η or the scales of asset value <strong>in</strong>nov<strong>at</strong>ions and liquidity trade. Rais<strong>in</strong>g θ <strong>in</strong>creases thefraction expla<strong>in</strong>ed by commonality <strong>in</strong> order flow. We f<strong>in</strong>d th<strong>at</strong> a rel<strong>at</strong>ively small signal correl<strong>at</strong>ionof θ = 0.2 gener<strong>at</strong>es the two-thirds share r<strong>at</strong>io th<strong>at</strong> Hasbrouck and Seppi f<strong>in</strong>d. 7 For θ = 0.2,the cross-asset correl<strong>at</strong>ion <strong>in</strong> liquidity trade must be <strong>at</strong> least η = 0.135 for net order flows to bepositively correl<strong>at</strong>ed (and, for example, η = 0.25 gener<strong>at</strong>es a net order flow correl<strong>at</strong>ion of 0.12).Tak<strong>in</strong>g our model further, we can compare the r<strong>at</strong>ios of the first two eigenvalues <strong>in</strong> the covariancem<strong>at</strong>rices of order flow and price changes with their empirical counterparts. Fix<strong>in</strong>g θ = 0.2, aliquidity trade correl<strong>at</strong>ion of η = 0.5 allows us to m<strong>at</strong>ch the 2.183 eigenvalue r<strong>at</strong>io for order flowsth<strong>at</strong> Hasbrouck and Seppi f<strong>in</strong>d. Because the correl<strong>at</strong>ion of price changes is unaffected by the correl<strong>at</strong>ionof liquidity trade, η only <strong>in</strong>fluences the eigenvalue r<strong>at</strong>io for order flow; and θ = 0.2 implies19