Annual Fund Reports - Apr '08 - Mar ' - Tata AIA Life Insurance

Annual Fund Reports - Apr '08 - Mar ' - Tata AIA Life Insurance

Annual Fund Reports - Apr '08 - Mar ' - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

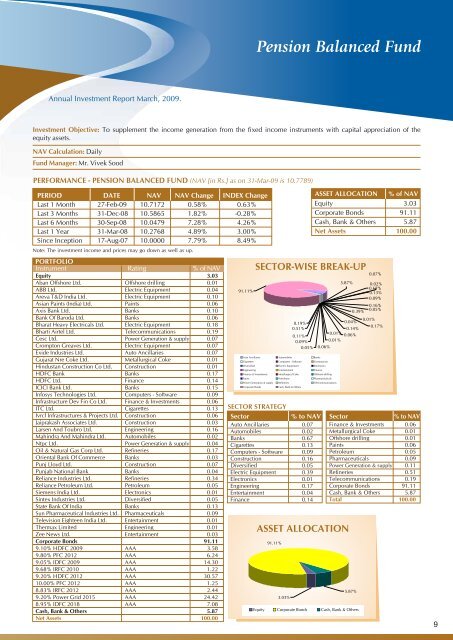

Pension Balanced <strong>Fund</strong><strong>Annual</strong> Investment Report <strong>Mar</strong>ch, 2009.Investment Objective: To supplement the income generation from the fixed income instruments with capital appreciation of theequity assets.NAV Calculation: Daily<strong>Fund</strong> Manager: Mr. Vivek SoodPERFORMANCE - PENSION BALANCED FUND (NAV [in Rs.] as on 31-<strong>Mar</strong>-09 is 10.7789)PERIOD DATE NAV NAV Change INDEX ChangeLast 1 Month 27-Feb-09 10.7172 0.58% 0.63%Last 3 Months 31-Dec-08 10.5865 1.82% -0.28%Last 6 Months 30-Sep-08 10.0479 7.28% 4.26%Last 1 Year 31-<strong>Mar</strong>-08 10.2768 4.89% 3.00%Since Inception 17-Aug-07 10.0000 7.79% 8.49%Note: The investment income and prices may go down as well as up.PORTFOLIOInstrumentRating% of NAVEquity 3.03Aban Offshore Ltd. Offshore drilling 0.01ABB Ltd. Electric Equipment 0.04Areva T&D India Ltd. Electric Equipment 0.10Asian Paints (India) Ltd. Paints 0.06Axis Bank Ltd. Banks 0.10Bank Of Baroda Ltd. Banks 0.06Bharat Heavy Electricals Ltd. Electric Equipment 0.18Bharti Airtel Ltd. Telecommunications 0.19Cesc Ltd. Power Generation & supply 0.07Crompton Greaves Ltd. Electric Equipment 0.07Exide Industries Ltd. Auto Ancillaries 0.07Gujarat Nre Coke Ltd. Metallurgical Coke 0.01Hindustan Construction Co Ltd. Construction 0.01HDFC Bank Banks 0.17HDFC Ltd. Finance 0.14ICICI Bank Ltd. Banks 0.15Infosys Technologies Ltd. Computers - Software 0.09Infrastructure Dev Fin Co Ltd. Finance & Investments 0.06ITC Ltd. Cigarettes 0.13Ivrcl Infrastructures & Projects Ltd. Construction 0.06Jaiprakash Associates Ltd. Construction 0.03Larsen And Toubro Ltd. Engineering 0.16Mahindra And Mahindra Ltd. Automobiles 0.02Ntpc Ltd. Power Generation & supply 0.04Oil & Natural Gas Corp Ltd. Refineries 0.17Oriental Bank Of Commerce Banks 0.03Punj Lloyd Ltd. Construction 0.07Punjab National Bank Banks 0.04Reliance Industries Ltd. Refineries 0.34Reliance Petroleum Ltd. Petroleum 0.05Siemens India Ltd. Electronics 0.01Sintex Industries Ltd. Diversified 0.05State Bank Of India Banks 0.13Sun Pharmaceutical Industries Ltd. Pharmaceuticals 0.09Television Eighteen India Ltd. Entertainment 0.01Thermax Limited Engineering 0.01Zee News Ltd. Entertainment 0.03Corporate Bonds 91.119.10% HDFC 2009 AAA 3.589.80% PFC 2012 AAA 6.249.05% IDFC 2009 AAA 14.309.68% IRFC 2010 AAA 1.229.20% HDFC 2012 AAA 30.5710.00% PFC 2012 AAA 1.258.83% IRFC 2012 AAA 2.449.20% Power Grid 2015 AAA 24.428.95% IDFC 2018 AAA 7.08Cash, Bank & Others 5.87Net Assets 100.0091.11%SECTOR STRATEGYSectorAuto Ancillaries 0.07Automobiles 0.02Banks 0.67Cigarettes 0.13Computers - Software 0.09Construction 0.16Diversified 0.05Electric Equipment 0.39Electronics 0.01Engineering 0.17Entertainment 0.04Finance 0.14ASSET ALLOCATION % of NAVEquity 3.03Corporate Bonds 91.11Cash, Bank & Others 5.87Net Assets 100.00SECTOR-WISE BREAK-UP0.19%0.51%0.11%0.09%0.05%Auto Ancillaries Automobiles Banks0.06%Cigarettes Computers - Software ConstructionDiversified Electric Equipment ElectronicsEngineering Entertainment FinanceFinance & Investments Metallurgical Coke Offshore drillingPaints Petroleum Pharmaceuticals0.01%0.01%Power Generation & supply Refineries TelecommunicationsCorporate BondsCash, Bank & Others5.87%% to NAV SectorASSET ALLOCATION91.11%3.03%0.04%0.39%0.14%0.06%0.02%0.67%0.13%0.09%0.16%0.05%0.01%0.07%0.17%% to NAVFinance & Investments 0.06Metallurgical Coke 0.01Offshore drilling 0.01Paints 0.06Petroleum 0.05Pharmaceuticals 0.09Power Generation & supply 0.11Refineries 0.51Telecommunications 0.19Corporate Bonds 91.11Cash, Bank & Others 5.87Total 100.005.87%Equity Corporate Bonds Cash, Bank & Others9