Notes to Financial Statements - BDO

Notes to Financial Statements - BDO

Notes to Financial Statements - BDO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

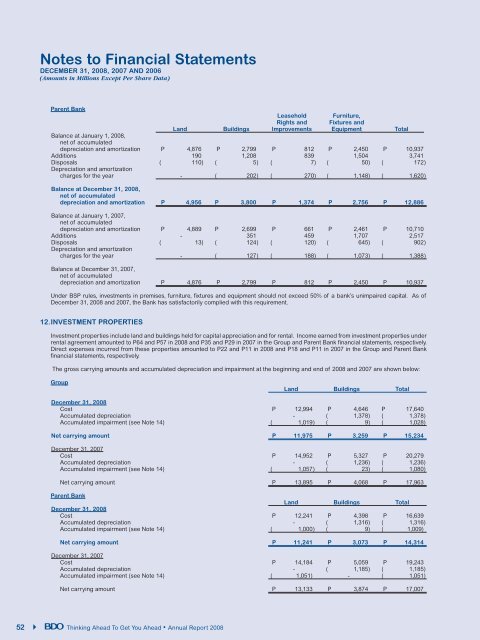

<strong>Notes</strong> <strong>to</strong> <strong>Financial</strong> <strong>Statements</strong>DECEMBER 31, 2008, 2007 AND 2006(Amounts in Millions Except Per Share Data)Parent BankLeasehold Furniture,Rights and Fixtures andLand Buildings Improvements Equipment TotalBalance at January 1, 2008,net of accumulateddepreciation and amortization P 4,876 P 2,799 P 812 P 2,450 P 10,937Additions 190 1,208 839 1,504 3,741Disposals ( 110 ) ( 5 ) ( 7 ) ( 50 ) ( 172 )Depreciation and amortizationcharges for the year - ( 202 ) ( 270 ) ( 1,148 ) ( 1,620 )Balance at December 31, 2008,net of accumulateddepreciation and amortization P 4,956 P 3,800 P 1,374 P 2,756 P 12,886Balance at January 1, 2007,net of accumulateddepreciation and amortization P 4,889 P 2,699 P 661 P 2,461 P 10,710Additions - 351 459 1,707 2,517Disposals ( 13 ) ( 124 ) ( 120 ) ( 645 ) ( 902 )Depreciation and amortizationcharges for the year - ( 127 ) ( 188 ) ( 1,073 ) ( 1,388 )Balance at December 31, 2007,net of accumulateddepreciation and amortization P 4,876 P 2,799 P 812 P 2,450 P 10,937Under BSP rules, investments in premises, furniture, fixtures and equipment should not exceed 50% of a bank’s unimpaired capital. As ofDecember 31, 2008 and 2007, the Bank has satisfac<strong>to</strong>rily complied with this requirement.12. INVESTMENT PROPERTIESInvestment properties include land and buildings held for capital appreciation and for rental. Income earned from investment properties underrental agreement amounted <strong>to</strong> P64 and P57 in 2008 and P35 and P29 in 2007 in the Group and Parent Bank financial statements, respectively.Direct expenses incurred from these properties amounted <strong>to</strong> P22 and P11 in 2008 and P18 and P11 in 2007 in the Group and Parent Bankfinancial statements, respectively.The gross carrying amounts and accumulated depreciation and impairment at the beginning and end of 2008 and 2007 are shown below:GroupLand Buildings TotalDecember 31, 2008Cost P 12,994 P 4,646 P 17,640Accumulated depreciation - ( 1,378 ) ( 1,378 )Accumulated impairment (see Note 14) ( 1,019 ) ( 9 ) ( 1,028 )Net carrying amount P 11,975 P 3,259 P 15,234December 31, 2007Cost P 14,952 P 5,327 P 20,279Accumulated depreciation - ( 1,236 ) ( 1,236 )Accumulated impairment (see Note 14) ( 1,057 ) ( 23 ) ( 1,080 )Net carrying amount P 13,895 P 4,068 P 17,963Parent BankLand Buildings TotalDecember 31, 2008Cost P 12,241 P 4,398 P 16,639Accumulated depreciation - ( 1,316 ) ( 1,316 )Accumulated impairment (see Note 14) ( 1,000 ) ( 9 ) ( 1,009)Net carrying amount P 11,241 P 3,073 P 14,314December 31, 2007Cost P 14,184 P 5,059 P 19,243Accumulated depreciation - ( 1,185 ) ( 1,185 )Accumulated impairment (see Note 14) ( 1,051) - ( 1,051 )Net carrying amount P 13,133 P 3,874 P 17,00752Thinking Ahead To Get You Ahead • Annual Report 2008