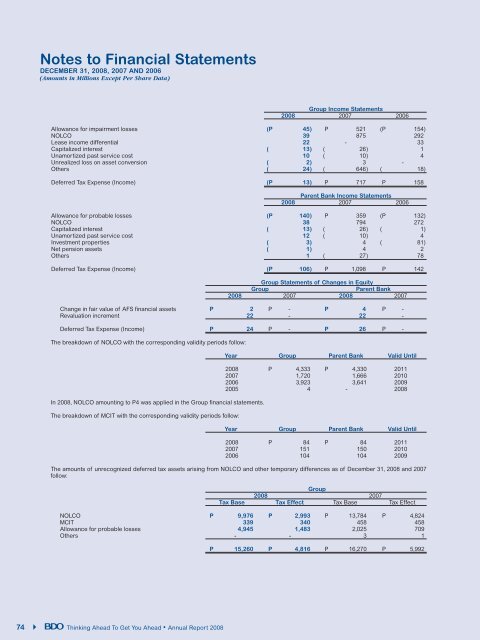

<strong>Notes</strong> <strong>to</strong> <strong>Financial</strong> <strong>Statements</strong>DECEMBER 31, 2008, 2007 AND 2006(Amounts in Millions Except Per Share Data)Group Income <strong>Statements</strong>2008 2007 2006Allowance for impairment losses (P 45 ) P 521 (P 154 )NOLCO 39 875 292Lease income differential 22 - 33Capitalized interest ( 13 ) ( 26 ) 1Unamortized past service cost 10 ( 10 ) 4Unrealized loss on asset conversion ( 2 ) 3 -Others ( 24 ) ( 646 ) ( 18 )Deferred Tax Expense (Income) (P 13 ) P 717 P 158Parent Bank Income <strong>Statements</strong>2008 2007 2006Allowance for probable losses (P 140 ) P 359 (P 132 )NOLCO 38 794 272Capitalized interest ( 13 ) ( 26 ) ( 1 )Unamortized past service cost 12 ( 10 ) 4Investment properties ( 3 ) 4 ( 81 )Net pension assets ( 1 ) 4 2Others 1 ( 27 ) 78Deferred Tax Expense (Income) (P 106 ) P 1,098 P 142Group <strong>Statements</strong> of Changes in EquityGroupParent Bank2008 2007 2008 2007Change in fair value of AFS financial assets P 2 P - P 4 P -Revaluation increment 22 - 22 -Deferred Tax Expense (Income) P 24 P - P 26 P -The breakdown of NOLCO with the corresponding validity periods follow:In 2008, NOLCO amounting <strong>to</strong> P4 was applied in the Group financial statements.The breakdown of MCIT with the corresponding validity periods follow:Year Group Parent Bank Valid Until2008 P 4,333 P 4,330 20112007 1,720 1,666 20102006 3,923 3,641 20092005 4 - 2008Year Group Parent Bank Valid Until2008 P 84 P 84 20112007 151 150 20102006 104 104 2009The amounts of unrecognized deferred tax assets arising from NOLCO and other temporary differences as of December 31, 2008 and 2007follow:Group2008 2007Tax Base Tax Effect Tax Base Tax EffectNOLCO P 9,976 P 2,993 P 13,784 P 4,824MCIT 339 340 458 458Allowance for probable losses 4,945 1,483 2,025 709Others - - 3 1P 15,260 P 4,816 P 16,270 P 5,99274Thinking Ahead To Get You Ahead • Annual Report 2008

<strong>Notes</strong> <strong>to</strong> <strong>Financial</strong> <strong>Statements</strong>DECEMBER 31, 2008, 2007 AND 2006(Amounts in Millions Except Per Share Data)Parent Bank2008 2007Tax Base Tax Effect Tax Base Tax EffectNOLCO P 9,637 P 2,891 P 13,438 P 4,703MCIT 339 339 372 372Allowance for probable losses 6,016 1,805 - -27.2 Relevant Tax RegulationsRepublic Act 9504P 15,992 P 5,035 P 13,810 P 5,075Effective July 2008, Republic Act 9504 was approved giving corporate tax payers an option <strong>to</strong> claim itemized deduction or optional standarddeduction (OSD) equivalent <strong>to</strong> 40% of gross sales. Once the option <strong>to</strong> use OSD is made, it shall be irrevocable for the taxable year for whichthe option was made. In 2008, the Group opted <strong>to</strong> continue claiming itemized standard deductions.Revenue Regulation 12-2007On Oc<strong>to</strong>ber 19, 2007, the Bureau of Internal Revenue (BIR) issued Revenue Regulation (RR) 12-2007 which requires the quarterly computationand payment of the MCIT beginning on the income tax return for fiscal quarter ending September 30, 2007. This RR amended certainprovisions of RR 9-98 which specifically provides for the computation of the MCIT at the end of each taxable year.Thus, in the computation of the tax due for the taxable quarter, if the computed quarterly MCIT is higher than the quarterly regular corporateincome tax, the tax due <strong>to</strong> be paid for such taxable quarter at the time of filing the quarterly corporate income tax return shall be the MCITwhich is 2% of the gross income as of the end of the taxable quarter.Republic Act 9337On May 24, 2005, Republic Act No. 9337 (RA 9337), amending certain sections of the National Internal Revenue Code of 1997, was signed in<strong>to</strong>law and became effective beginning on November 1, 2005. The following were the major changes brought about by RA 9337 that are relevant<strong>to</strong> the Group:(a) RCIT rate was increased from 32% <strong>to</strong> 35% starting on November 1, 2005 until December 31, 2008 and will be reduced <strong>to</strong> 30% beginning onJanuary 1, 2009;(b) 10% value-added tax (VAT) rate was increased <strong>to</strong> 12% effective on February 1, 2006;(c) 12% VAT rate was now imposed on certain goods and services that were previously zero-rated or subject <strong>to</strong> percentage tax;(d) Input tax on capital goods shall be claimed on a staggered basis over 60 months or the useful life of the related assets, whichever is shorter;and,(e) Creditable input VAT was capped at a maximum of 70% of output VAT per quarter which was effective until the third quarter of 2006 (thiscap was removed effective for quarters ending on December 31, 2006 and onwards).27.3 Gross Receipts Tax (GRT)/ VATBeginning January 1, 2003, the imposition of VAT on banks and financial institutions became effective pursuant <strong>to</strong> the provisions of RepublicAct 9010. The Bank and <strong>BDO</strong> Private became subject <strong>to</strong> VAT based on their gross receipts, in lieu of the GRT under Sections 121 and 122 ofthe Tax Code which was imposed on banks, non-banks financial intermediaries and finance companies in prior years.On January 29, 2004, Republic Act 9238 reverts the imposition of GRT on banks and financial institutions. This law is retroactive <strong>to</strong> January1, 2004. The Bank and <strong>BDO</strong> Private complied with the transitional guidelines provided by the BIR on the final disposition of the uncollectedOutput VAT as of December 31, 2004.On May 24, 2005, the amendments on RA 9337 was approved amending, among others, the gross receipts tax on royalties, rentals of property,real or personal, profits from exchange and on net trading gains within the taxable year on foreign currency, debt securities, derivatives andother similar financial instruments from 5% <strong>to</strong> 7% effective November 1, 2005.Thinking Ahead To Get You Ahead • Annual Report 2008 75