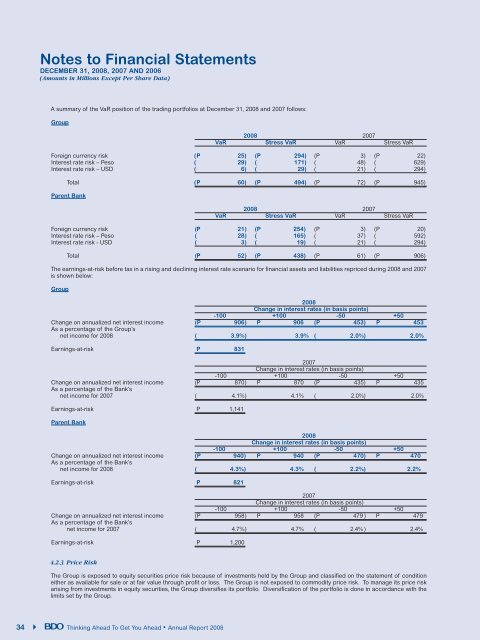

<strong>Notes</strong> <strong>to</strong> <strong>Financial</strong> <strong>Statements</strong>DECEMBER 31, 2008, 2007 AND 2006(Amounts in Millions Except Per Share Data)A summary of the VaR position of the trading portfolios at December 31, 2008 and 2007 follows:Group2008 2007VaR Stress VaR VaR Stress VaRForeign currency risk (P 25 ) (P 294 ) (P 3 ) (P 22 )Interest rate risk – Peso ( 29 ) ( 171 ) ( 48 ) ( 629 )Interest rate risk – USD ( 6 ) ( 29 ) ( 21 ) ( 294 )Total (P 60 ) (P 494 ) (P 72 ) (P 945 )Parent Bank2008 2007VaR Stress VaR VaR Stress VaRForeign currency risk (P 21 ) (P 254 ) (P 3 ) (P 20 )Interest rate risk – Peso ( 28 ) ( 165 ) ( 37 ) ( 592 )Interest rate risk - USD ( 3 ) ( 19 ) ( 21 ) ( 294 )Total (P 52 ) (P 438 ) (P 61 ) (P 906 )The earnings-at-risk before tax in a rising and declining interest rate scenario for financial assets and liabilities repriced during 2008 and 2007is shown below:Group2008Change in interest rates (in basis points)-100 +100 -50 +50Change on annualized net interest income (P 906 ) P 906 (P 453 ) P 453As a percentage of the Group’snet income for 2008 ( 3.9% ) 3.9 % ( 2.0% ) 2.0%Earnings-at-risk P 8312007Change in interest rates (in basis points)-100 +100 -50 +50Change on annualized net interest income (P 870 ) P 870 (P 435 ) P 435As a percentage of the Bank’snet income for 2007 ( 4.1% ) 4.1% ( 2.0% ) 2.0%Earnings-at-risk P 1,141Parent Bank2008Change in interest rates (in basis points)-100 +100 -50 +50Change on annualized net interest income (P 940 ) P 940 (P 470 ) P 470As a percentage of the Bank’snet income for 2008 ( 4.3% ) 4.3% ( 2.2% ) 2.2%Earnings-at-risk P 8212007Change in interest rates (in basis points)-100 +100 -50 +50Change on annualized net interest income (P 958 ) P 958 (P 479 ) P 479As a percentage of the Bank’snet income for 2007 ( 4.7% ) 4.7% ( 2.4% ) 2.4%Earnings-at-risk P 1,2004.2.3 Price RiskThe Group is exposed <strong>to</strong> equity securities price risk because of investments held by the Group and classified on the statement of conditioneither as available for sale or at fair value through profit or loss. The Group is not exposed <strong>to</strong> commodity price risk. To manage its price riskarising from investments in equity securities, the Group diversifies its portfolio. Diversification of the portfolio is done in accordance with thelimits set by the Group.34Thinking Ahead To Get You Ahead • Annual Report 2008

<strong>Notes</strong> <strong>to</strong> <strong>Financial</strong> <strong>Statements</strong>DECEMBER 31, 2008, 2007 AND 2006(Amounts in Millions Except Per Share Data)The table below summarizes the impact of increases of the financial assets at FVTPL and available-for-sale securities on the Group’s 2008 and2007 net income after tax for the year and on equity. The analysis is based on the assumption that the correlated equity indices had decreasedby 46.4% in 2008 and increased by 19.2% in 2007 for securities under fair value through profit or loss and available-for-sale securities with allother variables held constant and all the Group’s equity instruments moved according <strong>to</strong> the his<strong>to</strong>rical correlation with the index:GroupImpact onImpact onnet income after taxother components of equity2008 2007 2008 2007Fair value through profit or loss (P 28 ) P 18 P - P -Available-for-sale - - ( 189 ) 51Total (P 28 ) P 18 (P 189 ) P 514.2.4 Credit RiskCredit risk is the risk that the counterparty in a transaction may default and arises from lending, trade finance, treasury, derivatives and otheractivities undertaken by the Group. The Group manages its credit risk and loan portfolio through the RMG, which undertakes several functionswith respect <strong>to</strong> credit risk management.The RMG undertakes credit analysis and review <strong>to</strong> ensure consistency in the Group’s risk assessment process. The RMG performs risk ratingsfor corporate accounts and assists the design and development of scorecards for consumer accounts. It also ensures that the Group’s creditpolicies and procedures are adequate <strong>to</strong> meet the demands of the business. The RMG is also responsible for developing procedures <strong>to</strong>streamline and expedite the processing of credit applications.The RMG also undertakes portfolio management by reviewing the Group’s loan portfolio, including the portfolio risks associated with particularindustry sec<strong>to</strong>rs, loan size and maturity, and development of a strategy for the Group <strong>to</strong> achieve its desired portfolio mix and risk profile.The Group structures the levels of credit risk it undertakes by placing limits on the amount of risk accepted in relation <strong>to</strong> one borrower, orgroups of borrowers, and <strong>to</strong> industry segments. Such risks are moni<strong>to</strong>red on a revolving basis and subject <strong>to</strong> an annual or more frequentreview. Limits on the level of credit risk by product and industry sec<strong>to</strong>r are approved quarterly by the RMC.Exposure <strong>to</strong> credit risk is managed through regular analysis of the ability of borrowers and potential borrowers <strong>to</strong> meet interest and capitalrepayment obligations and by changing these lending limits when appropriate. Exposure <strong>to</strong> credit risk is also managed in part by obtainingcollateral and corporate and personal guarantees.The RMG reviews the Group’s loan portfolio in line with the Group’s policy of not having significant unwarranted concentrations of exposure<strong>to</strong> individual counterparties, in accordance with the BSP’s prohibitions on maintaining a financial exposure <strong>to</strong> any single person or group ofconnected persons in excess of 25% of its net worth.4.2.4.1 Exposure <strong>to</strong> Credit RiskThe following table shows the exposure <strong>to</strong> credit risk as of December 31, 2008 and 2007 for each internal risk grade and the related allowancefor impairment losses:Group2008Loans and Due from InvestmentReceivables Other Banks SecuritiesCarrying Amount P 491,986 P 17,102 P 153,698Individually ImpairedGrade: Unclassified P 12 P 161 P 15Grade C: Impaired 4,224 - -Grade D: Impaired 10,304 - 5,249Grade E: Impaired 4,375 - 121Grade F: Impaired 5,193 - 655Gross Amount 24,108 161 6,040Allowance for impairment ( 16,382) - ( 5,129 )Carrying amount 7,726 161 911Collectively ImpairedGrade: Unclassified 3,230 - -Grade C: Impaired 8 - -Grade D: Impaired 305 - -Grade E: Impaired 112 - -Grade F: Impaired - - -Gross Amount 3,655 - -Allowance for impairment ( 2,718) - -Carrying amount 937 - -Sub <strong>to</strong>tal (Carried Forward) P 8,663 P 161 P 911Thinking Ahead To Get You Ahead • Annual Report 2008 35