Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

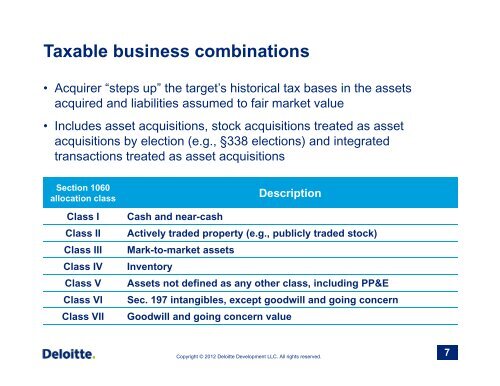

Taxable business combinations• Acquirer “steps up” the target’s historical tax bases in the assetsacquired and liabilities assumed to fair market value• Includes asset acquisitions, stock acquisitions treated as assetacquisitions by election (e.g., §338 elections) and integratedtransactions treated as asset acquisitionsSection 1060allocation classClass IClass IIClass IIIClass IVClass VClass VIClass VIIDescriptionCash and near-cashActively traded property (e.g., publicly traded stock)Mark-to-market assetsInventoryAssets not defined as any other class, including PP&ESec. 197 intangibles, except goodwill and going concernGoodwill and going concern valueCopyright © 2012 <strong>Deloitte</strong> Development LLC. All rights reserved.7