Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

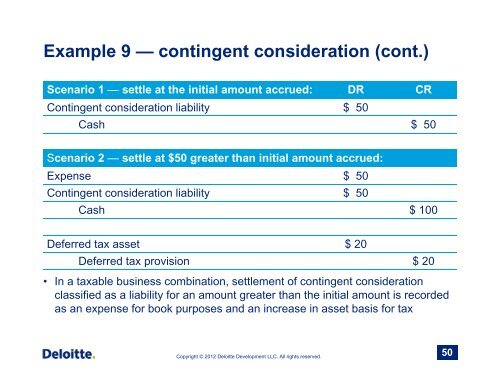

Example 9 — contingent consideration (cont.)Scenario 1 — settle at the initial amount accrued: DR CRContingent consideration liability $ 50Cash $ 50Scenario 2 — settle at $50 greater than initial amount accrued:Expense $ 50Contingent consideration liability $ 50Cash $ 100Deferred tax asset $ 20Deferred tax provision $ 20• In a taxable business combination, settlement of contingent considerationclassified as a liability for an amount greater than the initial amount is recordedas an expense for book purposes and an increase in asset basis for taxCopyright © 2012 <strong>Deloitte</strong> Development LLC. All rights reserved.50