Directors' Reports and Financial Statements - DCC plc

Directors' Reports and Financial Statements - DCC plc

Directors' Reports and Financial Statements - DCC plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

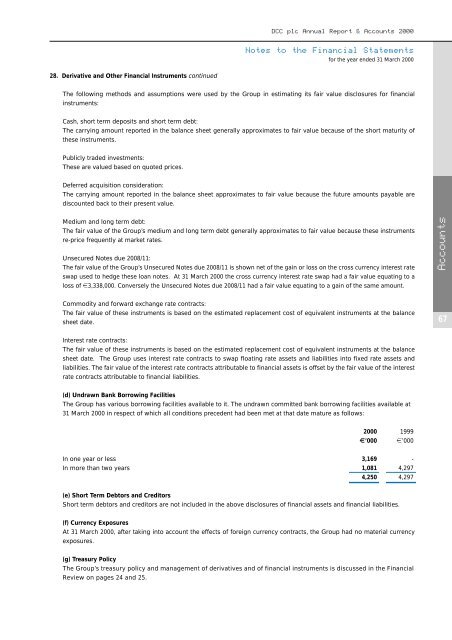

<strong>DCC</strong> <strong>plc</strong> Annual Report & Accounts 2000Notes to the <strong>Financial</strong> <strong>Statements</strong>for the year ended 31 March 200028. Derivative <strong>and</strong> Other <strong>Financial</strong> Instruments continuedThe following methods <strong>and</strong> assumptions were used by the Group in estimating its fair value disclosures for financialinstruments:Cash, short term deposits <strong>and</strong> short term debt:The carrying amount reported in the balance sheet generally approximates to fair value because of the short maturity ofthese instruments.Publicly traded investments:These are valued based on quoted prices.Deferred acquisition consideration:The carrying amount reported in the balance sheet approximates to fair value because the future amounts payable arediscounted back to their present value.Medium <strong>and</strong> long term debt:The fair value of the Group’s medium <strong>and</strong> long term debt generally approximates to fair value because these instrumentsre-price frequently at market rates.Unsecured Notes due 2008/11:The fair value of the Group’s Unsecured Notes due 2008/11 is shown net of the gain or loss on the cross currency interest rateswap used to hedge these loan notes. At 31 March 2000 the cross currency interest rate swap had a fair value equating to aloss of e3,338,000. Conversely the Unsecured Notes due 2008/11 had a fair value equating to a gain of the same amount.AccountsCommodity <strong>and</strong> forward exchange rate contracts:The fair value of these instruments is based on the estimated replacement cost of equivalent instruments at the balancesheet date.67Interest rate contracts:The fair value of these instruments is based on the estimated replacement cost of equivalent instruments at the balancesheet date. The Group uses interest rate contracts to swap floating rate assets <strong>and</strong> liabilities into fixed rate assets <strong>and</strong>liabilities. The fair value of the interest rate contracts attributable to financial assets is offset by the fair value of the interestrate contracts attributable to financial liabilities.(d) Undrawn Bank Borrowing FacilitiesThe Group has various borrowing facilities available to it. The undrawn committed bank borrowing facilities available at31 March 2000 in respect of which all conditions precedent had been met at that date mature as follows:2000 1999E’000 e’000In one year or less 3,169 -In more than two years 1,081 4,2974,250 4,297(e) Short Term Debtors <strong>and</strong> CreditorsShort term debtors <strong>and</strong> creditors are not included in the above disclosures of financial assets <strong>and</strong> financial liabilities.(f) Currency ExposuresAt 31 March 2000, after taking into account the effects of foreign currency contracts, the Group had no material currencyexposures.(g) Treasury PolicyThe Group’s treasury policy <strong>and</strong> management of derivatives <strong>and</strong> of financial instruments is discussed in the <strong>Financial</strong>Review on pages 24 <strong>and</strong> 25.