September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

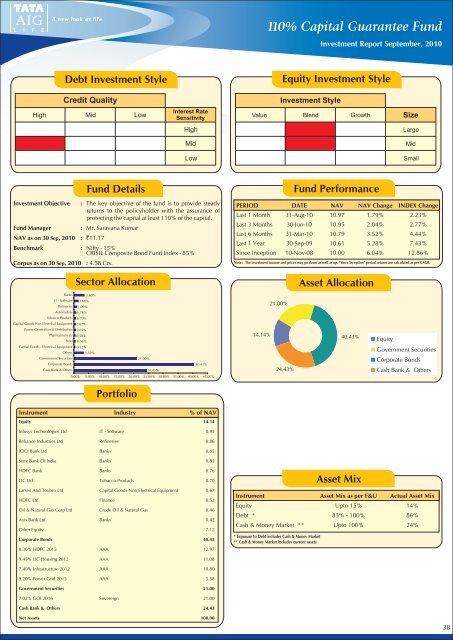

110% Capital Guarantee FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallInvestment Objective :Fund ManagerNAV as on 30 Sep, 2010 : `11.17Fund DetailsThe key objective of the fund is to provide steadyreturns to the policyholder with the assurance ofprotecting the capital at least 110% of the capital.: Mr. Saravana KumarBenchmark : Nifty - 15%CRISIL Composite Bond Fund Index - 85%Corpus as on 30 Sep, 2010: 4.58 Crs.Fund PerformancePERIOD DATE NAV NAV Change INDEX ChangeLast 1 Month 31-Aug-10 10.97 1.79% 2.23%Last 3 Months 30-Jun-10 10.95 2.04% 2.77%Last 6 Months 31-Mar-10 10.79 3.52% 4.44%Last 1 Year 30-Sep-09 10.61 5.28% 7.43%Since Inception 10-Nov-08 10.00 6.04% 12.86%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationBanksIT - SoftwareRefineriesAutomobileTobacco ProductsCapital Goods-Non Electrical EquipmentPower Generation & DistributionPharmaceuticalsSteelCapital Goods - Electrical EquipmentOthers3.60%1.60%1.09%0.78%0.70%0.67%0.65%0.58%0.56%0.52%3.39%Government Securities21.00%Corporate Bonds40.43%Cash Bank & Others24.43%0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00% 45.00%Portfolio14.14%21.00%24.43%Asset Allocation40.43%EquityGovernment SecuritiesCorporate BondsCash Bank & OthersInstrument Industry % of NAVEquity 14.14Infosys Technologies Ltd IT - Software 0.93Reliance Industries Ltd Refineries 0.86ICICI Bank Ltd Banks 0.85State Bank Of India Banks 0.85HDFC Bank Banks 0.76ITC Ltd Tobacco Products 0.70Larsen And Toubro Ltd Capital Goods-Non Electrical Equipment 0.67HDFC Ltd Finance 0.52Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 0.46Axis Bank Ltd Banks 0.42Other Equity 7.12Corporate Bonds 40.438.30% HDFC 2015 AAA 12.97Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity Upto 15%14%Debt * 85% - 100%86%Cash & Money Market ** Upto 100%24%* Exposure to Debt includes Cash & Money Market** Cash & Money Market includes current assets9.45% LIC Housing 2012 AAA 11.087.40% Infrastructure 2012 AAA 10.809.20% Power Grid 2015 AAA 5.58Government Securities 21.007.02% GOI 2016 Sovereign 21.00Cash Bank & Others 24.43Net Assets 100.0038