Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

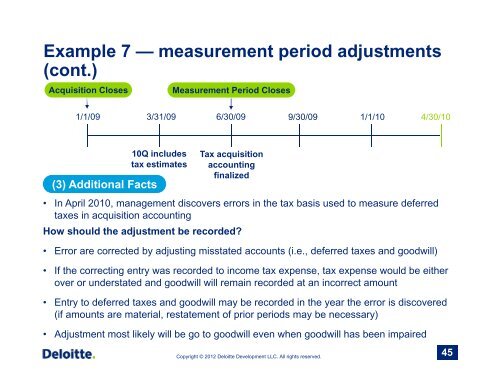

Example 7 — measurement period adjustments(cont.)<strong>Acquisition</strong> ClosesMeasurement Period Closes1/1/09 3/31/09 6/30/09 9/30/09 1/1/104/30/10(3) Additional Facts10Q includestax estimatesTax acquisitionaccountingfinalized• In April 2010, management discovers errors in the tax basis used to measure deferredtaxes in acquisition accountingHow should the adjustment be recorded?• Error are corrected by adjusting misstated accounts (i.e., deferred taxes and goodwill)• If the correcting entry was recorded to income tax expense, tax expense would be eitherover or understated and goodwill will remain recorded at an incorrect amount• Entry to deferred taxes and goodwill may be recorded in the year the error is discovered(if amounts are material, restatement of prior periods may be necessary)• Adjustment most likely will be go to goodwill even when goodwill has been impairedCopyright © 2012 <strong>Deloitte</strong> Development LLC. All rights reserved.45