continued - St James's Place

continued - St James's Place

continued - St James's Place

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

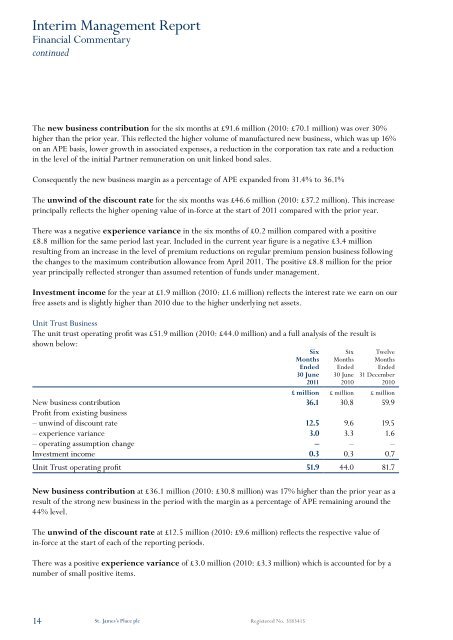

Interim Management ReportFinancial Commentary<strong>continued</strong>The new business contribution for the six months at £91.6 million (2010: £70.1 million) was over 30%higher than the prior year. This reflected the higher volume of manufactured new business, which was up 16%on an APE basis, lower growth in associated expenses, a reduction in the corporation tax rate and a reductionin the level of the initial Partner remuneration on unit linked bond sales.Consequently the new business margin as a percentage of APE expanded from 31.4% to 36.1%The unwind of the discount rate for the six months was £46.6 million (2010: £37.2 million). This increaseprincipally reflects the higher opening value of in-force at the start of 2011 compared with the prior year.There was a negative experience variance in the six months of £0.2 million compared with a positive£8.8 million for the same period last year. Included in the current year figure is a negative £3.4 millionresulting from an increase in the level of premium reductions on regular premium pension business followingthe changes to the maximum contribution allowance from April 2011. The positive £8.8 million for the prioryear principally reflected stronger than assumed retention of funds under management.Investment income for the year at £1.9 million (2010: £1.6 million) reflects the interest rate we earn on ourfree assets and is slightly higher than 2010 due to the higher underlying net assets.Unit Trust BusinessThe unit trust operating profit was £51.9 million (2010: £44.0 million) and a full analysis of the result isshown below:SixMonthsEnded30 June2011SixMonthsEnded30 June2010TwelveMonthsEnded31 December2010£ million £ million £ millionNew business contribution 36.1 30.8 59.9Profit from existing business– unwind of discount rate 12.5 9.6 19.5– experience variance 3.0 3.3 1.6– operating assumption change – – –Investment income 0.3 0.3 0.7Unit Trust operating profit 51.9 44.0 81.7New business contribution at £36.1 million (2010: £30.8 million) was 17% higher than the prior year as aresult of the strong new business in the period with the margin as a percentage of APE remaining around the44% level.The unwind of the discount rate at £12.5 million (2010: £9.6 million) reflects the respective value ofin-force at the start of each of the reporting periods.There was a positive experience variance of £3.0 million (2010: £3.3 million) which is accounted for by anumber of small positive items.14<strong>St</strong>. James’s <strong>Place</strong> plc Registered No. 3183415