September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

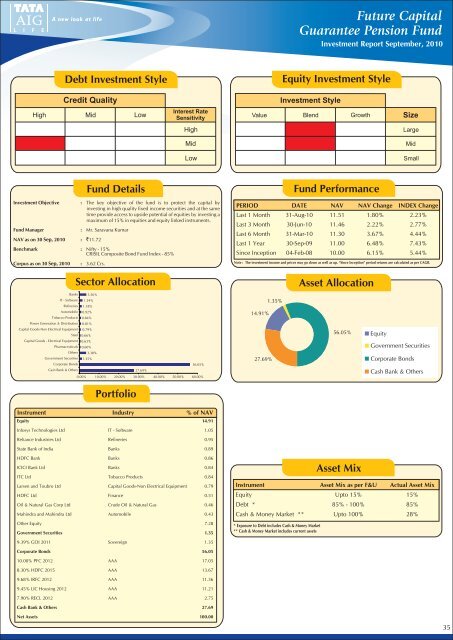

Future CapitalGuarantee Pension FundInvestment Report <strong>September</strong>, 2010Debt Investment StyleEquity Investment StyleCredit QualityInvestment StyleHigh Mid LowInterest RateSensitivityValue Blend GrowthSizeHighLargeMidMidLowSmallInvestment Objective :Fund ManagerNAV as on 30 Sep, 2010 : `11.72Fund DetailsThe key objective of the fund is to protect the capital byinvesting in high quality fixed income securities and at the sametime provide access to upside potential of equities by investing amaximum of 15% in equities and equity linked instruments.: Mr. Saravana KumarBenchmark : Nifty - 15%CRISIL Composite Bond Fund Index - 85%Corpus as on 30 Sep, 2010: 3.62 Crs.Fund PerformancePERIOD DATE NAV NAV Change INDEX ChangeLast 1 Month 31-Aug-10 11.51 1.80% 2.23%Last 3 Month 30-Jun-10 11.46 2.22% 2.77%Last 6 Month 31-Mar-10 11.30 3.67% 4.44%Last 1 Year 30-Sep-09 11.00 6.48% 7.43%Since Inception 04-Feb-08 10.00 6.15% 5.44%Note : The investment income and prices may go down as well as up. “Since Inception” period returns are calculated as per CAGR.Sector AllocationBanksIT - SoftwareRefineriesAutomobileTobacco ProductsPower Generation & DistributionCapital Goods-Non Electrical EquipmentSteelCapital Goods - Electrical EquipmentPharmaceuticalsOthersGovernment Securities3.56%1.54%1.18%0.92%0.84%0.81%0.79%0.66%0.63%0.60%3.38%1.35%Corporate Bonds56.05%Cash Bank & Others27.69%0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00%Portfolio14.91%27.69%1.35%Asset Allocation56.05% EquityGovernment SecuritiesCorporate BondsCash Bank & OthersInstrument Industry % of NAVEquity 14.91Infosys Technologies Ltd IT - Software 1.05Reliance Industries Ltd Refineries 0.95State Bank of India Banks 0.89HDFC Bank Banks 0.86ICICI Bank Ltd Banks 0.84ITC Ltd Tobacco Products 0.84Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 0.79HDFC Ltd Finance 0.51Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 0.46Mahindra and Mahindra Ltd Automobile 0.43Other Equity 7.28Government Securities 1.359.39% GOI 2011 Sovereign 1.35Corporate Bonds 56.0510.00% PFC 2012 AAA 17.058.30% HDFC 2015 AAA 13.679.68% IRFC 2012 AAA 11.369.45% LIC Housing 2012 AAA 11.217.90% RECL 2012 AAA 2.75Cash Bank & Others 27.69Net Assets 100.00Asset MixInstrument Asset Mix as per F&U Actual Asset MixEquity Upto 15%15%Debt * 85% - 100% 85%Cash & Money Market ** Upto 100% 28%* Exposure to Debt includes Cash & Money Market** Cash & Money Market includes current assets35