Melbourne Airport 2011 Annual Report

Melbourne Airport 2011 Annual Report

Melbourne Airport 2011 Annual Report

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OwnershipAPAC has demonstrated consistent growth sinceits inception in 1997. Strong management and diverserevenue streams continue to enable APAC to capitaliseon opportunities and deliver aviation excellence.APAC is a majority Australian owned company,representing the retirement savings of thousandsof Australians. APAC’s shareholders are:Hastings FundsManagement20%AMP25%Deutsche AssetManagement(RREEFInfrastructure)17.5%Future Fund16.8%Industry FundsManagement20.7%About APACAustralia Pacific <strong>Airport</strong>s Corporate Limited (APAC)operates two key Australian aviation assets,<strong>Melbourne</strong> <strong>Airport</strong> and Launceston <strong>Airport</strong>.APAC acquired <strong>Melbourne</strong> <strong>Airport</strong> in July 1997.Launceston <strong>Airport</strong> was acquired shortly after(May 1998) in partnership with the Launceston CityCouncil. Both airports are operated under a 50 yearlong-term lease from the Federal Government,with an option for a further 49 years.Australia Pacific <strong>Airport</strong>s Corporation LtdABN 89 069 775 266Photograph by Tony Moclair

APAC<strong>2011</strong> ANNUAL REPORTOUR PURPOSETo responsibly develop a growingand profitable airport group in theAsia Pacific region.OUR OBJECTIVETo be the most successful airportgroup in the Asia Pacific region.3

4Total passengers2Mat <strong>Melbourne</strong> andLaunceston <strong>Airport</strong>s

APAC<strong>2011</strong> ANNUAL REPORTCONTENTS6 <strong>2011</strong> Highlights8 Chairman’s Message9 Chief Executive Officer’s Message10 APAC Board of Directors14 GROWING THE BUSINESS21 Service26 Our REPUTATION32 our TEAM34 Results Summary51 Corporate Directory5

<strong>2011</strong>HIGHLIGHTS8% 9%Total revenueOperating profit26%Net profit14%International passenger growth28.19 millionNo. of <strong>Melbourne</strong> <strong>Airport</strong> passengers1.15 millionNo. of Launceston <strong>Airport</strong> passengers6

APAC<strong>2011</strong> ANNUAL REPORTResultsAt A GlanceYear ended 30 June<strong>2011</strong>($ millions)2010($ millions)CHANGE(per cent)Total revenue 561 518 8%Operating expenses 138 131 5%Operating profit 423 387 9%Change in fair value of investment property 59 11Profit before borrowing costs, depreciation & amortisation 482 398 21%Depreciation & amortisation 65 53 23%Interest 126 115 10%Profit before tax 291 230 26%Income tax expense 88 69 27%Net profit 203 161 26%7

CHAIRMAN’SMESSAGE“These are indeed challengingtimes for aviation, but they arealso exciting times.”Jack RitchThroughout the 15 years that I have been an APAC boardmember the aviation industry has seen many changes, someexciting and some that have undoubtedly tested us. Duringthe past year, we’ve had to manage the impacts of devastatingfloods, volcanic ash clouds from Chile; a strong Australiandollar and continuing global economic volatility.Despite these challenges, we’ve continued to invest andgrow successfully.Our domestic and international passenger numbers increased,our airline customers added new capacity, and our retail,freight and property activities performed well. Over the periodthat I have been involved with APAC, the number of passengersthrough <strong>Melbourne</strong> <strong>Airport</strong> has more than doubled.In 2010/11, 29.34 million passengers passed through<strong>Melbourne</strong> and Launceston <strong>Airport</strong>s, an increase of two millionpassengers on 2009/10. And despite some challenges in thedomestic market, this growth is forecast to continue.A substantial capital works program is underway to growour airports’ capacity and support our forecast growth.We invested $137 million during the year with this figureset to increase next year, demonstrating the Board’s andshareholders’ confidence in the business.Through the superannuation funds who are our shareholders,<strong>Melbourne</strong> and Launceston <strong>Airport</strong>s help to support theretirement incomes for millions of Australians and we take thisresponsibility very seriously. As vital pieces of infrastructurein both Victoria and Tasmania, we also work with keystakeholders, including federal and state governments toserve and attract travellers and tourists.<strong>Melbourne</strong> <strong>Airport</strong>’s strength and potential was reaffirmedduring the year with the completion of a US$600 millionrefinancing program through the US Private Placement market.The successful refinancing was supported by the FederalGovernment’s extension of the existing Tripartite Deeds whichprovides confidence, certainty and clarity on rightsfor financiers who invest in airports.The success of the privatisation of Australia’s airports wasalso reaffirmed by the Productivity Commission’s inquiryinto the economic regulation of airport services draft reportthat was recently released. The ‘light handed’ regulatoryregime has encouraged investment, innovation and growth invital transport infrastructure. We’ll be strongly encouragingthe Federal Government to continue this approach when itconsiders its response to the Productivity Commission’s finalreport which is due by the end of <strong>2011</strong>.During the year, we welcomed four new members to theAPAC Board – Nadine Lennie from The Future Fund, AndrewFellowes and John Harvey representing Hastings FundManagement and Paul Breen from AMP. Richard Hedleyfrom Deutsche Bank was also re-appointed. Our new boardmembers bring with them vast and varied experience and weare delighted that they’ve joined us.Subsequently, we also saw three Board members resign andI’d like to acknowledge our departing directors for their valuablecontributions. Thank you to John Dorrian from Deutsche Bank,Phil Garling from AMP and Steve Boulton from Hastings FundManagement for their dedication throughout their terms.On behalf of the Board, I’d like to thank Chris Woodruff, thesenior management team and all of APAC’s staff for theirefforts throughout the year.These are indeed challenging times for aviation, but they arealso exciting times. I am confident that APAC will continueto grow, successfully manage that growth and continue todeliver excellent results.8

APAC<strong>2011</strong> ANNUAL REPORTCHIEFEXECUTIVEOFFICER’SMESSAGE“Managing the impacts of ourgrowth will be core to APAC’scontinued success over thecoming years.”Chris WoodruffThis year was another year of growth for APAC but as has beenthe case for the last few years, it also had its challenges.The aviation industry is without a doubt dynamic, and it’s alsoan industry that continually challenges all of us who work in it.This year alone, we faced economic volatility, volcanic ashfrom South America and a soaring Australian dollar. But asvital infrastructure in Victoria and Tasmania, our successis also fundamental for the growth of our home states.Financially, we performed strongly with aeronautical revenueincreasing by 9 per cent to $237 million, retail revenueincreasing by 10 per cent to $239 million and revenue fromour Property group increasing by 4 per cent to $83 million.These three revenues contributed to a total revenue of $561million, an 8 per cent increase on 2009/10 and clearly alignedwith our total passenger growth.We tightly controlled our costs and again passed securitysavings to our airline customers, delivering some of thelowest aeronautical costs in Australia while simultaneouslymaintaining our high security levels.Our operating profit, before borrowing costs and depreciation,also reflects total passenger growth, increasing by 9 per centto $423 million.In August 2010, we completed $1.25 billion worth of financingand in June <strong>2011</strong>, we completed our current refinancingprogram, raising US$600 million in the US Private Placementmarket. The success of our refinancing reflects the confidencethe markets have in APAC’s stability as well as our abilityto continue to grow successfully.One of the core elements to our success this year was the eightper cent increase in APAC’s total passenger growth takingtotal passengers at Launceston to 1.15 million passengersand to 28.19 million passengers at <strong>Melbourne</strong>. This was drivenby 14 per cent international growth at <strong>Melbourne</strong> where Asiacontinued to be the key growth region, with Chinese passportholders increasing by an impressive 26 per cent compared tolast year. Over the next two decades, Asia will continue to bethe dominant growth region for <strong>Melbourne</strong> <strong>Airport</strong> and ourfocus on tailoring our customer’s experience will only becomemore pertinent as our competitors apply a renewed vigour onreclaiming the growth that they believe is rightfully theirs.It has been a particularly challenging year for domestic travelwith severe floods in Queensland and volcanic ash taking theirtoll. Launceston <strong>Airport</strong> in particular has felt these impacts.Despite this, domestically, we achieved growth of 3 per centat Launceston and 6 per cent at <strong>Melbourne</strong>.Our freight capacity also continued to grow as well. Launcestonannounced a $1.5 million hangar redevelopment with AustralianAir Express boosting Launceston’s processing and freighthandling facilities. <strong>Melbourne</strong>’s share of the Australian airfreight market rose to 31 per cent.Managing the impacts of growth will be core to APAC’s continuedsuccess over the coming years. Our growth at <strong>Melbourne</strong>in particular has at peak times, created additional pressureon our terminal facilities and our road network.We have brought forward a number of infrastructure projectsto manage these demands and deliver a great experience forour passengers and our airline customers as well as ensurethat we can accommodate future growth.Protecting Victoria’s curfew free status and the benefits thisdelivers to all of Victoria will also be a priority for us going forward.In 2010/11, we put in place strong foundations to manage ourgrowth while also maintaining it and delivering great resultsfor APAC as well as our airline customers, our suppliers andour communities as we strive to be the most successfulairport group in Asia Pacific.I would like to thank all of my team, our airline customers,our suppliers, tenants and contractors for deliveringa successful year.9

APAC BOARD OFDIRECTORSJack RitchChairmanChris WoodruffManaging DirectorAndrew FellowesDirectorKyle ManginiDirectorAppointed 1 November 1995Mr Ritch was appointeda director of APAC inNovember 1995.Appointed 31 August 2007Mr Woodruff is ChiefExecutive Officer andManaging Director of<strong>Melbourne</strong> <strong>Airport</strong>.Appointed 7 April <strong>2011</strong>Mr Fellowes is anAssociate Director ofHastings ManagementLimited.Appointed 16 October 2009Mr Mangini is headof Infrastructure andSpecialised Fundsat Industry FundsManagement.John DorrianPhil GarlingSteve BoultonAppointed April 2007Resigned May <strong>2011</strong>Appointed March 2004Resigned July <strong>2011</strong>Appointed February 2008Resigned April <strong>2011</strong>10

APAC<strong>2011</strong> ANNUAL REPORTNadine LennieDirectorAppointed 20 January <strong>2011</strong>Ms Lennie is a Directorof Infrastructure andTimberland at TheFuture Fund.John HarveyDirectorAppointed 2 May <strong>2011</strong>Mr Harvey is currentlya Director and AuditCommittee Chairman ofAustralian InfrastructureFund Limited and DavidJones Limited.Paul BreenDirectorAppointed 6 July <strong>2011</strong>Mr Breen is the InvestmentManager at AMP CapitalInvestors.Richard HedleyDirectorAppointed 16 June 2008 –30 August 2010Re-appointed 2 May <strong>2011</strong>Mr Hedley is a Directorof RREEF AlternativeInvestments.COMPANY SECRETARIESKirby ClarkChief Financial Officerand Deputy ChiefExecutive OfficerLisa EvansLegal ServicesManager and CompanySecretary11

<strong>Melbourne</strong>’s runwayoverlay project was criticalto maintaining optimalsafety conditions for airlinecustomers and passengers.12

APAC<strong>2011</strong> ANNUAL REPORT13

GrowingThe Business14%<strong>Melbourne</strong>’s internationalpassengers14

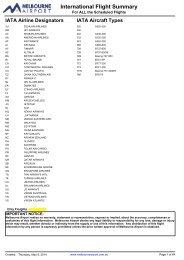

APAC<strong>2011</strong> ANNUAL REPORTAPAC’s operations at <strong>Melbourne</strong>and Launceston airportscontinued to grow throughoutthe year however, 2010/11was a challenging year as wecontinue our commitmentto grow the business byunderstanding current andfuture needs of our passengersas well as capitalising onairport market opportunities.Aeronautically, we continued to achieve genuine growthin an increasingly dynamic and challenging industry.Launceston <strong>Airport</strong> recorded a 2 per cent growthto reach 1.15 million passengers. <strong>Melbourne</strong> <strong>Airport</strong>achieved an 8 per cent increase in total passengersto reach 28.19 million passengers. This saw an overallincrease of passengers for APAC of 8 per centto reach 29.34 million passengers.<strong>Melbourne</strong>’s international growth of 14 per cent wasthe main driver of this continued growth while domesticpassengers grew by 6 per cent to reach 21,902,747.15

Growing the BusinessGrowingcapacityVictoria’s reputation as a premier tourist destination wasstrengthened as we welcomed new airlines to <strong>Melbourne</strong>,and additional services to both <strong>Melbourne</strong> and Launceston.The addition of new services by Jetstar and QantasLinkin Launceston to the key destinations of <strong>Melbourne</strong>,Brisbane and Sydney, saw Launceston record its highestnumber of passengers in a month of 118,000 in December2010. Domestic capacity at <strong>Melbourne</strong> <strong>Airport</strong> was alsoincreased, most notably by Jetstar with an additional29 per cent seat capacity for the year.Jetstar also increased international services at<strong>Melbourne</strong>, launching daily services to Singapore andAuckland as well as twice weekly services to Queenstown.Key growth markets were also further supported throughChina Southern, China Eastern and Vietnam Airlinesall increasing to daily services. Virgin Australia increasedinternational services to Los Angeles, Christchurch, Baliand Fiji. Qantas increased capacity on its London andLos Angeles services by introducing A380s and Emiratesintroduced B777s to increase capacity on its Dubai1626%inChinese passportholders through<strong>Melbourne</strong> <strong>Airport</strong>services. <strong>Melbourne</strong> <strong>Airport</strong> also welcomed Royal Bruneiand Strategic Airlines who commenced internationalservices during the year.The Asia Pacific region continued to be a key growth areafor <strong>Melbourne</strong>. China, Singapore, Malaysia and Japanwere the highest growth markets for the year with26 per cent increase in Chinese passport holders, whileSingapore and Malaysia increased by 16 per cent andJapan increased by 15 per cent. Our traditional marketsremained key with New Zealand, the UK and the USAalso experiencing solid growth of 12 per cent, 7 per centand 5 per cent respectively.

APAC<strong>2011</strong> ANNUAL REPORT250,000 = 31%tonnes of international air freightannually at <strong>Melbourne</strong> <strong>Airport</strong>of Australia’s totalair freight marketLaunceston <strong>Airport</strong>Another area of growth was <strong>Melbourne</strong>’s freight market.Following a 3 per cent increase in exports and an 8 percent increase in imports, we increased to approximately250,000 tonnes or 31 per cent of Australia’s total airfreight market. This growth, combined with the stronginternational passenger growth will see expansion of ourexisting freight facilities in the coming year.We continue to invest in our airports to accommodatefor current and future growth.Launceston completed a $4 millionredevelopment of its airfield lightingAt <strong>Melbourne</strong>, EYE advertising embarked on a $4 millionredevelopment of advertising with Australia’s first highdefinition external airport digital billboards, as well as24 internal digital advertising signs within the terminal.Launceston <strong>Airport</strong> completed a $4 million airfieldlighting project. A $1.5 million hangar redevelopmentproject was also signed with Australian Air Expressto improve freight facilities at Launceston <strong>Airport</strong>.17

Growing the BusinessGrowingInfrastructure<strong>Melbourne</strong>’s expanded international departures retail areaWe invested $137 million during the year togrow capacity and support growth.<strong>Melbourne</strong>’s international terminal expansionWe continued the expansion of our international terminalat <strong>Melbourne</strong> with stage one of the retail developmentsopening on time in November 2010. Features of thenew retail space include the first stand alone luxurywatch store in Australia, the first WHSmith in Australiaas well as the iconic <strong>Melbourne</strong> restaurant, Café Vue.The second stage is scheduled to open on time inDecember <strong>2011</strong>.The international departures expansion also includes24 new check-in counters, a new state-of-the-art‘smart’ outbound baggage sortation system, two newgates and continued upgrades to our aerobridges thatimproves the range of aircraft able to use the gates to nowinclude A380s. The new outbound baggage system wassuccessfully implemented over the busy 2010 Christmasholiday period with the new gates and upgradedaerobridges to be operational in December <strong>2011</strong>.At our busiest times, the growth at <strong>Melbourne</strong> <strong>Airport</strong>has put pressure on the facilities. During the year, wealso embarked on a redevelopment program for theinternational arrivals area. The redevelopment includesadditional baggage carousels and in conjunction with theborder agencies, additional room to accommodate newprocesses to streamline the entire arrivals process.18

APAC<strong>2011</strong> ANNUAL REPORTAPAC’s outlook for growth at both <strong>Melbourne</strong> and Launcestonairports looks strong and continued investment in long terminfrastructure will ensure growth aspirations for the airportsand our customers can be achieved, while also ensuring thecurrent high service levels. These developments, alignedwith the <strong>Melbourne</strong> <strong>Airport</strong> and Launceston <strong>Airport</strong> MasterPlans, will continue to look at responsible and efficient waysto grow our operations while always providing to our airlinecustomers, suppliers, staff and passengers, high levelsof safety, security and service.<strong>Melbourne</strong>’s road networkIn addition to this work, we also have a number of projectsunderway to improve the flow of traffic into the airport andaround the terminal. One of the key road improvementprojects is the construction of the APAC Drive on-ramp,an additional elevated two lane city bound entry tothe Tullamarine Freeway. This will take approximately15 per cent of traffic from the southern end of theairport precinct and reduce traffic around the terminal.Construction on this critical piece of infrastructurecommenced in July <strong>2011</strong> and is scheduled forcompletion in July 2012.<strong>Melbourne</strong> <strong>Airport</strong>’s business park<strong>Melbourne</strong> <strong>Airport</strong>’s business park also had a strongyear with construction commencing on a new facilityfor Primus Australia and underpinning our developmentstrategy to ensure the long term sustainable growth ofthe business park. Hanrob’s new state-of-the-art dogand cat boarding facility was completed on time andon budget, opening on 1 July <strong>2011</strong>. Although this projectinitially met resistance from local residents, throughconsultation, a new and ultimately better locationwas selected and agreed on by all parties.Essendon Football Club at <strong>Melbourne</strong><strong>Melbourne</strong> <strong>Airport</strong> was also pleased to welcomeEssendon Football Club’s decision to build theirnew sporting and community facilities on <strong>Melbourne</strong><strong>Airport</strong> grounds. Consultation has commenced andwill continue as part of the major development planin the coming year.Artist’s impression of the completedAPAC Drive on-rampCafe Vue<strong>Melbourne</strong>’s newcheck-in counters19

96,000<strong>Melbourne</strong>’s busiest day – 29 Oct 20108%in <strong>Melbourne</strong>’s totalpassengers to 28.1M20

APAC<strong>2011</strong> ANNUAL REPORTServiceWe consider great service to be a coreelement of APAC’s operations and thestrong growth experienced over the lastyear, particularly at <strong>Melbourne</strong> <strong>Airport</strong>, haspresented many challenges. Operationallyhowever, we maintained our high servicestandards through a period of immensegrowth. This is a significant achievementand demonstrates the commitment ofour operations team and our operationalreadiness at both airports.<strong>Melbourne</strong> <strong>Airport</strong>’s Quality of ServiceMonitoring (QSM) scores show continuinghigh results in the top quartile of 3.8 to4.5 range. From an overall experience,we have proudly averaged 4.2 for the lastthree quarters in T2. This is a particularlyoutstanding result noting that these highstandards have been maintained with theaddition of over 2 million more passengersand amid significant development works.Our commitment to our customers isalso showing results. Chinese passengersurveys at <strong>Melbourne</strong> <strong>Airport</strong> show highsatisfaction levels, verifying our tailoredapproach to this area of the market.We will continue to refine our visitorprograms and cultural training to ensurewe continue to deliver the best possiblepassenger experience.<strong>Melbourne</strong>’s international arrivals hall21

ServiceRunway OverlayProjectThe $55 million runway overlay maintenance projectincluded essential resurfacing of the runways tocontinue to provide optimum safety conditions for ourairline customers and passengers. The unprecedentedinclement weather and fog early in <strong>2011</strong>, caused 80night works to be rescheduled, however the projectteam was able to accelerate works resulting in projectcompletion being only one month behind schedule.The project remains scheduled to be completedunder budget and combined with the Cat lllb systeminstalled last year, sees <strong>Melbourne</strong>’s runways assome of the safest in Australia.22

A critical element in maintaining servicestandards for the year was <strong>Melbourne</strong>’srunway overlay project.APAC<strong>2011</strong> ANNUAL REPORT250successful and on timerun way closures andopenings23

Service<strong>Melbourne</strong>’s multi-level long term car park24Car ParksOur high levels of service also extend outside ourterminal, with car parks at <strong>Melbourne</strong> also receivinghigh satisfaction results of 4 to 4.2. These high levelswere maintained from last year’s high service leveldespite the growth in passengers. These results followthe successful opening of the new multi-level car parklast year and the upgrading of the access managementsoftware to strengthen the protection of credit carddata at all <strong>Melbourne</strong> car parks. This year, we alsoundertook extensive market research to improveour understanding of what people want when theypark at <strong>Melbourne</strong> <strong>Airport</strong> which will continue toimprove our service levels.SecuritySecurity is always a priority at APAC and <strong>Melbourne</strong><strong>Airport</strong> again achieved best practice security auditresults and provided some of the lowest security costsin Australia. We also continued to reduce securitycosts to our airline customers, with 9 per cent and5 per cent reductions for international and domesticpassengers respectively, with these savings thenpassed back to our airline customers as savingson their security requirements.We further supported government aviation securityinitiatives and hosted an enhanced technology trialfor liquids, aerosols and gels (LAGS) in Novemberas part of the international aviation sector. The trialwas successful with the results now being utilised bythe Australian Government as well as US, Europeanand Canadian government regulators to identifyenhanced security procedures with the aim of creatingconsistent global security process.

APAC<strong>2011</strong> ANNUAL REPORTGroundTransportFollowing the release of <strong>Melbourne</strong> <strong>Airport</strong>’s GroundTransport Plan last year, we continued to work closelywith key partners such as SkyBus and the VictorianTaxi Directorate to improve current ground transportoptions as well as look towards future groundtransport options. We also welcomed the StateGovernment’s commitment to fund a feasibilitystudy into a rail link to <strong>Melbourne</strong> <strong>Airport</strong>.<strong>Melbourne</strong>’s SkyBus service25

OURReputationIn our commitment to be the most successful airportgroup in the Asia Pacific region, we know that wemust earn the trust and support of our stakeholdersby operating responsibly and communicating clearly.We must earn a good reputation and, in essence,earn our licence to operate by respecting andworking together for the mutual benefit of APAC,our communities and the environment.Our airports do not operate in isolation. They are part of alarger community. At <strong>Melbourne</strong>, there are approximately12,500 people who work at the airport every day. Locatedwithin the City of Hume, our operations and activitiesalso impact our neighbouring cities of Melton, Brimbankand Moonee Ponds. Our community includes residents,local businesses, travellers, airlines, business partners,governments at all levels, as well as everyone whoworks at <strong>Melbourne</strong> <strong>Airport</strong>.Launceston <strong>Airport</strong> too is part of the greater Launcestoncommunity. Located in the Northern Midlands municipality,Launceston’s operations neighbour the towns of Evandaleand Perth, with the city of Launceston located to thenorth of the airport. There are approximately 150 staffwho work at Launceston <strong>Airport</strong> every day. APAC iscommitted to being a good neighbour and working forthe benefit of our communities.26

APAC<strong>2011</strong> ANNUAL REPORT12,500people work at <strong>Melbourne</strong><strong>Airport</strong> every day27

Our ReputationCommunityCelebrating Diwali at <strong>Melbourne</strong>Throughout the year, Launceston <strong>Airport</strong> continuedto support the local community through key partners,supporting the Glover Art Prize, the Blue Sky Ball andLaunceston’s international choir, Sing Elon. Launcestonalso proudly supports the protection of a Tasmanian icon,through the ‘Save the Tasmanian Devil Program Appeal’.<strong>Melbourne</strong> <strong>Airport</strong> also supports a number of communityprograms such as Western Chances and the SalvationArmy’s Jacana Centre. As a major partner in Victoria’stourism sector, we also support industry and culturaldevelopment programs such as the Victorian TourismAwards and the <strong>Melbourne</strong> Museum. <strong>Melbourne</strong><strong>Airport</strong> also continues to participate in Clean UpAustralia Day, Earth Hour, World Environment Dayand Tree Planting Days.<strong>Melbourne</strong> <strong>Airport</strong> also supports anumber of community programs suchas Western Chances and the SalvationArmy’s Jacana Centre.We were pleased this year to reintroduce the <strong>Melbourne</strong><strong>Airport</strong> Chaplain to provide counselling and guidance forpassengers, staff and the wider airport community.Reflecting our multicultural heritage and globalconnections, <strong>Melbourne</strong> <strong>Airport</strong> also celebrates keydates in different cultures including Chinese NewYear, Diwali, the Indian Festival of Light andMalaysia’s Merdeka Day.28

APAC<strong>2011</strong> ANNUAL REPORTClean Up Australia DayPlanning Coordination Forum and the CommunityConsultation Aviation GroupCommunity Consultation Aviation GroupAPAC has long recognised that working withgovernment, business and the local community isparamount to successful operations and last year weformalised the avenues for which these key groupsengage with <strong>Melbourne</strong> and Launceston <strong>Airport</strong>swith the establishment of the Planning CoordinationForum and the Community Consultation AviationGroup. In <strong>Melbourne</strong>, both groups were formed inMarch and will continue to improve our two waydialogue with key stakeholders and communities.The committees are also an avenue for localactivities within the community, both on and off theairport, that may impact the ongoing developmentof the airport to be highlighted. We look forward tocontinuing to work with both of these groups alongwith the Noise Abatement Committee.29

Our ReputationSafety& ENVIRONMENTsafe every day. To this end, our safety standard andpractices are non-negotiable.We are proud to again this year achieve our high standardof safety and continue our strong performance in this area.SafetyAs a part of <strong>Melbourne</strong> and Launceston’s criticalinfrastructure, we also work closely with key partners inboth states on emergency preparedness by investing innew equipment and facilities as well as an emergencytraining exercise.Both <strong>Melbourne</strong> and Launceston <strong>Airport</strong>s also continueto work with regulators including the Office of TransportSecurity and Civil Aviation Safety Authority (CASA) todeliver the highest standards of safety and security.One of APAC’s priorities is to make sure that passengers,APAC staff and the wider airport communities go homeThis is a particularly good result for <strong>Melbourne</strong> <strong>Airport</strong>which, as a 24 hour operation is a complex operatingenvironment, and one that has an increasing numberof construction activities. Our focus on integrating safetyas a priority into our everyday processes and practicesis now even more critical.Launceston <strong>Airport</strong>’s pro-active and stringent riskmanagement processes are reflected in the robustsafety culture that continues to ensure a strong safetyperformance throughout the year.This year, both <strong>Melbourne</strong> and Launceston <strong>Airport</strong>sretained our SafetyMAP accreditation, an independentlyaudited industry Safety Management System, whichsaw them continue to be the only two airports in Australiawith this accreditation.30

APAC<strong>2011</strong> ANNUAL REPORTelectric vehicle to assess the viability of electricityas an alternative fuel source. A second trial willcommence later this year.EnvironmentIn 2010/11, we also strengthened our commitment toworking responsibly and respecting our environment.The year was a milestone for Launceston’s environmentalefforts with its Environment Strategy approved byThe Federal Minister for Infrastructure and Transport,the Hon Anthony Albanese MP in September 2010.The Environment Strategy is Launceston <strong>Airport</strong>’senvironmental blueprint for the next five years andoutlines the goals, targets and initiatives that it willfocus on.<strong>Melbourne</strong> <strong>Airport</strong> maintained its certification tothe Australian Standard ISO14001:2004 and remainsone of only two airports in Australia to be certifiedto this standard.This year, <strong>Melbourne</strong> <strong>Airport</strong> participated in the StateGovernment’s Electric Vehicle trial to assess differenttechnology. From December 2010 to March <strong>2011</strong>,<strong>Melbourne</strong> <strong>Airport</strong> staff successfully trialled the<strong>Melbourne</strong> also upgraded its waste managementsystems with all bins within <strong>Melbourne</strong>’s car parksnow meeting the new Australian Standards throughimproved lid colour, signage and public awarenesson recycling. This has resulted in a significant increasein the amount of waste diverted from landfill to recyclingwith a current level of 27 per cent waste diversion fromlandfill across <strong>Melbourne</strong> <strong>Airport</strong>. <strong>Melbourne</strong> alsocontinued to focus on improving energy efficienciesincluding retrofitting T3 with LED lighting that reducedcarbon emissions by approximately 35 per cent.We also implemented Australia’s first KYOTO air-coolingsystem in <strong>Melbourne</strong> <strong>Airport</strong>’s new data centre toreduce IT power consumption and carbon emissions.KyotoCooling is a heat exchange cooling systemdesigned specifically for heat and energy intensive datacentres, and harnesses the temperature differencebetween indoor and outdoor air. It controls airflow andtemperature whilst maintaining a contaminant freeenvironment and is used throughout Europe.We continued to work collaboratively with keyenvironmental stakeholders including the FederalGovernment’s <strong>Airport</strong> Environment Officer, businesspartners, local councils and the community.27%waste diversion from landfillat <strong>Melbourne</strong> <strong>Airport</strong>31

OUR TEAMOur success is driven by our people and with ouroverall focus on growing responsibly and providinghigh levels of service, it’s critical that our teamworks together to continue to manage the safeand efficient flow of 29.34 million people through<strong>Melbourne</strong> and Launceston <strong>Airport</strong>s.This year, as an organisation and as a team, we focussedon ‘how’ we do business as we deliver high service levelsto our airline customers, suppliers and stakeholders.By focussing on the people who deliver the resultsand ‘how’ we successfully deliver as well as ‘what’ wedeliver, we continually seek to improve our processes,performance and conduct. By focussing on the peoplewho deliver the results and how we deliver the results,we are also focussing on the long term future andsuccess of our business.This year, we again conducted a staff survey andincreased our engagement levels as well as achieved87 per cent participation. This participation level isparticularly pleasing in a year of change and challenge. Italsoclearly demonstrates that our people are passionateand committed to our business.We also progressed well on our commitment toupgrade staff facilities at <strong>Melbourne</strong> <strong>Airport</strong>. Designedto encourage a collaborative and collective workingenvironment, we have commenced the progressivemove into the new accommodation which willcontinue throughout <strong>2011</strong>/12.Consistent with our positive passenger growth, and toassist in the efficient and effective management of ourcurrent and future growth, our team has also grown.To complement the team’s focus of ‘how’ we do business,recruitment during the year concentrated on attractingthe right people to join the team, those with passionand talent, and who demonstrate behaviour consistentwith our values. Recruitment has also concentrated onexpanding our capabilities in key areas to ensure we candeliver on current priorities as well our long term goal ofgrowing successfully and responsibly.One of the key areas of feedback was for furtherdefinition around company values. As part of our focuson ‘how’ we achieve our results, throughout the year, ourcultural steering group managed the development andimplementation of our new company values. All of theteam now strive to embody these values.32

APAC<strong>2011</strong> ANNUAL REPORTOur team manages the safeand efficient flow of29.34Mpeople through <strong>Melbourne</strong> andLaunceston <strong>Airport</strong>s33

RESULTSSUMMARYfor the financial year ended 30 June <strong>2011</strong> ($ millions)YEAR20012002200320042005Financial results – APACAeronautical including security 64 66 101 126 144Retail 77 80 92 106 123Property & rental 52 53 48 52 54Other 2 2 2 2 2Total Revenue 195 201 243 286 323Operating expenses 55 65 74 83 93Operating profit 140 136 169 203 230Investment property gains 0 0 0 0 0Profit before borrowing costs, depreciation and amortisation 140 136 169 203 230Depreciation and amortisation 35 36 40 45 38Interest 137 97 97 90 80Profit / (loss) before tax (32) 3 32 68 112Tax expense / (benefit) (22) 5 13 27 33Net profit / (loss) (10) (2) 19 41 79Capital expenditure – property, plant, equipmentand Investment PRoperty<strong>Melbourne</strong> 28 45 42 38 108Launceston 2 0 0 0 1Total 30 45 42 39 108Passenger volumes<strong>Melbourne</strong> <strong>Airport</strong>International 3 3 3 4 4Domestic 14 13 13 15 16Total (excluding transit passengers) 17 16 17 19 21Transit passengers 0 0 0 0 0Total (including transit passengers) 17 16 17 19 21Launceston <strong>Airport</strong>Domestic 0.52 0.53 0.58 0.67 0.82Aircraft movements (thousands)<strong>Melbourne</strong> <strong>Airport</strong>International 23 23 21 24 28Domestic 162 133 135 140 151General aviation 2 2 2 1 1Total 187 158 158 165 181Launceston <strong>Airport</strong>Domestic 13 9 8 8 9General aviation 13 12 7 7 6Total 26 22 15 15 1534

APAC<strong>2011</strong> ANNUAL REPORT20062007200820092010<strong>2011</strong>CHANGE(per cent)149 162 192 202 218 237 9%138 158 187 196 218 239 10%59 62 69 77 80 83 4%2 2 1 1 2 2 0%348 384 449 476 518 561 8%102 114 115 124 131 138 5%246 270 334 352 387 423 9%91 77 22 (33) 11 59 10%337 347 356 319 398 482 21%34 37 39 46 53 65 23%80 84 90 96 115 126 10%223 226 227 177 230 291 26%67 68 68 53 69 88 27%156 158 159 124 161 203 26%8%Passengers at <strong>Melbourne</strong><strong>Airport</strong>77 105 130 212 157 1471 1 4 16 5 478 107 134 228 162 1514 5 5 5 6 6 14%17 18 19 20 21 22 6%21 22 24 25 26 28 8%0 0 0 0 0 0 17%21 23 24 25 26 28 8%0.92 0.99 1.10 1.11 1.12 1.15 2.70%25 24 25 27 30 33 8%153 155 167 166 165 172 5%1 1 2 1 1 1 4%179 180 194 194 196 206 5%10 10 11 11 11 11 2%6 5 6 6 7 7 4%15 15 17 17 17 18 3%35

RESULTS SUMMARYPROFIT& LOSSfor the financial year ended 30 June <strong>2011</strong>CONSOLIDATEDINFLOWS(OUTFLOWS)<strong>2011</strong>$’0002010$’000OPERATING REVENUEAeronautical revenues 237,085 217,917Retail revenues 239,537 218,399Property revenues 82,613 79,717Interest and other revenues 1,846 1,798Total operating revenue 561,081 517,831Non-operating revenue 57 23Revenue from ordinary activities 561,138 517,854Less: operating costsStaff costs 28,991 28,046Service and utilities 76,051 70,325Maintenance costs 15,280 13,688Administration, marketing and other 18,200 18,342Operating profit 422,616 387,453Add :Change in fair value of investment property 59,448 11,236Profit before borrowing costs, depreciation and amortisation 482,064 398,689Less:Depreciation and amortisation 64,501 53,843Borrowing costs 126,475 115,052Profit before income tax expense 291,088 229,794Less:Income tax expense 87,554 68,909Profit for the year 203,534 160,88536

APAC<strong>2011</strong> ANNUAL REPORTBALANCESHEETas at 30 June <strong>2011</strong>CONSOLIDATED<strong>2011</strong>$’0002010$’000Current assetsInventories 352 317Receivables 36,891 31,253Other financial assets 265 766Total current assets 37,508 32,336Non-current assetsProperty, plant and equipment 1,279,872 1,191,812Investment property 959,390 885,300Goodwill 671,866 671,866Total non-current assets 2,911,128 2,748,978Total assets 2,948,636 2,781,314Current liabilitiesBank overdraft 8,901 8,456Payables 60,094 39,789Borrowings – 1,181,203Current tax liabilities 5,620 13,421Provisions 4,783 4,563Other financial liabilities 6,116 137Total current liabilities 85,514 1,247,569Non-current liabilitiesBorrowings 1,785,480 546,563Payables 1,191 1,132Deferred tax liabilities 339,547 313,907Provisions 930 710Other liabilities 50,852 52,037Total non-current liabilities 2,178,000 914,349Total liabilities 2,263,514 2,161,918Net assets 685,122 619,396EquityIssued capital 118,100 118,100Reserves (36,103) (32,929)Retained earnings 603,125 534,225Total equity 685,122 619,39637

RESULTS SUMMARYCASH FLOWSTATEMENTas at 30 June <strong>2011</strong>CONSOLIDATEDINFLOWS(OUTFLOWS)<strong>2011</strong>$’0002010$’000Cash flows from operating activitiesReceipts from customers 611,952 567,856Payments to suppliers and employees (189,550) (181,846)Income tax (paid) received (68,356) (70,373)Interest received 353 263Interest and other costs of finance paid (121,107) (116,936)Net cash provided by operating activities 233,292 198,964Cash flows from investing activitiesPayment for property, plant and equipment (137,027) (160,631)Proceeds from sale of property, plant and equipment 81 20Payment for investment property (14,642) (1,253)Net cash used in investing activities (151,588) (161,864)Cash Flows from financing activitiesProceeds from borrowings 1,555,368 261,000Repayment of borrowings (1,496,280) (182,000)Payment for debt issue costs (6,603) (3,511)Dividend paid (134,634) (134,634)Net cash provided by / (used in) financing activities (82,149) (59,145)Net increase / (decrease) in cash held (445) (22,045)Cash assets at the beginning of the financial year (8,456) 13,589Cash assets at the end of the financial year (8,901) (8,456)38

APAC<strong>2011</strong> ANNUAL REPORTSUMMARY OF KEYNOTES to FinancialInformationfor the Financial financial Year year Ended ended 30 June <strong>2011</strong>1. Summary of key accounting policiesStatement of complianceThe financial report is extracted from a general purposefinancial report which has been prepared in accordancewith the Corporations Act, Accounting Standards andUrgent Issues Group Interpretations and complies withother requirements of the law. Accounting Standardsinclude Australian equivalents to International Financial<strong>Report</strong>ing Standards (‘A-IFRS’).Compliance with the A-IFRS ensures that the consolidatedfinancial statements and notes of the entity comply withInternational Financial <strong>Report</strong>ing Standards (‘IFRS’).The financial statements were authorised for issueby the directors on 30 August 2010 and can be obtainedfrom the website listed in Note 25.Basis of preparationThe financial report has been prepared on the basisof historical cost. Cost is based on the fair values ofthe consideration given in exchange for assets. Unlessotherwise indicated all amounts are presented inAustralian dollars.Rounding off of amountsThe Company is a company of the kind referred toin ASIC Class Order 98/0100, dated 10 July 1998, andin accordance with that Class Order, amounts in theDirectors’ <strong>Report</strong> and the Financial <strong>Report</strong> have beenrounded off to the nearest thousand dollars, unlessotherwise indicated.Significant accounting policiesThe following significant accounting policies havebeen adopted in the preparation and presentationof the financial report:(a) Principles of consolidationThe consolidated financial statements are preparedby combining the financial statements of all the entitiesthat comprise the consolidated entity, being the Company(the parent entity) and its subsidiaries as defined inAccounting Standard AASB 127 Consolidated and SeparateFinancial Statements’. A list of subsidiaries appearsin Note 23 to the financial statements. Consistentaccounting policies are employed in the preparation andpresentation of the consolidated financial statements.The consolidated financial statements include theinformation and results of each controlled entity from thedate on which the Company obtains control and until suchtime as the Company ceases to control such entity.In preparing the consolidated financial statements,all inter-company balances and transactions andunrealised profits arising within the consolidatedentity are eliminated in full.(b) DepreciationProperty, plant and equipment are stated at cost lessaccumulated depreciation and impairment.Assets acquired are recorded at the cost of acquisitionbeing the purchase consideration determined as at thedate of acquisition plus costs incidental to the acquisition.Depreciation is provided on property, includingbuildings, plant and equipment, roads, runways andother infrastructure but excluding land. Depreciationis calculated on a straight line basis so as to write offthe net cost of each asset over its expected useful life.The following estimated useful lives are used in thecalculation of depreciation:• Buildings• Roads, runways and other infrastructure• Plant and equipment10–40 years13–80 years3–15 yearsLand leased as part of the airport acquisition has beenvalued at acquisition at fair value. The leased land isamortised on a straight line basis over the period of theleases, which are 99 years.39

RESULTS SUMMARYSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>1. Summary of key accounting policies (CONT’D)(c) Income taxCurrent taxCurrent tax is calculated by reference to the amount ofincome taxes payable or recoverable in respect of thetaxable profit or tax loss for the period. It is calculatedusing tax rates and tax laws that have been enacted orsubstantively enacted by reporting date. Current tax forcurrent and prior periods is recognised as a liability (orasset) to the extent that it is unpaid (or refundable).Deferred taxDeferred tax is accounted for using the comprehensivebalance sheet liability method in respect of temporarydifferences arising from differences between carryingamount of assets and liabilities in the financial statementsand the corresponding tax base of those items.In principle, deferred tax liabilities are recognised for alltaxable temporary differences. Deferred tax assets arerecognised to the extent that it is probable that sufficienttaxable amounts will be available against which deductibletemporary differences or unused tax losses and tax offsetscan be utilised. However, deferred tax assets and liabilitiesare not recognised if the temporary differences giving riseto them arise from the initial recognition of assets andliabilities (other than as a result of a business combination)which affects neither taxable income nor accounting profit.Deferred tax assets and liabilities are measured at the taxrates that are expected to apply to the period(s) when theasset and liability giving rise to them are realised or settled,based on tax rates (and tax laws) that have been enacted orsubstantively enacted by reporting date. The measurementof deferred tax liabilities and assets reflects the taxconsequences that would follow from the manner in whichthe Company expects, at the reporting date, to recover orsettle that carrying amount of its assets and liabilities.Deferred tax assets and liability are offset when they relateto income taxes leased by the same taxation authority, andthe Company intends to settle its current tax assets andliabilities on a net basis.Current and deferred tax for the periodCurrent and deferred tax is recognised as an expenseor income in that income statement, except when it relatesto items credited or debited directly to equity, in whichcase the deferred tax is also recognised directly in equity,or where it arises from the initial accounting for a businesscombination, in which case it is taken to account in thedetermination of goodwill or excess.Tax consolidationThe Company and all its wholly-owned Australianresident entities are part of a tax consolidated groupunder Australian taxation law. Australia Pacific <strong>Airport</strong>sCorporation Limited (“APAC”) is the head entity in the taxconsolidatedgroup. Tax expense/recovery, deferred taxliabilities and deferred tax assets arising from temporarydifferences of the members of the tax consolidated groupare recognised in the separate financial statements of themembers of the tax consolidated group using the ‘groupallocation’ approach. Current tax liabilities and assetsand deferred tax assets arising from unused tax lossesand tax credits of the members of the tax-consolidatedgroup are recognised by APAC (as head entity in the taxconsolidatedgroup).40

APAC<strong>2011</strong> ANNUAL REPORTSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>1. Summary of key accounting policies (CONT’D)(d) Impairment of assetsAt each reporting date, the consolidated entity reviewsthe carrying amounts of its tangible and intangible assetsto determine whether there is any indication that thoseassets have suffered an impairment loss. If any suchindication exists, the recoverable amount of the assetis estimated in order to determine the extent ofthe impairment loss (if any).Recoverable amount is the higher of fair value less coststo sell and value in use. In assessing value in use, theestimated future cash flows are discounted to theirpresent value using a pre-tax discount rate that reflectscurrent market assessments of the time value of moneyand the risks specific to the asset for which the estimatesof future cash flows have not been adjusted.If the recoverable amount of an asset (or cash-generatingunit) is estimated to be less than its carrying amount, thecarrying amount of the asset (cash-generating unit) isreduced to its recoverable amount. An impairment lossis recognised in profit or loss immediately, unless therelevant asset is carried at fair value, in which case theimpairment loss is treated as a revaluation decrease.Where an impairment loss subsequently reverses, thecarrying amount of the asset (cash-generating unit)is increased to the revised estimate of its recoverableamount, but only to the extent that the increased carryingamount does not exceed the carrying amount that wouldhave been determined had no impairment loss beenrecognised for the asset (cash-generating unit) in prioryears. A reversal of an impairment loss is recognisedin profit or loss immediately, unless the relevant assetis carried at fair value in which case the reversal of theimpairment loss is treated as a revaluation increase.(e) Investment PropertyProperty held to earn rentals and/or for capitalappreciation, is separately presented in the balancesheet as investment property. Investment property isinitially recorded at cost, including transaction costs.Subsequent to initial recognition, investment propertyis recorded at fair value. Gains or losses arising froma change in the fair value of this investment propertyare recognised in the profit or loss for the periodin which they arise.41

RESULTS SUMMARYSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>CONSOLIDATED<strong>2011</strong>$’0002010$’0002. Income tax recognised in profitThe prima facie income tax expense on pre-tax accounting profit reconciles tothe income tax expense in the financial statements as follows:Profit from operations 291,088 229,794Income tax expense calculated at 30% 87,326 68,939Permanent differences:Non deductible expenses 188 117Non-deductible depreciation 25 62Under/(over) provision of income tax in previous year 15 (4)Investment allowance – (205)Income tax expense 87,554 68,9093. Current receivablesTrade receivables 36,891 31,25342

APAC<strong>2011</strong> ANNUAL REPORTSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>CONSOLIDATEDLeaseholdLand$’000Buildings$’000Roads, runways,and otherinfrastructure$’000Plant andequipment$’000Assets underconstruction$’000Total$’0004. Property, plant and equipmentGross carrying amount – at costBalance at 30 June 2010 67,449 452,361 689,816 261,005 115,121 1,585,752Additions – – – – 152,605 152,605Disposals – – (2,129) (546) – (2,675)Transfers to / (from) assetsunder construction – 38,946 16,489 49,331 (104,766) –Balance at 30 June <strong>2011</strong> 67,449 491,307 704,176 309,790 162,960 1,735,682Accumulated depreciation/amortisationBalance at 30 June 2010 7,773 114,458 145,485 126,223 – 393,940Depreciation and amortisationexpense 717 20,142 21,278 22,364 – 64,501Disposals – – (2,129) (500) – (2,629)Balance at 30 June <strong>2011</strong> 8,490 134,600 164,634 148,087 – 455,810Net book value as at 30 June <strong>2011</strong> 58,959 356,707 539,542 161,704 162,960 1,279,872An independent valuation of certain assets was completed at 30 June 2009. Leasehold land, buildings, road andrunways and other infrastructure were valued by Mr Gary Longden FAPI of the firm Jones Lang LaSalle. The valuationwas based on depreciated replacement value. The Directors have adopted cost approach in the accounts. If the valuationhad been booked the carrying values would have been $148,348,000 for leasehold land, $383,500,000 for buildings and$640,400,000 for roads, runways and infrastructure as at 30 June 2009. The valuation did not include any allowance forcapital gains tax that may arise on disposal.CONSOLIDATED<strong>2011</strong>$’0002010$’000Aggregate depreciation and amortisation allocated, whether recognisedas an expense or capitalised as part of the carrying amount of other assetsduring the year.• Leasehold land 717 696• Buildings 20,142 16,341• Roads, runways and other infrastructure 21,278 20,430• Plant and equipment 22,364 16,37664,501 53,84343

RESULTS SUMMARYSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>CONSOLIDATED<strong>2011</strong>$’0002010$’0005. Investment propertiesBalance at beginning of financial year 885,300 872,811Additions for the year 14,642 1,253Net gain from fair value adjustments 59,448 11,236Balance at end of financial year 959,390 885,300Investment property was valued by Mr. Gary Longden FAPI of the firm Jones Lang LaSalle. Mr. Longden is an independent valuerand has extensive experience of valuing property for the consolidated entity.The value of investment property is measured on a fair value basis being the amounts for which the property could be exchangedbetween willing parties in an arm’s length transaction, based on current prices in an active market for similar property in thesame location and subject to similar leases.In assessing the value of the investment property, the independent valuer has considered two basis of valuation being:1. discounted cash flow; and2. capitalisation approach6. GoodwillGoodwill at cost: 671,866 671,866Goodwill has been allocated for impairment testing to two cash generating units, being the operations of <strong>Melbourne</strong> andLaunceston <strong>Airport</strong>s. The recoverable amount of cash generating units is determined based on a value in use calculation whichuse cashflow projections based on financial budgets approved by management covering a ten year period, and a discount rateof 11.6% per annum, (2010: 11.6%).7. Current payablesTrade payables 43,220 29,042Goods and services tax payable 1,794 2,499Non-trade payables to:– Other 1,108 54046,122 32,081Interest Payable to:– Secured debt – other entities (i) 13,694 7,601– Other 278 10713,972 7,70860,094 39,789(i) Secured by a fixed and floating charge over the consolidated entity’s assets. Security given is all the assetsof all operating companies. There have been no defaults on loans payable during the current or prior years.44

APAC<strong>2011</strong> ANNUAL REPORTSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>CONSOLIDATED<strong>2011</strong>$’0002010$’0008. Current borrowingsSecured:– Senior – bank debt (i) – 700,000Domestic Bonds (i)– Variable rate notes (11 June <strong>2011</strong>) – 250,000– US Private Placement (i) ($232m fixed 6.65% due 13 May <strong>2011</strong>) – 232,280– 1,182,280Deferred borrowing costs – (1,077)– 1,181,203(i) Secured by a fixed and floating charge over the consolidated entity’s assets. Security given is all the assets of theoperating companies. There have been no defaults on loans payable during the current or prior years.9. Current tax liabilitiesIncome tax payable 5,620 13,42110. Current provisionsEmployee entitlements 4,783 4,56311. Other current financial liabilitiesInterest rate swaps 6,116 13712. Non-current borrowingsNon-trade payables to:– Senior – bank debt (i) 1,145,000 251,000– Domestic bonds (i)• Fixed rate notes (6.5% 26 August 2014) 100,000 –• Fixed rate notes (6.0% 15 December 2015) (ii) 100,000 100,000• Variable rate notes (15 December 2015) (ii) 200,000 200,000• Fixed rate notes (7.0% 26 August 2016) 250,000 –Total borrowings 1,795,000 551,000Deferred borrowing costs (9,520) (4,437)1,785,480 546,563Aggregate amortisation allocated, whether recognised as an expense orcapitalised as part of the carrying amount of other assets during the year:• Deferred borrowing costs 5,229 5,45645

RESULTS SUMMARYSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>CONSOLIDATED<strong>2011</strong>$’0002010$’00013. Non-current payablesNon trade payables 1,191 1,13214. Deferred tax liabilitiesTemporary differences 339,547 313,90715. Non-current provisionsEmployee benefits 930 71016. Non-current other liabilitiesUnearned revenue 5,388 5,040Interest rate swaps 45,464 46,99717. Capitalised borrowing costs50,852 52,037– Property, Plant and Equipment 5,994 7,801– Investment Property 131 –Weighted average capitalisation rate on funds borrowed generally7.0% (2010: 7.0%)6,125 7,80118. Issued capital118,100,000 Ordinary shares – fully paid (2009: 118,100,000) 118,100 118,100Fully paid ordinary shares carry one vote per share and carry the right to dividends.19. Hedging reserveBalance at beginning of financial year (32,929) (26,712)Gained recognised:– interest rate swaps (4,535) (8,881)Deferred tax arising on hedges 1,361 2,664(3,174) (6,217)Balance at end of financial year (36,103) (32,929)The hedging reserve represents hedging gains and losses recognised on the effective portion of cash flow hedges.The cumulative deferred gain or loss on the hedge is recognised in profit or loss when the hedged transaction impactsthe profit or loss.46

APAC<strong>2011</strong> ANNUAL REPORTSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>CONSOLIDATED<strong>2011</strong>$’0002010$’00020. Retained earningsBalance at beginning of financial year 534,225 507,974Profit for the year 203,534 160,885Dividends paid (134,634) (134,634)Balance at end of financial year 603,125 534,22521. Commitments for expenditureCapital expenditure commitmentsProperty, plant and equipmentNot longer than 1 year 138,286 43,848Longer than 1 year but not longer than 5 years – –138,286 43,84822. Subsequent eventsOn 22 June <strong>2011</strong>, APAC announced that it had reached agreement on a new US$600 million debt issue, which willsettle on 15 September <strong>2011</strong>. The new issue comprises three tranches each of US$200 million which mature 10,12 and 15 years after settlement.The interest rate exposure on each tranche has been swapped into fixed A$ payments such that the tranches are effectivelythree fixed rate A$ loans totalling $573 million. The loans will initially be used to repay drawn bank debt.47

RESULTS SUMMARYSUMMARY OF KEYNOTES to FinancialInformationfor the financial year ended 30 June <strong>2011</strong>OWNERSHIP INTERESTNAME OF ENTITYCOUNTRY OFINCORPORATION<strong>2011</strong>(per cent)2010(per cent)23. CONTROLLED ENTITIESParent entityAustralia Pacific <strong>Airport</strong>s Corporation LimitedAustraliaControlled entitiesAPAC (Holdings No. 2 ) Pty Limited(i)Australia 100% 100%− Australia Pacific <strong>Airport</strong>s (<strong>Melbourne</strong>) Pty. Limited Australia 100% 100%Australia Pacific <strong>Airport</strong>s (Property) Pty. Limited(i) (ii)Australia 100% 100%APAC (Holdings) Pty. Limited(i)Australia 100% 100%− Australia Pacific <strong>Airport</strong>s (Launceston) Pty. Limited(i)Australia 100% 100%(i) These subsidiaries are classified as small proprietary companies and in accordance with the Corporations Act 2001are relieved from the requirement to prepare, audit and lodge financial statements.(ii) This subsidiary was dormant during the financial year.CONSOLIDATED<strong>2011</strong>$’0002010$’00024. DividendsA fully franked interim dividend was paid during the financial year 134,634 134,634Franking account 51,437 41,08325. Additional Company InformationAustralia Pacific <strong>Airport</strong>s Corporation Limited ACN 069 775 266 is a non-listed public companyincorporated and operating in Australia.Principal Registered Office and Principal Place of BusinessLevel 2, Terminal 2<strong>Melbourne</strong> <strong>Airport</strong>+61 3 9297 1600Website: www.melbourneairport.com.auEmail: reception@melair.com.auInformation is extracted from the Audit Financial Statements which are available on the above website.48

APAC<strong>2011</strong> ANNUAL REPORT49

Australia Pacific <strong>Airport</strong>s CorporationABN 89 069 775 266Locked Bag 16Gladstone ParkVictoria 3043 Australia<strong>Melbourne</strong> <strong>Airport</strong><strong>Airport</strong> Drive<strong>Melbourne</strong> <strong>Airport</strong>Victoria 3045 AustraliaTelephone: +61 3 9297 1600Facsimile: +61 3 9297 1886Email: reception@melair.com.auWebsite: www.melbourneairport.com.auLaunceston <strong>Airport</strong>201 Evandale Main RoadWestern JunctionTasmania 7212 AustraliaTelephone: +61 3 6391 6222Facsimile: +61 3 6391 8580Email: information@lst.com.auWebsite: www.launcestonairport.com.au