Notes to Financial Statements - BDO

Notes to Financial Statements - BDO

Notes to Financial Statements - BDO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

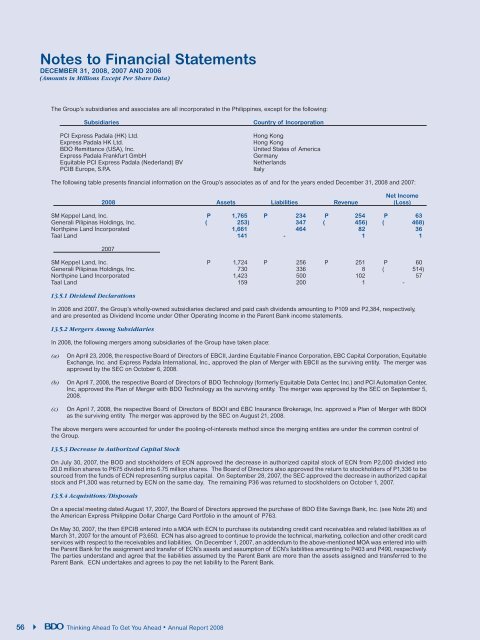

<strong>Notes</strong> <strong>to</strong> <strong>Financial</strong> <strong>Statements</strong>DECEMBER 31, 2008, 2007 AND 2006(Amounts in Millions Except Per Share Data)The Group’s subsidiaries and associates are all incorporated in the Philippines, except for the following:SubsidiariesPCI Express Padala (HK) Ltd.Express Padala HK Ltd.<strong>BDO</strong> Remittance (USA), Inc.Express Padala Frankfurt GmbHEquitable PCI Express Padala (Nederland) BVPCIB Europe, S.P.A.Country of IncorporationHong KongHong KongUnited States of AmericaGermanyNetherlandsItalyThe following table presents financial information on the Group’s associates as of and for the years ended December 31, 2008 and 2007:Net Income2008 Assets Liabilities Revenue (Loss)SM Keppel Land, Inc. P 1,765 P 234 P 254 P 63Generali Pilipinas Holdings, Inc. ( 253 ) 347 ( 456 ) ( 468 )Northpine Land Incorporated 1,661 464 82 36Taal Land 141 - 1 12007SM Keppel Land, Inc. P 1,724 P 256 P 251 P 60Generali Pilipinas Holdings, Inc. 730 336 8 ( 514 )Northpine Land Incorporated 1,423 500 102 57Taal Land 159 200 1 -13.5.1 Dividend DeclarationsIn 2008 and 2007, the Group’s wholly-owned subsidiaries declared and paid cash dividends amounting <strong>to</strong> P109 and P2,384, respectively,and are presented as Dividend Income under Other Operating Income in the Parent Bank income statements.13.5.2 Mergers Among SubsidiariesIn 2008, the following mergers among subsidiaries of the Group have taken place:(a)(b)(c)On April 23, 2008, the respective Board of Direc<strong>to</strong>rs of EBCII, Jardine Equitable Finance Corporation, EBC Capital Corporation, EquitableExchange, Inc. and Express Padala International, Inc., approved the plan of Merger with EBCII as the surviving entity. The merger wasapproved by the SEC on Oc<strong>to</strong>ber 6, 2008.On April 7, 2008, the respective Board of Direc<strong>to</strong>rs of <strong>BDO</strong> Technology (formerly Equitable Data Center, Inc.) and PCI Au<strong>to</strong>mation Center,Inc, approved the Plan of Merger with <strong>BDO</strong> Technology as the surviving entity. The merger was approved by the SEC on September 5,2008.On April 7, 2008, the respective Board of Direc<strong>to</strong>rs of <strong>BDO</strong>I and EBC Insurance Brokerage, Inc. approved a Plan of Merger with <strong>BDO</strong>Ias the surviving entity. The merger was approved by the SEC on August 21, 2008.The above mergers were accounted for under the pooling-of-interests method since the merging entities are under the common control ofthe Group.13.5.3 Decrease in Authorized Capital S<strong>to</strong>ckOn July 30, 2007, the BOD and s<strong>to</strong>ckholders of ECN approved the decrease in authorized capital s<strong>to</strong>ck of ECN from P2,000 divided in<strong>to</strong>20.0 million shares <strong>to</strong> P675 divided in<strong>to</strong> 6.75 million shares. The Board of Direc<strong>to</strong>rs also approved the return <strong>to</strong> s<strong>to</strong>ckholders of P1,336 <strong>to</strong> besourced from the funds of ECN representing surplus capital. On September 28, 2007, the SEC approved the decrease in authorized capitals<strong>to</strong>ck and P1,300 was returned by ECN on the same day. The remaining P36 was returned <strong>to</strong> s<strong>to</strong>ckholders on Oc<strong>to</strong>ber 1, 2007.13.5.4 Acquisitions/DisposalsOn a special meeting dated August 17, 2007, the Board of Direc<strong>to</strong>rs approved the purchase of <strong>BDO</strong> Elite Savings Bank, Inc. (see Note 26) andthe American Express Philippine Dollar Charge Card Portfolio in the amount of P763.On May 30, 2007, the then EPCIB entered in<strong>to</strong> a MOA with ECN <strong>to</strong> purchase its outstanding credit card receivables and related liabilities as ofMarch 31, 2007 for the amount of P3,650. ECN has also agreed <strong>to</strong> continue <strong>to</strong> provide the technical, marketing, collection and other credit cardservices with respect <strong>to</strong> the receivables and liabilities. On December 1, 2007, an addendum <strong>to</strong> the above-mentioned MOA was entered in<strong>to</strong> withthe Parent Bank for the assignment and transfer of ECN’s assets and assumption of ECN’s liabilities amounting <strong>to</strong> P403 and P490, respectively.The parties understand and agree that the liabilities assumed by the Parent Bank are more than the assets assigned and transferred <strong>to</strong> theParent Bank. ECN undertakes and agrees <strong>to</strong> pay the net liability <strong>to</strong> the Parent Bank.56Thinking Ahead To Get You Ahead • Annual Report 2008