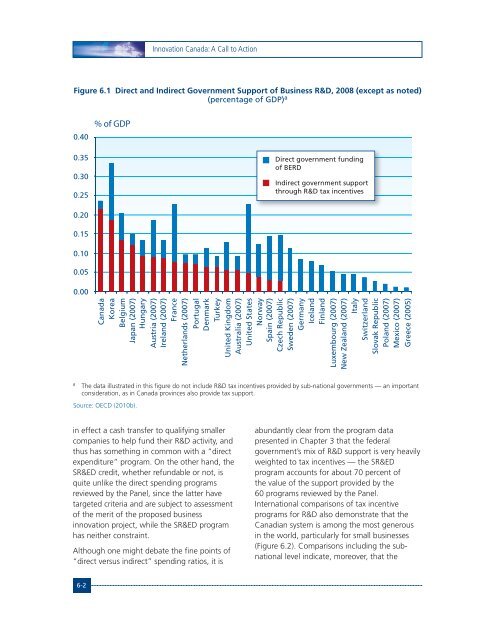

<strong>Innovation</strong> <strong>Canada</strong>: A <strong>Call</strong> <strong>to</strong> <strong>Action</strong>Figure 6.1 Direct and Indirect Government Support of Business R&D, 2008 (except as noted)(percentage of GDP) a0.40% of GDP0.350.300.25Direct government fundingof BERDIndirect government supportthrough R&D tax incentives0.200.150.100.050.00<strong>Canada</strong>KoreaBelgiumJapan (2007)HungaryAustria (2007)Ireland (2007)FranceNetherlands (2007)PortugalDenmarkTurkeyUnited KingdomAustralia (2007)United StatesNorwaySpain (2007)Czech RepublicSweden (2007)GermanyIcelandFinlandLuxembourg (2007)New Zealand (2007)ItalySwitzerlandSlovak RepublicPoland (2007)Mexico (2007)Greece (2005)aThe data illustrated in this figure do not include R&D tax incentives provided by sub-national governments — an importantconsideration, as in <strong>Canada</strong> provinces also provide tax support.Source: OECD (2010b).in effect a cash transfer <strong>to</strong> qualifying smallercompanies <strong>to</strong> help fund their R&D activity, andthus has something in common with a “directexpenditure” program. On the other hand, theSR&ED credit, whether refundable or not, isquite unlike the direct spending programsreviewed by the Panel, since the latter havetargeted criteria and are subject <strong>to</strong> assessmen<strong>to</strong>f the merit of the proposed businessinnovation project, while the SR&ED programhas neither constraint.Although one might debate the fine points of“direct versus indirect” spending ratios, it isabundantly clear from the program datapresented in Chapter 3 that the federalgovernment’s mix of R&D support is very heavilyweighted <strong>to</strong> tax incentives — the SR&EDprogram accounts for about 70 percent ofthe value of the support provided by the60 programs reviewed by the Panel.International comparisons of tax incentiveprograms for R&D also demonstrate that theCanadian system is among the most generousin the world, particularly for small businesses(Figure 6.2). Comparisons including the subnationallevel indicate, moreover, that the6-2

Program Mix and DesignBox 6.1 Direct Support Versus Indirect SupportThe OECD (2010a, p. 76) defines direct and indirect funding as follows: “Government directR&D funding includes grants, loans and procurement. Government indirect R&D fundingincludes tax incentives such as R&D tax credits.” In practical terms, the main distinctionbetween direct and indirect support is that the latter is open ended and is available <strong>to</strong> allfirms, whereas the former is limited in overall funding and is allocated by programadministra<strong>to</strong>rs <strong>to</strong> specific projects, industries or regions. Direct support can therefore betargeted <strong>to</strong> specific areas, contrary <strong>to</strong> more neutral indirect measures.It follows that the principal advantage of direct instruments lies in the ability <strong>to</strong> focussupport on ac<strong>to</strong>rs or activities considered more likely <strong>to</strong> achieve high social returns or <strong>to</strong>advance specific policy goals. Notwithstanding the benefits associated with this ability <strong>to</strong>strategically target resources, there are also some drawbacks <strong>to</strong> direct support measures. Inparticular, they generally involve more rigorous selection and evaluation processes, whichcan translate in<strong>to</strong> higher administration costs for government and compliance costs forbeneficiaries. Moreover, they can raise some concerns around the desirability of governments“picking winners” in the marketplace.Conversely, indirect measures are advantageous for the opposite reason. Since they arenon-discrimina<strong>to</strong>ry and widely available across firms, sec<strong>to</strong>rs, fields and activities, theymore closely conform <strong>to</strong> market rationality. Indirect measures are also generally easier andcheaper <strong>to</strong> implement. The flip side, however, is that they are less amenable <strong>to</strong> being steered<strong>to</strong>ward specific policy objectives.combination of federal and provincial tax creditsin <strong>Canada</strong> provides much higher subsidy ratesfor R&D than are available, for example, in USstates.The question therefore is whether <strong>Canada</strong> isrelying <strong>to</strong>o heavily on “indirect” tax expenditurein its overall mix of business innovation/R&Dsupport. The great advantage of a tax-basedapproach is that, once basic eligibility criteria aremet, it does not discriminate on the basis ofsec<strong>to</strong>r, region or specific opportunity. Since theSR&ED program is based on the tax system, i<strong>to</strong>perates “au<strong>to</strong>matically.” The tax incentivestimulates R&D generally, but leaves projectselection decisions <strong>to</strong> individual firms. Thegovernment does not try <strong>to</strong> pick the winners —the companies do. The strength of the programis also potentially its weakness. The tax credit isa blunt instrument. Not every R&D project willgenerate the same rate of social return; notevery R&D performer is equally in need ofstimulus or equally likely <strong>to</strong> be successful; andgovernments will often be well justified inseeking <strong>to</strong> promote, through targeted support,certain domains of innovation and R&D forstrategic purposes.Changing the Mix:More Direct SupportThe SR&ED program plays a fundamental role inlowering the costs of industrial R&D for firms,enhancing investment in R&D, and making<strong>Canada</strong> a more attractive place <strong>to</strong> locate R&Dactivity. However, a key implication of this heavyreliance on the program is that federal supportfor innovation may be overweighted <strong>to</strong>wardsubsidizing the cost of business R&D rather thanother important aspects of innovation. Inparticular, the Panel believes the federal6-3