September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

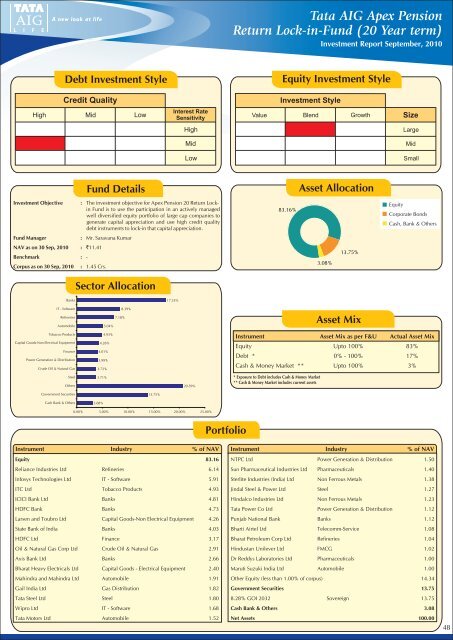

<strong>Tata</strong> AIG Apex PensionReturn Lock-in-Fund (20 Year term)Investment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallFund DetailsAsset AllocationInvestment Objective :The investment objective for Apex Pension 20 Return LockinFund is to use the participation in an actively managedwell diversified equity portfolio of large cap companies togenerate capital appreciation and use high credit qualitydebt instruments to lock-in that capital appreciation.83.16%EquityCorporate BondsCash, Bank & OthersFund Manager: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `11.41Benchmark : -Corpus as on 30 Sep, 2010: 1.45 Crs.3.08%13.75%Sector AllocationBanks17.35%IT - SoftwareRefineriesAutomobile8.39%7.18%5.04%Asset MixTobacco ProductsCapital Goods-Non Electrical EquipmentFinancePower Generation & DistributionCrude Oil & Natural Gas4.93%4.26%4.01%3.99%3.72%Instrument Asset Mix as per F&U Actual Asset MixEquity Upto 100%83%Debt * 0% - 100% 17%Cash & Money Market ** Upto 100% 3%SteelOthers3.71%20.59%* Exposure to Debt includes Cash & Money Market** Cash & Money Market includes current assetsGovernment Securities13.75%Cash Bank & Others3.08%0.00% 5.00% 10.00% 15.00% 20.00% 25.00%PortfolioInstrument Industry % of NAV Instrument Industry % of NAVEquity 83.16 NTPC Ltd Power Generation & Distribution 1.50Reliance Industries Ltd Refineries 6.14 Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.40Infosys Technologies Ltd IT - Software 5.91 Sterlite Industries (India) Ltd Non Ferrous Metals 1.38ITC Ltd Tobacco Products 4.93 Jindal Steel & Power Ltd Steel 1.27ICICI Bank Ltd Banks 4.81 Hindalco Industries Ltd Non Ferrous Metals 1.23HDFC Bank Banks 4.73 <strong>Tata</strong> Power Co Ltd Power Generation & Distribution 1.12Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.26 Punjab National Bank Banks 1.12State Bank of India Banks 4.03 Bharti Airtel Ltd Telecomm-Service 1.08HDFC Ltd Finance 3.17 Bharat Petroleum Corp Ltd Refineries 1.04Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 2.91 Hindustan Unilever Ltd FMCG 1.02Axis Bank Ltd Banks 2.66 Dr Reddys Laboratories Ltd Pharmaceuticals 1.00Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 2.40 Maruti Suzuki India Ltd Automobile 1.00Mahindra and Mahindra Ltd Automobile 1.91 Other Equity (less than 1.00% of corpus) 14.34Gail India Ltd Gas Distribution 1.82 Government Securities 13.75<strong>Tata</strong> Steel Ltd Steel 1.80 8.28% GOI 2032 Sovereign 13.75Wipro Ltd IT - Software 1.68 Cash Bank & Others 3.08<strong>Tata</strong> Motors Ltd Automobile 1.52 Net Assets 100.0048