Final report for One North East And NEPIC 21/12/10 - The Carbon ...

Final report for One North East And NEPIC 21/12/10 - The Carbon ...

Final report for One North East And NEPIC 21/12/10 - The Carbon ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

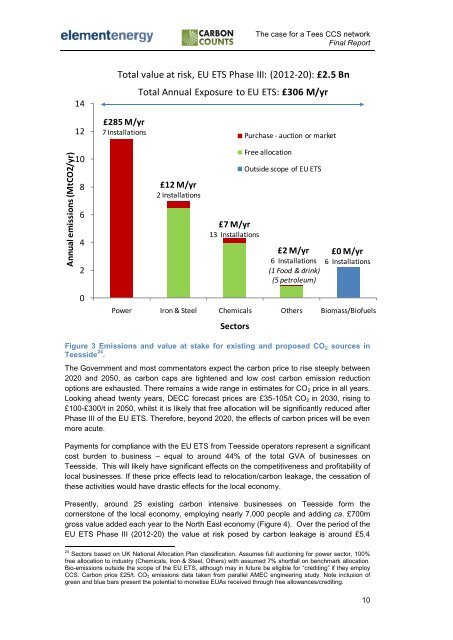

Annual emissions (MtCO2/yr)<strong>The</strong> case <strong>for</strong> a Tees CCS network<strong>Final</strong> Report14Total value at risk, EU ETS Phase III: (20<strong>12</strong>-20): £2.5 BnTotal Annual Exposure to EU ETS: £306 M/yr<strong>12</strong>£285 M/yr7 InstallationsPurchase - auction or market<strong>10</strong>8£<strong>12</strong> M/yr2 InstallationsFree allocationOutside scope of EU ETS642£7 M/yr13 Installations£2 M/yr6 Installations(1 Food & drink)(5 petroleum)£0 M/yr6 Installations0Power Iron & Steel Chemicals Others Biomass/BiofuelsSectorsFigure 3 Emissions and value at stake <strong>for</strong> existing and proposed CO 2 sources inTeesside 24 .<strong>The</strong> Government and most commentators expect the carbon price to rise steeply between2020 and 2050, as carbon caps are tightened and low cost carbon emission reductionoptions are exhausted. <strong>The</strong>re remains a wide range in estimates <strong>for</strong> CO 2 price in all years.Looking ahead twenty years, DECC <strong>for</strong>ecast prices are £35-<strong>10</strong>5/t CO 2 in 2030, rising to£<strong>10</strong>0-£300/t in 2050, whilst it is likely that free allocation will be significantly reduced afterPhase III of the EU ETS. <strong>The</strong>re<strong>for</strong>e, beyond 2020, the effects of carbon prices will be evenmore acute.Payments <strong>for</strong> compliance with the EU ETS from Teesside operators represent a significantcost burden to business – equal to around 44% of the total GVA of businesses onTeesside. This will likely have significant effects on the competitiveness and profitability oflocal businesses. If these price effects lead to relocation/carbon leakage, the cessation ofthese activities would have drastic effects <strong>for</strong> the local economy.Presently, around 25 existing carbon intensive businesses on Teesside <strong>for</strong>m thecornerstone of the local economy, employing nearly 7,000 people and adding ca. £700mgross value added each year to the <strong>North</strong> <strong>East</strong> economy (Figure 4). Over the period of theEU ETS Phase III (20<strong>12</strong>-20) the value at risk posed by carbon leakage is around £5.424 Sectors based on UK National Allocation Plan classification. Assumes full auctioning <strong>for</strong> power sector, <strong>10</strong>0%free allocation to industry (Chemicals, Iron & Steel, Others) with assumed 7% shortfall on benchmark allocation.Bio-emissions outside the scope of the EU ETS, although may in future be eligible <strong>for</strong> “crediting” if they employCCS. <strong>Carbon</strong> price £25/t. CO 2 emissions data taken from parallel AMEC engineering study. Note inclusion ofgreen and blue bars present the potential to monetise EUAs received through free allowances/crediting.<strong>10</strong>