Directors' Reports and Financial Statements - DCC plc

Directors' Reports and Financial Statements - DCC plc

Directors' Reports and Financial Statements - DCC plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

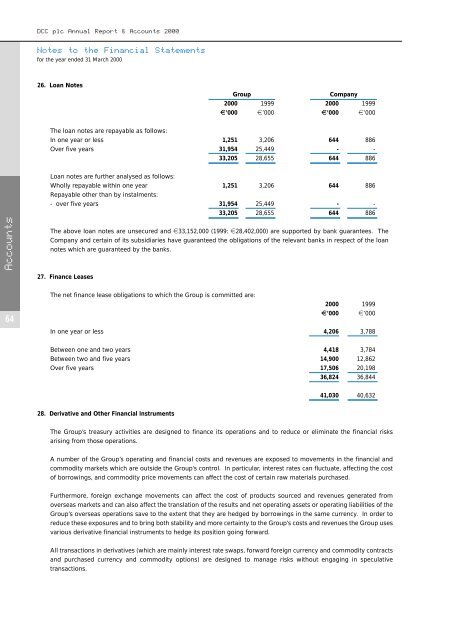

<strong>DCC</strong> <strong>plc</strong> Annual Report & Accounts 2000Notes to the <strong>Financial</strong> <strong>Statements</strong>for the year ended 31 March 200026. Loan NotesGroupCompany2000 1999 2000 1999E’000 e’000 E’000 e’000The loan notes are repayable as follows:In one year or less 1,251 3,206 644 886Over five years 31,954 25,449 - -33,205 28,655 644 886AccountsLoan notes are further analysed as follows:Wholly repayable within one year 1,251 3,206 644 886Repayable other than by instalments:- over five years 31,954 25,449 - -33,205 28,655 644 886The above loan notes are unsecured <strong>and</strong> e33,152,000 (1999: e28,402,000) are supported by bank guarantees. TheCompany <strong>and</strong> certain of its subsidiaries have guaranteed the obligations of the relevant banks in respect of the loannotes which are guaranteed by the banks.27. Finance Leases64The net finance lease obligations to which the Group is committed are:2000 1999E’000 e’000In one year or less 4,206 3,788Between one <strong>and</strong> two years 4,418 3,784Between two <strong>and</strong> five years 14,900 12,862Over five years 17,506 20,19836,824 36,84441,030 40,63228. Derivative <strong>and</strong> Other <strong>Financial</strong> InstrumentsThe Group’s treasury activities are designed to finance its operations <strong>and</strong> to reduce or eliminate the financial risksarising from those operations.A number of the Group’s operating <strong>and</strong> financial costs <strong>and</strong> revenues are exposed to movements in the financial <strong>and</strong>commodity markets which are outside the Group’s control. In particular, interest rates can fluctuate, affecting the costof borrowings, <strong>and</strong> commodity price movements can affect the cost of certain raw materials purchased.Furthermore, foreign exchange movements can affect the cost of products sourced <strong>and</strong> revenues generated fromoverseas markets <strong>and</strong> can also affect the translation of the results <strong>and</strong> net operating assets or operating liabilities of theGroup’s overseas operations save to the extent that they are hedged by borrowings in the same currency. In order toreduce these exposures <strong>and</strong> to bring both stability <strong>and</strong> more certainty to the Group’s costs <strong>and</strong> revenues the Group usesvarious derivative financial instruments to hedge its position going forward.All transactions in derivatives (which are mainly interest rate swaps, forward foreign currency <strong>and</strong> commodity contracts<strong>and</strong> purchased currency <strong>and</strong> commodity options) are designed to manage risks without engaging in speculativetransactions.