September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

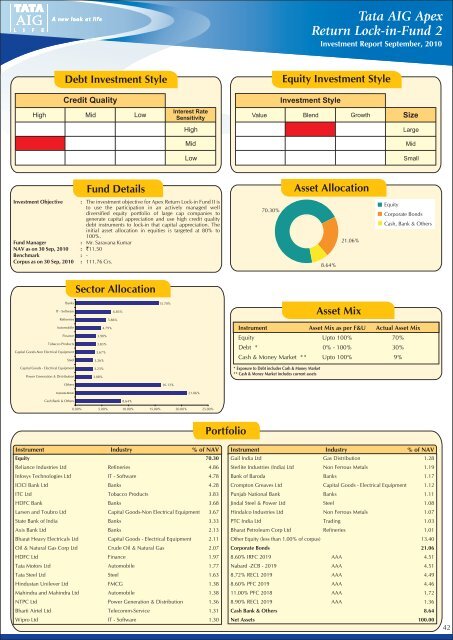

<strong>Tata</strong> AIG ApexReturn Lock-in-Fund 2Investment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallFund DetailsAsset AllocationInvestment Objective : The investment objective for Apex Return Lock-in Fund II isto use the participation in an actively managed welldiversified equity portfolio of large cap companies togenerate capital appreciation and use high credit qualitydebt instruments to lock-in that capital appreciation. Theinitial asset allocation in equities is targeted at 80% to100%.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 2010 : `11.50Benchmark : -Corpus as on 30 Sep, 2010 : 111.76 Crs.70.30%8.64%21.06%EquityCD/CP’s Corporate BondsCash, Bank & OthersSector AllocationBanksIT - SoftwareRefineriesAutomobileFinanceTobacco ProductsCapital Goods-Non Electrical EquipmentSteel6.83%5.86%4.79%3.90%3.83%3.67%3.26%15.70%Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity Upto 100%70%Debt * 0% - 100% 30%Cash & Money Market ** Upto 100% 9%Capital Goods - Electrical EquipmentPower Generation & Distribution3.23%3.08%* Exposure to Debt includes Cash & Money Market** Cash & Money Market includes current assetsOthers16.13%Corporate Bonds21.06%Cash Bank & Others8.64%0.00% 5.00% 10.00% 15.00% 20.00% 25.00%PortfolioInstrument Industry % of NAV Instrument Industry % of NAVEquity 70.30 Gail India Ltd Gas Distribution 1.28Reliance Industries Ltd Refineries 4.86 Sterlite Industries (India) Ltd Non Ferrous Metals 1.19Infosys Technologies Ltd IT - Software 4.78 Bank of Baroda Banks 1.17ICICI Bank Ltd Banks 4.28 Crompton Greaves Ltd Capital Goods - Electrical Equipment 1.12ITC Ltd Tobacco Products 3.83 Punjab National Bank Banks 1.11HDFC Bank Banks 3.68 Jindal Steel & Power Ltd Steel 1.08Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 3.67 Hindalco Industries Ltd Non Ferrous Metals 1.07State Bank of India Banks 3.33 PTC India Ltd Trading 1.03Axis Bank Ltd Banks 2.13 Bharat Petroleum Corp Ltd Refineries 1.01Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 2.11 Other Equity (less than 1.00% of corpus) 13.40Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 2.07 Corporate Bonds 21.06HDFC Ltd Finance 1.97 8.60% IRFC 2019 AAA 4.51<strong>Tata</strong> Motors Ltd Automobile 1.77 Nabard -ZCB - 2019 AAA 4.51<strong>Tata</strong> Steel Ltd Steel 1.63 8.72% RECL 2019 AAA 4.49Hindustan Unilever Ltd FMCG 1.38 8.60% PFC 2019 AAA 4.46Mahindra and Mahindra Ltd Automobile 1.38 11.00% PFC 2018 AAA 1.72NTPC Ltd Power Generation & Distribution 1.36 8.90% RECL 2019 AAA 1.36Bharti Airtel Ltd Telecomm-Service 1.31 Cash Bank & Others 8.64Wipro Ltd IT - Software 1.30 Net Assets 100.0042