Notes to Financial Statements - BDO

Notes to Financial Statements - BDO

Notes to Financial Statements - BDO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

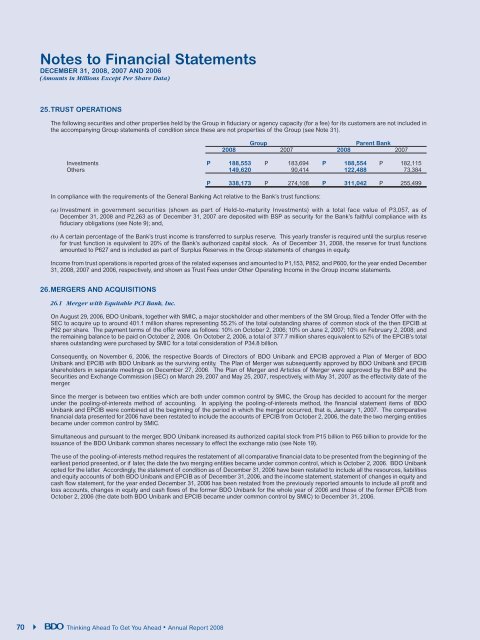

<strong>Notes</strong> <strong>to</strong> <strong>Financial</strong> <strong>Statements</strong>DECEMBER 31, 2008, 2007 AND 2006(Amounts in Millions Except Per Share Data)25. TRUST OPERATIONSThe following securities and other properties held by the Group in fiduciary or agency capacity (for a fee) for its cus<strong>to</strong>mers are not included inthe accompanying Group statements of condition since these are not properties of the Group (see Note 31).GroupParent Bank2008 2007 2008 2007Investments P 188,553 P 183,694 P 188,554 P 182,115Others 149,620 90,414 122,488 73,384P 338,173 P 274,108 P 311,042 P 255,499In compliance with the requirements of the General Banking Act relative <strong>to</strong> the Bank’s trust functions:(a) Investment in government securities (shown as part of Held-<strong>to</strong>-maturity Investments) with a <strong>to</strong>tal face value of P3,057, as ofDecember 31, 2008 and P2,263 as of December 31, 2007 are deposited with BSP as security for the Bank’s faithful compliance with itsfiduciary obligations (see Note 9); and,(b) A certain percentage of the Bank’s trust income is transferred <strong>to</strong> surplus reserve. This yearly transfer is required until the surplus reservefor trust function is equivalent <strong>to</strong> 20% of the Bank’s authorized capital s<strong>to</strong>ck. As of December 31, 2008, the reserve for trust functionsamounted <strong>to</strong> P627 and is included as part of Surplus Reserves in the Group statements of changes in equity.Income from trust operations is reported gross of the related expenses and amounted <strong>to</strong> P1,153, P852, and P600, for the year ended December31, 2008, 2007 and 2006, respectively, and shown as Trust Fees under Other Operating Income in the Group income statements.26. MERGERS AND ACQUISITIONS26.1 Merger with Equitable PCI Bank, Inc.On August 29, 2006, <strong>BDO</strong> Unibank, <strong>to</strong>gether with SMIC, a major s<strong>to</strong>ckholder and other members of the SM Group, filed a Tender Offer with theSEC <strong>to</strong> acquire up <strong>to</strong> around 401.1 million shares representing 55.2% of the <strong>to</strong>tal outstanding shares of common s<strong>to</strong>ck of the then EPCIB atP92 per share. The payment terms of the offer were as follows: 10% on Oc<strong>to</strong>ber 2, 2006; 10% on June 2, 2007; 10% on February 2, 2008; andthe remaining balance <strong>to</strong> be paid on Oc<strong>to</strong>ber 2, 2008. On Oc<strong>to</strong>ber 2, 2006, a <strong>to</strong>tal of 377.7 million shares equivalent <strong>to</strong> 52% of the EPCIB’s <strong>to</strong>talshares outstanding were purchased by SMIC for a <strong>to</strong>tal consideration of P34.8 billion.Consequently, on November 6, 2006, the respective Boards of Direc<strong>to</strong>rs of <strong>BDO</strong> Unibank and EPCIB approved a Plan of Merger of <strong>BDO</strong>Unibank and EPCIB with <strong>BDO</strong> Unibank as the surviving entity. The Plan of Merger was subsequently approved by <strong>BDO</strong> Unibank and EPCIBshareholders in separate meetings on December 27, 2006. The Plan of Merger and Articles of Merger were approved by the BSP and theSecurities and Exchange Commission (SEC) on March 29, 2007 and May 25, 2007, respectively, with May 31, 2007 as the effectivity date of themerger.Since the merger is between two entities which are both under common control by SMIC, the Group has decided <strong>to</strong> account for the mergerunder the pooling-of-interests method of accounting. In applying the pooling-of-interests method, the financial statement items of <strong>BDO</strong>Unibank and EPCIB were combined at the beginning of the period in which the merger occurred, that is, January 1, 2007. The comparativefinancial data presented for 2006 have been restated <strong>to</strong> include the accounts of EPCIB from Oc<strong>to</strong>ber 2, 2006, the date the two merging entitiesbecame under common control by SMIC.Simultaneous and pursuant <strong>to</strong> the merger, <strong>BDO</strong> Unibank increased its authorized capital s<strong>to</strong>ck from P15 billion <strong>to</strong> P65 billion <strong>to</strong> provide for theissuance of the <strong>BDO</strong> Unibank common shares necessary <strong>to</strong> effect the exchange ratio (see Note 19).The use of the pooling-of-interests method requires the restatement of all comparative financial data <strong>to</strong> be presented from the beginning of theearliest period presented, or if later, the date the two merging entities became under common control, which is Oc<strong>to</strong>ber 2, 2006. <strong>BDO</strong> Unibankopted for the latter. Accordingly, the statement of condition as of December 31, 2006 have been restated <strong>to</strong> include all the resources, liabilitiesand equity accounts of both <strong>BDO</strong> Unibank and EPCIB as of December 31, 2006, and the income statement, statement of changes in equity andcash flow statement, for the year ended December 31, 2006 has been restated from the previously reported amounts <strong>to</strong> include all profit andloss accounts, changes in equity and cash flows of the former <strong>BDO</strong> Unibank for the whole year of 2006 and those of the former EPCIB fromOc<strong>to</strong>ber 2, 2006 (the date both <strong>BDO</strong> Unibank and EPCIB became under common control by SMIC) <strong>to</strong> December 31, 2006.70Thinking Ahead To Get You Ahead • Annual Report 2008