Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

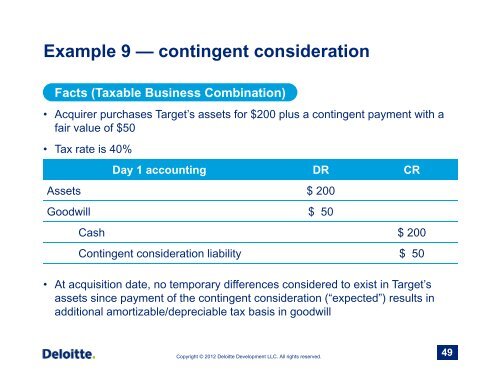

Example 9 — contingent considerationFacts (Taxable Business Combination)• Acquirer purchases Target’s assets for $200 plus a contingent payment with afair value of $50• Tax rate is 40%Day 1 accounting DR CRAssets $ 200Goodwill $ 50Cash $ 200Contingent consideration liability $ 50• At acquisition date, no temporary differences considered to exist in Target’sassets since payment of the contingent consideration (“expected”) results inadditional amortizable/depreciable tax basis in goodwillCopyright © 2012 <strong>Deloitte</strong> Development LLC. All rights reserved.49