Tim Jerzyk Vice President Investor Relations - Yum!

Tim Jerzyk Vice President Investor Relations - Yum!

Tim Jerzyk Vice President Investor Relations - Yum!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

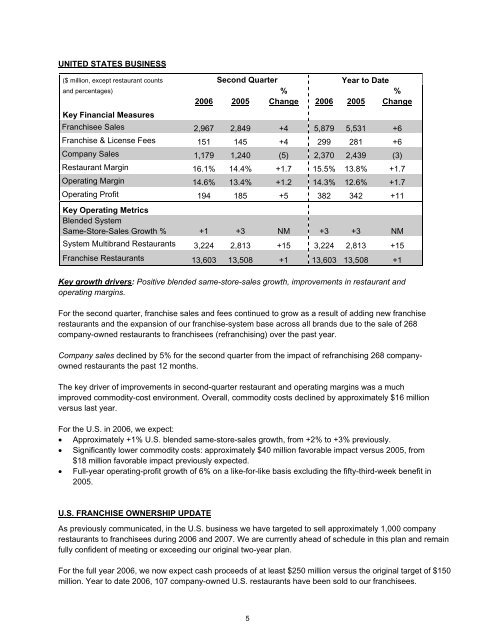

UNITED STATES BUSINESS($ million, except restaurant countsand percentages)Key Financial MeasuresSecond QuarterYear to Date%%2006 2005 Change 2006 2005 ChangeFranchisee Sales 2,967 2,849 +4 5,879 5,531 +6Franchise & License Fees 151 145 +4 299 281 +6Company Sales 1,179 1,240 (5) 2,370 2,439 (3)Restaurant Margin 16.1% 14.4% +1.7 15.5% 13.8% +1.7Operating Margin 14.6% 13.4% +1.2 14.3% 12.6% +1.7Operating Profit 194 185 +5 382 342 +11Key Operating MetricsBlended SystemSame-Store-Sales Growth % +1 +3 NM +3 +3 NMSystem Multibrand Restaurants 3,224 2,813 +15 3,224 2,813 +15Franchise Restaurants 13,603 13,508 +1 13,603 13,508 +1Key growth drivers: Positive blended same-store-sales growth, improvements in restaurant andoperating margins.For the second quarter, franchise sales and fees continued to grow as a result of adding new franchiserestaurants and the expansion of our franchise-system base across all brands due to the sale of 268company-owned restaurants to franchisees (refranchising) over the past year.Company sales declined by 5% for the second quarter from the impact of refranchising 268 companyownedrestaurants the past 12 months.The key driver of improvements in second-quarter restaurant and operating margins was a muchimproved commodity-cost environment. Overall, commodity costs declined by approximately $16 millionversus last year.For the U.S. in 2006, we expect:• Approximately +1% U.S. blended same-store-sales growth, from +2% to +3% previously.• Significantly lower commodity costs: approximately $40 million favorable impact versus 2005, from$18 million favorable impact previously expected.• Full-year operating-profit growth of 6% on a like-for-like basis excluding the fifty-third-week benefit in2005.U.S. FRANCHISE OWNERSHIP UPDATEAs previously communicated, in the U.S. business we have targeted to sell approximately 1,000 companyrestaurants to franchisees during 2006 and 2007. We are currently ahead of schedule in this plan and remainfully confident of meeting or exceeding our original two-year plan.For the full year 2006, we now expect cash proceeds of at least $250 million versus the original target of $150million. Year to date 2006, 107 company-owned U.S. restaurants have been sold to our franchisees.5