Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

Deloitte FAS 141R-Acquisition Accounting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

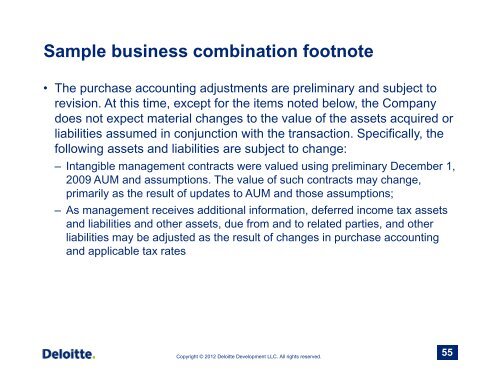

Sample business combination footnote• The purchase accounting adjustments are preliminary and subject torevision. At this time, except for the items noted below, the Companydoes not expect material changes to the value of the assets acquired orliabilities assumed in conjunction with the transaction. Specifically, thefollowing assets and liabilities are subject to change:– Intangible management contracts were valued using preliminary December 1,2009 AUM and assumptions. The value of such contracts may change,primarily as the result of updates to AUM and those assumptions;– As management receives additional information, deferred income tax assetsand liabilities and other assets, due from and to related parties, and otherliabilities may be adjusted as the result of changes in purchase accountingand applicable tax ratesCopyright © 2012 <strong>Deloitte</strong> Development LLC. All rights reserved.55