September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

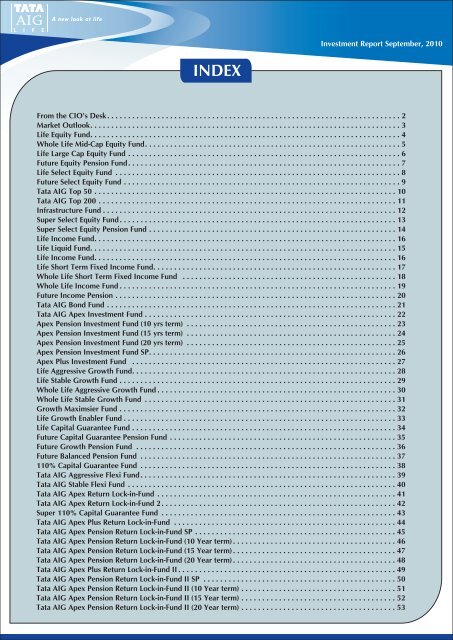

Investment Report <strong>September</strong>, 2010INDEXFrom the CIO's Desk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Market Outlook. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3<strong>Life</strong> Equity Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Whole <strong>Life</strong> Mid-Cap Equity Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5<strong>Life</strong> Large Cap Equity Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Future Equity Pension Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7<strong>Life</strong> Select Equity Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Future Select Equity Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9<strong>Tata</strong> AIG Top 50 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10<strong>Tata</strong> AIG Top 200 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11Infrastructure Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12Super Select Equity Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13Super Select Equity Pension Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14<strong>Life</strong> Income Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16<strong>Life</strong> Liquid Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15<strong>Life</strong> Income Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16<strong>Life</strong> Short Term Fixed Income Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17Whole <strong>Life</strong> Short Term Fixed Income Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18Whole <strong>Life</strong> Income Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19Future Income Pension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20<strong>Tata</strong> AIG Bond Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21<strong>Tata</strong> AIG Apex Investment Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22Apex Pension Investment Fund (10 yrs term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23Apex Pension Investment Fund (15 yrs term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24Apex Pension Investment Fund (20 yrs term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25Apex Pension Investment Fund SP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26Apex Plus Investment Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27<strong>Life</strong> Aggressive Growth Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28<strong>Life</strong> Stable Growth Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29Whole <strong>Life</strong> Aggressive Growth Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30Whole <strong>Life</strong> Stable Growth Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31Growth Maximsier Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32<strong>Life</strong> Growth Enabler Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33<strong>Life</strong> Capital Guarantee Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34Future Capital Guarantee Pension Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35Future Growth Pension Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36Future Balanced Pension Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37110% Capital Guarantee Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38<strong>Tata</strong> AIG Aggressive Flexi Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39<strong>Tata</strong> AIG Stable Flexi Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40<strong>Tata</strong> AIG Apex Return Lock-in-Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41<strong>Tata</strong> AIG Apex Return Lock-in-Fund 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42Super 110% Capital Guarantee Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43<strong>Tata</strong> AIG Apex Plus Return Lock-in-Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44<strong>Tata</strong> AIG Apex Pension Return Lock-in-Fund SP . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45<strong>Tata</strong> AIG Apex Pension Return Lock-in-Fund (10 Year term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46<strong>Tata</strong> AIG Apex Pension Return Lock-in-Fund (15 Year term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47<strong>Tata</strong> AIG Apex Pension Return Lock-in-Fund (20 Year term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48<strong>Tata</strong> AIG Apex Plus Return Lock-in-Fund II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49<strong>Tata</strong> AIG Apex Pension Return Lock-in-Fund II SP . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50<strong>Tata</strong> AIG Apex Pension Return Lock-in-Fund II (10 Year term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51<strong>Tata</strong> AIG Apex Pension Return Lock-in-Fund II (15 Year term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52<strong>Tata</strong> AIG Apex Pension Return Lock-in-Fund II (20 Year term) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

From the CIO’s DeskInvestment Report <strong>September</strong>, 2010Dear Friends,<strong>September</strong> 2010 saw the Indian equity markets regain the 20,000 levels after a gap of almost 30months due to strong capital flows, mainly from the FIIs, who are keen to have a slice of the Indiagrowth story.On 16th Sep 2010, the RBI hiked the repo rate by 25 bps to 6.00% and the reverse repo by 50 bps to 5.00% therebynarrowing the rate corridor to 100 bps, the lowest in the last few years .While 25bps hike was expected, additional hikeof 25bps in Reverse repo was a surprise.The government announced its borrowing calendar for the second half of the financial year, reducing the amount by`100 billion as compared to the earlier budget. The borrowing now stands at `1.63 trillion for the second half, `2.84trillion being the first half borrowing. The bond markets rallied on this development.The FII investment cap on government securities (with residual maturity greater than five years) and corporate bondshave been increased by US$5 bn, taking the respective cap to US$10 bn and US$20 bn. This would bring in moreinflows and ease the pressure on the Current account.The cumulative rainfall for the period June 1st 2010 till Sep 22nd 2010 was at 4% above long period average. The firstadvance estimates of Kharif (summer) crop production for FY2011 shows a significant pick up from FY2010. Food grainproduction is expected to increase by 10% from FY2010.The Index of Industrial Production (IIP) rebounded to 13.8% in July after dipping to 5.9% in June, reflecting buoyancyin the economy.The new series of headline WPI inflation points to a moderating trend, apart from being more broad based andrepresenting the current consumption basket. The headline inflation in the new series came in 100 bps lower than theold series, at 8.5% YoY in August 2010.India stands out amidst global slowdown; and seems to be a preferred destination to emerging market flows as itsgrowth dynamics is predominantly driven by domestic demand. Foreign investors have put in more than US$ 6.4bn inthe month of <strong>September</strong> 2010 taking the overall investment in the year to US$ 19.2 bn.The India growth story is in stark contrast to the muted economic recovery in the US and Europe. The Fed finallyacknowledged the risk of deflation in its post-FOMC press brief, maintaining to be in a stand-by mode for furtherquantitative easing, should the risk of deflation increase significantly. ECB too warned of a slowdown ahead, even afterraising the annual growth estimate.At the current market levels, we believe that the valuations are rich and will look reasonable only as the marketdiscounts the FY 2012 earnings, which would happen in the next 2-3 quarters.I take this opportunity to convey that the Assets under management has crossed `11,500 crores as of Sep 30th 2010,an indication of the confidence shown by our esteemed policyholders in our fund performance.Saravana KumarChief Investment Officer2

Market OutlookInvestment Report <strong>September</strong>, 2010INVESTMENT PHILOSOPHYInvestment Objective : To Generate a superior and consistent risk adjusted investment returns to meet investors long term objective andreturn expectation.The foundation of the investment philiosophy rests on the following tenets:We have a long term view based on fundamental research to meet our investor's long term objectivesWe follow a well defined research process & methodology with rigourWe have a largely bottom up stock picking to identify quality stocks at reasonable valuationsWe follow the same philosophy used for Balance sheet and third party investmentThese make us well suited for insurance and pension fund investment.DEBT MARKET OUTLOOKn 16th Sep 2010, the RBI hiked the repo rate by 25 bps to 6% and reverse repo rate by 50 bps to 5% narrowing the Liquidity Adjustment Facility-LAF corridor toO100 bps. The higher raise in reverse repo rate effectively raised the floor of interest rates in the system; sending a stronger anti-inflationary signal. This willeffectively reduce the band in which short-term rates are likely to trade. We expect a further 25bps hike on Nov 2nd, 2010.As expected, India has hiked the FII limit in corporate bonds and government bonds (with residual maturity of more than 5 years), by US$5bn to US$20bn andUS$10bn, respectively. The latest move is in line with India's strategy of gradual opening up of the capital account of the balance of payments and to further developthe debt markets. There is a strong demand for local currency debt, given the much higher government bond yields compared to those in the developed world andexpectations of the rupee to appreciate. The 10-year government bond yield in India is around 540bp higher than what it is in the US. In the current calendar year (asof 23rd <strong>September</strong> 2010), net FII investment in debt stands at US$ 9.8bn, the inflow in debt has surged from a mere US$1bn in 2009.The WPI inflation on the new base fell sharply to 8.51% for August 2010 from 9.78% in July 2010. In the old WPI series with base FY1994, the WPI inflation wouldhave fallen to 9.51% in August from 9.98% in July. More significantly, manufacturing inflation in August in new base is only 4.78% in the new index versus 6.17% inJuly as per old base. WPI inflation, primarily driven by high food inflation, is likely to ease further in the next few months on the back of an expected good kharif(summer) crop. Area sown under FY 2011 kharif crops is significantly higher by 10% as compared to the corresponding period of FY 2010.IIP growth in July' 2010, at 13.8%, came in significantly ahead of consensus estimates of 7.8%. The rebound was led by the capital goods sector that grew by a robust63% YoY in July 2010. IIP is likely to continue in the high growth trajectory in the ensuing months too. The cumulative IIP growth for the first four months of FY 2011stood at 11.4%, significantly higher as compared with 4.7% registered during the corresponding period of FY 2010. Going forward, improved domestic demand anddiminishing inflationary expectations in the coming months, can help IIP register double digit growth in FY 2011 too (IIP growth in FY2010 was at 10.4% YoY).The Indian federal government will borrow `100bn less in the 2nd half of the current fiscal year (2010-11) than previously budgeted. The borrowing is now pegged at`1.63 trillion in the six months beginning October 1st, 2010. The lower borrowing owes to the windfall from the auction of telecom licences and buoyant revenuecollection given the strength of economic recovery. In its Budget announced in February 2010, the federal government had planned gross borrowing of `4.57 trillion(net borrowing of `3.45 trillion). It has completed gross borrowing of `2.84 trillion so far.The government will meet its fiscal deficit target of 5.5% of GDP in 2010-11 from a revised 6.6% of GDP in 2009-10. Improving fiscal finances have three mainpositive implications: (1) greater scope for government bond yields to ease (2) lower the risk of government borrowing crowding out credit to the private sector and(3) higher probability of a sustainable upturn in India's investment cycle.The 10 year G-Sec breached the 8% mark post the RBI hike in the policy rates and rallied to 7.85% levels post the announcement of reduced second half borrowing andincrease in FII limits. With the expectation of a 25 bps rate hike on Nov 2nd, which is already factored in the yield curve, the 10 year would trade in a range of 7.80%-8.00%.EQUITY MARKET OUTLOOKhe month of <strong>September</strong> 2010 was dominated by the stellar performance of the benchmark indices, Nifty and the Sensex clocking double digit returns. TheTbroader markets, reflected by the CNX Midcap index demonstrated more muted returns of just over 4%.The indices were powered by FII inflows in <strong>September</strong> 2010, as Indian growth story was getting a fair share of emerging market allocation from the FIIs. All sectorsdelivered positive performance for the month. FII inflows in the cash market surged to a record level ( in excess of US$6.4 billion), while domestic institutions sold arecord level of shares (at US$2.9 billion) during the month.Year to date, foreign institutions have bought stock worth US$19.2 billion whereas domestic institutions have sold US$2.6 billion in the cash market. MSCI India'svaluations touched a 31-month high at the end of <strong>September</strong> 2010 and are trading at a 68% premium to the MSCI Emerging market valuations.Mergers and Acquisition activity picked up in August and touched a 31-month high. Macro indicators remained robust with IIP growth accelerating to 13.8% YoY inJuly, inflation coming off highs, and credit growth accelerating to a 21-month high.The second quarter revenues are expected to be robust as domestic consumption drivers are intact, but the margins will be under pressure due to rising input costs.Steel, Aluminum and Crude have registered double digit price increases on a year on year basis and the companies are passing on prices to the customer on a laggedbasis.The consumption story is playing itself out on the back of a strong off take in rural demand, as autumn farm income growth could increase by a fourth, with a betterthan-expectedharvest likely in October-November 2010. Summer farm income growth has already doubled in 2010 to 18.9% from 2009 on agricultural inflationagflation.While rains are lowering agflation, they are also compensating the farmer by watering a much larger crop, resulting in higher rural incomes, their by higherrural demand, which could buffer the economy against a possible global slowdown.As the equity markets are currently trading at stretched valuations, a robust second quarter number is crucial to sustain the market fundamentals as markets transition todiscounting the FY 2012 EPS in the next 6 months. The third and fourth quarter numbers will also be closely monitored as the base effect will come off sharply by thattime.3

<strong>Life</strong> Large Cap Equity FundInvestment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthFund PerformanceSizeLargeMidSmallInvestment Objective :Fund ManagerNAV as on 30 Sep, 10 : `11.71Fund DetailsThe primary investment objective of the fund is togenerate long-term capital appreciation from aportfolio that is invested pre-dominantly in equityand equity linked securities.: Mr. Saravana KumarBenchmark : NSE Nifty 50 Index - 100%Corpus as on 30 Sep, 10 : 583.35 Crs.Asset AllocationPERIOD DATE NAVNSE Nifty50 IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 10.69 5402.40 9.56% 11.62%Last 3 Months 30-Jun-10 10.41 5312.50 12.53% 13.50%Last 6 Months 31-Mar-10 10.09 5249.10 16.11% 14.88%5.76%1.56%92.69%EquityCash, Bank & OthersCD/CP’sLast 1 Year 30-Sep-09 9.63 5083.95 21.66% 18.61%Since Inception 07-Jan-08 10.00 6279.10 5.96% -1.47%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationBanks21.30%IT - Software11.28%AutomobileRefineriesPharmaceuticalsSteel6.85%6.34%5.83%4.72%Asset MixCapital Goods - Electrical EquipmentTobacco ProductsCapital Goods-Non Electrical EquipmentNon Ferrous MetalsCrude Oil & Natural GasFinanceDiversified4.68%4.52%4.49%3.35%3.04%2.51%2.17%Instrument Asset Mix as per F&U Actual Asset MixEquity Upto 100%93%Debt * Upto 100%7%Cash & Money Market ** Upto 100% 7%Gas DistributionPower Generation & DistributionRealty1.76%1.67%1.59%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsConsumer Durables1.41%Auto Ancillaries1.19%Cement1.07%Others2.92%CD/CP's1.56%Cash Bank & Others5.76%0.00% 5.00% 10.00% 15.00% 20.00% 25.00%PortfolioInstrument Industry % of NAVEquity 92.69Infosys Technologies Ltd IT - Software 7.43Housing Development Finance Corp Bank Banks 6.19Reliance Industries Ltd Refineries 5.89ITC Ltd Tobacco Products 4.52ICICI Bank Ltd Banks 4.48Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 3.87State Bank of India Banks 3.34Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.04Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.04Bank of Baroda Banks 2.84Mahindra and Mahindra Ltd Automobile 2.37JSW Steel Limited Steel 2.26<strong>Tata</strong> Motors Ltd Automobile 2.26Sterlite Industries (India) Ltd Non Ferrous Metals 2.00Gail India Ltd Gas Distribution 1.76Dr Reddys Laboratories Ltd Pharmaceuticals 1.67HCL Technologies Ltd IT - Software 1.66Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.65Crompton Greaves Ltd Capital Goods - Electrical Equipment 1.64Housing Development Finance Corp Ltd Finance 1.63Sintex Industries Ltd Diversified 1.58Instrument Industry % of NAV<strong>Tata</strong> Steel Ltd Steel 1.56Wipro Ltd IT - Software 1.46Punjab National Bank Banks 1.44Cipla Ltd Pharmaceuticals 1.38Hindalco Industries Ltd Non Ferrous Metals 1.35Titan Industries Ltd Consumer Durables 1.23Axis Bank Ltd Banks 1.22Maruti Suzuki India Ltd Automobile 1.21Exide Industries Ltd Auto Ancillaries 1.19Divi'S Laboratories Ltd Pharmaceuticals 1.13Jaiprakash Associates Ltd Realty 1.10Ultratech Cement Ltd Cement 1.07Union Bank of India Banks 1.07Bajaj Auto Ltd - New Shs Automobile 1.01Other Equity(less than 1.00% of corpus) 10.15CD/CP's 1.56State Bank of Mysore 2011 - CD P1+ 0.75State Bank of Patiala 2010 - CD P1+ 0.41Bank of Baroda 2010 - CD P1+ 0.41Cash Bank & Others 5.76Net Assets 100.006

Future Equity Pension FundInvestment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthFund PerformanceSizeLargeMidSmallInvestment Objective :Fund ManagerNAV as on 30 Sep, 10 : `13.48Fund DetailsThe primary investment objective of the fund is togenerate long-term capital appreciation from aportfolio that is invested pre-dominantly in equityand equity-linked securities.: Mr. Saravana KumarBenchmark : NSE Nifty 50 Index - 100%Corpus as on 30 Sep, 10 : 200.23 Crs.Asset AllocationPERIOD DATE NAVNSE Nifty50 IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 12.36 5402.40 9.10% 11.62%Last 3 Months 30-Jun-10 11.88 5312.50 13.53% 13.50%Last 6 Months 31-Mar-10 11.51 5249.10 17.11% 14.88%93.46%EquityCash, Bank & OthersLast 1 Year 30-Sep-09 10.89 5083.95 23.84% 18.61%Since Inception 04-Feb-08 10.00 5463.50 11.91% 3.79%6.54%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationBanksIT - SoftwareRefineriesAutomobileCapital Goods - Electrical EquipmentCrude Oil & Natural GasTobacco ProductsCapital Goods-Non Electrical EquipmentFinanceSteelDiversifiedPharmaceuticalsPower Generation & DistributionGas DistributionNon Ferrous MetalsPaints/VarnishRealtyAuto AncillariesTelecomm-ServiceTextilesConsumer DurablesCementOthersCash Bank & Others6.66%5.47%5.04%4.74%4.45%4.31%3.92%3.69%3.27%2.99%2.59%2.14%1.50%1.46%1.32%1.14%1.10%1.07%1.02%1.00%2.58%6.54%11.55%20.45%Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 80% - 100% 93%Debt * Upto 20%7%Cash & Money Market ** Upto 20% 7%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets0.00% 5.00% 10.00% 15.00% 20.00% 25.00%PortfolioInstrument Industry % of NAVEquity 93.46Infosys Technologies Ltd IT - Software 6.86Reliance Industries Ltd Refineries 6.66ICICI Bank Ltd Banks 5.56Housing Development Finance Corp Bank Banks 4.97ITC Ltd Tobacco Products 4.45State Bank of India Banks 4.45Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.31Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.09Housing Development Finance Corp Ltd Finance 3.02Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 2.98Axis Bank Ltd Banks 2.30<strong>Tata</strong> Steel Ltd Steel 2.28<strong>Tata</strong> Motors Ltd Automobile 2.08Mahindra and Mahindra Ltd Automobile 2.07Bank of Baroda Banks 1.96Crompton Greaves Ltd Capital Goods - Electrical Equipment 1.95HCL Technologies Ltd IT - Software 1.58Sterlite Industries (India) Ltd Non Ferrous Metals 1.50Instrument Industry % of NAVSintex Industries Ltd Diversified 1.48Asian Paints (India) Ltd Paints/Varnish 1.46Gail India Ltd Gas Distribution 1.43Jindal Steel & Power Ltd Steel 1.41Wipro Ltd IT - Software 1.35Bajaj Auto Ltd - New Shs Automobile 1.32NTPC Ltd Power Generation & Distribution 1.30Mphasis Ltd IT - Software 1.24Exide Industries Ltd Auto Ancillaries 1.14Bharti Airtel Ltd Telecomm-Service 1.10Aditya Birla Nuvo Ltd Textiles 1.07Punjab National Bank Banks 1.03<strong>Tata</strong> Power Co Ltd Power Generation & Distribution 1.02Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.01Dr Reddys Laboratories Ltd Pharmaceuticals 1.01Ultratech Cement Ltd Cement 1.00Other Equity(less than 1.00% of corpus) 12.02Cash Bank & Others 6.54Net Assets 100.007

<strong>Life</strong> Select Equity FundInvestment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthFund PerformanceSizeLargeMidSmallFund DetailsInvestment Objective : The primary investment objective of the fund is to p r o v i d eincome distribution over a period of medium to long termwhile at all times emphasizing the importance of capitalappreciation. The fund will invest significant amount inequity and equity linked instruments specifically excludingcompanies predominantly dealing in Gambling,Lotteries/Contests, Animal Produce, Liquor, T o b a c c o ,Entertainment (Films, TV etc) Hotels, Banks and FinancialInstitutions.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 10 : `18.40Benchmark : S & P India 500 Shariah Index - 100%Corpus as on 30 Sep, 10 : 117.10 Crs.Asset AllocationPERIOD DATE NAVS & P India 500Shariah IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 17.16 1287.72 7.28% 8.47%Last 3 Months 30-Jun-10 17.07 1308.04 7.79% 6.79%Last 6 Months 31-Mar-10 16.21 1274.90 13.55% 9.56%93.11%EquityCash, Bank & Others( Non Interest BearingSecurities)Last 1 Year 30-Sep-09 14.90 1210.84 23.53% 15.36%Since Inception 06-Oct-08 10.00 844.46 36.00% 28.88%6.89%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationIT - SoftwarePharmaceuticalsFMCGRefineriesCapital Goods - Electrical EquipmentCapital Goods-Non Electrical EquipmentCrude Oil & Natural GasAuto AncillariesGas DistributionConsumer DurablesAutomobileSteelTelecomm-ServiceChemicalsPaints/VarnishCementPower Generation & DistributionDiversifiedLogisticsCash Bank & Others( Non Interest Bearing Securities)8.15%7.59%6.97%5.42%5.24%4.63%4.26%3.71%3.58%3.12%2.50%2.30%2.27%2.27%2.22%1.03%0.54%6.89%12.75%14.56%Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity Upto 100% 93%Debt * Upto 100% 7%Cash & Money Market ** Upto 100% 7%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%PortfolioInstrument Industry % of NAVEquity 93.11Reliance Industries Ltd Refineries 7.59Infosys Technologies Ltd IT - Software 7.55Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.73Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.70Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.48Titan Industries Ltd Consumer Durables 2.80Hindustan Unilever Ltd FMCG 2.64Cadila Healthcare Ltd Pharmaceuticals 2.52Bharti Airtel Ltd Telecomm-Service 2.50Glaxosmithkline Consumer Healthcare Ltd FMCG 2.42Crompton Greaves Ltd Capital Goods - Electrical Equipment 2.40Divi'S Laboratories Ltd Pharmaceuticals 2.36Castrol India Ltd Chemicals 2.30Ultratech Cement Ltd Cement 2.27Asian Paints (India) Ltd Paints/Varnish 2.27Lupin Ltd Pharmaceuticals 2.24Gujarat Gas Company Ltd Gas Distribution 2.22NTPC Ltd Power Generation & Distribution 2.22Instrument Industry % of NAVHCL Technologies Ltd IT - Software 2.16Exide Industries Ltd Auto Ancillaries 2.10Dr Reddys Laboratories Ltd Pharmaceuticals 2.09Gail India Ltd Gas Distribution 2.04Bajaj Auto Ltd - New Shs Automobile 2.01Wipro Ltd IT - Software 1.98Jindal Steel & Power Ltd Steel 1.81Mphasis Ltd IT - Software 1.81Colgate-Palmolive (India) Ltd FMCG 1.79Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.73Motherson Sumi Systems Ltd Auto Ancillaries 1.53Cipla Ltd Pharmaceuticals 1.51Steel Authority of India Ltd Steel 1.31Patni Computer Systems Ltd IT - Software 1.06Voltas Limited Diversified 1.03SKF India Ltd Auto Ancillaries 1.00Other Equity(less than 1.00% of corpus) 7.94Cash Bank & Others (Non Interest Bearing Securities) 6.89Net Assets 100.008

Future Select Equity FundInvestment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthSizeLargeMidSmallFund DetailsInvestment Objective : The primary investment objective of the fund is to provideincome distribution over a period of medium to long termwhile at all times emphasizing the importance of capitalappreciation. The fund will invest significant amount inequity and equity linked instruments specifically excludingcompanies predominantly dealing in Gambling,Lotteries/Contests, Animal Produce, Liquor, Tobacco,Entertainment (Films, TV etc) Hotels, Banks and FinancialInstitutions.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 10 : `17.85Benchmark : S & P India 500 Shariah Index - 100%Corpus as on 30 Sep, 10 : 20.73 Crs.Fund PerformanceAsset AllocationPERIOD DATE NAVS & P India 500Shariah IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 16.7995 1287.72 6.24% 8.47%Last 3 Months 30-Jun-10 16.6894 1308.04 6.94% 6.79%Last 6 Months 31-Mar-10 15.8890 1274.90 12.33% 9.56%94.72%5.28%EquityCash, Bank & Others( Non Interest BearingSecurities)Last 1 Year 30-Sep-09 14.6950 1210.84 21.46% 15.36%Since Inception 06-Oct-08 10.0000 844.46 33.92% 28.88%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationIT - Software16.48%Pharmaceuticals12.85%Refineries7.38%Capital Goods - Electrical EquipmentFMCGCapital Goods-Non Electrical Equipment7.35%6.05%5.53%Asset MixGas DistributionAutomobileCrude Oil & Natural GasChemicalsConsumer DurablesAuto AncillariesPaints/VarnishTelecomm-Service4.95%4.07%3.86%3.25%3.11%3.11%2.90%2.65%Instrument Asset Mix as per F&U Actual Asset MixEquity Upto 100%95%Debt * Upto 100%5%Cash & Money Market ** Upto 100%5%SteelPower Generation & DistributionCement2.51%2.09%2.05%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsLogistics1.25%Diversified1.16%Agro Chemicals1.08%Non Ferrous Metals1.04%Cash Bank & Others( Non Interest Bearing Securities)5.28%0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00%PortfolioInstrument Industry % of NAVEquity 94.72Reliance Industries Ltd Refineries 7.38Infosys Technologies Ltd IT - Software 7.36Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.95Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.59Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.05Asian Paints (India) Ltd Paints/Varnish 2.90Cadila Healthcare Ltd Pharmaceuticals 2.85Lupin Ltd Pharmaceuticals 2.81Indraprastha Gas Ltd Gas Distribution 2.65Bharti Airtel Ltd Telecomm-Service 2.65Crompton Greaves Ltd Capital Goods - Electrical Equipment 2.56Glaxosmithkline Consumer Healthcare Ltd FMCG 2.45Gail India Ltd Gas Distribution 2.30Hindustan Unilever Ltd FMCG 2.24Castrol India Ltd Chemicals 2.21Bajaj Auto Ltd - New Shs Automobile 2.13NTPC Ltd Power Generation & Distribution 2.09Ultratech Cement Ltd Cement 2.05Exide Industries Ltd Auto Ancillaries 1.97Wipro Ltd IT - Software 1.81Mphasis Ltd IT - Software 1.80Dr Reddys Laboratories Ltd Pharmaceuticals 1.74Instrument Industry % of NAVHCL Technologies Ltd IT - Software 1.62Oracle Financial Services Software Ltd IT - Software 1.62Titan Industries Ltd Consumer Durables 1.58Cipla Ltd Pharmaceuticals 1.55Steel Authority of India Ltd Steel 1.48Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.46Glenmark Pharmaceuticals Ltd Pharmaceuticals 1.45Container Corp of India Ltd Logistics 1.25Siemens India Ltd Consumer Durables 1.19Alstom Projects India Ltd Capital Goods - Electrical Equipment 1.18Polaris Software Lab Ltd IT - Software 1.18Voltas Limited Diversified 1.16SKF India Ltd Auto Ancillaries 1.13Patni Computer Systems Ltd IT - Software 1.10United Phosphorus Ltd Agro Chemicals 1.08Maruti Suzuki India Ltd Automobile 1.04Hindustan Zinc Ltd Non Ferrous Metals 1.04Pidilite Industries Ltd Chemicals 1.04Jindal Steel & Power Ltd Steel 1.02Divi'S Laboratories Ltd Pharmaceuticals 1.00Other Equity(less than 1.00% of corpus) 4.00Cash Bank & Others( Non Interest Bearing Securities) 5.28Net Assets 100.009

<strong>Tata</strong> AIG Top 50Investment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthFund PerformanceSizeLargeMidSmallFund DetailsInvestment Objective : The fund will invest primarily in select stocks andequity linked instruments which are a part of Nifty50 Index with a focus on generating long termcapital appreciation. The Fund will not replicate theindex, but aim to attain performance better than theperformance of the Index.Fund Manager : Mr. Saravana KumarNAV as on 30 Sep, 10 : `18.16Benchmark : NSE Nifty 50 Index - 100%Corpus as on 30 Sep, 10 : 46.54 Crs.Asset AllocationPERIOD DATE NAVNSE Nifty50 IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 16.46 5402.40 10.34% 11.62%Last 3 Month 30-Jun-10 16.11 5312.50 12.76% 13.50%Last 6 Month 31-Mar-10 15.81 5249.10 14.85% 14.88%95.01%EquityCash, Bank & OthersLast 1 Year 30-Sep-09 15.40 5083.95 17.90% 18.61%Since Inception 12-Jan-09 10.00 2773.10 41.61% 57.29%4.99%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationBanks21.00%IT - Software11.76%RefineriesAutomobileTobacco Products6.14%5.75%9.30%Asset MixSteelCapital Goods-Non Electrical EquipmentCrude Oil & Natural GasPower Generation & DistributionCapital Goods - Electrical EquipmentNon Ferrous Metals5.01%4.85%4.79%4.26%3.73%3.27%Instrument Asset Mix as per F&U Actual Asset MixEquity Upto 100%95%Debt * Upto 100%5%Cash & Money Market ** Upto 100% 5%Telecomm-Service3.24%FinancePharmaceuticals3.02%2.34%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsGas Distribution1.74%FMCG1.66%Others3.15%Cash Bank & Others4.99%0.00% 5.00% 10.00% 15.00% 20.00% 25.00%PortfolioInstrument Industry % of NAVEquity 95.01Reliance Industries Ltd Refineries 7.85Infosys Technologies Ltd IT - Software 7.70ICICI Bank Ltd Banks 6.22Housing Development Finance Corp Bank Banks 5.88ITC Ltd Tobacco Products 5.75State Bank of India Banks 4.87Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.85Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.92Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.73<strong>Tata</strong> Steel Ltd Steel 2.66Axis Bank Ltd Banks 2.64Bharti Airtel Ltd Telecomm-Service 2.52Housing Development Finance Corp Ltd Finance 2.36<strong>Tata</strong> Motors Ltd Automobile 2.36Mahindra and Mahindra Ltd Automobile 2.23HCL Technologies Ltd IT - Software 2.03Instrument Industry % of NAVWipro Ltd IT - Software 2.03NTPC Ltd Power Generation & Distribution 1.86Jindal Steel & Power Ltd Steel 1.82Gail India Ltd Gas Distribution 1.74Hindalco Industries Ltd Non Ferrous Metals 1.69Hindustan Unilever Ltd FMCG 1.66Sterlite Industries (India) Ltd Non Ferrous Metals 1.58Maruti Suzuki India Ltd Automobile 1.55Bharat Petroleum Corp Ltd Refineries 1.45Punjab National Bank Banks 1.39Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.30Cipla Ltd Pharmaceuticals 1.04<strong>Tata</strong> Power Co Ltd Power Generation & Distribution 1.02Other Equity(less than 1.00% of corpus) 7.30Cash Bank & Others 4.99Net Assets 100.0010

<strong>Tata</strong> AIG Top 200Investment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthFund PerformanceSizeLargeMidSmallFund DetailsInvestment Objective : The fund will invest primarily in select stocks andequity linked instruments which are a part of BSE200 Index with a focus on generating long-termcapital appreciation. The Fund will not replicate theindex but aim to attain performance better than theperformance of the Index.Fund Manager : Mr. Saravana KumarNAV as on 30 Sep, 10 : `20.26Benchmark : BSE 200 - 100%Corpus as on 30 Sep, 10 : 79.54 Crs.Asset AllocationPERIOD DATE NAVBSE 200NAVChangeINDEXChangeLast 1 Month 31-Aug-10 18.80 2302.88 7.79% 9.88%Last 3 Month 30-Jun-10 18.20 2248.06 11.37% 12.56%88.95%EquityCash, Bank & OthersLast 6 Month 31-Mar-10 17.47 2199.50 16.00% 15.05%Last 1 Year 30-Sep-09 16.36 2094.94 23.88% 20.79%11.05%Since Inception 12-Jan-09 10.00 1091.37 50.95% 63.29%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationBanksIT - SoftwareRefineriesPharmaceuticalsCapital Goods-Non Electrical EquipmentAutomobileTobacco ProductsFinanceCrude Oil & Natural GasFMCGCapital Goods - Electrical EquipmentSteelPower Generation & DistributionNon Ferrous MetalsConsumer DurablesTelecomm-ServiceDiversifiedGas DistributionAgro ChemicalsOthersCash Bank & Others6.47%5.51%4.27%4.16%3.81%3.81%3.58%3.42%3.25%2.78%2.66%2.50%2.01%1.86%1.76%1.44%1.13%7.64%9.42%11.05%17.48%Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity Upto 100%89%Debt * Upto 100%11%Cash & Money Market ** Upto 100% 11%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00%PortfolioInstrument Industry % of NAVEquity 88.95Infosys Technologies Ltd IT - Software 5.56Reliance Industries Ltd Refineries 4.96HDFC Bank Banks 3.91ITC Ltd Tobacco Products 3.81ICICI Bank Ltd Banks 3.78Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 3.48State Bank of India Banks 3.26Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 2.91Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 1.87Titan Industries Ltd Consumer Durables 1.85Bharti Airtel Ltd Telecomm-Service 1.84Axis Bank Ltd Banks 1.84Mahindra and Mahindra Ltd Automobile 1.61<strong>Tata</strong> Motors Ltd Automobile 1.59Nestle India Ltd FMCG 1.57Power Finance Corp Ltd Finance 1.51Instrument Industry % of NAVGail India Ltd Gas Distribution 1.44<strong>Tata</strong> Steel Ltd Steel 1.43Crompton Greaves Ltd Capital Goods - Electrical Equipment 1.38NTPC Ltd Power Generation & Distribution 1.36Sterlite Industries (India) Ltd Non Ferrous Metals 1.26Jindal Steel & Power Ltd Steel 1.24Hindalco Industries Ltd Non Ferrous Metals 1.24Lupin Ltd Pharmaceuticals 1.22Wipro Ltd IT - Software 1.19Divi'S Laboratories Ltd Pharmaceuticals 1.18HCL Technologies Ltd IT - Software 1.16United Phosphorus Ltd Agro Chemicals 1.13Sintex Industries Ltd Diversified 1.06Other Equity(less than 1.00% of corpus) 27.30Cash Bank & Others 11.05Net Assets 100.0011

Super Select Equity Pension FundInvestment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthAsset AllocationSizeLargeMidSmallFund DetailsInvestment Objective : The primary investment objective of the fund is to provideincome distribution over a period of medium to long termwhile at all times emphasizing the importance of capitalappreciation. The fund will invest significant amount inequity and equity linked instruments specifically excludingcompanies predominantly dealing in Gambling,Lotteries/Contests, Animal Produce, Liquor, Tobacco,Entertainment (Films, TV etc) Hotels, Banks and FinancialInstitutions.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 10 : `11.5428Benchmark : S & P India 500 Shariah Index - 100%Corpus as on 30 Sep, 10 : 18.70 Crs.Asset Mix11.18%88.82%EquityCash, Bank & Others(Non Interest BearingSecurities)Instrument Asset Mix as per F&U Actual Asset MixEquity 60% - 100% 89%Debt * Upto 40% 11%Cash & Money Market ** Upto 40% 11%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsSector AllocationIT - Software15.17%Pharmaceuticals10.55%Refineries7.39%Crude Oil & Natural Gas6.43%Gas Distribution6.31%FMCG6.29%Capital Goods - Electrical Equipment6.07%Capital Goods-Non Electrical Equipment4.62%Auto Ancillaries3.58%Chemicals3.06%Steel2.99%Telecomm-Service2.45%Power Generation & Distribution2.32%Paints/Varnish2.14%Automobile1.95%Non Ferrous Metals1.73%Cement1.70%Entertainment1.38%Diversified1.03%Others1.66%Cash Bank & Others( Non Interest Bearing Securities)11.18%0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%PortfolioInstrument Industry % of NAVEquity 88.82Infosys Technologies Ltd IT - Software 8.15Reliance Industries Ltd Refineries 7.39Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.39Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.98Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.75Bharti Airtel Ltd Telecomm-Service 2.45Gujarat Gas Company Ltd Gas Distribution 2.38NTPC Ltd Power Generation & Distribution 2.32Hindustan Unilever Ltd FMCG 2.31Gail India Ltd Gas Distribution 2.30HCL Technologies Ltd IT - Software 2.25Exide Industries Ltd Auto Ancillaries 2.19Glaxosmithkline Consumer Healthcare Ltd FMCG 2.17Asian Paints (India) Ltd Paints/Varnish 2.14Cadila Healthcare Ltd Pharmaceuticals 2.10Crompton Greaves Ltd Capital Goods - Electrical Equipment 2.01Dr Reddys Laboratories Ltd Pharmaceuticals 1.93Castrol India Ltd Chemicals 1.91Jindal Steel & Power Ltd Steel 1.89Divi'S Laboratories Ltd Pharmaceuticals 1.84Instrument Industry % of NAVHindustan Zinc Ltd Non Ferrous Metals 1.73Ultratech Cement Ltd Cement 1.70Wipro Ltd IT - Software 1.68Indraprastha Gas Ltd Gas Distribution 1.63Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.62Oil India Ltd Crude Oil & Natural Gas 1.61Motherson Sumi Systems Ltd Auto Ancillaries 1.39Jagran Prakashan Ltd Entertainment 1.38Mphasis Ltd IT - Software 1.33Pidilite Industries Ltd Chemicals 1.15Bajaj Auto Ltd - New Shs Automobile 1.10Steel Authority of India Ltd Steel 1.10Polaris Software Lab Ltd IT - Software 1.09Cairn India Ltd Crude Oil & Natural Gas 1.07Lupin Ltd Pharmaceuticals 1.04Cipla Ltd Pharmaceuticals 1.03Voltas Limited Diversified 1.03Other Equity(less than 1.00% of corpus) 6.27Cash Bank & Others( Non Interest Bearing Securities) 11.18Net Assets 100.0014

<strong>Life</strong> Liquid FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowFund PerformanceInterest RateSensitivityHighMidLowFund DetailsInvestment Objective : To provide safety of funds, liquidity and return oninvestments, in that order.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `14.32Benchmark : CRISIL Liquid Fund Index -100%Corpus as on 30 Sep, 2010 : 33.80 Crs.Maturity ProfilePERIOD DATE NAV Crisil LiquidFund IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 14.26 1590.19 0.44% 0.48%Last 3 Months 30-Jun-10 14.13 1575.66 1.36% 1.41%Last 6 Months 31-Mar-10 13.95 1560.20 2.67% 2.41%Last 1 Year 30-Sep-09 13.58 1535.67 5.46% 4.05%Last 3 Years 30-Sep-07 11.80 1337.28 6.68% 6.11%Since Inception 02-Mar-04 10.00 1103.15 5.61% 5.79%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.Rating Profile120.00%100.00%80.00%60.00%40.00%20.00%0.00%Less than 1 YearAsset Allocation91.21%91.21%8.79%P1+Cash Bank & Others8.79%CD/CP'sCash Bank & OthersPortfolioInstrument Rating % of NAVCD/CP's 91.21RECL 2010 - CP P1+ 18.96HDFC 2011 - CP P1+ 11.52HDFC Bank 2010 - CD P1+ 8.77PNB 2011 - CD P1+ 8.62Canara Bank 2011 - CD P1+ 8.62State Bank of Mysore 2011 - CD P1+ 8.58Andhra Bank 2011 - CD P1+ 8.23IDBI Bank 2011 - CD P1+ 6.28Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * Upto 100% 100%Cash & Money Market ** Upto 100% 100%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsBank of Baroda 2011 - CD P1+ 5.78State Bank of Patiala 2010 - CD P1+ 2.92Bank of Baroda 2010 - CD P1+ 2.92Cash Bank & Others 8.79Net Assets 100.0015

<strong>Life</strong> Income FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowInvestment Objective :Fund ManagerNAV as on 30 Sep, 2010 : `13.85Fund DetailsTo provide long-term capital appreciation by investing inhigh credit quality fixed-income instruments. Stability ofreturn and protection of principal over a long-terminvestment horizon will be the prime driver for investmentmanagement.: Mr. Saravana KumarBenchmark : CRISIL Composite Bond Fund Index -100%Corpus as on 30 Sep, 2010: 158.10 Crs.Fund PerformancePERIOD DATE NAV Crisil Composite NAV INDEXBond Fund Index Change ChangeLast 1 Month 31-Aug-10 13.75 1618.71 0.71% 0.57%Last 3 Months 30-Jun-10 13.72 1613.87 0.96% 0.88%Last 6 Months 31-Mar-10 13.40 1586.80 3.33% 2.60%Last 1 Year 30-Sep-09 12.96 1543.70 6.88% 5.46%Last 3 Years 30-Sep-07 10.91 1353.09 8.26% 6.36%Since Inception 02-Mar-04 10.00 1193.20 5.07% 4.83%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.4.43%20.40%Rating Profile7.72%16.05%AAAAA+SovereignCD/CP'sCash Bank & OthersPortfolioInstrument Rating % of NAV Instrument Rating % of NAVGovernment Securities 20.407.17% GOI 2015 Sovereign 5.588.20% GOI 2022 Sovereign 4.488.30% GOI 2040 Sovereign 3.157.02% GOI 2016 Sovereign 2.807.80% GOI 2020 Sovereign 2.218.32% GOI 2032 Sovereign 0.957.61% GOI 2015 Sovereign 0.628.07% GOI 2017 Sovereign 0.549.39% GOI 2011 Sovereign 0.07Corporate Bonds 55.838.80% <strong>Tata</strong> Sons 2015 AAA 4.16HDFC Ltd 2013 AAA 3.529.50% Exim Bank 2013 AAA 3.2710.00% PFC 2012 AAA 3.269.20% Power Grid 2014 AAA 3.252.00% Indian Hotels Company Ltd 2014 AA+ 2.738.50% Exim Bank 2011 AAA 2.549.35% ILFS 2010 AAA 2.537.35% HPCL 2012 AAA 2.1910.75% Reliance Industries 2018 AAA 2.139.45% REC 2013 AAA 1.958.60% PFC 2014 AAA 1.908.40% HDFC 2014 AAA 1.897.45% LIC Housing Finance Ltd 2012 AAA 1.8850.00%40.00%30.00%20.00%10.00%0.00%51.40% 55.83%Maturity ProfileLess than 1 Year 1-3 Years 3-6 Years 6 Years andAboveAsset Allocation20.40%7.72%16.05%Corporate BondsGovernment SecuritiesCD/CP'sCash Bank & Others6.90 % PFC 2012 AAA 1.877.40% <strong>Tata</strong> Chemicals 2011 AA+ 1.7010.95% Rural Elect Corp. 2011 AAA 1.629.15% LIC Housing Finance 2010 AAA 1.588.75% Reliance Industries Ltd 2020 AAA 1.4010.75% Rural Elect Corp. 2013 AAA 1.349.80% ICICI Bank 2013 AAA 1.319.20% Larsen & Toubro 2012 AAA 1.288.35% HDFC 2015 AAA 1.267.20% Rural Elect Corp. 2012 AAA 1.2510.00% IDFC 2012 AAA 1.179.20% Power Grid 2015 AAA 1.137.74% <strong>Tata</strong> Communication Ltd 2012 AAA 0.7610.10% Power Grid Corp 2013 AAA 0.499.80% PFC 2012 AAA 0.339.50% HDFC 2013 AAA 0.13CD/CP's 7.72State Bank of Mysore 2011 - CD P1+ 2.75Bank of Baroda 2011 - CD P1+ 2.47State Bank of Patiala 2010 - CD P1+ 0.94Bank of Baroda 2010 - CD P1+ 0.94HDFC Bank 2010 - CD P1+ 0.31PNB 2011 - CD P1+ 0.31Cash Bank & Others 16.05Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 60% - 100% 100%Cash & Money Market ** Upto 100% 24%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets16

<strong>Life</strong> Short Term Fixed Income FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowInvestment Objective :Fund ManagerNAV as on 30 Sep, 2010 : `13.04Fund DetailsThe primary objective is to generate stable returns byinvesting in fixed income securities having maturitiesbetween 1 & 3 years.: Mr. Saravana KumarBenchmark : CRISIL India Short Term Bond Fund Index -100%Corpus as on 30 Sep, 2010: 17.67 Crs.Fund PerformancePERIOD DATE NAVCRISIL IndiaNAV INDEXChange ChangeShort TermBond Fund IndexLast 1 Month 31-Aug-10 12.97 1662.57 0.49% 0.46%Last 3 Months 30-Jun-10 12.97 1654.29 0.52% 0.97%Last 6 Months 31-Mar-10 12.78 1632.46 2.01% 2.32%Last 1 Year 30-Sep-09 12.41 1591.88 5.04% 4.92%Last 3 Years 30-Sep-07 10.48 1354.36 7.54% 7.24%Since Inception 01-Jul-06 10.00 1242.00 6.44% 7.22%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.72.91%Rating Profile100.00%80.00%60.00%40.00%20.00%0.00%72.91%Maturity ProfileLess than 1 Year1-3 YearsAsset AllocationAAACorporate BondsP1+CD/CP's19.22%7.87%Cash Bank & Others19.22%7.87%Cash Bank & OthersPortfolioInstrument Rating % of NAVCorporate Bonds 72.917.55% National Housing Bank 2013 AAA 15.03HDFC Ltd 2013 AAA 10.889.68% IRFC 2012 AAA 8.748.40% LIC Housing Finance 2013 AAA 5.687.35% HPCL 2012 AAA 5.607.30% LIC Housing 2013 AAA 5.547.76% LIC Housing 2012 AAA 5.076.84% HDFC Ltd 2011 AAA 4.507.74% <strong>Tata</strong> Communication Ltd 2012 AAA 2.257.75% RECL 2012 AAA 2.256.90% PFC Ltd 2012 AAA 2.239.50% HDFC 2013 AAA 1.757.90% RECL 2012 AAA 1.707.40% Infrastructure 2012 AAA 1.68CD/CP's 7.87Andhra Bank 2011 - CD P1+ 7.87Cash Bank & Others 19.22Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 60% - 100% 100%Cash & Money Market ** Upto 100% 27%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets17

Whole <strong>Life</strong> Short TermFixed Income FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowInvestment Objective :Fund ManagerNAV as on 30 Sep, 2010 : `12.53Fund DetailsThe primary investment objective of the fund is to generatestable returns by investing in fixed income securities havingshorter maturity periods. Under normal circumstances, theaverage maturity of the Fund may be in the range of 1-3years.: Mr. Saravana KumarBenchmark : CRISIL Short Term Bond Index -100%Corpus as on 30 Sep, 2010: 24.73 Crs.Fund PerformancePERIOD DATE NAV CRISIL Short TermBond IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 12.47 1662.57 0.49% 0.46%Last 3 Months 30-Jun-10 12.45 1654.29 0.66% 0.97%Last 6 Months 31-Mar-10 12.25 1632.46 2.35% 2.32%Last 1 Year 30-Sep-09 11.84 1591.88 5.89% 4.92%Last 3 Years 30-Sep-07 10.02 1354.36 7.75% 7.24%Since Inception 08-Jan-07 10.00 1281.09 6.24% 7.37%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.Rating Profile80.00%70.00%60.00%50.00%40.00%30.00%20.00%10.00%0.00%Maturity ProfileLess than 1 Year 1-3 YearsAsset Allocation66.79%18.84%18.84%AAAP1+Cash Bank & Others14.37% 66.79%Corporate BondsCD/CP'sCash Bank & Others14.37%PortfolioInstrument Rating % of NAVCorporate Bonds 66.797.55% National Housing Bank 2013 AAA 9.94HDFC Ltd 2013 AAA 8.608.40% LIC Housing Finance 2013 AAA 8.129.68% IRFC 2012 AAA 6.257.74% <strong>Tata</strong> Communication Ltd 2012 AAA 6.047.90% RECL 2012 AAA 5.259.50% NABARD 2012 AAA 4.167.76% LIC Housing 2012 AAA 3.626.98% IRFC 2012 AAA 3.207.35% HPCL 2012 AAA 3.206.84% HDFC 2011 AAA 2.817.40% Infrastructure 2012 AAA 2.407.75% RECL 2012 AAA 1.616.90% PFC 2012 AAA 1.59CD/CP's 14.37Andhra Bank 2011 - CD P1+ 5.63HDFC 2011 - CP P1+ 3.94Bank of Baroda 2010 - CD P1+ 2.40State Bank of Patiala 2010 - CD P1+ 2.40Cash Bank & Others 18.84Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 60% - 100% 100%Cash & Money Market ** Upto 100% 33%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets18

Whole <strong>Life</strong> Income FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowFund DetailsInvestment Objective : The primary investment objective of the fund is to generateincome through investing in a range of debt and moneymarket instruments of various maturities with a view tomaximising the optimal balance between yield, safety andliquidity. The Fund will have no investments in equity orequity-linked instruments at any point of time.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `12.46Benchmark : CRISIL Composite Bond Fund Index -100%Corpus as on 30 Sep, 2010 : 47.75 Crs.Fund PerformancePERIOD DATE NAV Crisil CompositeBond Fund IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 12.39 1618.71 0.58% 0.57%Last 3 Months 30-Jun-10 12.40 1613.87 0.53% 0.88%Last 6 Months 31-Mar-10 12.15 1586.80 2.59% 2.60%Last 1 Year 30-Sep-09 11.75 1543.70 6.06% 5.46%Last 3 Years 30-Sep-07 10.01 1353.09 7.58% 6.36%Since Inception 08-Jan-07 10.00 1298.79 6.08% 6.25%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.Rating Profile100.00%80.00%60.00%40.00%20.00%0.00%Less than 1YearMaturity Profile1-3 Years 3-6 Years 6 Years andAboveAsset Allocation52.84%21.19%22.85%AAACorporate BondsAA+Government Securities21.19%3.12%SovereignCash Bank & Others55.96%22.85%Cash Bank & OthersPortfolioInstrument Rating % of NAVCorporate Bonds 55.968.60% PFC 2014 AAA 5.2511.50% RECL 2013 AAA 5.017.55% National Housing Bank 2013 AAA 4.749.45% LIC Housing 2012 AAA 4.268.80% Power Grid 2015 AAA 4.236.98% IRFC 2012 AAA 4.147.30% LIC Housing 2013 AAA 4.108.90% Power Grid 2015 AAA 3.988.84% Power Grid 2016 AAA 3.707.74% <strong>Tata</strong> Communication Ltd 2012 AAA 3.137.40% <strong>Tata</strong> Chemicals 2011 AA+ 3.129.50% NABARD 2012 AAA 2.158.50% PFC 2014 AAA 2.096.90% PFC 2012 AAA 2.067.40% Infrastructure 2012 AAA 1.669.50% HDFC 2013 AAA 1.088.80% <strong>Tata</strong> Sons 2015 AAA 1.0610.00% PFC 2012 AAA 0.22Government Securities 21.197.02% GOI 2016 Sovereign 9.688.20% GOI 2022 Sovereign 6.357.17% GOI 2015 Sovereign 3.087.80% GOI 2020 Sovereign 2.09Cash Bank & Others 22.85Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 60% - 100% 100%Cash & Money Market ** Upto 100% 23%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets19

Future Income PensionInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowInvestment Objective :Fund ManagerNAV as on 30 Sep, 2010 : `11.74Fund DetailsThe primary investment objective of the fund is to generateincome through investing in a range of debt and moneymarket instruments of various maturities with a view tomaximising the optimal balance between yield, safety andliquidity.: Mr. Saravana KumarBenchmark : CRISIL Composite Bond Fund Index -100%Corpus as on 30 Sep, 2010: 14.80 Crs.Fund PerformancePERIOD DATE NAV Crisil CompositeBond Fund IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 11.69 1618.71 0.43% 0.57%Last 3 Months 30-Jun-10 11.70 1613.87 0.41% 0.88%Last 6 Months 31-Mar-10 11.46 1586.80 2.45% 2.60%Last 1 Year 30-Sep-09 11.11 1543.70 5.73% 5.46%Since Inception 04-Feb-08 10.00 1404.20 6.24% 5.73%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Rating Profile100.00%80.00%60.00%40.00%20.00%0.00%Maturity ProfileLess than 1 Year 1-3 Years 3-6 YearsAsset Allocation51.87%51.87%22.12%AAA22.12%Corporate BondsSovereignGovernment Securities26.01%Cash Bank & Others26.01%Cash Bank & OthersPortfolioInstrument Rating % of NAVCorporate Bonds 51.877.55% National Housing Bank 2013 AAA 9.968.60% PFC 2014 AAA 6.778.40% HDFC 2014 AAA 6.729.45% LIC Housing 2012 AAA 5.498.90% Power Grid 2015 AAA 5.1310.00% PFC 2012 AAA 4.879.68% IRFC 2012 AAA 4.877.40% Infrastructure 2012 AAA 4.017.90% RECL 2012 AAA 3.37Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 60% - 100% 100%Cash & Money Market ** Upto 100% 22%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets8.30% HDFC 2015 AAA 0.67Government Securities 26.017.02% GOI 2016 Sovereign 26.01Cash Bank & Others 22.12Net Assets 100.0020

<strong>Tata</strong> AIG Bond FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowInvestment Objective :Fund ManagerNAV as on 30 Sep, 2010 : `11.17Fund DetailsThe objective of the scheme is to invest in GovernmentBonds and highly rated Fixed Income instruments. Theprimary objective of the Fund is to conserve capital whilegenerating income by investing in short to medium termdebt instruments of various maturities.: Mr. Saravana KumarBenchmark : CRISIL Composite Bond Fund Index -100%Corpus as on 30 Sep, 2010: 10.95 Crs.Fund PerformancePERIOD DATE NAV Crisil CompositeBond Fund IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 11.12 1618.71 0.44% 0.57%Last 3 Months 30-Jun-10 11.13 1613.87 0.41% 0.88%Last 6 Months 31-Mar-10 10.91 1586.80 2.36% 2.60%Last 1 Year 30-Sep-09 10.63 1543.70 5.14% 5.46%Since Inception 12-Jan-09 10.00 1503.68 6.68% 4.74%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.100.00%80.00%60.00%40.00%20.00%0.00%Maturity ProfileLess than 1 Year 1-3 Years 3-6 Years21.97%Rating ProfileAsset Allocation25.28%52.75%25.28%AAASovereignCash Bank & Others21.97%52.75%Corporate BondsGovernment SecuritiesCash Bank & OthersPortfolioInstrument Rating % of NAVCorporate Bonds 52.758.60% PFC 2014 AAA 9.157.55% National Housing Bank 2013 AAA 8.988.90% Power Grid 2015 AAA 5.789.50% Nabard 2012 AAA 4.698.45% RECL 2015 AAA 4.558.30 HDFC 2015 AAA 4.528.28% LIC Housing Finance 2015 AAA 4.526.98% IRFC 2012 AAA 3.619.50% HDFC 2013 AAA 2.828.84% Power Grid 2016 AAA 2.309.45% LIC Housing 2012 AAA 0.937.90% RECL 2012 AAA 0.91Government Securities 21.977.02% GOI 2016 Sovereign 21.97Cash Bank & Others 25.28Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 0% - 100% 100%Cash & Money Market ** Upto 100% 25%* Exposure to Debt includes Cash & Money Market** Cash & Money Market includes current assets21

<strong>Tata</strong> AIG APEX Investment FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidInvestment Objective :Fund ManagerFund DetailsObjective is to provide capital protection with a high levelof safety and liquidity through judicious investment in highquality short-term debt.: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `10.0268Benchmark : -LowCorpus as on 30 Sep, 2010: 19.21 Crs.100.00%80.00%60.00%40.00%20.00%0.00%Maturity ProfileLess than 1 YearAsset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 0% - 100% 100%Cash & Money Market ** 0% - 100% 100%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsRating ProfileAsset Allocation100.00%Cash Bank & Others100.00%Cash Bank & OthersPortfolioInstrument Industry % of NAVCash Bank & Others 100.00Net Assets 100.0022

Apex PensionInvestment Fund (10 yrs term)Investment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowInvestment Objective :Fund ManagerFund DetailsThe investment objective for Apex Pension InvestmentFund (10 Years) is to provide capital protection with a highlevel of safety and liquidity through judicious investment inhigh quality short-term debt. The strategy is to generatebetter returns with low level of risk through investment isfixed interest securities having short term maturity profile.The risk profile of the fund is very low and asset allocationwill be upto 100% in Money Markets and Cash.: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `10.0969Benchmark : -Corpus as on 30 Sep, 2010: 0.96 Crs.100.00%80.00%60.00%40.00%20.00%0.00%Maturity ProfileLess than 1 YearAsset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 0% - 100% 100%Cash & Money Market ** 0% - 100% 100%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsRating ProfileAsset Allocation100.00%100.00%Cash Bank & OthersCash Bank & OthersPortfolioInstrument Industry % of NAVCash Bank & Others 100.00Net Assets 100.0023

Apex PensionInvestment Fund (15 yrs term)Investment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowFund DetailsInvestment Objective : The investment objective for Apex Pension InvestmentFund (15 Years) is to provide capital protection with a highlevel of safety and liquidity through judicious investment inhigh quality short-term debt. The strategy is to generatebetter returns with low level of risk through investment isfixed interest securities having short term maturity profile.The risk profile of the fund is very low and asset allocationwill be upto 100% in Money Markets and Cash.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `10.0677Benchmark : -Corpus as on 30 Sep, 2010 : 0.10 Crs.100.00%80.00%60.00%40.00%20.00%0.00%Maturity ProfileLess than 1 YearAsset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 0% - 100% 100%Cash & Money Market ** 0% - 100%100%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsRating ProfileAsset Allocation100.00%100.00%Cash Bank & OthersCash Bank & OthersPortfolioInstrument Industry % of NAVCash Bank & Others 100.00Net Assets 100.0024

Apex PensionInvestment Fund (20 yrs term)Investment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowFund DetailsInvestment Objective : The investment objective for Apex Pension InvestmentFund (20 Years) is to provide capital protection with a highlevel of safety and liquidity through judicious investment inhigh quality short-term debt. The strategy is to generatebetter returns with low level of risk through investment isfixed interest securities having short term maturity profile.The risk profile of the fund is very low and asset allocationwill be upto 100% in Money Markets and Cash.Fund Manager : Mr. Saravana KumarNAV as on 30 Sep, 2010 : `10.3209Benchmark : -Corpus as on 30 Sep, 2010 : 0.07 Crs.100.00%80.00%60.00%40.00%20.00%0.00%Maturity ProfileLess than 1 YearAsset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 0% - 100% 100%Cash & Money Market ** 0% - 100%100%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsRating ProfileAsset Allocation100.00%100.00%Cash Bank & OthersCash Bank & OthersPortfolioInstrument Industry % of NAVCash Bank & Others 100.00Net Assets 100.0025

Apex Pension Investment Fund SPInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowInvestment Objective :Fund ManagerFund DetailsThe investment objective for Apex Pension Investment Fund isto provide capital protection with a high level of safety andliquidity through judicious investment in high quality shorttermdebt. The strategy is to generate better returns withlow level of risk through investment is fixed interestsecurities having short term maturity profile. The risk profileof the fund is very low and asset allocation will be upto100% in Money Markets and Cash.: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `10.0853Benchmark : -Corpus as on 30 Sep, 2010: 0.58 Crs.100.00%80.00%60.00%40.00%20.00%Maturity ProfileAsset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 0% - 100% 100%Cash & Money Market ** 0% - 100% 100%0.00%Less than 1 Year* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsRating ProfileAsset Allocation100.00%100.00%Cash Bank & OthersCash Bank & OthersPortfolioInstrument Industry % of NAVCash Bank & Others 100.00Net Assets 100.0026

Apex Plus Investment FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleCredit QualityHigh Mid LowInterest RateSensitivityHighMidLowFund DetailsInvestment Objective : The investment objective for Apex Plus Investment Fund isto provide capital protection with a high level of safety andliquidity through judicious investment in high quality shorttermdebt. The strategy is to generate better returns with lowlevel of risk through investment is fixed interest securitieshaving short term maturity profile. The risk profile of thefund is very low and asset allocation will be upto 100% inMoney Markets and Cash.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `10.0941Benchmark : -Corpus as on 30 Sep, 2010: 1.44 Crs.100.00%80.00%60.00%40.00%20.00%0.00%Maturity ProfileLess than 1 YearAsset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 0% 0%Debt * 0% - 100%100%Cash & Money Market ** 0% - 100%100%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsRating ProfileAsset Allocation100.00%100.00%Cash Bank & OthersCash Bank & OthersPortfolioInstrument Industry % of NAVCash Bank & Others 100.00Net Assets 100.0027

<strong>Life</strong> Aggressive Growth FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallFund DetailsInvestment Objective : To maximize the return while investing in mix of Equity &Fixed Income Investments. The fund will maintain amedium to high risk profile. The Equity investments will bein a range of 50% - 80% of the fund.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `16.92Benchmark : BSE Sensex - 65%CRISIL Composite Bond Fund Index - 35%Corpus as on 30 Sep, 2010: 328.56 Crs.Fund PerformancePERIOD DATE NAV NAV Change INDEX ChangeLast 1 Month 31-Aug-10 15.90 6.44% 7.79%Last 3 Months 30-Jun-10 15.43 9.64% 9.00%Last 6 Months 31-Mar-10 15.01 12.75% 10.33%Last 1 Year 30-Sep-09 14.36 17.84% 13.08%Last 3 Years 30-Sep-07 13.73 7.21% 5.54%Since Inception 01-Jul-06 10.00 13.17% 12.67%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.Sector AllocationBanks14.57%IT - Software7.88%Capital Goods - Electrical EquipmentRefineriesAutomobileTobacco ProductsCapital Goods-Non Electrical EquipmentCrude Oil & Natural GasDiversifiedRealty4.44%4.21%3.78%3.73%3.72%2.84%2.23%2.13%Others16.14%Government Securities 1.47%Corporate Bonds24.18%Cash Bank & Others8.70%0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%Portfolio65.66%Asset AllocationEquity24.18%Corporate BondsGovernment Securities1.47%8.70%Cash Bank & OthersPortfolioInstrument Industry % of NAVEquity 65.66Infosys Technologies Ltd IT - Software 4.23Reliance Industries Ltd Refineries 4.21ITC Ltd Tobacco Products 3.73ICICI Bank Ltd Banks 3.39HDFC Bank Banks 3.26State Bank of India Banks 3.25Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 3.12Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 2.64Bharti Airtel Ltd Telecomm-Service 2.01Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 1.92Crompton Greaves Ltd Capital Goods - Electrical Equipment 1.50Sintex Industries Ltd Diversified 1.49Axis Bank Ltd Banks 1.40<strong>Tata</strong> Steel Ltd Steel 1.39Mahindra and Mahindra Ltd Automobile 1.37Wipro Ltd IT - Software 1.37HCL Technologies Ltd IT - Software 1.34<strong>Tata</strong> Motors Ltd Automobile 1.34Exide Industries Ltd Auto Ancillaries 1.20Bank of Baroda Banks 1.13Sterlite Industries (India) Ltd Non Ferrous Metals 1.12Bajaj Auto Ltd - New Shs Automobile 1.07Other Equity (less then 1% of corpus) 18.19Government Securities 1.477.02% GOI 2016 Sovereign 1.47Corporate Bonds 24.182.00% <strong>Tata</strong> Motors 2014 AAA 3.649.35% ILFS 2010 AAA 2.137.30% LIC Housing Fin 2013 AAA 2.09Instrument Industry % of NAV8.40 % LIC Housing Finance 2013 AAA 1.9311.25% PFC 2018 AAA 1.7510.25% HDFC 2012 AAA 1.579.80% PFC 2012 AAA 1.579.50% HDFC 2013 AAA 1.25HDFC Ltd 2013 AAA 1.238.40% HDFC 2014 AAA 1.2110.9% Rural Elect Corp. 2013 AAA 1.047.65% RECL 2016 AAA 1.029.45% REC 2013 AAA 0.949.80% PFC 2012 AAA 0.62HDFC Ltd 2012 AAA 0.616.90% PFC Ltd. 2012 AAA 0.6010.60% IRFC 2018 AAA 0.516.84% HDFC 2011 AAA 0.45Cash Bank & Others 8.70Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 50% - 80%66%Debt * 20% - 50% 34%Cash & Money Market ** Upto 50% 9%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets28

<strong>Life</strong> Stable Growth FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallFund DetailsInvestment Objective : To provide reasonable returns by investing in a mix of Equityand Fixed Income instruments. The fund will maintain low tomedium risk profile with the equity investments ranging from30% - 50% of the fund.Fund ManagerNAV as on 30 Sep, 2010 : `15.76: Mr. Saravana KumarBenchmark : BSE Sensex - 40%CRISIL Composite Bond Fund Index - 60%Corpus as on 30 Sep, 2010 : 38.22 Crs.Fund PerformancePERIOD DATE NAV NAV Change INDEX ChangeLast 1 Month 31-Aug-10 15.14 4.07% 5.01%Last 3 Months 30-Jun-10 14.94 5.50% 5.88%Last 6 Months 31-Mar-10 14.59 8.03% 7.36%Last 1 Year 30-Sep-09 14.03 12.36% 10.15%Last 3 Years 30-Sep-07 12.59 7.78% 5.85%Since Inception 01-Jul-06 10.00 11.29% 10.17%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.Sector AllocationBanks9.35%IT - SoftwareCapital Goods - Electrical EquipmentRefineriesTobacco ProductsFinanceCapital Goods-Non Electrical EquipmentPharmaceuticalsSteelCrude Oil & Natural Gas3.83%2.40%2.20%2.15%1.98%1.86%1.36%1.22%1.18%OthersGovernment Securities10.51%7.56%Corporate Bonds40.35%Cash Bank & Others14.06%0% 5% 10% 15% 20% 25% 30% 35% 40% 45%Portfolio7.56%14.06%40.35%Asset Allocation38.04%EquityCorporate BondsGovernment SecuritiesCash Bank & OthersPortfolioInstrument Industry % of NAVEquity 38.04Infosys Technologies Ltd IT - Software 2.39ICICI Bank Ltd Banks 2.33Reliance Industries Ltd Refineries 2.20ITC Ltd Tobacco Products 2.15HDFC Bank Banks 2.08Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 1.61State Bank of India Banks 1.48Axis Bank Ltd Banks 1.21HDFC Ltd Finance 1.15Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 1.14Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 1.13Crompton Greaves Ltd Capital Goods - Electrical Equipment 1.00Other Equity (less than 1.00% of corpus) 18.16Government Securities 7.567.02% GOI 2016 Sovereign 7.56Corporate Bonds 40.3510.75% Reliance Ind 2018 AAA 5.869.45% REC 2013 AAA 5.39Instrument Industry % of NAVHDFC Ltd 2012 AAA 5.2811.50% Rural Elect Corp. 2013 AAA 5.128.60% PFC Ltd 2014 AAA 3.938.28% LIC Housing Finance 2015 AAA 3.8910.90% Rural Elect Corp. 2013 AAA 3.079.80% PFC 2012 AAA 2.689.05% IDFC 2010 AAA 2.099.50% HDFC MD 2013 AAA 1.622.00% <strong>Tata</strong> Motors Ltd 2014 AAA 1.42Cash Bank & Others 14.06Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 30% - 50%38%Debt * 50% - 70% 62%Cash & Money Market ** Upto 50% 14%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets29

Whole <strong>Life</strong>Aggressive Growth FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallFund DetailsInvestment Objective : The primary investment objective of the Fund is tomaximize the returns with medium to high risk.Fund ManagerNAV as on 30 Sep, 2010 : `15.39: Mr. Saravana KumarBenchmark : Nifty - 65%CRISIL Composite Bond Fund Index - 35%Corpus as on 30 Sep, 2010: 212.13 Crs.Fund PerformancePERIOD DATE NAV NAV Change INDEX ChangeLast 1 Month 31-Aug-10 14.42 6.74% 7.75%Last 3 Months 30-Jun-10 14.07 9.43% 9.08%Last 6 Months 31-Mar-10 13.62 13.03% 10.58%Last 1 Year 30-Sep-09 12.99 18.54% 14.01%Last 3 Years 30-Sep-07 11.96 8.77% 6.32%Since Inception 08-Jan-07 10.00 12.26% 10.08%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.Sector AllocationBanks15.10%IT - Software7.09%RefineriesAutomobileTobacco ProductsCapital Goods - Electrical EquipmentCapital Goods-Non Electrical EquipmentFMCGSteelCrude Oil & Natural Gas4.19%3.78%3.53%2.99%2.96%2.77%2.72%2.56%Others17.76%Government Securities 2.27%Corporate Bonds26.09%Cash Bank & Others6.18%0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%Portfolio65.46%6.18%Asset AllocationEquityCorporate Bonds26.09% Government Securities2.27%Cash Bank & OthersPortfolioInstrument Industry % of NAVEquity 65.46Infosys Technologies Ltd IT - Software 4.31Reliance Industries Ltd Refineries 4.19ICICI Bank Ltd Banks 3.57ITC Ltd Tobacco Products 3.53HDFC Bank Banks 3.23State Bank of India Banks 3.21Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 2.90Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 1.85Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 1.81Axis Bank Ltd Banks 1.81HDFC Ltd Finance 1.73Mahindra and Mahindra Ltd Automobile 1.47<strong>Tata</strong> Steel Ltd Steel 1.38<strong>Tata</strong> Motors Ltd Automobile 1.35Asian Paints (India) Ltd Paints/Varnish 1.25Bank of Baroda Banks 1.23Crompton Greaves Ltd Capital Goods - Electrical Equipment 1.18Gail India Ltd Gas Distribution 1.13Sintex Industries Ltd Diversified 1.09Wipro Ltd IT - Software 1.06NTPC Ltd Power Generation & Distribution 1.02Sterlite Industries (India) Ltd Non Ferrous Metals 1.01Jindal Steel & Power Ltd Steel 1.00Other Equity (less than 1.00% of corpus) 19.15Government Securities 2.277.02% GOI 2016 Sovereign 2.27Corporate Bonds 26.098.40% LIC Housing Finance 2013 AAA 4.7811.50% Rural Electric Corp. 2013 AAA 2.568.80% <strong>Tata</strong> Sons 2015 AAA 1.91Instrument Industry % of NAVHDFC Ltd 2012 AAA 1.908.70% PFC 2015 AAA 1.902.00% <strong>Tata</strong> Motor 2014 AAA 1.542.00% Indian Hotel Company 2014 AA+ 1.538.80% Power Grid 2015 AAA 1.439.20% HDFC Ltd 2012 AAA 1.208.40% HDFC 2014 AAA 1.177.95% PFC 2016 AAA 1.159.05% IDFC 2010 AAA 0.9911.75% Rural Electric Corp Ltd 2011 AAA 0.988.50% PFC 2014 AAA 0.949.50% HDFC 2013 AAA 0.6310.75% Reliance Ind 2018 AAA 0.536.90% PFC 2012 AAA 0.4610.90% Rural Electric Corp. 2013 AAA 0.358.28% LIC Housing Finance 2015 AAA 0.14Cash Bank & Others 6.18Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 50% - 80%65%Debt * 20% - 50% 35%Cash & Money Market ** Upto 50% 6%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets30

Whole <strong>Life</strong>Stable Growth FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallInvestment Objective :Fund ManagerFund DetailsNAV as on 30 Sep, 2010 : `13.38The primary investment objective of the Fund isprovide reasonable returns with low to mediumrisk.: Mr. Saravana KumarBenchmark : Nifty - 40%CRISIL Composite Bond Fund Index - 60%Corpus as on 30 Sep, 2010: 36.92 Crs.Sector AllocationFund PerformancePERIOD DATE NAV NAV Change INDEX ChangeLast 1 Month 31-Aug-10 12.86 3.98% 4.99%Last 3 Months 30-Jun-10 12.70 5.34% 5.93%Last 6 Months 31-Mar-10 12.36 8.24% 7.51%Last 1 Year 30-Sep-09 11.90 12.45% 10.72%Last 3 Years 30-Sep-07 10.81 7.35% 6.33%Since Inception 08-Jan-07 10.00 8.11% 8.60%Note: The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.Asset AllocationBanksIT - SoftwareRefineriesCapital Goods - Electrical EquipmentSteelAutomobileTobacco ProductsCrude Oil & Natural GasFMCGFinanceOthersCorporate BondsGovernment SecuritiesCD/CP'sCash Bank & Others2.41%2.08%2.01%2.01%1.64%1.62%1.61%1.42%4.53%5.36%7.61%7.82%10.60%15.25%34.03%0% 5% 10% 15% 20% 25% 30% 35% 40%37.54%15.25%5.36%7.82%34.03%EquityCorporate BondsGovernmemt SecuritiesCD/CP'sCash Bank & OthersPortfolioPortfolioInstrument Industry % of NAVEquity 37.54Infosys Technologies Ltd IT - Software 2.73Reliance Industries Ltd Refineries 2.41ICICI Bank Ltd Banks 1.96HDFC Bank Banks 1.69ITC Ltd Tobacco Products 1.64State Bank of India Banks 1.49Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 1.39Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 1.14Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 0.97Mahindra and Mahindra Ltd Automobile 0.94Other Equity 21.18Government Securities 7.827.02% GOI 2016 Sovereign 7.82Corporate Bonds 34.038.70% PFC 2015 AAA 6.81HDFC Ltd 2012 AAA 5.478.28% LIC Housing Finance 2015 AAA 5.366.98% IRFC 2012 AAA 4.28Instrument Industry % of NAV10.75% Reliance Ind 2018 AAA 3.0311.50% Rural Electric Corp. 2013 AAA 2.959.20% Power Grid 2015 AAA 2.772.00% <strong>Tata</strong> Motor 2014 AAA 1.477.90% RECL 2012 AAA 1.089.05% IDFC 2010 AAA 0.81CD/CP's 5.36Bank of Baroda 2010 - CD P1+ 2.68State Bank of Patiala 2010 - CD P1+ 2.68Cash Bank & Others 15.25Net Asset 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity 30% - 50%38%Debt * 50% - 70% 62%Cash & Money Market ** Upto 70% 21%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assets31