Women’s economic opportunityA new global index and ranking2Access to FinanceIndicators in this category:2.1) Building credit histories (a composite measure of the ability to build a credit history)2.2) Women’s access to finance programmes (availability of outreach programmes to women thattarget the provision of financial services through either government initiatives or private lenders)2.3) Delivering financial services2.4) Private sector credit as a percent of Gross Domestic ProductPlease note that this section includes a discussion of some, but not all, of the above indicators8. P Honohan, “Cross-countryvariation in household accessto financial services”, preparedfor the conference “Access toFinance”, Washington DC, March2007.The ability to obtain a loan is crucial for women entrepreneurs, while, more generally, access to a savingsaccount helps to boost savings and growth. According to Honohan (2007), 8 countries with deep financialmarkets suffer from less absolute poverty, with wider financial development having a “favourable impactboth on economic growth and on the degree to which growth is pro-poor.” Although many emergingmarkets have reasonably developed financial sectors geared towards providing funding to the corporatesector, lending to small businesses and individuals lags behind. This is due to several factors: the loanapplicant may lack collateral, a credit history or official documentation; and, for the financial institutionthere is a disincentive to process large numbers of small loans, since the operating cost per loan is high.Financial institutions may be wary of extending credit to women because they may have less professional/business experience, and also because women’s businesses are often concentrated in low-growth sectors.Women may sometimes face greater difficulties than men in accessing credit, as in many countrieswomen’s access to moveable and immoveable property is restricted either by law or by social andcustomary practices, leaving them with very few assets. Moreover, choices regarding how a woman candispose of her income and assets may be decided by the male head of the household, a designation eitherby tradition, or in some countries, by law. Norms are gradually changing as women gain more decisionmakingpower within the family, in part due to their increasing economic participation and correspondingability to contribute financially.There are no comprehensive sex-disaggregated data relating to financial services. Most of thefinancial indicators in the <strong>Index</strong> therefore are based on the disproportionately positive effect they haveon women’s ability to access financial services. Improvements in national conditions measured by theseindictors would have a positive effect on women’s employment and business opportunities. For example,the building credit histories indicator considers if credit registries can distribute credit information fromretailers, trade creditors or utilities companies; if businesses can use moveable assets as collateral andwhether financial institutions accept such assets as collateral; and if microfinance institutions can provideinformation to credit bureaus. These factors may be especially important for new entrants to the labour23© <strong>Economist</strong> <strong>Intelligence</strong> <strong>Unit</strong> Limited 2010

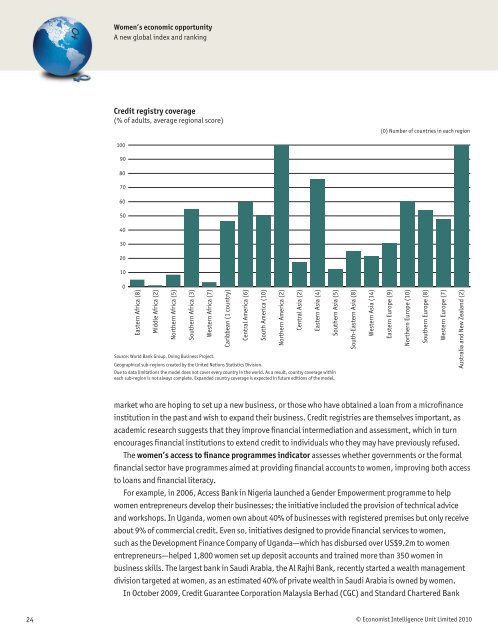

Women’s economic opportunityA new global index and rankingCredit registry coverage(% of adults, average regional score)(0) Number of countries in each region1009080706050403020100Eastern Africa (8)Middle Africa (2)Northern Africa (5)Southern Africa (3)Western Africa (7)Caribbean (1 country)Source: World Bank Group, Doing Business Project.Geographical sub-regions created by the <strong>Unit</strong>ed Nations Statistics Division.Due to data limitations the model does not cover every country in the world. As a result, country coverage withineach sub-region is not always complete. Expanded country coverage is expected in future editions of the model.Central America (6)South America (10)Northern America (2)Central Asia (2)Eastern Asia (4)Southern Asia (5)South-Eastern Asia (8)Western Asia (14)Eastern Europe (9)Northern Europe (10)Southern Europe (8)Western Europe (7)Australia and New Zealand (2)market who are hoping to set up a new business, or those who have obtained a loan from a microfinanceinstitution in the past and wish to expand their business. Credit registries are themselves important, asacademic research suggests that they improve financial intermediation and assessment, which in turnencourages financial institutions to extend credit to individuals who they may have previously refused.The women’s access to finance programmes indicator assesses whether governments or the formalfinancial sector have programmes aimed at providing financial accounts to women, improving both accessto loans and financial literacy.For example, in 2006, Access Bank in Nigeria launched a Gender Empowerment programme to helpwomen entrepreneurs develop their businesses; the initiative included the provision of technical adviceand workshops. In Uganda, women own about 40% of businesses with registered premises but only receiveabout 9% of commercial credit. Even so, initiatives designed to provide financial services to women,such as the Development Finance Company of Uganda—which has disbursed over US$9.2m to womenentrepreneurs—helped 1,800 women set up deposit accounts and trained more than 350 women inbusiness skills. The largest bank in Saudi Arabia, the Al Rajhi Bank, recently started a wealth managementdivision targeted at women, as an estimated 40% of private wealth in Saudi Arabia is owned by women.In October 2009, Credit Guarantee Corporation Malaysia Berhad (CGC) and Standard Chartered Bank24© <strong>Economist</strong> <strong>Intelligence</strong> <strong>Unit</strong> Limited 2010