Property Times European Shopping Centres 2010 Shift to value-add ...

Property Times European Shopping Centres 2010 Shift to value-add ...

Property Times European Shopping Centres 2010 Shift to value-add ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

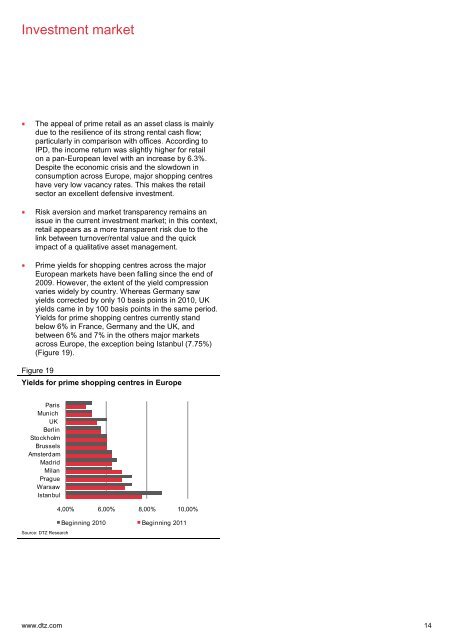

Investment marketThe appeal of prime retail as an asset class is mainlydue <strong>to</strong> the resilience of its strong rental cash flow;particularly in comparison with offices. According <strong>to</strong>IPD, the income return was slightly higher for retailon a pan-<strong>European</strong> level with an increase by 6.3%.Despite the economic crisis and the slowdown inconsumption across Europe, major shopping centreshave very low vacancy rates. This makes the retailsec<strong>to</strong>r an excellent defensive investment.Risk aversion and market transparency remains anissue in the current investment market; in this context,retail appears as a more transparent risk due <strong>to</strong> thelink between turnover/rental <strong>value</strong> and the quickimpact of a qualitative asset management.Prime yields for shopping centres across the major<strong>European</strong> markets have been falling since the end of2009. However, the extent of the yield compressionvaries widely by country. Whereas Germany sawyields corrected by only 10 basis points in <strong>2010</strong>, UKyields came in by 100 basis points in the same period.Yields for prime shopping centres currently standbelow 6% in France, Germany and the UK, andbetween 6% and 7% in the others major marketsacross Europe, the exception being Istanbul (7.75%)(Figure 19).Figure 19Yields for prime shopping centres in EuropeParisMunichUKBerlinS<strong>to</strong>ckholmBrusselsAmsterdamMadridMilanPragueWarsawIstanbulSource: DTZ Research4,00% 6,00% 8,00% 10,00%Beginning <strong>2010</strong> Beginning 2011www.dtz.com 14