Ford's full FHR report - Rapid Ratings

Ford's full FHR report - Rapid Ratings

Ford's full FHR report - Rapid Ratings

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

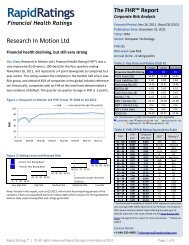

Section 1: Executive Summary<br />

YOY credit quality has improved: For the most recent<br />

period, the 12 months (rolling quarters) ended Dec 31, 2011,<br />

Ford Motor Co has experienced a strong improvement in<br />

financial health, as evidenced by a 17 point <strong>FHR</strong> increase,<br />

largely reflecting improvements delivered in overall<br />

profitability, cost structure and sales performance. The<br />

quarterly score change was a 4 point rise.<br />

Now Moderate Risk: At the same time, the rating now<br />

depicts a Moderate Risk credit profile as debt service<br />

management, overall profitability and cost structure are at<br />

high levels relative to the global data set. These areas<br />

represent key contributors to the overall strength of the<br />

company.<br />

Figure 3: Non-linear Risk Scale<br />

Highest<br />

Default<br />

Risk<br />

Lowest<br />

0 10 20 30 40 50 60 70 80 90 100<br />

Financial Health Rating<br />

Figure 3 indicates observed default incidences across the<br />

complete spectrum of <strong>FHR</strong> levels.<br />

50% of defaults occurred with an <strong>FHR</strong> below 25, while 80% were<br />

below 40.<br />

Name: Ford Motor Co<br />

<strong>FHR</strong>: 68<br />

Risk Level: Moderate Risk<br />

<strong>FHR</strong> Report<br />

Ford Motor Co, February 24, 2012<br />

Weaknesses: Ford Motor Co demonstrates weakness in<br />

leveraging, sales performance and working capital efficiency<br />

relative to the global industry set, and has done so<br />

traditionally as well as currently.<br />

The cash flow story is mixed: While Ford Motor Co<br />

generated positive cash from operations in the most recent<br />

period, overall performance was mixed. Although cash flow<br />

coverage of capital expenditures was exceptionally strong,<br />

free cash flow coverage of debt was only moderate.<br />

Very inconsistent history: From an historical perspective,<br />

Ford Motor Co has displayed a very inconsistent risk profile<br />

as the rating has moved within four different risk categories<br />

during the period (YE 2003 - YE 2011). Over that time the<br />

rating fluctuated from a high of 68 in FY 2011 to a low of 11<br />

in FY 2009. Ford Motor Co is currently an investment grade<br />

company.<br />

Moderate underperformance in generating returns: The<br />

Return on Capital Employed (ROCE) for the most recent<br />

period, which at 8.15% represents a moderate<br />

underperformance and is a modest decline as compared to<br />

the previous <strong>full</strong> year at 8.55%, is modestly below the high<br />

point of 8.96% achieved in Q1 2011. The range over the past<br />

three years has been between -13.66% and 8.96%.<br />

The bottom line: Ford Motor Co is situated in our<br />

Moderate Risk group, displays strength in three of our six<br />

performance categories, somewhat offset by moderate<br />

underperformance in ROCE, and was upgraded in the most<br />

recent period. This suggests that to those for whom Ford<br />

Motor Co represents an existing exposure, and/or for those<br />

considering Ford Motor Co as a new or increased exposure,<br />

such exposure represents a reasonable risk.<br />

<strong>Rapid</strong> <strong>Ratings</strong> | © All rights reserved <strong>Rapid</strong> <strong>Ratings</strong> International 2012 Page 2 of 9