“Airbus vs. Boeing in Super Jumbos: A Case of Failed Preemptionâ€Â

“Airbus vs. Boeing in Super Jumbos: A Case of Failed Preemptionâ€Â

“Airbus vs. Boeing in Super Jumbos: A Case of Failed Preemptionâ€Â

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

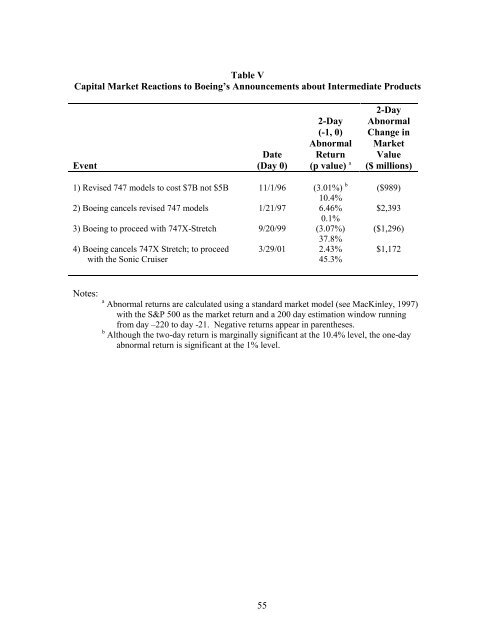

Table VCapital Market Reactions to <strong>Boe<strong>in</strong>g</strong>’s Announcements about Intermediate ProductsEventDate(Day 0)2-Day2-Day Abnormal(-1, 0) Change <strong>in</strong>Abnormal MarketReturn Value(p value) a ($ millions)1) Revised 747 models to cost $7B not $5B 11/1/96 (3.01%) b10.4%2) <strong>Boe<strong>in</strong>g</strong> cancels revised 747 models 1/21/97 6.46%0.1%3) <strong>Boe<strong>in</strong>g</strong> to proceed with 747X-Stretch 9/20/99 (3.07%)37.8%4) <strong>Boe<strong>in</strong>g</strong> cancels 747X Stretch; to proceed 3/29/01 2.43%with the Sonic Cruiser45.3%($989)$2,393($1,296)$1,172Notes:a Abnormal returns are calculated us<strong>in</strong>g a standard market model (see MacK<strong>in</strong>ley, 1997)with the S&P 500 as the market return and a 200 day estimation w<strong>in</strong>dow runn<strong>in</strong>gfrom day –220 to day -21. Negative returns appear <strong>in</strong> parentheses.b Although the two-day return is marg<strong>in</strong>ally significant at the 10.4% level, the one-dayabnormal return is significant at the 1% level.55