September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

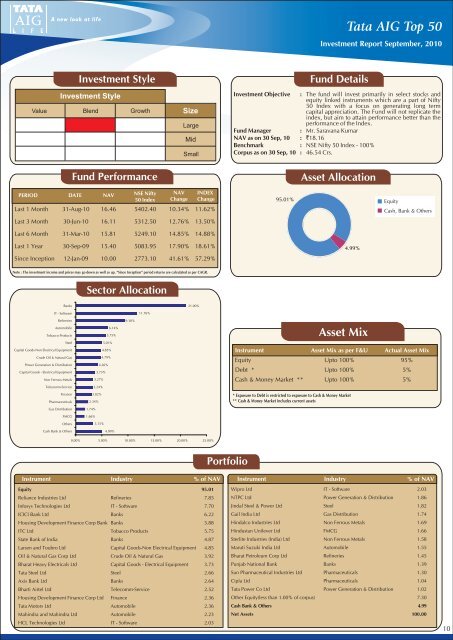

<strong>Tata</strong> AIG Top 50Investment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthFund PerformanceSizeLargeMidSmallFund DetailsInvestment Objective : The fund will invest primarily in select stocks andequity linked instruments which are a part of Nifty50 Index with a focus on generating long termcapital appreciation. The Fund will not replicate theindex, but aim to attain performance better than theperformance of the Index.Fund Manager : Mr. Saravana KumarNAV as on 30 Sep, 10 : `18.16Benchmark : NSE Nifty 50 Index - 100%Corpus as on 30 Sep, 10 : 46.54 Crs.Asset AllocationPERIOD DATE NAVNSE Nifty50 IndexNAVChangeINDEXChangeLast 1 Month 31-Aug-10 16.46 5402.40 10.34% 11.62%Last 3 Month 30-Jun-10 16.11 5312.50 12.76% 13.50%Last 6 Month 31-Mar-10 15.81 5249.10 14.85% 14.88%95.01%EquityCash, Bank & OthersLast 1 Year 30-Sep-09 15.40 5083.95 17.90% 18.61%Since Inception 12-Jan-09 10.00 2773.10 41.61% 57.29%4.99%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationBanks21.00%IT - Software11.76%RefineriesAutomobileTobacco Products6.14%5.75%9.30%Asset MixSteelCapital Goods-Non Electrical EquipmentCrude Oil & Natural GasPower Generation & DistributionCapital Goods - Electrical EquipmentNon Ferrous Metals5.01%4.85%4.79%4.26%3.73%3.27%Instrument Asset Mix as per F&U Actual Asset MixEquity Upto 100%95%Debt * Upto 100%5%Cash & Money Market ** Upto 100% 5%Telecomm-Service3.24%FinancePharmaceuticals3.02%2.34%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsGas Distribution1.74%FMCG1.66%Others3.15%Cash Bank & Others4.99%0.00% 5.00% 10.00% 15.00% 20.00% 25.00%PortfolioInstrument Industry % of NAVEquity 95.01Reliance Industries Ltd Refineries 7.85Infosys Technologies Ltd IT - Software 7.70ICICI Bank Ltd Banks 6.22Housing Development Finance Corp Bank Banks 5.88ITC Ltd Tobacco Products 5.75State Bank of India Banks 4.87Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.85Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.92Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.73<strong>Tata</strong> Steel Ltd Steel 2.66Axis Bank Ltd Banks 2.64Bharti Airtel Ltd Telecomm-Service 2.52Housing Development Finance Corp Ltd Finance 2.36<strong>Tata</strong> Motors Ltd Automobile 2.36Mahindra and Mahindra Ltd Automobile 2.23HCL Technologies Ltd IT - Software 2.03Instrument Industry % of NAVWipro Ltd IT - Software 2.03NTPC Ltd Power Generation & Distribution 1.86Jindal Steel & Power Ltd Steel 1.82Gail India Ltd Gas Distribution 1.74Hindalco Industries Ltd Non Ferrous Metals 1.69Hindustan Unilever Ltd FMCG 1.66Sterlite Industries (India) Ltd Non Ferrous Metals 1.58Maruti Suzuki India Ltd Automobile 1.55Bharat Petroleum Corp Ltd Refineries 1.45Punjab National Bank Banks 1.39Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.30Cipla Ltd Pharmaceuticals 1.04<strong>Tata</strong> Power Co Ltd Power Generation & Distribution 1.02Other Equity(less than 1.00% of corpus) 7.30Cash Bank & Others 4.99Net Assets 100.0010