continued - St James's Place

continued - St James's Place

continued - St James's Place

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

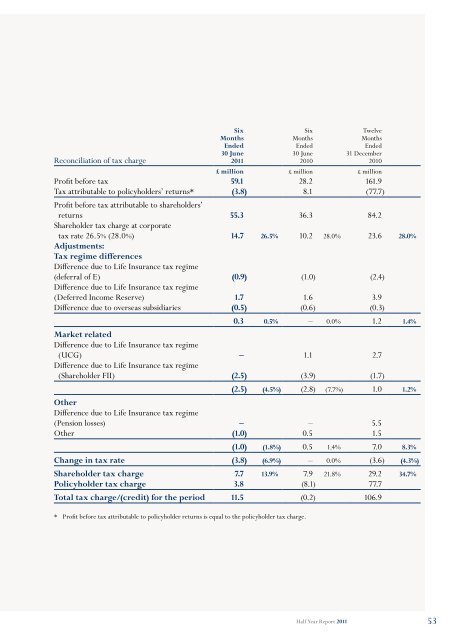

Reconciliation of tax chargeSixMonthsEnded30 June2011SixMonthsEnded30 June2010TwelveMonthsEnded31 December2010£ million £ million £ millionProfit before tax 59.1 28.2 161.9Tax attributable to policyholders’ returns* (3.8) 8.1 (77.7)Profit before tax attributable to shareholders’returns 55.3 36.3 84.2Shareholder tax charge at corporatetax rate 26.5% (28.0%) 14.7 26.5% 10.2 28.0% 23.6 28.0%Adjustments:Tax regime differencesDifference due to Life Insurance tax regime(deferral of E) (0.9) (1.0) (2.4)Difference due to Life Insurance tax regime(Deferred Income Reserve) 1.7 1.6 3.9Difference due to overseas subsidiaries (0.5) (0.6) (0.3)0.3 0.5% – 0.0% 1.2 1.4%Market relatedDifference due to Life Insurance tax regime(UCG) – 1.1 2.7Difference due to Life Insurance tax regime(Shareholder FII) (2.5) (3.9) (1.7)(2.5) (4.5%) (2.8) (7.7%) 1.0 1.2%OtherDifference due to Life Insurance tax regime(Pension losses) – – 5.5Other (1.0) 0.5 1.5(1.0) (1.8%) 0.5 1.4% 7.0 8.3%Change in tax rate (3.8) (6.9%) – 0.0% (3.6) (4.3%)Shareholder tax charge 7.7 13.9% 7.9 21.8% 29.2 34.7%Policyholder tax charge 3.8 (8.1) 77.7Total tax charge/(credit) for the period 11.5 (0.2) 106.9* Profit before tax attributable to policyholder returns is equal to the policyholder tax charge.Half Year Report 201153