Annual Fund Reports - Apr '08 - Mar ' - Tata AIA Life Insurance

Annual Fund Reports - Apr '08 - Mar ' - Tata AIA Life Insurance

Annual Fund Reports - Apr '08 - Mar ' - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

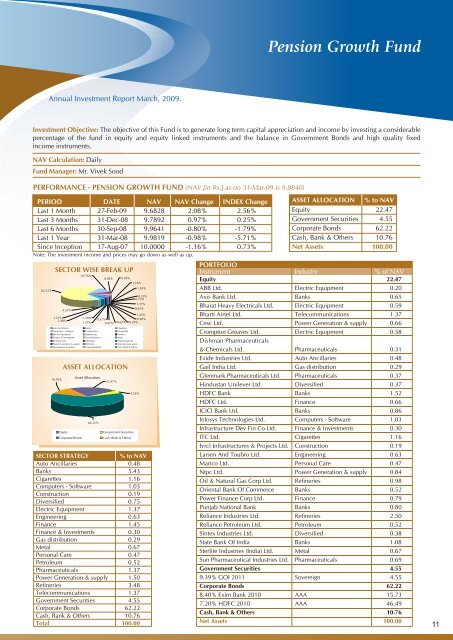

Pension Growth <strong>Fund</strong><strong>Annual</strong> Investment Report <strong>Mar</strong>ch, 2009.Investment Objective: The objective of this <strong>Fund</strong> is to generate long term capital appreciation and income by investing a considerablepercentage of the fund in equity and equity linked instruments and the balance in Government Bonds and high quality fixedincome instruments.NAV Calculation: Daily<strong>Fund</strong> Manager: Mr. Vivek SoodPERFORMANCE - PENSION GROWTH FUND (NAV [in Rs.] as on 31-<strong>Mar</strong>-09 is 9.8840)PERIOD DATE NAV NAV Change INDEX ChangeLast 1 Month 27-Feb-09 9.6828 2.08% 2.56%Last 3 Months 31-Dec-08 9.7892 0.97% 0.25%Last 6 Months 30-Sep-08 9.9641 -0.80% -1.79%Last 1 Year 31-<strong>Mar</strong>-08 9.9819 -0.98% -5.71%Since Inception 17-Aug-07 10.0000 -1.16% 0.73%Note: The investment income and prices may go down as well as up.62.22%SECTOR WISE BREAK UP1.37%3.48%4.55%10.76%1.50%1.37%0.48%0.52%0.47%5.43%0.67%Auto Ancillaries Banks CigarettesComputers - Software Construction DiversifiedElectric Equipment Engineering FinanceFinance & Investments Gas distribution MetalPersonal Care Petroleum PharmaceuticalsASSET ALLOCATION1.16%Power Generation & supply Refineries TelecommunicationsGovernment Securities Corporate Bonds Cash, Bank & Others10.76%EquityCorporate BondsAsset Allocation62.22%22.47%Government SecuritiesCash, Bank & Others1.03%0.19%0.75%1.37%0.63%1.45%0.30%0.29%4.55%SECTOR STRATEGY% to NAVAuto Ancillaries 0.48Banks 5.43Cigarettes 1.16Computers - Software 1.03Construction 0.19Diversified 0.75Electric Equipment 1.37Engineering 0.63Finance 1.45Finance & Investments 0.30Gas distribution 0.29Metal 0.67Personal Care 0.47Petroleum 0.52Pharmaceuticals 1.37Power Generation & supply 1.50Refineries 3.48Telecommunications 1.37Government Securities 4.55Corporate Bonds 62.22Cash, Bank & Others 10.76Total 100.00ASSET ALLOCATION % to NAVEquity 22.47Government Securities 4.55Corporate Bonds 62.22Cash, Bank & Others 10.76Net Assets 100.00PORTFOLIOInstrumentIndustry% of NAVEquity 22.47ABB Ltd. Electric Equipment 0.20Axis Bank Ltd. Banks 0.65Bharat Heavy Electricals Ltd. Electric Equipment 0.59Bharti Airtel Ltd. Telecommunications 1.37Cesc Ltd. Power Generation & supply 0.66Crompton Greaves Ltd. Electric Equipment 0.58Dishman Pharmaceuticals& Chemicals Ltd. Pharmaceuticals 0.31Exide Industries Ltd. Auto Ancillaries 0.48Gail India Ltd. Gas distribution 0.29Glenmark Pharmaceuticals Ltd. Pharmaceuticals 0.37Hindustan Unilever Ltd. Diversified 0.37HDFC Bank Banks 1.52HDFC Ltd. Finance 0.66ICICI Bank Ltd. Banks 0.86Infosys Technologies Ltd. Computers - Software 1.03Infrastructure Dev Fin Co Ltd. Finance & Investments 0.30ITC Ltd. Cigarettes 1.16Ivrcl Infrastructures & Projects Ltd. Construction 0.19Larsen And Toubro Ltd. Engineering 0.63<strong>Mar</strong>ico Ltd. Personal Care 0.47Ntpc Ltd. Power Generation & supply 0.84Oil & Natural Gas Corp Ltd. Refineries 0.98Oriental Bank Of Commerce Banks 0.52Power Finance Corp Ltd. Finance 0.79Punjab National Bank Banks 0.80Reliance Industries Ltd. Refineries 2.50Reliance Petroleum Ltd. Petroleum 0.52Sintex Industries Ltd. Diversified 0.38State Bank Of India Banks 1.08Sterlite Industries (India) Ltd. Metal 0.67Sun Pharmaceutical Industries Ltd. Pharmaceuticals 0.69Government Securities 4.559.39% GOI 2011 Sovereign 4.55Corporate Bonds 62.228.40% Exim Bank 2010 AAA 15.737.20% HDFC 2010 AAA 46.49Cash, Bank & Others 10.76Net Assets 100.0011