Directors' Reports and Financial Statements - DCC plc

Directors' Reports and Financial Statements - DCC plc

Directors' Reports and Financial Statements - DCC plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

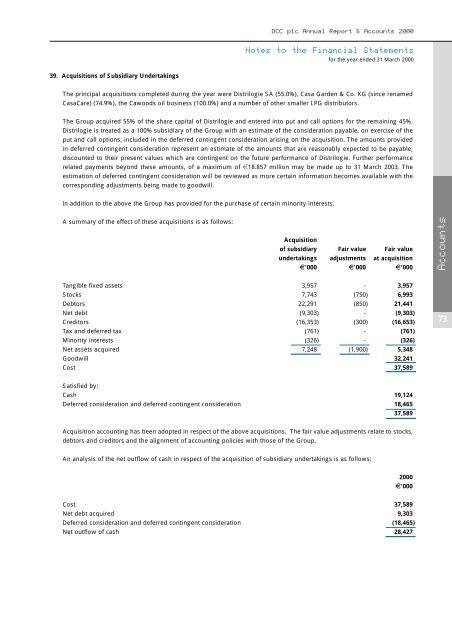

<strong>DCC</strong> <strong>plc</strong> Annual Report & Accounts 2000Notes to the <strong>Financial</strong> <strong>Statements</strong>for the year ended 31 March 200039. Acquisitions of Subsidiary UndertakingsThe principal acquisitions completed during the year were Distrilogie SA (55.0%), Casa Garden & Co. KG (since renamedCasaCare) (74.9%), the Cawoods oil business (100.0%) <strong>and</strong> a number of other smaller LPG distributors.The Group acquired 55% of the share capital of Distrilogie <strong>and</strong> entered into put <strong>and</strong> call options for the remaining 45%.Distrilogie is treated as a 100% subsidiary of the Group with an estimate of the consideration payable, on exercise of theput <strong>and</strong> call options, included in the deferred contingent consideration arising on the acquisition. The amounts providedin deferred contingent consideration represent an estimate of the amounts that are reasonably expected to be payable,discounted to their present values which are contingent on the future performance of Distrilogie. Further performancerelated payments beyond these amounts, of a maximum of e18.857 million may be made up to 31 March 2003. Theestimation of deferred contingent consideration will be reviewed as more certain information becomes available with thecorresponding adjustments being made to goodwill.In addition to the above the Group has provided for the purchase of certain minority interests.A summary of the effect of these acquisitions is as follows:Acquisitionof subsidiary Fair value Fair valueundertakings adjustments at acquisitionE’000 E’000 E’000AccountsTangible fixed assets 3,957 - 3,957Stocks 7,743 (750) 6,993Debtors 22,291 (850) 21,441Net debt (9,303) - (9,303)Creditors (16,353) (300) (16,653)Tax <strong>and</strong> deferred tax (761) - (761)Minority interests (326) - (326)Net assets acquired 7,248 (1,900) 5,348Goodwill 32,241Cost 37,58973Satisfied by:Cash 19,124Deferred consideration <strong>and</strong> deferred contingent consideration 18,46537,589Acquisition accounting has been adopted in respect of the above acquisitions. The fair value adjustments relate to stocks,debtors <strong>and</strong> creditors <strong>and</strong> the alignment of accounting policies with those of the Group.An analysis of the net outflow of cash in respect of the acquisition of subsidiary undertakings is as follows:2000E’000Cost 37,589Net debt acquired 9,303Deferred consideration <strong>and</strong> deferred contingent consideration (18,465)Net outflow of cash 28,427