September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

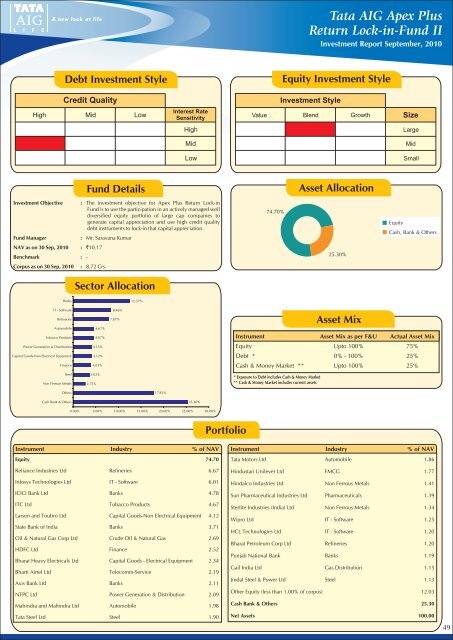

<strong>Tata</strong> AIG Apex PlusReturn Lock-in-Fund IIInvestment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallFund DetailsAsset AllocationInvestment Objective :Fund ManagerThe investment objective for Apex Plus Return Lock-inFund is to use the participation in an actively managed welldiversified equity portfolio of large cap companies togenerate capital appreciation and use high credit qualitydebt instruments to lock-in that capital appreciation.: Mr. Saravana Kumar74.70%EquityCash, Bank & OthersNAV as on 30 Sep, 2010 : `10.17Benchmark : -25.30%Corpus as on 30 Sep, 2010: 8.72 Crs.Sector AllocationBanks12.57%IT - SoftwareRefineriesAutomobileTobacco ProductsPower Generation & DistributionCapital Goods-Non Electrical EquipmentFinance4.67%4.67%4.13%4.12%4.03%8.46%7.87%Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity Upto 100%75%Debt * 0% - 100% 25%Cash & Money Market ** Upto 100% 25%SteelNon Ferrous Metals3.62%2.75%* Exposure to Debt includes Cash & Money Market** Cash & Money Market includes current assetsOthers17.81%Cash Bank & Others25.30%0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%PortfolioInstrument Industry % of NAV Instrument Industry % of NAVEquity 74.70 <strong>Tata</strong> Motors Ltd Automobile 1.86Reliance Industries Ltd Refineries 6.67Infosys Technologies Ltd IT - Software 6.01ICICI Bank Ltd Banks 4.78ITC Ltd Tobacco Products 4.67Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.12State Bank of India Banks 3.71Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 2.69HDFC Ltd Finance 2.52Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 2.34Bharti Airtel Ltd Telecomm-Service 2.19Axis Bank Ltd Banks 2.11NTPC Ltd Power Generation & Distribution 2.09Mahindra and Mahindra Ltd Automobile 1.98<strong>Tata</strong> Steel Ltd Steel 1.90Hindustan Unilever Ltd FMCG 1.77Hindalco Industries Ltd Non Ferrous Metals 1.41Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.39Sterlite Industries (India) Ltd Non Ferrous Metals 1.34Wipro Ltd IT - Software 1.25HCL Technologies Ltd IT - Software 1.20Bharat Petroleum Corp Ltd Refineries 1.20Punjab National Bank Banks 1.19Gail India Ltd Gas Distribution 1.15Jindal Steel & Power Ltd Steel 1.13Other Equity (less than 1.00% of corpus) 12.03Cash Bank & Others 25.30Net Assets 100.0049