Dynamic Risk Asset Allocation: Annual Report - Putnam Investments

Dynamic Risk Asset Allocation: Annual Report - Putnam Investments

Dynamic Risk Asset Allocation: Annual Report - Putnam Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

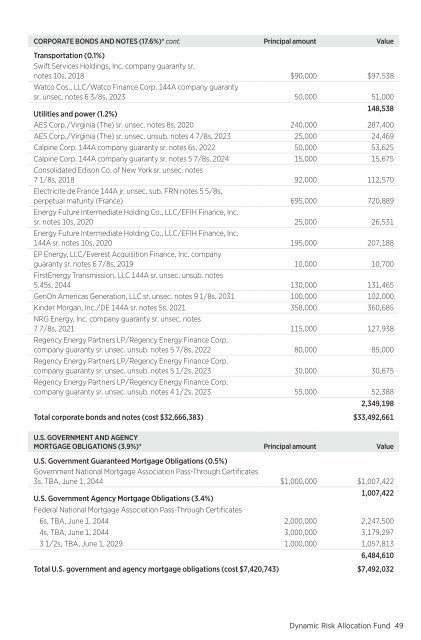

CORPORATE BONDS AND NOTES (17.6%)* cont. Principal amount ValueTransportation (0.1%)Swift Services Holdings, Inc. company guaranty sr.notes 10s, 2018 $90,000 $97,538Watco Cos., LLC/Watco Finance Corp. 144A company guarantysr. unsec. notes 6 3/8s, 2023 50,000 51,000Utilities and power (1.2%)148,538AES Corp./Virginia (The) sr. unsec. notes 8s, 2020 240,000 287,400AES Corp./Virginia (The) sr. unsec. unsub. notes 4 7/8s, 2023 25,000 24,469Calpine Corp. 144A company guaranty sr. notes 6s, 2022 50,000 53,625Calpine Corp. 144A company guaranty sr. notes 5 7/8s, 2024 15,000 15,675Consolidated Edison Co. of New York sr. unsec. notes7 1/8s, 2018 92,000 112,570Electricite de France 144A jr. unsec. sub. FRN notes 5 5/8s,perpetual maturity (France) 695,000 720,889Energy Future Intermediate Holding Co., LLC/EFIH Finance, Inc.sr. notes 10s, 2020 25,000 26,531Energy Future Intermediate Holding Co., LLC/EFIH Finance, Inc.144A sr. notes 10s, 2020 195,000 207,188EP Energy, LLC/Everest Acquisition Finance, Inc. companyguaranty sr. notes 6 7/8s, 2019 10,000 10,700FirstEnergy Transmission, LLC 144A sr. unsec. unsub. notes5.45s, 2044 130,000 131,465GenOn Americas Generation, LLC sr. unsec. notes 9 1/8s, 2031 100,000 102,000Kinder Morgan, Inc./DE 144A sr. notes 5s, 2021 358,000 360,685NRG Energy, Inc. company guaranty sr. unsec. notes7 7/8s, 2021 115,000 127,938Regency Energy Partners LP/Regency Energy Finance Corp.company guaranty sr. unsec. unsub. notes 5 7/8s, 2022 80,000 85,000Regency Energy Partners LP/Regency Energy Finance Corp.company guaranty sr. unsec. unsub. notes 5 1/2s, 2023 30,000 30,675Regency Energy Partners LP/Regency Energy Finance Corp.company guaranty sr. unsec. unsub. notes 4 1/2s, 2023 55,000 52,3882,349,198Total corporate bonds and notes (cost $32,666,383) $33,492,661U.S. GOVERNMENT AND AGENCYMORTGAGE OBLIGATIONS (3.9%)* Principal amount ValueU.S. Government Guaranteed Mortgage Obligations (0.5%)Government National Mortgage Association Pass-Through Certificates3s, TBA, June 1, 2044 $1,000,000 $1,007,422U.S. Government Agency Mortgage Obligations (3.4%)1,007,422Federal National Mortgage Association Pass-Through Certificates6s, TBA, June 1, 2044 2,000,000 2,247,5004s, TBA, June 1, 2044 3,000,000 3,179,2973 1/2s, TBA, June 1, 2029 1,000,000 1,057,8136,484,610Total U.S. government and agency mortgage obligations (cost $7,420,743) $7,492,032<strong>Dynamic</strong> <strong>Risk</strong> <strong>Allocation</strong> Fund49