Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

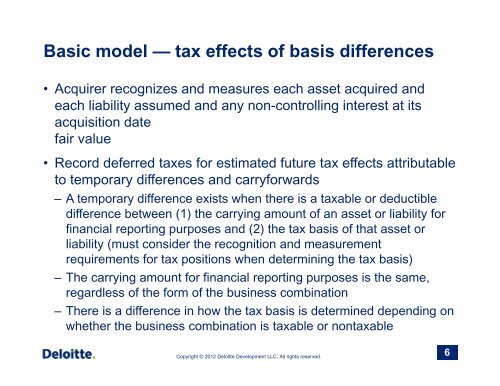

Basic model — tax effects of basis differences• Acquirer recognizes and measures each asset acquired andeach liability assumed and any non-controlling interest at itsacquisition datefair value• Record deferred taxes for estimated future tax effects attributableto temporary differences and carryforwards– A temporary difference exists when there is a taxable or deductibledifference between (1) the carrying amount of an asset or liability forfinancial reporting purposes and (2) the tax basis of that asset orliability (must consider the recognition and measurementrequirements for tax positions when determining the tax basis)– The carrying amount for financial reporting purposes is the same,regardless of the form of the business combination– There is a difference in how the tax basis is determined depending onwhether the business combination is taxable or nontaxableCopyright © 2012 <strong>Deloitte</strong> Development LLC. All rights reserved.6