September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

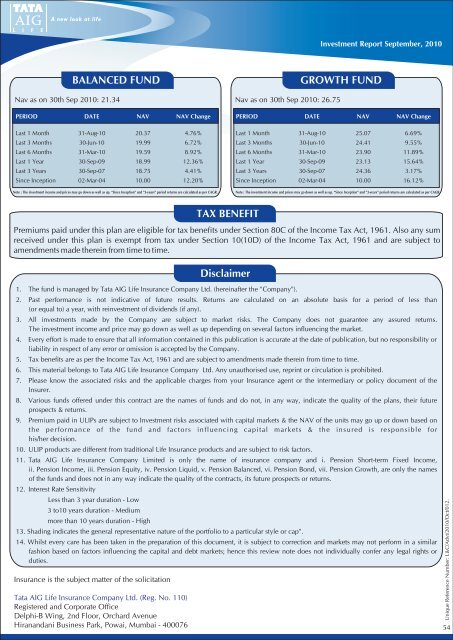

Investment Report <strong>September</strong>, 2010BALANCED FUNDGROWTH FUNDNav as on 30th Sep 2010: 21.34 Nav as on 30th Sep 2010: 26.75PERIOD DATE NAV NAV ChangeLast 1 Month 31-Aug-10 20.37 4.76%Last 3 Months 30-Jun-10 19.99 6.72%Last 6 Months 31-Mar-10 19.59 8.92%Last 1 Year 30-Sep-09 18.99 12.36%Last 3 Years 30-Sep-07 18.75 4.41%Since Inception 02-Mar-04 10.00 12.20%Note : The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.PERIOD DATE NAV NAV ChangeLast 1 Month 31-Aug-10 25.07 6.69%Last 3 Months 30-Jun-10 24.41 9.55%Last 6 Months 31-Mar-10 23.90 11.89%Last 1 Year 30-Sep-09 23.13 15.64%Last 3 Years 30-Sep-07 24.36 3.17%Since Inception 02-Mar-04 10.00 16.12%Note : The investment income and prices may go down as well as up. “Since Inception” and "3-years" period returns are calculated as per CAGR.Disclaimer1. The fund is managed by <strong>Tata</strong> AIG <strong>Life</strong> <strong>Insurance</strong> Company Ltd. (hereinafter the "Company").2. Past performance is not indicative of future results. Returns are calculated on an absolute basis for a period of less than(or equal to) a year, with reinvestment of dividends (if any).3. All investments made by the Company are subject to market risks. The Company does not guarantee any assured returns.The investment income and price may go down as well as up depending on several factors influencing the market.4. Every effort is made to ensure that all information contained in this publication is accurate at the date of publication, but no responsibility orliability in respect of any error or omission is accepted by the Company.5. Tax benefits are as per the Income Tax Act, 1961 and are subject to amendments made therein from time to time.6. This material belongs to <strong>Tata</strong> AIG <strong>Life</strong> <strong>Insurance</strong> Company Ltd. Any unauthorised use, reprint or circulation is prohibited.7. Please know the associated risks and the applicable charges from your <strong>Insurance</strong> agent or the intermediary or policy document of theInsurer.8. Various funds offered under this contract are the names of funds and do not, in any way, indicate the quality of the plans, their futureprospects & returns.9. Premium paid in ULIPs are subject to Investment risks associated with capital markets & the NAV of the units may go up or down based onthe performance of the fund and factors influencing capital markets & the insured is responsible forhis/her decision.10. ULIP products are different from traditional <strong>Life</strong> <strong>Insurance</strong> products and are subject to risk factors.11. <strong>Tata</strong> AIG <strong>Life</strong> <strong>Insurance</strong> Company Limited is only the name of insurance company and i. Pension Short-term Fixed Income,ii. Pension Income, iii. Pension Equity, iv. Pension Liquid, v. Pension Balanced, vi. Pension Bond, vii. Pension Growth, are only the namesof the funds and does not in any way indicate the quality of the contracts, its future prospects or returns.12. Interest Rate SensitivityLess than 3 year duration - Low3 to10 years duration - Mediummore than 10 years duration - High13. Shading indicates the general representative nature of the portfolio to a particular style or cap".14. Whilst every care has been taken in the preparation of this document, it is subject to correction and markets may not perform in a similarfashion based on factors influencing the capital and debt markets; hence this review note does not individually confer any legal rights orduties.<strong>Insurance</strong> is the subject matter of the solicitation<strong>Tata</strong> AIG <strong>Life</strong> <strong>Insurance</strong> Company Ltd. (Reg. No. 110)Registered and Corporate OfficeDelphi-B Wing, 2nd Floor, Orchard AvenueHiranandani Business Park, Powai, Mumbai - 400076TAX BENEFITPremiums paid under this plan are eligible for tax benefits under Section 80C of the Income Tax Act, 1961. Also any sumreceived under this plan is exempt from tax under Section 10(10D) of the Income Tax Act, 1961 and are subject toamendments made therein from time to time.Unique Reference Number: L&C/Advt/2010/Oct/012.54